UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Rocky Mountain Chocolate Factory, Inc. issued the following press release on October 4, 2021:

Rocky Mountain Chocolate Factory Reminds Stockholders to Vote “FOR” ALL RMCF Nominees on the WHITE Proxy Card

RMCF’s Strong Director Nominees Have the Mission-Critical Skills, Experience and Diversity to Support the Company’s Transformation Strategy

The RMCF Board Continues to Take Decisive, Strategic Actions to Increase Value for ALL Stockholders

Urges Stockholders to Vote "FOR" ALL of the Company's Nominees TODAY on the WHITE Proxy Card

DURANGO, CO / October 4, 2021 / Rocky Mountain Chocolate Factory, Inc. (NASDAQ: RMCF) (the "Company" or “RMCF”), one of North America's largest retailers, franchisers and manufacturers of premium, handcrafted chocolates and confections, is reminding all stockholders to vote on the WHITE proxy card today FOR ALL of RMCF’s director nominees ahead of the Company’s 2021 Annual Meeting of Stockholders (the "Annual Meeting"), to be held October 6, 2021.

The Company today issued the following open letter to stockholders, detailing the transformative omnichannel and digital strategy the Company is implementing, as well as the diverse skills, relevant expertise and public company experience possessed by the Company’s director nominees:

***

October 4, 2021

Your vote could decide the future of Rocky Mountain Chocolate Factory (“RMCF”) – no matter how many shares you own. But time is running out! It is imperative that stockholders vote as soon as possible. Please vote on the WHITE proxy card today FOR ALL of RMCF’s director nominees.

RMCF’s 2021 Annual Meeting of Stockholders (the “Annual Meeting”) is just a few days away and will be held on October 6, 2021. If you have not voted yet, please VOTE TODAY. If you have voted on the blue proxy card, you can still change your vote to the WHITE proxy card! Please do so by following the instructions at the bottom of this letter.

A dissident group is seeking to obtain control of RMCF’s Board, yet has only presented a superficial and ineffective plan to stockholders. You deserve better. Here are the facts:

|

|

●

|

RMCF is taking decisive, strategic action to accelerate a transformation strategy focused on growth and innovation. We have completed one phase of a brand refresh, are expanding our digital and omnichannel platforms, and are executing our strategy to increase revenue, profitability and drive stockholder value.

|

|

|

●

|

RMCF has nominated a strong slate of directors with the mission-critical skills to execute our strategic plan, accelerate our transformation and grow our Company. Our nominees are ideally positioned to support our ongoing brand refreshment, market expansion and development of new distribution channels, and the execution of our transformative strategy to maximize value for ALL stockholders.

|

|

|

●

|

RMCF’s nominees bring deep experience across e-commerce, product innovation, digital marketing, branding, supply chain and logistics, franchising and accounting and capital markets, key areas of forward-looking expertise for the Company. Further, the nominees understand what it takes to lead retail and CPG companies and have public company Board and leadership experience.

|

|

|

●

|

Over the last several years, RMCF has thoughtfully refreshed the Board. Upon election at the Annual Meeting, five of six directors will be independent, and 50% of the Board will be diverse by race, ethnicity or gender.

|

|

|

●

|

RMCF’s financial and operational performance continues to improve despite an unpredictable environment. With a healthy balance sheet, strong free cash flow and no debt, RMCF has a solid financial foundation from which to execute its transformational strategy and seize the growth opportunities ahead. The Company is confident that the plan and strategic actions it is implementing will benefit franchisees and team members, and drive increasing value for all RMCF stockholders.

|

|

|

●

|

The dissident group has presented a superficial and ineffective plan for RMCF. We believe they lack the expertise to create value for stockholders, and are pursuing a self-serving public contest at your expense that is built on misleading and inaccurate information. Further, AB Value has a clear record of value destruction, including a recent situation in which it took control of another company, installed one of its unqualified principals as CEO and ultimately oversaw a bankruptcy filing at that same company. For RMCF stockholders, the choice is clear.

|

RMCF strongly urges stockholders to discard any blue proxy cards you may receive and vote on the WHITE proxy card today FOR ALL six of the highly-qualified and very experienced nominees. If you have already returned a blue proxy card, you can change your vote simply by voting by telephone, via the Internet or by signing, dating and returning a WHITE proxy card today.

RMCF’s proxy statement and other important information related to the Annual Meeting can be found on the SEC's website at www.sec.gov and on the Company's website at rmcf.com/SEC-Filings.

|

Your vote is important, no matter how many shares you own.

If you have any questions about how to vote your shares, or need additional assistance, please contact the firm assisting us in the solicitation of proxies:

Georgeson LLC

1290 Avenue of the Americas, 9th Floor

New York, New York 10104

(888) 658-5755 (Toll Free)

Please refer to the enclosed WHITE proxy card for information on how to vote by telephone or by Internet, or simply complete, sign and date the WHITE proxy card and return it TODAY in the postage-paid envelope provided.

|

About Rocky Mountain Chocolate Factory, Inc.

Rocky Mountain Chocolate Factory, Inc., headquartered in Durango, Colorado, is an international franchiser of gourmet chocolate, confection and self-serve frozen yogurt stores and a manufacturer of an extensive line of premium chocolates and other confectionery products. The Company, its subsidiaries and its franchisees and licensees operate more than 300 Rocky Mountain Chocolate Factory and self-serve frozen yogurt stores across the United States, South Korea, Qatar, the Republic of Panama, and The Republic of the Philippines. The Company's common stock is listed on the Nasdaq Global Market under the symbol "RMCF."

Important Additional Information and Where to Find It

This communication relates to the Annual Meeting. In connection with the Annual Meeting, Rocky Mountain Chocolate Factory, Inc. (the “Company” or “RMCF”) filed a definitive proxy statement on Schedule 14A, an accompanying WHITE proxy card and other relevant documents with the Securities and Exchange Commission (the "SEC") on September 9, 2021 in connection with the solicitation of proxies from stockholders for the Annual Meeting. The definitive proxy statement and a form of WHITE proxy were first mailed or otherwise furnished to the stockholders of the Company on September 9, 2021 as supplemented on September 20, 2021. BEFORE MAKING ANY VOTING DECISION, STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE COMPANY'S DEFINITIVE PROXY STATEMENT IN ITS ENTIRETY AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE ANNUAL MEETING OR INCORPORATED BY REFERENCE IN THE DEFINITIVE PROXY STATEMENT, IF ANY, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING. This communication is not a substitute for the definitive proxy statement or any other document that may be filed by the Company with the SEC. Investors and stockholders may obtain a copy of the documents free of charge at the SEC's website at www.sec.gov, and in the "SEC Filings" section of the of the Company's Investor Relations website at www.rmcf.com/Investor-Relations.aspx or by contacting the Company's Investor Relations department at (970) 375-5678, as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC. In addition, the documents (when available) may be obtained free of charge by directing a request by mail or telephone to: Rocky Mountain Chocolate Factory, Inc., 265 Turner Drive, Durango, Colorado 81303, Attn: Secretary, (970) 259-0554.

Certain Information Regarding Participants to the Solicitation

The Company, its directors and certain of its directors, director nominees, executive officers and members of management and employees of the Company and agents retained by the Company are participants in the solicitation of proxies from stockholders in connection with matters to be considered at the Annual Meeting. Information regarding the Company's directors, director nominees and executive officers, and their beneficial ownership of the Company's common stock is set forth in the Company's Annual Report on Form 10-K for the fiscal year ended February 28, 2021, filed with the SEC on June 1, 2021, as amended by Amendment No. 1 on Form 10-K/A filed with the SEC on June 28, 2021, and in the definitive proxy statement. Changes to the direct or indirect interests of the Company's directors and executive officers are set forth in SEC filings on Initial Statements of Beneficial Ownership on Form 3, Statements of Change in Ownership on Form 4 and Annual Statements of Changes in Beneficial Ownership on Form 5. These documents are available free of charge as described above.

Forward-Looking Statements

This press release includes statements of the Company's expectations, intentions, plans and beliefs that constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to come within the safe harbor protection provided by those sections. These forward-looking statements involve various risks and uncertainties. The nature of the Company's operations and the environment in which it operates subjects it to changing economic, competitive, regulatory and technological conditions, risks and uncertainties. The statements, other than statements of historical fact, included in this press release are forward-looking statements. Many of the forward-looking statements contained in this press release may be identified by the use of forward-looking words such as "will," "intend," "believe," "expect," "anticipate," "should," "plan," "estimate," "potential," or similar expressions. Factors which could cause results to differ include, but are not limited to: the impact of the COVID-19 pandemic and global economic conditions on the Company's business, including, among other things, online sales, factory sales, retail sales and royalty and marketing fees, the Company's liquidity, the Company's cost cutting and capital preservation measures, achievement of the anticipated potential benefits of the strategic alliance with Edible Arrangements®, LLC and its affiliates ("Edible"), the ability to provide products to Edible under the strategic alliance, Edible's ability to increase the Company's online sales, changes in the confectionery business environment, seasonality, consumer interest in the Company's products, general economic conditions, the success of the Company's frozen yogurt business, receptiveness of the Company's products internationally, consumer and retail trends, costs and availability of raw materials, competition, the success of the Company's co-branding strategy, the success of international expansion efforts and the effect of government regulations. Government regulations which the Company and its franchisees and licensees either are, or may be, subject to and which could cause results to differ from forward-looking statements include, but are not limited to: local, state and federal laws regarding health, sanitation, safety, building and fire codes, franchising, licensing, employment, manufacturing, packaging and distribution of food products and motor carriers. For a detailed discussion of the risks and uncertainties that may cause the Company's actual results to differ from the forward-looking statements contained herein, please see the "Risk Factors" contained in Item 1A. of the Company's Annual Report on Form 10-K for the fiscal year ended February 28, 2021, as amended. Additional factors that might cause such differences include, but are not limited to: the length and severity of the current COVID-19 pandemic and its effect on among other things, factory sales, retail sales, royalty and marketing fees and operations, the effect of any governmental action or mandated employer-paid benefits in response to the COVID-19 pandemic, and the Company's ability to manage costs and reduce expenditures and the availability of additional financing if and when required. These forward-looking statements apply only as of the date hereof. As such they should not be unduly relied upon for more current circumstances. Except as required by law, the Company undertakes no obligation to release publicly any revisions to these forward-looking statements that might reflect events or circumstances occurring after the date of this press release or those that might reflect the occurrence of unanticipated events.

Media Contacts:

Dan Scorpio / Jake Yanulis

Abernathy MacGregor

amg-rmcf@abmac.com

(212) 371-5999

Investor Contact:

William P. Fiske

Georgeson LLC

(212) 440-9128

SOURCE: Rocky Mountain Chocolate Factory, Inc.

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

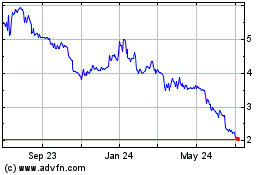

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Apr 2023 to Apr 2024