UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

ROCKY MOUNTAIN

CHOCOLATE FACTORY, INC.

265 Turner Drive

Durango, Colorado 81303

Your vote is important.

Vote for RMCF’s strong director nominees that are taking decisive action to drive a transformation strategy, focused on innovation and increasing stockholder value.

|

September 28, 2021

Dear fellow Rocky Mountain Chocolate Factory stockholders,

Thank you for your ongoing support. I appreciate your investment in Rocky Mountain Chocolate Factory (“RMCF”).

As co-founder of RMCF, building this Company has been my life’s work. I have truly loved every day I have spent in our stores, working with our team at our Durango facility and committing myself to serving our customers with the very best, handmade chocolates and memorable experiences. As I prepare to step down from RMCF’s Board, I felt it was important to share with you how excited I am for RMCF’s future. We have an incredible leadership team that has led our Company through a challenging pandemic. We produce what I strongly believe are the world’s best chocolate and confection products. And we have nominated a talented group of directors to help lead and guide our Company’s transformative next chapter.

This is an important moment for our Company. RMCF’s Board and leadership team are taking decisive and disciplined action to execute our transformation strategy and accelerate the Company’s growth. We have put forward director nominees who possess the mission-critical skills specifically suited to guide RMCF’s strategy to build on our position as an omnichannel retailer, franchiser and manufacturer of premium, handcrafted chocolates and confections. We continue to be focused on delighting our millions of consumers around the world as we best serve all of our stakeholders. We remain confident that the plan and strategic actions we are implementing will benefit our franchisees and our team members, and drive increasing value for all RMCF stockholders.

I write to ask you to vote today, on the WHITE proxy card, for all of RMCF’s director nominees for election at the 2021 Annual Meeting of Stockholders (the “Annual Meeting”), to be held on October 6, 2021.

RMCF IS TAKING DECISIVE AND FORWARD-LOOKING ACTIONS TO INCREASE VALUE FOR ALL STOCKHOLDERS

Our Board and leadership team continue to execute a transformational and innovative strategic plan at RMCF, focused on driving growth, increasing revenue and profitability, maximizing value for stockholders and continuing to deliver premium products and memorable experiences our customers love.

We have completed the first phase of a brand refresh that, once complete, we expect will be transformational for RMCF. RMCF’s store-level performance continues to be strong, and we are excited for customers to experience our refreshed brand vision as retail stores reopen and we return to normal operations. Future phases of our brand refreshment plan will include new displays to drive sales at our retail stores and innovative packaging enhancements. Once complete, our redesigned packaging will be a critical aspect of our strategic focus on gift boxes and gift assortments. We believe our gift box and packaging strategy initiatives will help RMCF reach new customer segments, deepen brand loyalty to RMCF and drive additional sales to our retail stores.

|

|

|

RMCF is expanding its e-commerce and digital capabilities, and new and recently added Board members have the product innovation, technology and digital platforms expertise to support this initiative. We are innovating and integrating our online and brick-and-mortar sales efforts as we accelerate our omnichannel transformation, and we are developing new distribution channels to expand RMCF’s customer reach, including through direct-to-consumer and other third-party retail or e-commerce partners. We believe that expanding our distribution will increase utilization and profitability at our manufacturing facility, which is the largest facility in the U.S. dedicated to the production of handcrafted chocolates and confections. As we add production and execute our plan, with the support of RMCF’s strong director nominees, we believe we can achieve our goals of adding new franchised units and driving growth through our digital, e-commerce and omnichannel transformation. Achieving these elements of our plan would have a measurable benefit to RMCF’s revenue and profitability and will drive further growth.

As a result of our recent settlement with Immaculate Confection we have received a significant new order as a start to rebuilding their purchases, which has historically generated close to $1 million in annual sales. This positive development is creating real value for our Company and our stockholders. We expect new business with Immaculate Confection will contribute to increased utilization at our Durango facility, improving our profitability and helping us expand our international franchise network. We are confident that our current working relationship with Immaculate Confection will allow us to further develop the Canadian market. Management has also been conducting meaningful discussions with Immaculate Confection to explore ways we can further integrate or possibly consolidate our North American operations, expand on their success in developing exceptional packaging lines, and deepen our relationship and grow our business together. This is an exciting example of RMCF’s strategy in action.

RMCF’S DIRECTOR NOMINEES BRING STRONG SKILLS, SIGNIFICANT DIVERSITY AND FORWARD-LOOKING EXPERTISE TO GUIDE OUR GROWTH STRATEGY

RMCF has nominated a slate of director nominees that bring the mission-critical skills, experience and backgrounds necessary to drive the Company’s transformation strategy and enhance value for all stakeholders. We have thoughtfully refreshed the Company’s Board and, upon election at the Annual Meeting, five of six directors will be independent. Our nominees have public company leadership and Board experience and 50% of our Board will be diverse by race, ethnicity or gender.

VOTE TODAY for this majority-independent, diverse and skilled Board for RMCF:

|

|

|

Rahul Mewawalla, independent Chairperson.

Mr. Mewawalla has deep expertise across digital platforms, product innovation and technology to support the Company’s transformational growth strategy.

|

✓ Digital Platforms

✓ Product Innovation and E-Commerce

✓ Transformation and Growth Expertise

|

|

|

|

|

|

|

Bryan Merryman, Chief Executive Officer and director.

Mr. Merryman provides significant value and insights to the Board with his extensive knowledge of the Company and broad confectionery industry expertise.

|

✓ Confectionery Leadership

✓ Franchising

✓ Consumer Insights

|

|

|

|

|

|

|

Brett Seabert, independent director.

Mr. Seabert is a certified public accountant with significant executive leadership, financial services and accounting experience.

|

✓ Accounting

✓ Institutional Board Knowledge

✓ Investment Oversight

|

|

|

|

|

|

|

Jeffrey Geygan, independent director.

Mr. Geygan is one of the Company’s largest stockholders and has decades of investment management and operational turnaround experience.

|

✓ Public Company Experience

✓ Investment Management

✓ Turnaround Strategy

|

|

|

|

|

|

|

Elisabeth Charles, independent director nominee.

Ms. Charles has deep marketing, branding, omnichannel and consumer industry experience.

|

✓ Public Company Experience

✓ Omnichannel / Digital Marketing

✓ Brand Refreshment

|

|

|

|

|

|

|

Gabriel Arreaga, independent director nominee.

Mr. Arreaga has robust operations, procurement and supply chain experiences across the retail and consumer goods sectors.

|

✓ Corporate Strategy

✓ Supply Chain & Manufacturing

✓ Retail / CPG Operations

|

|

We will serve the interests of ALL stockholders and focus on driving growth and increasing shareholder value

Vote TODAY for RMCF’s director nominees and transformational strategy that is delivering results.

|

RMCF CONTINUES TO BE FINANCIALLY AND OPERATIONALLY ROBUST

RMCF continues to perform well financially and operationally. Our balance sheet is strong, as it has been for many years, and we continue to experience improving free cash flow as we come out of the pandemic. The Company has returned nearly $63 million to stockholders over the past two decades, through a combination of cash dividends and open market stock purchases, representing approximately $10.37 per share, based on current shares outstanding. We have a strong balance sheet and no debt, creating a strong financial foundation as we continue to implement our transformation plan. The last 18-months have been unprecedented, but because of the disciplined decisions our leadership team and Board have made, RMCF remains very well managed and poised for growth.

VOTE THE WHITE PROXY CARD TODAY FOR ALL OF THE BOARD'S NOMINEES

RMCF’S NOMINEES WILL SERVE THE INTERESTS OF ALL STOCKHOLDERS AS WE DRIVE GROWTH AND INCREASE STOCKHOLDER VALUE

As we celebrate RMCF’s 40th year anniversary this year, I believe the best years for the Company are ahead as we drive transformative innovation, growth and focus on delighting our consumers around the world.

I am incredibly excited about the next chapter of growth and innovation for RMCF. The strong slate of directors nominated by the Company brings the diverse, mission-critical skills necessary to execute our strategic plan and maximize value for all stockholders. Thank you very much for your investment in Rocky Mountain Chocolate Factory and your ongoing support.

Sincerely,

Franklin Crail

RMCF Co-Founder

|

|

Your vote is important, no matter how many shares you own.

If you have any questions about how to vote your shares, or need additional assistance, please contact the firm assisting us in the solicitation of proxies:

Georgeson LLC

1290 Avenue of the Americas, 9th Floor

New York, New York 10104

(888) 658-5755 (Toll Free)

Please refer to the enclosed WHITE proxy card for information on how to vote by telephone or by Internet, or simply complete, sign and date the WHITE proxy card and return it TODAY in the postage-paid envelope provided.

|

Important Additional Information and Where to Find It

This communication relates to the Annual Meeting. In connection with the Annual Meeting, Rocky Mountain Chocolate Factory, Inc. (the “Company” or “RMCF”) filed a definitive proxy statement on Schedule 14A, an accompanying WHITE proxy card and other relevant documents with the Securities and Exchange Commission (the "SEC") on September 9, 2021 in connection with the solicitation of proxies from stockholders for the Annual Meeting. The definitive proxy statement and a form of WHITE proxy were first mailed or otherwise furnished to the stockholders of the Company on September 9, 2021 as supplemented on September 20, 2021. BEFORE MAKING ANY VOTING DECISION, STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE COMPANY'S DEFINITIVE PROXY STATEMENT IN ITS ENTIRETY AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE ANNUAL MEETING OR INCORPORATED BY REFERENCE IN THE DEFINITIVE PROXY STATEMENT, IF ANY, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING. This communication is not a substitute for the definitive proxy statement or any other document that may be filed by the Company with the SEC. Investors and stockholders may obtain a copy of the documents free of charge at the SEC's website at www.sec.gov, and in the "SEC Filings" section of the of the Company's Investor Relations website at www.rmcf.com/Investor-Relations.aspx or by contacting the Company's Investor Relations department at (970) 375-5678, as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC. In addition, the documents (when available) may be obtained free of charge by directing a request by mail or telephone to: Rocky Mountain Chocolate Factory, Inc., 265 Turner Drive, Durango, Colorado 81303, Attn: Secretary, (970) 259-0554.

Certain Information Regarding Participants to the Solicitation

The Company, its directors and certain of its directors, director nominees, executive officers and members of management and employees of the Company and agents retained by the Company are participants in the solicitation of proxies from stockholders in connection with matters to be considered at the Annual Meeting. Information regarding the Company's directors, director nominees and executive officers, and their beneficial ownership of the Company’s common stock is set forth in the Company's Annual Report on Form 10-K for the fiscal year ended February 28, 2021, filed with the SEC on June 1, 2021, as amended by Amendment No. 1 on Form 10-K/A filed with the SEC on June 28, 2021, and in the definitive proxy statement. Changes to the direct or indirect interests of the Company's directors and executive officers are set forth in SEC filings on Initial Statements of Beneficial Ownership on Form 3, Statements of Change in Ownership on Form 4 and Annual Statements of Changes in Beneficial Ownership on Form 5. These documents are available free of charge as described above.

Forward-Looking Statements

This letter includes statements of the Company's expectations, intentions, plans and beliefs that constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to come within the safe harbor protection provided by those sections. These forward-looking statements involve various risks and uncertainties. The nature of the Company's operations and the environment in which it operates subjects it to changing economic, competitive, regulatory and technological conditions, risks and uncertainties. The statements, other than statements of historical fact, included in this press release are forward-looking statements. Many of the forward-looking statements contained in this press release may be identified by the use of forward-looking words such as "will," "intend," "believe," "expect," "anticipate," "should," "plan," "estimate," "potential," or similar expressions. Factors which could cause results to differ include, but are not limited to: the impact of the COVID-19 pandemic and global economic conditions on the Company's business, including, among other things, online sales, factory sales, retail sales and royalty and marketing fees, the Company's liquidity, the Company's cost cutting and capital preservation measures, achievement of the anticipated potential benefits of the strategic alliance with Edible Arrangements®, LLC and its affiliates ("Edible"), the ability to provide products to Edible under the strategic alliance, Edible's ability to increase the Company's online sales, changes in the confectionery business environment, seasonality, consumer interest in the Company's products, general economic conditions, the success of the Company's frozen yogurt business, receptiveness of the Company's products internationally, consumer and retail trends, costs and availability of raw materials, competition, the success of the Company's co-branding strategy, the success of international expansion efforts and the effect of government regulations. Government regulations which the Company and its franchisees and licensees either are, or may be, subject to and which could cause results to differ from forward-looking statements include, but are not limited to: local, state and federal laws regarding health, sanitation, safety, building and fire codes, franchising, licensing, employment, manufacturing, packaging and distribution of food products and motor carriers. For a detailed discussion of the risks and uncertainties that may cause the Company's actual results to differ from the forward-looking statements contained herein, please see the "Risk Factors" contained in Item 1A. of the Company's Annual Report on Form 10-K for the fiscal year ended February 28, 2021, as amended. Additional factors that might cause such differences include, but are not limited to: the length and severity of the current COVID-19 pandemic and its effect on among other things, factory sales, retail sales, royalty and marketing fees and operations, the effect of any governmental action or mandated employer-paid benefits in response to the COVID-19 pandemic, and the Company's ability to manage costs and reduce expenditures and the availability of additional financing if and when required. These forward-looking statements apply only as of the date hereof. As such they should not be unduly relied upon for more current circumstances. Except as required by law, the Company undertakes no obligation to release publicly any revisions to these forward-looking statements that might reflect events or circumstances occurring after the date of this press release or those that might reflect the occurrence of unanticipated events.

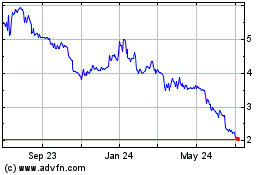

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Apr 2023 to Apr 2024