Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-266194

PROSPECTUS SUPPLEMENT

(To Prospectus dated July 27, 2022)

675,000 Shares of Common Stock

Pre-Funded Warrants to Purchase up to 325,000 Shares of Common Stock

Up to 325,000 Shares of Common Stock Underlying the Pre-Funded Warrants

We are offering 675,000 shares (the “Shares”) of our common stock, no par value (the “Common Stock”), and pre-funded warrants (the “Pre-Funded Warrants”) to purchase 325,000 shares of our Common Stock (and the shares of Common Stock underlying such Pre-Funded Warrants) directly to institutional investors pursuant to this prospectus supplement and the accompanying prospectus. The offering price per Share and per Pre-Funded Warrant is $1.50 and $1.4999, respectively. The Pre-Funded Warrants will have an exercise price of $0.0001 per share and will be exercisable upon issuance until exercised in full.

In a concurrent private placement, we are also issuing to the purchasers of the Shares, warrants to purchase up to 2,000,000 shares of Common Stock (the “Purchase Warrants”) at an exercise price of $1.60 per share (and the shares of Common Stock issuable upon the exercise of the Purchase Warrants).The Purchase Warrants and the shares of Common Stock issuable upon the exercise of such warrants are not being registered under the Securities Act of 1933, as amended (the “Securities Act”), are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act.

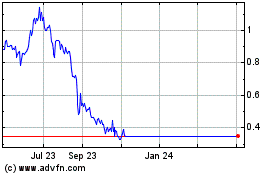

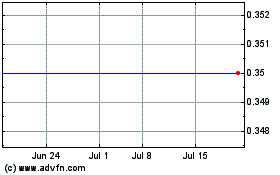

Our Common Stock is currently traded on the Nasdaq Capital Market under the symbol “RIBT.” On October 17, 2022, the last reported sale price of our Common Stock on the Nasdaq Capital Market was $1.60 per share.

As of the date of this prospectus supplement, the aggregate market value of our outstanding Common Stock held by non-affiliates was $16,361,209.60, based on 5,231,030 shares of outstanding Common Stock, of which 118,152 shares are held by affiliates, and a per share price of $3.20 per share, the closing price of our Common Stock on August 24, 2022, which is the highest closing sale price of our Common Stock on The Nasdaq Capital Market within the prior 60 days.

As of the date of this prospectus supplement, we have not offered or sold any securities pursuant to General Instruction I.B.6 to Form S-3 during the 12 calendar month period that ends on and includes the date hereof. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary offering with a value exceeding more than one-third of our “public float” (the market value of our Common Stock held by our non-affiliates) in any 12-month period so long as our public float remains below $75,000,000.

We have engaged H.C. Wainwright & Co., LLC (the “placement agent”), as our exclusive placement agent in connection with this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay the placement agent the placement agent fees set forth in the table below. See “Plan of Distribution” beginning on page S-16 of this prospectus supplement for more information regarding these arrangements.

| |

|

Per Share

|

|

|

Per Pre-

Funded

Warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$ |

1.50 |

|

|

|

1.4999 |

|

|

$ |

1,499,967.50 |

|

|

Placement agent fees (1)

|

|

$ |

0.105 |

|

|

|

0.105 |

|

|

$ |

102,750.00 |

|

|

Proceeds, before expenses, to us

|

|

$ |

1.3950 |

|

|

|

1.3949 |

|

|

$ |

1,397,217.50 |

|

|

(1)

|

We have agreed to reimburse the placement agent for certain expenses. See “Plan of Distribution” for a description of compensation payable to the placement agent.

|

Delivery of our shares of Common Stock and Pre-Funded Warrants is expected to be made on or about October 20, 2022.

An investment in our securities involves a high degree of risk. Please read “Risk Factors” on page S-7 of this prospectus supplement and in the documents incorporated by reference into this prospectus supplement before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

H.C. Wainwright & Co.

The date of this prospectus supplement is October 18, 2022

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. Under the shelf registration process, we may offer securities having an aggregate offering price of up to $50,000,000 under the accompanying base prospectus. This prospectus supplement may add to, update or change information in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement or the accompanying prospectus.

We provide information to you about this offering of shares of our Common Stock and Pre-Funded Warrants in two separate documents that are bound together: (1) this prospectus supplement, which describes the specific details regarding this offering of shares of our Common Stock and the Pre-Funded Warrants; and (2) the accompanying base prospectus, which provides general information, some of which may not apply to this offering. Generally, when we refer to this “prospectus,” we are referring to both documents combined.

If information in this prospectus supplement is inconsistent with the accompanying base prospectus or with any document incorporated by reference that was filed with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus supplement, the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates.

This prospectus supplement, the accompanying base prospectus and the documents incorporated into each by reference include important information about us, the securities being offered and other information you should know before investing in our securities. You should also read and consider information in the documents we have referred you to in the section of this prospectus supplement and the accompanying base prospectus entitled “Where You Can Find More Information” and “Incorporation of Certain Documents By Reference.”

You should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying base prospectus we may provide to you in connection with this offering and the information incorporated or deemed to be incorporated by reference therein. We have not, and the placement agent has not, authorized anyone to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the placement agent is not, offering to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained or incorporated by reference in this prospectus supplement or the accompanying base prospectus is accurate as of any date other than as of the date of this prospectus supplement or the accompanying base prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus supplement and the accompanying base prospectus or any sale of our securities. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus supplement were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus supplement contains and incorporates by reference market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe that these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. Although we are not aware of any misstatements regarding the market and industry data presented in this prospectus and the documents incorporated herein by reference, these estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus supplement and under similar headings in the other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

We are offering to sell, and are seeking offers to buy, the shares of our Common Stock and the Pre-Funded Warrants only in jurisdictions where such offers and sales are permitted. No action has been or will be taken in any jurisdiction by us or the placement agent that would permit a public offering of the shares of our Common Stock and the Pre-Funded Warrants or the possession or distribution of this prospectus supplement and the accompanying base prospectus in any jurisdiction, other than in the United States. Persons outside the United States who come into possession of this prospectus supplement and the accompanying base prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our Common Stock and the Pre-Funded Warrants and the distribution of this prospectus supplement and the accompanying base prospectus outside the United States. This prospectus supplement and the accompanying base prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying base prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

In this prospectus supplement, “we,” “us,” “our,” and the “company,” refer to RiceBran Technologies, a California corporation, and its subsidiaries, unless the context otherwise requires.

This prospectus supplement and the information incorporated herein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus supplement are the property of their respective owners.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this prospectus supplement we may file constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements relate to future events concerning our business and to our future revenues, operating results and financial condition. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “forecast,” “predict,” “propose,” “potential” or “continue,” or the negative of those terms or other comparable terminology.

Any forward-looking statements contained in this prospectus supplement are only estimates or predictions of future events based on information currently available to our management and management’s current beliefs about the potential outcome of future events. Whether these future events will occur as management anticipates, whether we will achieve our business objectives, and whether our revenues, operating results or financial condition will improve in future periods are subject to numerous risks. There are a number of important factors that could cause actual results to differ materially from the results anticipated by these forward-looking statements. These important factors include those that we discuss under the heading “Risk Factors” and in other sections of our Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the SEC on March 17, 2022, as amended on May 2, 2022, as well as in our other reports filed from time to time with the SEC that are incorporated by reference into this prospectus. You should read these factors and the other cautionary statements made in this prospectus and in the documents we incorporate by reference into this prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus or the documents we incorporate by reference into this prospectus. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about this offering and selected information contained elsewhere in or incorporated by reference into this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our securities. You should carefully read this entire prospectus supplement and the accompanying prospectus, including the information incorporated by reference herein and therein, including the “Risk Factors” section contained in this prospectus supplement and the other documents incorporated by reference into this prospectus supplement.

Overview

We are a specialty ingredient company that utilizes proprietary stabilization and separation technologies, supported by specialty milling processes, to deliver critical nutritional and functional ingredients derived from rice and other small and ancient grains for the food, nutraceutical, companion animal and equine feed categories. We are focused on milling rice and other small and ancient grains and producing, processing, and marketing value-added healthy, natural and nutrient dense products derived from these grains. Notably, we are a market leader in North America in converting raw rice bran into stabilized rice bran (“SRB”) and high value SRB derivative products including:

| |

●

|

RiBalance, a complete rice bran nutritional package derived from further processing SRB;

|

| |

●

|

RiSolubles, a highly nutritious, carbohydrate and lipid rich fraction of RiBalance;

|

| |

●

|

RiFiber, a protein and fiber rich insoluble derivative of RiBalance; and

|

| |

●

|

our family of ProRyza products, which includes derivatives composed of protein and protein/fiber blends.

|

Our existing and target customers are food and animal nutrition manufacturers, wholesalers and retailers, both domestically and internationally.

Corporate Information

We incorporated under the laws of the state of California in 2000, and our principal executive offices are located at 25420 Kuykendahl Rd., Suite B300, Tomball, TX 77375. Our telephone number is (281) 675-2421. Our website is located at www.ricebrantech.com. Information contained on, or that can be accessed through, our website is not part of this prospectus.

Recent Developments

Private Placement of Purchase Warrants

In a concurrent private placement, we are also issuing to the purchasers of the Shares and Pre-Funded Warrants, warrants to purchase up to 2,000,000 shares of Common Stock. The Purchase Warrants have an exercise price of $1.60 per share, are exercisable six months following issuance and will have a term of two and one-half years from the initial exercise date.

Reverse Stock Split

On August 25, 2022, we amended our articles of incorporation by filing with the California Secretary of State an amendment to effect a 1-for-10 reverse stock split of our Common Stock and to decrease the total number of authorized shares of our Common Stock on a post-reverse stock split basis, so that the total number of shares that we have the authority to issue is now 15,000,000 shares of Common Stock. The reverse stock split became effective at 11:59 PM PST on August 25, 2022.

Unless otherwise noted, all share and per share numbers contained in this prospectus supplement are reflected on a post-split basis for all periods presented.

THE OFFERING

| Issuer |

|

RiceBran Technologies |

| |

|

|

| Securities offered by us |

|

675,000 shares of our Common Stock

Pre-Funded Warrants to purchase 325,000 shares of Common Stock at an exercise price of $0.0001 per share. Each Pre-Funded Warrant will be exercisable immediately upon issuance and will not expire until exercised in full. This prospectus supplement also relates to the offering of the shares of Common Stock issuable upon exercise of such Pre-Funded Warrants. See “Description of Securities That We Are Offering—Pre-Funded Warrants” for a discussion on the terms of the Pre-Funded Warrants.

|

| |

|

|

| Offering price per Share or Pre-Funded Warrant |

|

$1.50 per Share and $1.4999 per Pre-Funded Warrant |

| |

|

|

| Common stock to be outstanding after this offering |

|

6,231,030 shares (1) |

| |

|

|

| Use of proceeds |

|

We estimate the net proceeds to us from this offering will be approximately $1.2 million after deducting estimated offering expenses payable by us. We intend to use the net proceeds from the sale of the securities offered by this prospectus for general corporate purposes, which may include funding capital expenditures and working capital and repaying indebtedness. See “Use of Proceeds.” |

| |

|

|

| Concurrent Private Placement |

|

In a concurrent private placement, we are selling to the investors purchasing the Shares and Pre-Funded Warrants in this offering Purchase Warrants to purchase up to 2,000,000 of our shares of Common Stock at an exercise price of $1.60 per share. The Purchase Warrants are exercisable six months following issuance and will have a term of two and one-half years from the initial exercise date. We will receive gross proceeds from exercise of the Purchase Warrants in such concurrent private placement transaction solely to the extent such Purchase Warrants are exercised for cash. The Purchase Warrants and the shares of Common Stock issuable upon the exercise of the Purchase Warrants are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act. There is no established public trading market for the Purchase Warrants, and we do not expect a market to develop. In addition, we do not intend to list the Purchase Warrants on The Nasdaq Capital Market, any other national securities exchange or any other nationally recognized trading system. See “Private Placement Transaction.” |

| |

|

|

| Risk factors |

|

You should read the “Risk Factors” section of this prospectus supplement and in the documents incorporated by reference in this prospectus supplement for a discussion of factors to consider before deciding to purchase shares of our Common Stock. |

| |

|

|

| Nasdaq Capital Market symbol |

|

“RIBT” |

(1) Includes the shares underlying the Pre-Funded Warrants but excludes the shares underlying the Purchase Warrants and Placement Agent Warrants (as defined below).

The number of shares of our Common Stock that will be outstanding immediately after this offering as shown above is based on 5,231,030 shares of Common Stock issued and outstanding as of June 30, 2022, after giving effect to the 1-for-10 reverse stock split that took effect on August 25, 2022, and, unless otherwise indicated excludes (on a post-split basis):

| |

●

|

58,971 shares of Common Stock reserved for future issuance upon the exercise of outstanding options, at a weighted average exercise price of $19.35 per share;

|

| |

●

|

19,862 shares of Common Stock reserved for issuance under our equity incentive plan;

|

| |

●

|

260,769 shares of Common Stock reserved for future issuance upon the exercise of outstanding warrants;

|

| |

●

|

2,000,000 shares of our Common Stock issuable upon the exercise of the Purchase Warrants offered in the concurrent private placement with an exercise price of $1.60 per share as described under “Private Placement Transaction”;

|

| |

●

|

63,000 shares of Common Stock issuable upon exercise of warrants issued to the placement agent as described in “Plan of Distribution” (the “Placement Agent Warrants”);

|

| |

●

|

168,792 shares of Common Stock issuable upon vesting of outstanding restricted stock units; and

|

| |

●

|

14,235 shares of Common Stock reserved for future issuance upon the conversion of outstanding Series G Preferred Stock.

|

RISK FACTORS

An investment in our securities involves a high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider the risk factors described below and in the accompanying prospectus and the risk factors discussed in the sections entitled “Risk Factors” contained in our most recent annual report on Form 10-K and in our subsequent Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K, as updated by our subsequent filings under the Exchange Act, each of which is incorporated by reference in this prospectus supplement and the accompanying prospectus, together with all of the other information contained in this prospectus supplement and the accompanying prospectus. Additional risks and uncertainties not presently known to us, or that we currently view as immaterial, may also impair our business. If any of these risks actually occur, our business, financial condition and results of operations could be materially and adversely affected. This could cause the trading price of our Common Stock to decline, resulting in a loss of all or part of your investment.

Risks Related to this Offering

We will have broad discretion in the use of the net proceeds from this offering and, despite our efforts, we may use the net proceeds in a manner that does not increase the value of your investment.

We intend to use the net proceeds, if any, from the sales of the securities offered hereby for general corporate purposes, which may include, among other things, funding capital expenditures and working capital and repaying indebtedness. We retain broad discretion over the use of the net proceeds from the sale of shares of Common Stock and Pre-Funded Warrants offered hereby. Accordingly, you will need to rely upon the judgment of our management with respect to the use of proceeds, potentially with only limited information concerning our specific intentions. These proceeds could be applied in ways that do not improve our operating results or increase the value of your investment.

We may allocate net proceeds from this offering in ways which differ from our estimates based on our current plans and assumptions discussed in the section entitled “Use of Proceeds” and with which you may not agree.

The allocation of net proceeds of the offering set forth in the “Use of Proceeds” section below represents our estimates based upon our current plans and assumptions regarding industry and general economic conditions, our future revenues and expenditures. The amounts and timing of our actual expenditures will depend on numerous factors, including market conditions, cash generated by our operations, business developments and related rate of growth. We may find it necessary or advisable to use portions of the proceeds from this offering for other purposes. Circumstances that may give rise to a change in the use of proceeds and the alternate purposes for which the proceeds may be used are discussed in the section entitled “Use of Proceeds” below. You may not have an opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use our proceeds. As a result, you and other stockholders may not agree with our decisions. See “Use of Proceeds” below for additional information

If you purchase shares of our Common Stock and Pre-Funded Warrants sold in this offering, you may experience immediate and substantial dilution in the net tangible book value of your shares. In addition, we may issue additional equity or convertible debt securities in the future, which may result in additional dilution to investors.

The price per share of our Common Stock being offered may be higher than the net tangible book value per share of our outstanding Common Stock prior to this offering. Based on an aggregate of 675,000 shares of our Common Stock sold at a price of $1.50 per share and Pre-Funded Warrants to purchase 325,000 shares of Common Stock sold at a price of $1.4999 per Pre-Funded Warrant, for aggregate gross proceeds of approximately $1.5 million, and after deducting commissions and estimated offering expenses payable by us, new investors in this offering will incur immediate dilution of $(0.98) per share. For a more detailed discussion of the foregoing, see the section entitled “Dilution” below.

There is no public market for the Pre-Funded Warrants to purchase shares of our Common Stock being offered in this offering.

There is no established public trading market for the Pre-Funded Warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the Pre-Funded Warrants on any national securities exchange or other nationally recognized trading system, including The Nasdaq Capital Market. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited.

The Pre-Funded Warrants purchased in this offering do not entitle the holder to any rights as common stockholders until the holder exercises the warrant for shares of our Common Stock, except as set forth in the Pre-Funded Warrants.

Until you acquire shares of our Common Stock upon exercise of your Pre-Funded Warrants purchased in this offering, such warrants will not provide you any rights as a common stockholder, except as set forth therein. Upon exercise of your Pre-Funded Warrants purchased in this offering, you will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs on or after the exercise date.

The Pre-Funded Warrants are speculative in nature.

The Pre-Funded Warrants offered hereby do not confer any rights of Common Stock ownership on their holders, such as voting rights, but rather merely represent the right to acquire shares of Common Stock at a fixed price. Specifically, commencing on the date of issuance, holders of the Pre-Funded Warrants may acquire the shares of Common Stock issuable upon exercise of such warrants at an exercise price of $0.0001 per share of Common Stock. Moreover, following this offering, the market value of the Pre-Funded Warrants is uncertain and there can be no assurance that the market value of the Pre-Funded Warrants will equal or exceed their public offering price.

Provisions of the Pre-Funded Warrants offered by this prospectus could discourage an acquisition of us by a third party.

Certain provisions of the Pre-Funded Warrants offered by this prospectus could make it more difficult or expensive for a third party to acquire us. The Pre-Funded Warrants prohibit us from engaging in certain transactions constituting “fundamental transactions” unless, among other things, the surviving entity assumes our obligations under the Pre-Funded Warrants. These and other provisions of the Pre-Funded Warrants offered by this prospectus could prevent or deter a third party from acquiring us even where the acquisition could be beneficial to stockholders.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our Common Stock, or securities convertible or exchangeable into Common Stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

Resales of our Common Stock in the public market during this offering by our stockholders may cause the market price of our Common Stock to fall.

We may issue Common Stock from time to time. This issuance from time to time of these new shares of our Common Stock, or our ability to issue these shares of Common Stock in this offering, could result in resales of our Common Stock by our current stockholders concerned about the potential dilution of their holdings. In turn, these resales could have the effect of depressing the market price for our Common Stock.

We are not currently paying dividends and will likely not pay dividends for the foreseeable future.

We have never paid or declared any cash dividends on our Common Stock. We currently intend to retain all available funds and any future earnings to fund the development and expansion of our business, and we do not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, contractual restrictions and other factors that our board of directors deems relevant.

The market price of our Common Stock may be adversely affected by market conditions affecting the stock markets in general, including price and trading fluctuations on Nasdaq.

Market conditions may result in volatility in the level of, and fluctuations in, market prices of stocks generally and, in turn, our Common Stock and sales of substantial amounts of our Common Stock in the market, in each case being unrelated or disproportionate to changes in our operating performance. A weak global economy or other circumstances, such as changes in tariffs and trade, could also contribute to extreme volatility of the markets, which may have an effect on the market price of our Common Stock.

We cannot predict the effect that our reverse stock split will have on the market price for shares of our Common Stock.

On August 25, 2022, we completed a 1-for-10 reverse stock split of our shares of Common Stock and proportionate reduction in the number of outstanding Common Stock from 52,310,304 to 5,231,030. The reverse stock split was effected in accordance with the authorization adopted by our stockholders at the annual meeting of stockholders held on July 14, 2022. Our board of directors determined to effect the reverse stock split because it is a potentially effective means to increase the per share market price of our Common Stock and thus enable us to regain compliance with the $1.00 per share minimum closing price required to maintain continued listing of our Common Stock on Nasdaq under Nasdaq Listing Rule 5450(a)(1), or the Minimum Bid Requirement. The board of directors also believed that a reverse stock split could improve the marketability and liquidity of the Common Stock. However, there can be no assurance that the market price of our Common Stock following the reverse stock split will remain at the level required for continuing compliance with the Minimum Bid Requirement, and there are a number of risks and potential disadvantages associated with a reverse stock split.

We cannot predict the effect of the reverse stock split upon the market price for shares of our Common Stock, and the history of similar reverse stock splits for companies in like circumstances has varied. Some investors may have a negative view of a reverse stock split. Even if the reverse stock split has a positive effect on the market price for shares of our Common Stock, performance of our business and financial results, general economic conditions and the market perception of our business, and other adverse factors which may not be in our control could lead to a decrease in the price of our Common Stock following the reverse stock split.

Even if the reverse stock split does result in an increased market price per share of our Common Stock, the market price per share following the reverse stock split may not increase in proportion to the reduction of the number of shares of our Common Stock outstanding before the implementation of the reverse stock split. Accordingly, even with an increased market price per share, the total market capitalization of shares of our Common Stock after the reverse stock split could be lower than the total market capitalization before the reverse stock split. Also, even if there is an initial increase in the market price per share of our Common Stock after the reverse stock split, the market price many not remain at that level.

If the market price of shares of our Common Stock declines following the reverse stock split, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the reverse stock split due to decreased liquidity in the market for our Common Stock. Accordingly, the total market capitalization of our Common Stock following the reverse stock split could be lower than the total market capitalization before the reverse stock split.

USE OF PROCEEDS

We estimate that the net proceeds from the sale of the 675,000 shares of Common Stock and the Pre-Funded Warrants to purchase 325,000 shares of Common Stock that we are offering will be approximately $1.2 million, after deducting the estimated placement agent fees and estimated offering expenses payable by us.

We will only receive additional proceeds from the exercise of the Purchase Warrants issuable in connection with the private placement if the Purchase Warrants are exercised and the holders of such Warrants pay the exercise price in cash upon such exercise and do not utilize the cashless exercise provision of the Purchase Warrants.

We intend to use the net proceeds from this offering for general corporate purposes, which may include funding capital expenditures and working capital and repaying indebtedness. The indebtedness we intend to repay includes our $1.8 million line of credit with Wells Fargo.

The intended use of the net proceeds of the offering set forth above represents our estimates based upon our current plans and assumptions regarding industry and general economic conditions, our future revenues and expenditures.

The amounts and timing of our actual expenditures will depend upon numerous factors, including market conditions, cash generated by our operations, business developments and related rate of growth. We may find it necessary or advisable to use portions of the proceeds from this offering for other purposes.

Circumstances that may give rise to a change in the use of proceeds and the alternate purposes for which the proceeds may be used include:

| |

●

|

the existence of other opportunities or the need to take advantage of changes in timing of our existing activities;

|

| |

●

|

the need or desire on our part to accelerate, increase or eliminate existing initiatives due to, among other things, changing market conditions and competitive developments; and/or

|

| |

●

|

if strategic opportunities of which we are not currently aware present themselves (including acquisitions, joint ventures, licensing and other similar transactions).

|

From time to time, we evaluate these and other factors and we anticipate continuing to make such evaluations to determine if the existing allocation of resources, including the proceeds of this offering, is being optimized. Pending such uses, we intend to invest the net proceeds of this offering in direct and guaranteed obligations of the United States, interest-bearing, investment-grade instruments or certificates of deposit.

DIVIDEND POLICY

We have never paid or declared any cash dividends on our Common Stock. We currently intend to retain all available funds and any future earnings to fund the development and expansion of our business, and we do not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, contractual restrictions and other factors that our board of directors deems relevant.

DILUTION

If you invest in our Common Stock, your interest will be diluted immediately to the extent of the difference between the offering price and the as adjusted net tangible book value per share of our Common Stock after this offering.

Our net tangible book value on June 30, 2022 was approximately $14.3 million, or $2.73 per share (as adjusted for our 1-for-10 reverse stock split that took effect August 25, 2022). “Net tangible book value” is total assets minus the sum of tangible liabilities and intangible assets. “Net tangible book value per share” is net tangible book value divided by the total number of shares outstanding.

After giving effect to the sale of 675,000 shares of our Common Stock in this offering at an offering price of $1.50 per share and the sale of Pre-Funded Warrants to purchase 325,000 shares of Common Stock at an offering price of $1.4999 per Pre-Funded Warrant and the issuance of the shares of Common Stock underlying the Pre-Funded Warrants upon the exercise thereof and after deducting estimated offering commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2022 would have been approximately $15.5 million, or $2.48 per share. This represents an immediate decrease in as adjusted net tangible book value of $0.25 per share to existing stockholders and an immediate dilution of $(0.98) per share to new investors purchasing securities in this offering. The following table illustrates this per share dilution:

|

Offering price per share of Common Stock

|

|

|

|

|

|

$ |

1.50 |

|

|

Net tangible book value per share as of June 30, 2022

|

|

$ |

2.73 |

|

|

|

|

|

|

Decrease in net tangible book value per share attributable to new investors purchasing our Common Stock in this offering

|

|

$ |

0.25 |

|

|

|

|

|

|

As adjusted net tangible book value per share after giving effect to this offering

|

|

|

|

|

|

$ |

2.48 |

|

|

Dilution per share to investors purchasing our Common Stock in this offering

|

|

|

|

|

|

$ |

(0.98 |

) |

The table and discussion above are based on 5,231,030 shares of Common Stock issued and outstanding as of June 30, 2022, after giving effect to the 1-for-10 reverse stock split that took effect on August 25, 2022, and excludes as of that date (on a post-split basis):

| |

●

|

58,971 shares of Common Stock reserved for future issuance upon the exercise of outstanding options, at a weighted average exercise price of $19.35 per share;

|

| |

●

|

19,862 shares of Common Stock reserved for issuance under our equity incentive plan;

|

| |

●

|

260,769 shares of Common Stock reserved for future issuance upon the exercise of outstanding warrants;

|

| |

●

|

2,000,000 shares of our Common Stock issuable upon the exercise of the Purchase Warrants offered in the concurrent private placement with an exercise price of $1.60 per share as described in “Private Placement Transaction”;

|

| |

●

|

63,000 shares of our Common Stock issuable upon the exercise of the Placement Agent Warrants;

|

| |

●

|

168,792 shares of Common Stock issuable upon vesting of outstanding restricted stock units; and

|

| |

●

|

14,235 shares of Common Stock reserved for future issuance upon the conversion of outstanding Series G Preferred Stock.

|

To the extent that any outstanding options are exercised, new options or additional securities are issued under our equity incentive plans, or we otherwise issue additional shares of Common Stock in the future, at a price less than the offering price, there will be further dilution to the investors.

In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

CAPITALIZATION

The following table sets forth our capitalization as of June 30, 2022, as follows:

| |

●

|

on an actual basis; and

|

| |

●

|

on an as adjusted basis to give effect to the sale of Common Stock, Pre-Funded Warrants and Purchase Warrants in this offering. The as adjusted column in the table below includes the net proceeds from this offering as cash and cash equivalents pending the application of such net proceeds as described in “Use of Proceeds.” The table below assumes the full exercise of the Pre-Funded Warrants resulting in the issuance of 325,000 shares of our Common Stock; however, it does not take into account the exercise of the Purchase Warrants

|

You should read this table together with the section of this prospectus supplement entitled “Use of Proceeds” and with the financial statements and related notes and the other information that we incorporated by reference into this prospectus supplement and the accompanying prospectus, including our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q that we file with the SEC from time to time.

|

|

|

As of June 30, 2022

|

|

| (in thousands, except share amounts) |

|

Actual

|

|

|

As Adjusted

|

|

|

Cash and Cash Equivalents

|

|

$ |

5,124 |

|

|

$ |

6,324 |

|

|

Long-term debt, including current portion

|

|

|

1,959 |

|

|

|

1,959 |

|

|

Equity attributable to our stockholders:

|

|

|

|

|

|

|

|

|

|

Preferred stock, no par value, 20,000,000 shares authorized and Series G, convertible, 300 shares authorized, issued and outstanding, stated value $15, 15, actual and as adjusted

|

|

|

75 |

|

|

|

75 |

|

|

Common stock, no par value, 15,000,000 shares authorized and 5,231,030 shares issued and outstanding as of June 30, 2022, actual; 6,231,030 shares issued and outstanding, as adjusted

|

|

|

326,672 |

|

|

|

327,872 |

|

|

Accumulated deficit

|

|

|

(311,996 |

) |

|

|

(311,996 |

) |

|

Total equity attributable to our stockholders

|

|

|

14,751 |

|

|

|

15,951 |

|

|

Total capitalization

|

|

$ |

16,710 |

|

|

$ |

17,910 |

|

The table above is based on 5,231,030 shares of Common Stock outstanding as of June 30, 2022, after giving effect to the 1-for-10 reverse stock split that took effect on August 25, 2022, and excludes (on a post-split basis):

| |

●

|

58,971 shares of Common Stock reserved for future issuance upon the exercise of outstanding options, at a weighted average exercise price of $19.35 per share;

|

| |

●

|

19,862 shares of Common Stock reserved for issuance under our equity incentive plan;

|

| |

●

|

260,769 shares of Common Stock reserved for future issuance upon the exercise of outstanding warrants;

|

| |

●

|

2,000,000 shares of our Common Stock issuable upon the exercise of the Purchase Warrants offered in the concurrent private placement with an exercise price of $1.60 per share as described in “Private Placement Transaction”;

|

| |

●

|

63,000 shares of our Common Stock issuable upon the exercise of the Placement Agent Warrants;

|

| |

●

|

168,792 shares of Common Stock issuable upon vesting of outstanding restricted stock units; and

|

| |

●

|

14,235 shares of Common Stock reserved for future issuance upon the conversion of outstanding Series G Preferred Stock.

|

DESCRIPTION OF SECURITIES THAT WE ARE OFFERING

Common Stock

See “Description of Capital Stock—Common Stock” on page 7 of the accompanying prospectus for a description of the material terms of our Common Stock.

Pre-Funded Warrants

The following summary of certain terms and provisions of the Pre-Funded Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by the provisions of, the Pre-Funded Warrants. You should carefully review the terms and provisions of the form of the Pre-Funded Warrant for a complete description of the terms and conditions of the Pre-Funded Warrants.

Duration and Exercise Price. The Pre-Funded Warrants offered hereby will entitle the holder thereof to purchase up to an aggregate of 325,000 shares of our Common Stock at an exercise price of $0.0001 per share, commencing immediately on the date of issuance. The Pre-Funded Warrants will be issued separately from the Common Stock and may be transferred separately immediately thereafter.

Exercisability. The Pre-Funded Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of Common Stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s warrants to the extent that the holder would own more than 4.99% (or, at the election of the holder, 9.99%) of our outstanding shares of Common Stock immediately after exercise, except that upon notice from the holder to us, the holder may increase or decrease the amount of ownership of outstanding shares of Common Stock after exercising the holder’s Pre-Funded Warrants up to 9.99% of the number of shares of Common Stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants, provided that any increase in this limitation shall not be effective until 61 days after notice to us.

Cashless Exercise. In lieu of making the cash payment otherwise contemplated to be made to us upon the exercise of a Pre-Funded Warrant in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of Common Stock determined according to a formula set forth in the Pre-Funded Warrant.

Exercise Price Adjustment. The exercise price of the Pre-Funded Warrants is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our Common Stock.

Fundamental Transaction. In the event of any fundamental transaction, as described in the Pre-Funded Warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of Common Stock, then upon any subsequent exercise of a Pre-Funded Warrant, the holder will have the right to receive as alternative consideration, for each share of Common Stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of Common Stock of the successor or acquiring corporation or of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of Common Stock for which the Pre-Funded Warrant is exercisable immediately prior to such event.

Transferability. In accordance with its terms and subject to applicable laws, a Pre-Funded Warrant may be transferred at the option of the holder upon surrender of the Pre-Funded Warrant to us together with the appropriate instruments of transfer and payment of funds sufficient to pay any transfer taxes (if applicable).

Fractional Shares. No fractional shares of Common Stock will be issued upon the exercise of the Pre-Funded Warrants. Rather, the number of shares of Common Stock to be issued will, at our election, either be rounded up to the nearest whole number or we will pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the exercise price.

Exchange Listing. There is no established trading market for the Pre-Funded Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Pre-Funded Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited.

Rights as a Stockholder. Except as otherwise provided in the Pre-Funded Warrants or by virtue of such holder’s ownership of shares of our Common Stock, the holder of a Pre-Funded Warrants does not have the rights or privileges of a holder of our Common Stock, including any voting rights, until the holder exercises the Pre-Funded Warrant.

PRIVATE PLACEMENT TRANSACTION

In a concurrent private placement, we plan to issue and sell to the investors the Purchase Warrants to purchase up to an aggregate of 2,000,000 shares of Common Stock at an exercise price equal to $1.60 per share.

The Purchase Warrants and the shares of Common Stock issuable upon the exercise of such warrants are not being registered under the Securities Act, are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act. Accordingly, investors may only sell shares of Common Stock issued upon exercise of the Purchase Warrants pursuant to an effective registration statement under the Securities Act covering the resale of those shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the Securities Act.

Exercisability. The Purchase Warrants are exercisable six months following issuance and will have a term of two and one-half years from the initial exercise date. The Purchase Warrants will be exercisable, at the option of the holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering the issuance of shares of Common Stock underlying the Purchase Warrants under the Securities Act is effective and available for the issuance of such shares, or an exemption from registration under the Securities Act is available for the issuance of such shares, by payment in full in immediately available funds for the number of Shares of Common Stock purchased upon such exercise. If at the time of exercise there is no effective registration statement registering, or the prospectus contained therein is not available for the issuance of the shares of Common Stock underlying the Purchase Warrants, then the Purchase Warrants may also be exercised, in whole or in part, at such time by means of a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of Common Stock determined according to the formula set forth in the warrant.

Exercise Limitation. A holder will not have the right to exercise any portion of the Purchase Warrants if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or, upon election of the holder, 9.99%) of the number of our shares of Common Stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the warrants. However, any holder may increase or decrease such percentage, but in no event may such percentage be increased to more than 9.99%, provided that any increase will not be effective until the 61st day after such election.

Exercise Price Adjustment. The exercise price of the Purchase Warrants is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our shares of Common Stock.

Transferability. Subject to applicable laws, the Purchase Warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange Listing. There is no established trading market for the Purchase Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Purchase Warrants on any national securities exchange or other trading market.

Fundamental Transactions. In the event of any fundamental transaction, as described in the Purchase Warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of Common Stock, then upon any subsequent exercise of a Purchase Warrant, the holder will have the right to receive as alternative consideration, for each share of Common Stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of Common Stock of the successor or acquiring corporation of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of Common Stock for which the Purchase Warrant is exercisable immediately prior to such event.

Notwithstanding the foregoing, in the event of a fundamental transaction, we or a successor entity shall, at the holder’s option, exercisable at any time concurrently or within thirty (30) days following the consummation of a fundamental transaction, purchase the Purchase Warrant by paying to the holder an amount equal to the Black Scholes Value (as defined in each Purchase Warrant) of the remaining unexercised portion of the Purchase Warrant on the date of the fundamental transaction. If the fundamental transaction is not within our control, the holders of the Purchase Warrants will only be entitled to receive from us or a successor entity the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the unexercised portion of the Purchase Warrant, that is being offered and paid to the holders of our Common Stock in connection with the fundamental transaction, whether that consideration is in the form of cash, stock or any combination thereof, or whether the holders of our Common Stock are given the choice to receive alternative forms of consideration in connection with the fundamental transaction.

Rights as a Stockholder. Except as otherwise provided in the Purchase Warrants or by virtue of such holder’s ownership of our Common Stock, the holder of a Purchase Warrant will not have the rights or privileges of a holder of our Common Stock, including any voting rights, until the holder exercises the warrant.

Resale Registration Rights. We have entered into a securities purchase agreement directly with certain institutional investors that have agreed to purchase our securities in this offering. We are required within 90 days of the date of the securities purchase agreement to file a registration statement providing for the resale of the shares of Common Stock issued and issuable upon the exercise of the Purchase Warrants. We are required to use commercially reasonable efforts to cause such registration to become effective within 180 days of the closing of the offering and to keep such registration statement effective at all times until no investor owns any Purchase Warrants or shares issuable upon exercise thereof.

You should review a copy of the securities purchase agreement and a copy of the form of the Purchase Warrant to be issued to the investors under the securities purchase agreement, which are executed or issued in connection with this offering and will be filed as exhibits to a Current Report on Form 8-K that we file with the SEC, for a complete description of the terms and conditions of the Purchase Warrants and the related transaction agreements.

PLAN OF DISTRIBUTION

Pursuant to an engagement letter agreement dated September 14, 2022, we have engaged H.C. Wainwright & Co., LLC, referred to herein as Wainwright or the placement agent, to act as our exclusive placement agent in connection with this offering. Under the terms of the engagement letter, Wainwright is not purchasing the securities offered by us in this offering, and is not required to sell any specific number or dollar amount of securities, but will assist us in this offering on a reasonable best efforts basis. The terms of this offering were subject to market conditions and negotiations between us, Wainwright and prospective investors. Wainwright will have no authority to bind us by virtue of the engagement letter. Wainwright may engage sub-agents or selected dealers to assist with this offering. We may not sell the entire amount of our shares of Common Stock offered pursuant to this prospectus supplement.

The placement agent proposes to arrange for the sale of the securities we are offering pursuant to this prospectus supplement and accompanying prospectus to one or more institutional or accredited investors through securities purchase agreements directly between the purchaser and us. We will only sell to such investors who have entered into the securities purchase agreement with us.

Delivery of the securities offered hereby is expected to take place on or about October 20, 2022, subject to satisfaction of customary closing conditions.

Fees and Expenses

We have agreed to pay the placement agent a cash fee equal to $102,750. The following table shows the per share and total cash fees we will pay to the placement agent in connection with the sale of our securities offered pursuant to this prospectus supplement and the accompanying prospectus, assuming the purchase of all of the securities offered hereby.

| |

|

Per Share

|

|

|

Per Pre-

Funded

Warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$ |

1.50 |

|

|

|

1.4999 |

|

|

$ |

1,499,967.50 |

|

|

Placement agent fees (1)

|

|

$ |

0.105 |

|

|

|

0.105 |

|

|

$ |

102,750.00 |

|

|

Proceeds, before expenses, to us

|

|

$ |

1.3950 |

|

|

|

1.3949 |

|

|

$ |

1,397,217.50 |

|

|

(1)

|

As described in the engagement letter, the placement agent fee may be reduced to 5.5% of the aggregate gross proceeds raised from the sale of securities to certain individuals or entities.

|

We have also agreed to pay the placement agent $50,000 for fees and expenses of legal counsel and other out-of-pocket expenses plus clearing fees that will not exceed $15,950. We estimate the total offering expenses of this offering that will be payable by us, excluding the placement agent’s fees and expenses, will be approximately $300,000.

In addition, we will issue to the placement agent, or its designees, warrants to purchase up to 63,000 shares of Common Stock. The Placement Agent Warrants will have an exercise price equal to $1.875 and will be exercisable for five years from the commencement of sales in this offering.

The securities purchase agreement that we entered into with certain investors prohibits, with certain limited exceptions, us: (i) for seven (7) months following the closing date from issuing any shares of Common Stock or Common Stock Equivalents (as defined in the securities purchase agreement) or filing any registration statement (other than a Form S-8), and (ii) for twelve (12) months following the closing date from issuing any shares of Common Stock or Common Stock Equivalents in a Variable Rate Transaction (as defined in the securities purchase agreement).

We have granted Wainwright, subject to certain exceptions, a right of first refusal for a period of twelve (12) months following September 14, 2022 to act as our exclusive underwriter or placement agent for any further capital raising transactions undertaken by us or any of our subsidiaries.

In the event that any investor whom the placement agent had contacted during the term of its engagement or introduced to the Company during the term of our engagement of the placement agent provides any capital to us, in a public or private offering or other financing or capital-raising transaction of any kind, within the 12 months following the expiration of termination of the engagement of the placement agent, we shall pay the placement agent the cash compensation provided above, calculated in the same manner.

We have agreed to indemnify the placement agent and specified other persons against certain liabilities relating to or arising out of the placement agent’s activities under its engagement letter, including liabilities under the Securities Act, and to contribute to payments that the placement agent may be required to make in respect of such liabilities.

The placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the sale of our securities offered hereby by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. The placement agent will be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of our securities by the placement agent. Under these rules and regulations, the placement agent may not (i) engage in any stabilization activity in connection with our securities; and (ii) bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until they have completed their participation in the distribution.

From time to time, the placement agent or its affiliates may provide in the future various advisory, investment and commercial banking and other services to us in the ordinary course of business, for which they have received and may continue to receive customary fees and commissions. However, except as disclosed in this prospectus supplement, we have no present arrangements with the placement agent for any further services.

Transfer Agent

The Transfer Agent and Registrar for our Common Stock is American Stock Transfer & Trust Company, LLC.

Listing

Our shares of Common Stock trade on the Nasdaq Capital Market under the ticker symbol “RIBT.” We do not intend to apply for listing of the Pre-Funded Warrants or the Purchase Warrants on any securities exchange or other nationally recognized trading system.

LEGAL MATTERS

The validity of the securities offered hereby will be passed upon for us by Weintraub Tobin Chediak Coleman Grodin Law Corporation, Sacramento, California. Ellenoff Grossman & Schole LLP, New York, New York is counsel to the placement agent in connection with this offering.

EXPERTS

The consolidated financial statements of RiceBran Technologies as of December 31, 2021 and for the two years then ended, incorporated in this prospectus supplement by reference from the Annual Report on Form 10-K for the year ended December 31, 2021, have been audited by RSM US LLP, an independent registered public accounting firm, as stated in their report thereon, included therein, and incorporated by reference in the prospectus and registration statement in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement is part of a registration statement on Form S-3 which we filed with the SEC. This prospectus supplement does not contain all of the information set forth in the registration statement and the exhibits to the registration statement. For further information with respect to us and the securities we are offering under this prospectus supplement, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement. Neither we nor any agent, underwriter or dealer has authorized any person to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus supplement is accurate as of any date other than the date on the front page of this prospectus supplement, regardless of the time of delivery of this prospectus supplement or any sale of the securities offered by this prospectus supplement.

We are subject to the information and periodic reporting requirements of the Exchange Act and, in accordance therewith, we file periodic reports, proxy statements and other information with the SEC. Such periodic reports, proxy statements and other information are available free of charge at our website, http://www.ricebrantech.com, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. Our website and the information contained on that site, or connected to that site, are not incorporated into and are not a part of this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” the information that we have filed with it, meaning we can disclose important information to you by referring you to those documents already on file with the SEC. The information incorporated by reference is considered to be part of this prospectus supplement and the accompanying base prospectus except for any information that is superseded by other information that is included in this prospectus supplement or the accompanying base prospectus.

This filing incorporates by reference the following documents, which we have previously filed with the SEC pursuant to the Exchange Act (other than Current Reports on Form 8-K, or portions thereof, furnished under Items 2.02 or 7.01 of Form 8-K):

| |

●

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the SEC on March 17, 2022, as amended on May 2, 2022;

|

| |

●

|

Our Quarterly Reports on Form 10-Q for the fiscal quarter ended March 31, 2022 and June 30, 2022 filed with the SEC on April 28, 2022 and August 11, 2022, respectively;

|

| |

●

|

Our Current Reports on Form 8-K filed with the SEC on March 17, 2022, April 28, 2022, July 20, 2022, August 25, 2022, September 14, 2022, September 29, 2022 and October 11, 2022, respectively; and

|

| |

●

|

The description of our Common Stock contained in our Form 8-A, filed with the SEC on December 12, 2013, as updated by the description of our Common Stock filed as Exhibit 4.09 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the SEC on March 17, 2022, including any amendments or reports filed for the purpose of updating such description.

|

We also incorporate by reference into this prospectus supplement all documents (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this prospectus supplement but prior to the termination of this offering. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Any information that we subsequently file with the SEC that is incorporated by reference as described above will automatically update and supersede any previous information that is part of this prospectus.

We hereby undertake to provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon written or oral request of any such person, a copy of any and all of the information that has been or may be incorporated by reference in this prospectus, other than exhibits to such documents. You may request, and we will provide you with, a copy of these filings, at no cost, by calling us at (281) 675-2421 or by writing to us at the following address:

RiceBran Technologies

25420 Kuykendahl Rd., Suite B300

Tomball, TX 77375

Attn: Corporate Secretary

Prospectus

RiceBran Technologies

$50,000,000

Common Stock

Preferred Stock

Warrants

Units

From time to time in one or more offerings, we may offer and sell up to an aggregate amount of $50,000,000 of any combination of the securities described in this prospectus, either individually or in combination. We may also offer common stock upon conversion of preferred stock, or common stock or preferred stock upon the exercise of warrants.

We will provide the specific terms of these offerings and securities in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as any documents incorporated by reference or deemed to be incorporated by reference into this prospectus, before buying any of the securities being offered.

This prospectus may not be used to offer or sell our securities, unless accompanied by a prospectus supplement relating to the offered securities.

Our common stock is currently listed on the Nasdaq Capital Market under the symbol “RIBT.” On July 14, 2022, the last reported sale price of our common stock was $0.38 per share. The applicable prospectus supplement will contain information, where applicable, as to any other listing, if any, on the Nasdaq Capital Market or other securities exchange, of the securities covered by the applicable prospectus supplement.

These securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or dealers or through a combination of these methods on a continuous or delayed basis. See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering of our securities in a prospectus supplement. If any underwriters or agents are involved in the sale of any securities with respect to which this prospectus is being delivered, we will disclose their names and the nature of our arrangements, including applicable fees, commissions, discounts and over-allotment options, in a prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” on page 5 of this prospectus and any similar section contained in the applicable prospectus supplement and in any free writing prospectuses we have authorized for use in connection with a specific offering, and under similar headings in the documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus or any accompanying prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus is __________, 2022.

TABLE OF CONTENTS

Page

ABOUT THIS PROSPECTUS

This prospectus is part of a shelf registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings from time to time having an aggregate initial offering price of $50,000,000. This prospectus provides you only with a general description of the securities we may offer. Each time we offer securities, we will provide you with a prospectus supplement that will contain more specific information about the securities being offered and the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings and securities. We may also add, update or change in the prospectus supplement any of the information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus, including, without limitation, a discussion of any risk factors or other special considerations that apply to these offerings or securities or the specific plan of distribution. If there is any inconsistency between the information in this prospectus and a prospectus supplement or any related free writing prospectus or information incorporated by reference having a later date, you should rely on the information in that prospectus supplement or any related free writing prospectus we may authorize to be provided to you or incorporated information having a later date. This prospectus may not be used to consummate a sale of securities, unless it is accompanied by a prospectus supplement.

This prospectus does not contain all the information provided in the registration statement we filed with the SEC. You should read this prospectus, and any accompanying prospectus supplement and any related free writing prospectus, together with additional information incorporated by reference as described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference,” before you invest in any of the securities being offered hereby.