Rhythm Pharmaceuticals, Inc. (Nasdaq: RYTM), a

biopharmaceutical company aimed at developing and commercializing

therapies for the treatment of rare genetic diseases of obesity,

today reported financial results and provided a business update for

the second quarter ended June 30, 2021.

“We have made tremendous progress in the second quarter towards

our goal of transforming the care of patients with rare genetic

diseases of obesity globally,” said David Meeker, M.D., Chair,

President and Chief Executive Officer of Rhythm. “We are pleased

with our first full quarter of IMCIVREE® (setmelanotide) commercial

availability in the United States with positive engagements with

patients, prescribers and payors. We recently secured European

Commission marketing authorization for the treatment of obesity and

the control of hunger associated with genetically confirmed

loss-of-function biallelic POMC, including PCSK1, deficiency or

biallelic LEPR deficiency in adults and children 6 years of age and

above, enabling us to expand patient access to IMCIVREE. From a

market access standpoint, we are encouraged that regulatory

authorities, such as National Institute for Health and Care

Excellence (NICE) in the United Kingdom, recognize these obesities

as rare genetic diseases for which there are no available treatment

options.”

Dr. Meeker continued, “In parallel, we are executing on our

clinical development and regulatory strategy to bring setmelanotide

to substantially more patients suffering from rare genetic diseases

of obesity. We look forward to completing supplementary regulatory

submissions in the second half of this year to both the U.S. Food

and Drug Administration (FDA) and European Medicines Agency (EMA),

seeking marketing authorization for setmelanotide for Bardet-Biedl

and Alström syndromes, and we are excited to continue advancing our

broad clinical development program in additional patient

populations. With agreement from both the FDA and EMA, we are

poised to initiate five clinical trials of setmelanotide: the

pivotal Phase 3 EMANATE trial with five sub-studies in heterozygous

POMC, PCSK1 or LEPR deficiency obesities and SRC1 and SH2B1

deficiency obesities, the Phase 2 DAYBREAK trial in 31 additional

genes each with strong or very strong ties to the MC4R pathway, as

well as a Phase 3 pediatrics trial for children younger than 6 and

two registrational trials for our weekly formulation of

setmelanotide. Taken together, we believe these efforts may enable

us to help many more people with rare genetic diseases of obesity

with a potential treatment for their insatiable hunger or

hyperphagia and early-onset, severe obesity.”

Second Quarter and Recent Business

Highlights:

Pipeline and Business Developments:

POMC and LEPR Deficiency Obesities:

- In July 2021, Rhythm announced that the European Commission

(EC) granted marketing authorization to IMCIVREE for the treatment

of obesity and the control of hunger associated with genetically

confirmed loss-of-function biallelic proopiomelanocortin (POMC),

including PCSK1, deficiency or biallelic leptin receptor (LEPR)

deficiency in adults and children 6 years of age and above.

- In Great Britain, Rhythm’s marketing

authorisation application for IMCIVREE is under review by the

Medicines & Healthcare Products Regulatory Agency (MHRA). The

Company today announced that IMCIVREE has been selected for

evaluation as a “Highly Specialised Technology” (HST) by the

National Institute for Health and Care Excellence (NICE). HST is a

specific status reserved for rare and severe diseases.

Bardet-Biedl Syndrome and Alström Syndrome:

- Today, Rhythm provided an update on its regulatory strategy for

setmelanotide for the treatment of Alström syndrome. Based on

feedback from both the FDA and EMA, Rhythm now plans to submit a

supplemental New Drug Application (sNDA) to the FDA and Type II

variation marketing authorization application (MAA) to the EMA in

the second half of 2021, which will cover both BBS and Alström

syndrome.

- Also in July 2021, Rhythm announced a collaborative research

agreement with the Clinical Registry Investigating Bardet-Biedl

Syndrome (CRIBBS) to initiate a population study focused on the

natural history of weight gain, hyperphagia and quality of life in

patients with BBS.

Additional Clinical Development Updates:

Today, Rhythm announced it has reached agreement with the FDA

and EMA on five new Phase 2 and Phase 3 clinical trials, all of

which the Company expects to initiate in the second half of

2021:

- EMANATE: a Phase 3,

randomized, double-blind, placebo-controlled trial to evaluate

setmelanotide in the five genes within the melanocortin-4 receptor

(MC4R) pathway in which Rhythm previously achieved proof of

concept, as announced in January. This trial is comprised of five

independent sub-studies evaluating setmelanotide in patients with:

heterozygous POMC/PCSK1 obesity; heterozygous LEPR obesity; certain

variants of the SRC1; certain variants of SH2B1 genes; or PCSK1

N221D deletions within the MC4R pathway;

- DAYBREAK: an

exploratory, Phase 2, two-stage, placebo-controlled trial of

setmelanotide in patients with variants in one of 31 additional

genes with strong or very strong MC4R pathway relevance. Patients

with a variant in one of the 31 genes who show an initial response

to treatment with setmelanotide will enter stage 2 where they will

be randomized to a placebo withdrawal arm or continuation on

setmelanotide;

- Pediatric patients:

a Phase 3, open-label trial evaluating setmelanotide in children

between the ages of 2 and 6 years old with obesity due to biallelic

POMC, PCSK1 or LEPR deficiency or BBS;

- Weekly formulation:

- Phase 3 study in patients currently

on daily setmelanotide therapy (“switch study”), that is a

randomized, double-blind trial to evaluate the efficacy of daily

and weekly formulations of setmelanotide in patients with obesity

due to biallelic POMC, PCSK1 or LEPR deficiency or BBS;

- Phase 3, randomized, double-blind

study in patients naïve to setmelanotide therapy (“de novo study”),

that includes a cross-over period to evaluate the weekly

formulation of setmelanotide in patients with BBS.

- Hypothalamic

obesity: In July 2021, the Company initiated an

exploratory Phase 2 clinical trial evaluating setmelanotide in

people living with hypothalamic obesity. Hypothalamic obesity is a

rare, acquired form of extreme obesity that occurs following damage

to the hypothalamic regions of the brain, which are responsible for

controlling physiological functions such as hunger and weight

regulation. Rhythm believes a subset of patients with hypothalamic

obesity have the potential to see reductions in weight and hunger

with setmelanotide if their MC4 receptor is sufficiently

intact.

Corporate

- In July 2021, Rhythm announced an exclusive distribution

agreement with Medison Pharma, a leading commercial partner for

highly innovative therapies in international markets, for Medison

to commercialize IMCIVREE in Israel.

- In July 2021, the Company announced the appointments of two new

senior leaders: Pamela Cramer as Chief Human Resources Officer and

Linda Shapiro, M.D., Ph.D., as Senior Vice President,

Clinical.

Key Upcoming Milestones:

Rhythm expects to achieve the following milestones in 2021:

Regulatory Milestones:

- Complete regulatory submissions to both the FDA and the EMA

seeking marketing authorization for setmelanotide for the treatment

of obesity in patients with BBS and Alström syndrome in the second

half of 2021.

Additional Clinical Milestones:

- Present full data from the pivotal Phase 3 trial evaluating

setmelanotide in BBS and Alström syndrome at the 59th Annual

European Society for Paediatric Endocrinology (ESPE) Meeting in

September 2021, following topline data presentations in March and

April;

- Rhythm now anticipates announcing new topline data from the

ongoing exploratory Phase 2 Basket Study evaluating setmelanotide

in patients with obesity due to a variant in the MC4 receptor, as

well as its study in patients with hypothalamic obesity, in the

first quarter of 2022.

Second Quarter 2021 Financial Results:

- Cash Position: As of June 30, 2021, cash, cash

equivalents and short-term investments were approximately $368.2

million, as compared to $172.8 million as of December 31, 2020.

This increase includes net proceeds of $98.4 million received upon

closing the sale of Rhythm’s Rare Pediatric Disease Priority Review

Voucher in February 2021, and net proceeds of approximately $161.7

million from Rhythm’s underwritten public offering of common stock,

which closed in February 2021, partially offset by cash used to

fund operating activities in the first half of 2021.

- Revenue: Product net revenues relating to

sales of IMCIVREE were $0.3 million for the second quarter of 2021.

Rhythm did not generate any product revenues in the second quarter

of 2020 as IMCIVREE was approved for commercial use by the FDA in

November 2020.

- R&D Expenses: R&D expenses were $25.1

million in the second quarter of 2021, as compared to $23.0 million

in the second quarter of 2020. The year-over-year increase was

primarily related to an increase of $2.3 million for purchases of

setmelanotide API and drug product and increase of $1.8 million for

hiring full-time employees to support increased clinical

development activities; these increases were partially offset by a

decrease of $1.9 million due to the absence of development

milestone payments in the current quarter.

- S,G&A Expenses: S,G&A expenses were

$15.5 million for the second quarter of 2021, as compared to $8.9

million for the second quarter of 2020. The year-over-year increase

was primarily related to an increase of $4.2 million in salaries

and benefits associated with additions to Rhythm’s executive

leadership team, increased headcount to support Rhythm’s expanding

business operations as well as establish its commercial operations

in the United States and internationally, an increase of $1.7

million for consulting fees to support U.S. and international

commercial operations and corporate legal and consulting support

for Rhythm’s international expansion, and an increase of $0.5

million for increased office support and insurance costs.

- Net Loss: Net loss was $35.4 million for the

second quarter of 2021, or a net loss per basic and diluted share

of $0.70, as compared to a net loss of $31.1 million for the second

quarter of 2020, or a net loss per basic and diluted share of

$0.71.

Year to Date 2021 Financial Results:

- Revenue: Product revenues relating to sales of

IMCIVREE were $0.3 million for the six months ended June 30, 2021.

Rhythm did not generate any product revenues in the six months

ended June 30, 2020 as IMCIVREE was approved for commercial use by

the FDA in November 2020.

- R&D Expenses: R&D expenses

were $45.0 million for the six months ended June 30,

2021, as compared to $45.5 million for the six months

ended June 30, 2020. The decrease was primarily due to a $2.0

million decrease related to completing the GO-ID genotyping study,

the Phase 3 POMC and LEPR trials and the Phase 2 weekly formulation

in early to mid-2020, as well as a $2.2 million decrease in patent

and regulatory filing costs. These decreases were partially offset

by increased costs related to Rhythm’s ongoing extension study, BBS

and renal studies. In addition, there was an increase of $3.2

million for hiring full-time employees to support increased

clinical development activities and $0.7 million for purchases of

setmelanotide API and drug product.

- S,G&A Expenses: S,G&A expenses

were $30.0 million for the six months ended June 30,

2021, as compared to $21.7 million for the six months

ended June 30, 2020. The increase was primarily due to an

increase of $4.0 million in salaries and benefits associated with

additions to Rhythm’s executive leadership team, increased

headcount to support Rhythm’s expanding business operations as well

as to establish its commercial operations in the United States and

internationally, an increase of $2.1 million for consulting fees to

support U.S. and international commercial operations and corporate

legal and consulting support for Rhythm’s international expansion,

an increase of $0.6 million for increased office support and

insurance, and an increase of $1.6 million associated with the

expenses incurred on the sale of Rhythm’s PRV to Alexion.

- Other income, net: Other income increased by

$99.0 million in the six months ended June 30, 2021 due primarily

to the sale of Rhythm’s PRV in February 2021.

- Provision for income taxes: The Company

recorded a tax provision of $17.0 million for the six months ended

June30, 2021, primarily related to the sale of Rhythm’s PRV, offset

by a tax benefit from ordinary losses. The Company expects to have

sufficient tax losses in the current year to offset the income from

the sale and thus no current year liability is expected.

- Net Income/(Loss): Net income was $8.4

million for the six months ended June 30, 2021, or a net

income per basic and diluted share of $0.17, as compared to a

net loss of $65.3 million for the six months

ended June 30, 2020, or a net loss per basic and diluted share

of $1.48.

Financial Guidance: Based on its current

operating plans, Rhythm expects that its existing cash, cash

equivalents and short-term investments as of June 30, 2021, will be

sufficient to fund its operating expenses and capital expenditure

requirements into at least the second half of 2023.

Conference Call Information

Rhythm Pharmaceuticals will host a live conference call and

webcast at 8:00 a.m. ET today to discuss this update, as

well as review its second quarter 2021 financial results and recent

business activities. The conference call may be accessed by dialing

(844) 498-0570 (domestic) or (409) 983-9726 (international), and

referring to conference ID 6776764. A webcast of the call will be

available under "Events and Presentations" in the Investor

Relations section of the Rhythm Pharmaceuticals website

at http://ir.rhythmtx.com/. The archived webcast will be

available on Rhythm Pharmaceuticals’ website

approximately two hours after the conference call and will be

available for 30 days following the call.

About Rhythm PharmaceuticalsRhythm is a

commercial-stage biopharmaceutical company committed to

transforming the treatment paradigm for people living with rare

genetic diseases of obesity. The Company’s precision medicine,

IMCIVREE (setmelanotide), was approved in November 2020 by the U.S.

Food and Drug Administration (FDA) for chronic weight management in

adult and pediatric patients 6 years of age and older with obesity

due to POMC, PCSK1 or LEPR deficiency confirmed by genetic testing

and by the European Commission (EC) in July 2021 for the treatment

of obesity and the control of hunger associated with genetically

confirmed loss-of-function biallelic POMC, including PCSK1,

deficiency or biallelic LEPR deficiency in adults and children 6

years of age and above. IMCIVREE is the first-ever FDA-approved and

EC-authorized therapy for these rare genetic diseases of obesity.

Rhythm is advancing a broad clinical development program for

setmelanotide in other rare genetic diseases of obesity. The

Company is leveraging the Rhythm Engine and the largest known

obesity DNA database - now with approximately 37,500 sequencing

samples - to improve the understanding, diagnosis and care of

people living with severe obesity due to certain genetic

deficiencies. The company is based in Boston, MA.

IMCIVREE®

(setmelanotide) IndicationIn the United States,

IMCIVREE is indicated for chronic weight management in adult and

pediatric patients 6 years of age and older with obesity due to

proopiomelanocortin (POMC), proprotein convertase subtilisin/kexin

type 1 (PCSK1), or leptin receptor (LEPR) deficiency. The condition

must be confirmed by genetic testing demonstrating variants

in POMC, PCSK1, or LEPR genes that are

interpreted as pathogenic, likely pathogenic, or of uncertain

significance (VUS).

In the EU, IMCIVREE is indicated for the treatment of obesity

and the control of hunger associated with genetically confirmed

loss-of-function biallelic POMC, including PCSK1, deficiency or

biallelic LEPR deficiency in adults and children 6 years of age and

above. IMCIVREE should be prescribed and supervised by a physician

with expertise in obesity with underlying genetic etiology.

Limitations of UseIMCIVREE is not indicated for

the treatment of patients with the following conditions as IMCIVREE

would not be expected to be effective:

- Obesity due to suspected POMC, PCSK1, or LEPR deficiency

with POMC, PCSK1, or LEPR variants classified

as benign or likely benign;

- Other types of obesity not related to POMC, PCSK1 or LEPR

deficiency, including obesity associated with other genetic

syndromes and general (polygenic) obesity.

Important Safety Information

WARNINGS AND PRECAUTIONS

Disturbance in Sexual Arousal: Sexual

adverse reactions may occur in patients treated with IMCIVREE.

Spontaneous penile erections in males and sexual adverse reactions

in females occurred in clinical studies with IMCIVREE. Instruct

patients who have an erection lasting longer than 4 hours to seek

emergency medical attention.

Depression and Suicidal Ideation: Some

drugs that target the central nervous system, such as IMCIVREE, may

cause depression or suicidal ideation. Monitor patients for new

onset or worsening of depression. Consider discontinuing IMCIVREE

if patients experience suicidal thoughts or behaviors.

Skin Pigmentation and Darkening of Pre-Existing

Nevi: IMCIVREE may cause generalized increased skin

pigmentation and darkening of pre-existing nevi due to its

pharmacologic effect. This effect is reversible upon

discontinuation of the drug. Perform a full body skin examination

prior to initiation and periodically during treatment with IMCIVREE

to monitor pre-existing and new skin pigmentary

lesions.

Risk of Serious Adverse Reactions Due to Benzyl Alcohol

Preservative in Neonates and Low Birth Weight

Infants: IMCIVREE is not approved for use in neonates

or infants.

ADVERSE REACTIONS

- The most common adverse reactions (incidence ≥23%) were

injection site reactions, skin hyperpigmentation, nausea, headache,

diarrhea, abdominal pain, back pain, fatigue, vomiting, depression,

upper respiratory tract infection, and spontaneous penile

erection.

USE IN SPECIFIC POPULATIONSDiscontinue IMCIVREE

when pregnancy is recognized unless the benefits of therapy

outweigh the potential risks to the fetus.

Treatment with IMCIVREE is not recommended for use while

breastfeeding.

To report SUSPECTED ADVERSE REACTIONS, contact Rhythm

Pharmaceuticals at +1 (833) 789-6337 or FDA at 1-800-FDA-1088

or www.fda.gov/medwatch.

See Full Prescribing Information for IMCIVREE.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including without limitation statements

regarding the potential, safety, efficacy, and regulatory and

clinical progress of setmelanotide, including the anticipated

timing for initiation of clinical trials and release of clinical

trial data and our expectations surrounding potential regulatory

submissions, approvals and timing thereof, our business strategy

and plans, including regarding commercialization of setmelanotide,

our participation in upcoming events and presentations, and the

sufficiency of our cash, cash equivalents and short-term

investments to fund our operations. Statements using word such as

“expect”, “anticipate”, “believe”, “may”, “will” and similar terms

are also forward-looking statements. Such statements are subject to

numerous risks and uncertainties, including, but not limited to,

the impact of our management transition, our ability to enroll

patients in clinical trials, the design and outcome of clinical

trials, the impact of competition, the ability to achieve or obtain

necessary regulatory approvals, risks associated with data analysis

and reporting, our liquidity and expenses, the impact of the

COVID-19 pandemic on our business and operations, including our

preclinical studies, clinical trials and commercialization

prospects, and general economic conditions, and the other important

factors discussed under the caption “Risk Factors” in our Quarterly

Report on Form 10-Q for the quarter ended June 30, 2021 and our

other filings with the Securities and Exchange Commission. Except

as required by law, we undertake no obligations to make any

revisions to the forward-looking statements contained in this

release or to update them to reflect events or circumstances

occurring after the date of this release, whether as a result of

new information, future developments or otherwise.

Condensed Consolidated Statements of Operations

and Comprehensive Income (Loss)(in thousands, except share and per

share data)(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended June 30, |

|

Six months ended June 30, |

| |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Product revenue, net |

|

$ |

274 |

|

|

$ |

— |

|

|

$ |

309 |

|

|

$ |

— |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

137 |

|

|

|

— |

|

|

|

141 |

|

|

|

— |

|

|

Research and development |

|

|

25,104 |

|

|

|

22,997 |

|

|

|

45,015 |

|

|

|

45,501 |

|

|

Selling, general, and administrative |

|

|

15,465 |

|

|

|

8,921 |

|

|

|

29,983 |

|

|

|

21,717 |

|

|

Total costs and expenses |

|

|

40,706 |

|

|

|

31,918 |

|

|

|

75,139 |

|

|

|

67,218 |

|

| Loss from operations |

|

|

(40,432 |

) |

|

|

(31,918 |

) |

|

|

(74,830 |

) |

|

|

(67,218 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income |

|

|

— |

|

|

|

— |

|

|

|

100,000 |

|

|

|

— |

|

|

Interest income, net |

|

|

21 |

|

|

|

801 |

|

|

|

175 |

|

|

|

1,937 |

|

|

Total other income, net |

|

|

21 |

|

|

|

801 |

|

|

|

100,175 |

|

|

|

1,937 |

|

| Income (loss) before

taxes |

|

|

(40,411 |

) |

|

|

(31,117 |

) |

|

|

25,345 |

|

|

|

(65,281 |

) |

| Provision for income

taxes |

|

|

(5,022 |

) |

|

|

— |

|

|

|

16,984 |

|

|

|

— |

|

|

Net income (loss) |

|

$ |

(35,389 |

) |

|

$ |

(31,117 |

) |

|

$ |

8,361 |

|

|

$ |

(65,281 |

) |

| Net income (loss) per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.70 |

) |

|

$ |

(0.71 |

) |

|

$ |

0.17 |

|

|

$ |

(1.48 |

) |

|

Diluted |

|

$ |

(0.70 |

) |

|

$ |

(0.71 |

) |

|

$ |

0.17 |

|

|

$ |

(1.48 |

) |

| Weighted-average common shares

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

50,209,484 |

|

|

|

44,098,860 |

|

|

|

48,931,127 |

|

|

|

44,074,352 |

|

|

Diluted |

|

|

50,209,484 |

|

|

|

44,098,860 |

|

|

|

49,644,704 |

|

|

|

44,074,352 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(35,389 |

) |

|

$ |

(31,117 |

) |

|

$ |

8,361 |

|

|

$ |

(65,281 |

) |

|

Unrealized (loss) gain on marketable securities |

|

|

79 |

|

|

|

567 |

|

|

|

(28 |

) |

|

|

630 |

|

| Comprehensive income

(loss) |

|

$ |

(35,310 |

) |

|

$ |

(30,550 |

) |

|

$ |

8,333 |

|

|

$ |

(64,651 |

) |

Rhythm Pharmaceuticals, Inc.Condensed

Consolidated Balance Sheets(in thousands, except share and per

share data)(Unaudited)

| |

|

June 30, |

|

December 31, |

| |

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

69,339 |

|

|

$ |

100,854 |

|

|

Short-term investments |

|

|

298,815 |

|

|

|

71,938 |

|

|

Prepaid expenses and other current assets |

|

|

10,300 |

|

|

|

8,876 |

|

|

Total current assets |

|

|

378,454 |

|

|

|

181,668 |

|

| Property and

equipment, net |

|

|

3,051 |

|

|

|

3,195 |

|

| Right-of-use

asset |

|

|

1,671 |

|

|

|

1,807 |

|

| Intangible assets,

net |

|

|

4,886 |

|

|

|

— |

|

| Restricted

cash |

|

|

328 |

|

|

|

403 |

|

|

Total assets |

|

$ |

388,390 |

|

|

$ |

187,073 |

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

5,009 |

|

|

$ |

4,900 |

|

|

Accrued expenses and other current liabilities |

|

|

11,880 |

|

|

|

12,559 |

|

|

Lease liability |

|

|

570 |

|

|

|

535 |

|

|

Total current liabilities |

|

|

17,459 |

|

|

|

17,994 |

|

| Long-term

liabilities: |

|

|

|

|

|

|

| Deferred tax

liability |

|

|

16,984 |

|

|

|

— |

|

| Lease

liability |

|

|

2,258 |

|

|

|

2,551 |

|

|

Total liabilities |

|

|

36,701 |

|

|

|

20,545 |

|

| Commitments and

contingencies (Note 5) |

|

|

|

|

|

|

| Stockholders’

equity: |

|

|

|

|

|

|

|

Preferred Stock, $0.001 par value: 10,000,000 shares authorized; no

shares issued and outstanding at June 30, 2021 and

December 31, 2020 |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value: 120,000,000 shares authorized;

50,226,739 and 44,235,903 shares issued and outstanding

June 30, 2021 and December 31, 2020,

respectively |

|

|

50 |

|

|

|

44 |

|

|

Additional paid-in capital |

|

|

802,584 |

|

|

|

625,762 |

|

|

Accumulated other comprehensive income |

|

|

21 |

|

|

|

49 |

|

|

Accumulated deficit |

|

|

(450,966 |

) |

|

|

(459,327 |

) |

|

Total stockholders’ equity |

|

|

351,689 |

|

|

|

166,528 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

388,390 |

|

|

$ |

187,073 |

|

Corporate Contact:David ConnollyHead of

Investor Relations and Corporate CommunicationsRhythm

Pharmaceuticals, Inc.857-264-4280dconnolly@rhythmtx.com

Investor Contact:Hannah DeresiewiczStern

Investor Relations,

Inc.212-362-1200hannah.deresiewicz@sternir.com

Media Contact:Adam DaleyBerry & Company

Public Relations212-253-8881adaley@berrypr.com

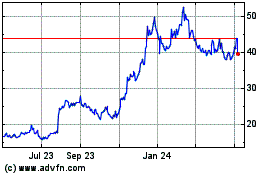

Rhythm Pharmaceuticals (NASDAQ:RYTM)

Historical Stock Chart

From Mar 2024 to Apr 2024

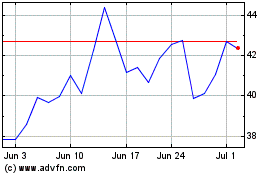

Rhythm Pharmaceuticals (NASDAQ:RYTM)

Historical Stock Chart

From Apr 2023 to Apr 2024