Rezolute Reports Fourth Quarter and Full Year Fiscal 2022 Results and Highlights Company Progress

September 15 2022 - 4:05PM

Rezolute, Inc. (Nasdaq: RZLT), a clinical-stage biopharmaceutical

company dedicated to developing transformative therapies with the

potential to shift the treatment paradigms of devastating metabolic

diseases, today announced its financial results for the fourth

quarter and full fiscal year ended June 30, 2022.

“This quarter marked steady progress as we continue to drive our

clinical programs forward, including RZ358 for congenital

hyperinsulinism and RZ402 for diabetic macular edema,” said Nevan

Charles Elam, Chief Executive Officer and Founder of Rezolute.

“With the $130 million financing that we completed, we are

well-capitalized to advance RZ358 into a Phase 3 trial and to

initiate a Phase 2 proof-of-concept study for RZ402. We believe

these candidates hold the potential to create a new standard of

care for patient populations in need of better therapeutic

options.”

Corporate and Clinical Highlights

- Financing Update

- Rezolute raised gross proceeds of $130 million in a registered

direct offering and concurrent private placement backed by notable

growth and life science investors.

- RZ358, monoclonal antibody for the treatment of

congenital hyperinsulinism

- The results of the Phase 2b RIZE study of RZ358 in

patients with congenital hyperinsulinism (HI) were revealed in a

late-breaking oral presentation at the 2022 Pediatric Endocrine

Society Annual Meeting in May and discussed by management in a

conference call following the presentation. RZ358 demonstrated

good safety and tolerability across all doses with no study

discontinuations or adverse drug reactions. Results exceeded

expectations for correction of hypoglycemia, including a highly

significant reduction of ~75% in hypoglycemia events by blood

glucometer (BGM) as well as time in hypoglycemia by continuous

glucose monitoring (CGM) at anticipated therapeutics doses.

Rezolute also presented additional data from the RIZE study at the

60th European Society for Paediatric Endocrinology (ESPE) meeting

this month.

- RZ402, oral plasma kallikrein inhibitor to treat

diabetic macular edema (DME)

- Positive topline data from the Phase 1b multiple-ascending dose

study of RZ402 were announced earlier this year. These data further

validate and support the potential for once daily oral dosing and

enable Rezolute to initiate a Phase 2 proof-of-concept study in the

fourth calendar quarter of this year.

- Key leadership announcement

- Rezolute announced the promotion of Brian Roberts, M.D.,

previously Senior Vice President and Head of Clinical Development,

to Chief Medical Officer of Rezolute. Dr. Roberts joined Rezolute

in 2017 as Vice President of Clinical Development and a member of

the founding management team.

Fourth Quarter and Full Year Fiscal 2022 Financial

Results

- Cash and cash equivalents totaled $150.4 million as of June 30,

2022.

- Research and development (R&D) expenses were $8.6 million

for the fourth quarter of fiscal 2022, compared to $4.4 million for

the same period in fiscal 2021. Full fiscal year 2022 R&D

expenses were $32.5 million, compared to $15.0 million in fiscal

year 2021. The increase from fiscal year 2021 to fiscal year 2022

was primarily due to increased spending for clinical trial

activities, manufacturing costs, compensation and benefits and an

increase in licensing payments.

- General and administrative (G&A) expenses were $2.7 million

for the fourth quarter of fiscal 2022, compared to $2.2 million for

the same period in fiscal 2021. Full fiscal year 2022 G&A

expenses were $9.4 million, compared to $7.9 million in fiscal year

2021. The increase from fiscal year 2021 to fiscal year 2022 were

primarily due to increased spending in professional services.

- Net loss was $9.4 million for the fourth quarter of fiscal

2022, compared to $6.5 million for the same period in fiscal 2021.

Full year fiscal 2022 net loss was $41.1 million compared to net

loss of $20.9 million for the fiscal year 2021.

About Rezolute, Inc.Rezolute strives to disrupt

current treatment paradigms by developing transformative therapies

for devastating rare and chronic metabolic diseases. Its novel

therapies hold the potential to both significantly improve outcomes

and reduce the treatment burden for patients, the treating

physician, and the healthcare system. Patient, clinician, and

advocate voices are integrated in the Company’s drug development

process, enabling Rezolute to boldly address a range of severe

conditions. Rezolute is steadfast in its mission to create

profound, positive, and lasting impact on patients’ lives. The

Company’s lead clinical asset, RZ358, is in late-stage development

for the treatment of congenital hyperinsulinism, a rare pediatric

endocrine disorder. Rezolute is also developing RZ402, an orally

available plasma kallikrein inhibitor, for the treatment of

diabetic macular edema. For more information, visit

www.rezolutebio.com or follow us on Twitter.

Forward-Looking StatementsThis release, like

many written and oral communications presented by Rezolute and our

authorized officers, may contain certain forward-looking statements

regarding our prospective performance and strategies within the

meaning of Section 27A of the Securities Act and Section 21E of the

Securities Exchange Act of 1934, as amended. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and are including this

statement for purposes of said safe harbor provisions.

Forward-looking statements, which are based on certain assumptions

and describe future plans, strategies, and expectations of

Rezolute, are generally identified by use of words such as

"anticipate," "believe," "estimate," "expect," "intend," "plan,"

"project," "seek," "strive," "try," or future or conditional verbs

such as "could," "may," "should," "will," "would," or similar

expressions. Our ability to predict results or the actual effects

of our plans or strategies is inherently uncertain. Accordingly,

actual results may differ materially from anticipated results.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

release. Except as required by applicable law or regulation,

Rezolute undertakes no obligation to update these forward-looking

statements to reflect events or circumstances that occur after the

date on which such statements were made. Important factors that may

cause such a difference include any other factors discussed in

Rezolute’s filings with the SEC, including the Risk Factors

contained in the Rezolute’s Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q, which are available at the SEC’s

website at www.sec.gov. You are urged to consider these factors

carefully in evaluating the forward-looking statements in this

release and are cautioned not to place undue reliance on such

forward-looking statements, which are qualified in their entirety

by this cautionary statement.

Investor Contact:Kimberly Minarovich/Carrie

McKimArgot Partnersrezolute@argotpartners.com 212-600-1902

Media:Ingrid MezoCanale Communications,

Inc.ingrid.mezo@canalecomm.com 301-473-2881

|

|

|

Rezolute, Inc. |

|

Condensed Consolidated Financial Statements

Data |

|

(in thousands, except per share data) |

|

(Unaudited) |

|

|

| |

|

Three Months Ended |

|

Year Ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Operations

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

8,574 |

|

|

$ |

4,389 |

|

|

$ |

32,486 |

|

|

$ |

14,987 |

|

|

General and administrative |

|

|

2,725 |

|

|

|

2,247 |

|

|

|

9,357 |

|

|

|

7,907 |

|

|

Total operating expenses |

|

|

11,299 |

|

|

|

6,636 |

|

|

|

41,843 |

|

|

|

22,894 |

|

|

Loss from operations |

|

|

(11,299 |

) |

|

|

(6,636 |

) |

|

|

(41,843 |

) |

|

|

(22,894 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-operating income, net |

|

|

1,876 |

|

|

|

146 |

|

|

|

783 |

|

|

|

1,992 |

|

|

Net loss |

|

$ |

(9,423 |

) |

|

$ |

(6,490 |

) |

|

$ |

(41,060 |

) |

|

$ |

(20,902 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.30 |

) |

|

$ |

(0.78 |

) |

|

$ |

(2.26 |

) |

|

$ |

(2.72 |

) |

|

Diluted |

|

$ |

(0.37 |

) |

|

$ |

(0.78 |

) |

|

$ |

(2.32 |

) |

|

$ |

(2.72 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

31,429 |

|

|

|

8,352 |

|

|

|

18,197 |

|

|

|

7,671 |

|

|

Diluted |

|

|

36,302 |

|

|

|

8,352 |

|

|

|

19,487 |

|

|

|

7,671 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

|

|

|

|

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

|

$ |

150,410 |

|

|

$ |

41,047 |

|

|

Working capital |

|

|

|

|

|

|

|

|

149,642 |

|

|

|

40,025 |

|

|

Total assets |

|

|

|

|

|

|

|

|

152,420 |

|

|

|

42,609 |

|

|

Long term debt, net of discount |

|

|

|

|

|

|

|

|

— |

|

|

|

13,968 |

|

|

Accumulated deficit |

|

|

|

|

|

|

|

|

(209,198 |

) |

|

|

(168,138 |

) |

|

Total stockholders’ equity |

|

|

|

|

|

|

|

|

149,471 |

|

|

|

26,099 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

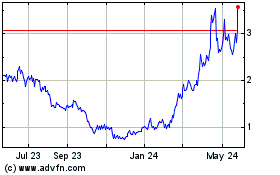

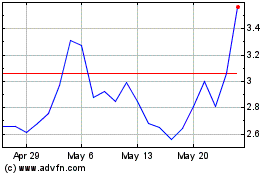

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From Apr 2023 to Apr 2024