Repligen Corporation (NASDAQ:RGEN), a life sciences company focused

on bioprocessing technology leadership, today announced that it has

entered into a definitive agreement to acquire privately-held C

Technologies, Inc. for approximately $240 million, comprised of

$192 million in cash plus $48 million in Repligen common stock. C

Technologies recorded revenue of $23.7 million in 2018, and is

projected to generate $27-$29 million in revenue (pro forma) in

2019, led by the success of its SoloVPE product-line which is

considered a gold standard for measuring protein concentration in

biopharmaceutical manufacturing. We believe the acquisition

of C Technologies will establish Repligen in the rapidly growing

Process Analytics segment of bioprocessing with best-in-class

protein measurement technologies and a strong foundation for

next-generation product development.

C Technologies is an analytics company with a market-leading

portfolio of spectroscopy products used primarily in

biopharmaceutical manufacturing. Over the past 10 years, C

Technologies’ SoloVPE platform has become a standard in quality

control and process development labs and in production-scale

manufacturing for off-line or at-line protein concentration

measurement. Use of the VPE technology delivers accurate and

consistent protein measurement results to customers, eliminating

the need for manual and time-consuming sample dilution while

reducing time to results. More recently, C Technologies introduced

its FlowVPE technology, which features in-line protein

concentration measurement in filtration, chromatography and

fill-finish applications. A key benefit of this in-line solution is

the ability to monitor a manufacturing process in real time.

Tony J. Hunt, President and CEO of Repligen said, “The addition

of C Technologies is a major step forward in building out a Process

Analytics franchise for Repligen. We are excited to have Craig and

the C Technologies team join Repligen. We look forward to further

developing the core Slope Spectroscopy® technology for real-time

bioprocess applications. We also plan to invest in expanding C

Technologies’ commercial team to support broader global adoption of

SoloVPE and FlowVPE, while continuing to deliver on the exceptional

customer service for which C Technologies is well known. We believe

that our acquisition of C Technologies will contribute to our

continued growth in upstream and downstream markets and build on

our strong first quarter performance.”

Craig Harrison, President and CEO of C Technologies said, “We

are very proud of the progress and impact we have made in biopharma

over the past decade. Our culture of technology innovation and

customer centricity is what differentiates us and where we feel a

real affinity with Repligen. We look forward to driving expanded,

global adoption of our products, and continuing to advance SoloVPE

and FlowVPE as standards in the industry for off-line, at-line and

in-line protein concentration measurement”.

Strategic and Financial Benefits of the

Transaction

- Establishes a key franchise for Repligen in the rapidly

growing process analytics segment of bioprocessingC

Technologies adds a fourth franchise - Process Analytics - to

Repligen’s bioprocessing portfolio, complementing our Filtration,

Chromatography and Proteins businesses. As the industry implements

single-use solutions and drives process efficiency with faster

turn-around between production campaigns the need for off-line,

at-line and in-line measurement technologies has become more

critical. C Technologies’ SoloVPE and FlowVPE product lines address

these needs with rapid, accurate and consistent results while

significantly reducing overall time to results for customers.

- Adds a market-leader in protein concentration

measurement with novel spectroscopy technology to our

portfolioC Technologies is a technology and market leader

in bioprocess analytics focused on protein concentration

measurement in bioprocessing applications. C Technologies has

established a spectroscopy portfolio – encompassing systems,

consumables and services – based on its patented Slope

Spectroscopy® solution with variable path length extension (VPE)

technology. C Technologies products have become widely adopted in

process development, manufacturing and in quality control

labs.

- Significantly expands capabilities to enable real-time

process monitoring in batch and continuous

manufacturingFlowVPE systems allow for in-line protein

concentration measurement, improving overall chromatography

performance and enabling real-time accurate final protein

measurements in TFF filtration and final formulation. The FlowVPE

system can be used in both batch and continuous manufacturing

making it well-positioned for increased industry adoption.

- Provides significant opportunity to expand global

market reach through investments in C Technologies’ commercial

infrastructure and in accelerated development of next-generation

productsRepligen plans to expand C Technologies’ global

presence by investing in its commercial organization across regions

and increasing R&D funding to accelerate development of

next-generation products, including technologies that align with

Repligen’s filtration and chromatography systems strategy.

- Positive projected financial impactC

Technologies recorded $23.7 million of revenue for 2018 and has

grown its revenue at an annual CAGR of approximately 20% since

2015. Its products are expected to add $16-$17 million to Repligen

revenue in 2019, assuming a 7-month period of Repligen ownership.

For the full year 2020, C Technologies is expected to contribute

$32-$34 million in incremental revenue, at gross margins well above

Repligen’s corporate average of 56%-57% per Repligen’s most recent

2019 guidance. Repligen expects the transaction to be

accretive to its overall EBIT margins and accretive to adjusted

earnings per diluted share (EPS) in 2019.

Approvals and FinancingThe transaction is

expected to be completed during the second quarter of 2019, subject

to the satisfaction of customary closing conditions, including the

expiration or termination of the waiting period under the

Hart-Scott-Rodino (HSR) Antitrust Improvements Act of 1976.

To fund the transaction, Repligen intends to use its cash on hand,

which totaled approximately $194 million at December 31, 2018 and

potentially a committed debt financing of $125 million that it has

obtained from J.P. Morgan Chase & Co.

Perella Weinberg Partners LP is acting as financial advisor and

Goodwin Procter LLP is serving as legal counsel to Repligen.

J.P. Morgan Chase & Co. is serving as lender, lead arranger and

the sole administrative agent under the committed debt financing

and Simpson Thatcher served as its legal advisor.

First Quarter Preliminary Financial

ResultsRepligen is today announcing preliminary financial

results for its first fiscal quarter of 2019. For the three month

period ended March 31, 2019, Repligen expects to report revenue in

the range of $60-$61 million, representing organic growth of

35%-37%, compared to $44.8 million in revenue for the three months

ended March 31, 2018. The Company expects to report fully diluted

GAAP earnings per share (EPS) for the first quarter of 2019 of

$0.16-$0.17, compared to $0.08 for the same period in 2018.

Repligen expects to report adjusted EPS (non-GAAP) for the first

quarter of 2019 of $0.27-$0.28, compared to $0.17 for the same

period in 2018. Adjustments to preliminary GAAP EPS,

reconciling to preliminary adjusted EPS, include the following

estimated adjustments: acquisition and integration costs of $0.04,

intangible amortization of $0.06 and non-cash interest expense of

$0.02, and the tax effect of intangible amortization and

integration costs (-$0.01), each per fully diluted share.

These financial results are preliminary estimates based on

information available to management as of the date of this press

release, and actual financial results could change. Repligen’s

actual financial results for its fiscal first quarter ended, March

31, 2019 are subject to the completion of its financial statements

for the quarter.

Use of Non-GAAP Financial MeasuresThe following

non-GAAP measure of financial performance is included in this

release and/or the slide deck that accompanies today’s webcast:

adjusted earnings per diluted share (EPS). Adjusted EPS

excludes gains or losses that are either isolated or cannot be

expected to occur again with any regularity or predictability, tax

provisions/benefits related to the previous items, benefits from

tax credit carryforwards, and the impact of tax audits or events.

In addition, our preliminary adjusted EPS estimates for the

first quarter of 2019, as noted above, exclude: acquisition and

integration costs, intangible amortization, non-cash interest

expense and the tax effect of intangible amortization and

acquisition costs. We exclude the above items because they are

outside of our normal operations and/or, in certain cases, are

difficult to forecast accurately for future periods. We believe

that the use of non-GAAP measures helps investors to gain a better

understanding of our core operating results and future prospects,

consistent with how management measures and forecasts the company's

performance, especially when comparing such results to previous

periods or forecasts.

Conference Call and Webcast Repligen management

will host a conference call and webcast at 8:30 am ET today to

provide more information on this announcement. The webcast

and accompanying slides can be accessed in the Investor Events

& Presentations section of Repligen’s website. An audio

archive of the call will be available for a limited period of time

following the event.

Live event webcast link (with slides):

Repligen to Acquire C Technologies

Live event dial-in:Domestic:

1-866-777-2509International: 1-412-317-5413Conference ID: No

passcode required

Archived event dial-in:Domestic:

1-877-344-7529International: 1-412-317-0888Conference ID:

10131175

About C Technologies Inc.C Technologies, Inc.

is a privately-held, Bridgewater, NJ based company known for

innovation in spectroscopy. The company designs and manufactures

assemblies, instrumentation and systems for spectroscopy

applications, primarily for biotech and pharmaceutical customers,

and also for government, research institutions and academia. C

Technologies applies its decades of experience to create innovative

tools, processes, and solutions for analytical and process

challenges. C Technologies' products for protein

concentration measurement are being used to support the

development of new biologic and pharmaceutical

products. Its leading instruments, SoloVPE and FlowVPE feature

the company’s Slope Spectroscopy® which leverages the power of its

patented variable pathlength extension (VPE) technology. The result

is a relatively rapid, robust and repeatable concentration

measurement method for biologics, small molecules or any sample

traditionally analyzed with UV-Vis, overcoming the limitations of

fixed pathlength methods.

About Repligen Corporation Repligen Corporation

(NASDAQ:RGEN) is a global bioprocessing company that develops and

commercializes highly innovative products that deliver cost and

process efficiencies to biological drug manufacturers worldwide.

Our portfolio includes protein products (Protein A affinity ligands

including NGL Impact™-A, cell culture growth factors),

chromatography products (OPUS® pre-packed columns, chromatography

resins, ELISA kits) and filtration products (including XCell™ ATF,

TangenX™ SIUS™ TFF and Spectrum KrosFlo™ TFF filters and systems).

The Protein A ligands and growth factor products that we produce

are essential components of Protein A affinity resins used in

biologics purification, and cell culture media used to accelerate

cell growth in a bioreactor. Our innovative line of OPUS®

chromatography columns, used in bench-scale through

commercial-scale biologics purification, are delivered pre-packed

to our customers with their choice of affinity resin. Our XCell™

ATF Systems, available in stainless steel and single-use

configurations, are used in perfusion processes to continuously

concentrate cells and increase product yield from a bioreactor.

Single-use SIUS™ TFF cassettes and hardware are used for biologic

drug concentration in downstream filtration processes. KrosFlo™ TFF

cartridges and systems are used in both upstream and downstream

filtration processes. Repligen’s corporate headquarters are in

Waltham, MA (USA), with additional administrative and manufacturing

operations in Marlborough, MA, Rancho Dominguez, CA, Lund, Sweden

and Ravensburg, Germany.

Forward-Looking StatementsThe following

constitutes a “Safe Harbor” statement under the Private Securities

Litigation Reform Act of 1995: This press release contains

forward-looking statements, which are made pursuant to the safe

harbor provisions of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Investors are cautioned that statements in this press

release which are not strictly historical statements, constitute

forward-looking statements, including, without limitation, express

or implied statements or guidance regarding the expected results of

the proposed acquisition of C Technologies on Repligen’s future

financial performance, including the accretive nature and the

timing of the accretive nature of the acquisition, expected

synergies following the acquisition of C Technologies, customer

adoption of C Technologies’ products, the expected expansion of

Repligen’s product lines, the anticipated funding for the

acquisition, the timing of the closing of the acquisition,

Repligen’s preliminary estimates of its first quarter 2019

financial results, and other statements identified by words like

“believe,” “expect,” “may,” “will,” “should,” “seek,” “anticipate,”

or “could” and similar expressions. Such forward-looking statements

are subject to a number of risks and uncertainties that could cause

actual results to differ materially from those anticipated,

including, without limitation, risks associated with: the risk that

the proposed acquisition may not be completed in a timely manner,

or at all; the occurrence of any event, change or other

circumstance that could give rise to the termination of the

acquisition; our ability to integrate Spectrum’s business and

personnel and to achieve expected synergies; our ability to

maintain or expand Spectrum’s historical sales; our ability to

accurately forecast the acquisition, related restructuring costs

and allocation of the purchase price, goodwill and other

intangibles acquisition related and other asset adjustments; our

ability to develop and commercialize products and the market

acceptance of our products; reduced demand for single-use or

disposable bioprocessing products that adversely impacts our future

revenues, cash flows, results of operations and financial

condition; our volatile stock price; and other risks detailed in

Repligen’s most recent Annual Report on Form 10-K on file with the

Securities and Exchange Commission and the other reports that

Repligen periodically files with the Securities and Exchange

Commission. Actual results may differ materially from those

Repligen contemplated by these forward-looking statements. These

forward looking statements reflect management’s current views and

Repligen does not undertake to update any of these forward-looking

statements to reflect a change in its views or events or

circumstances that occur after the date hereof except as required

by law.

Repligen Contact: Sondra S. NewmanSenior

Director Investor Relations(781) 419-1881investors@repligen.com

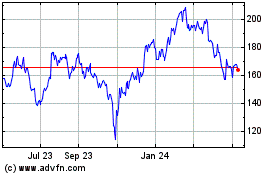

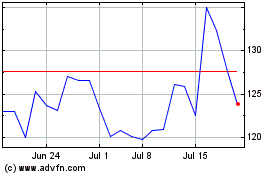

Repligen (NASDAQ:RGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Repligen (NASDAQ:RGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024