Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

December 20 2022 - 3:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of report: December 20, 2022

Commission File Number: 001-39387

Renalytix plc

(Translation of registrant’s name into English)

Finsgate

5-7 Cranwood Street

London EC1V 9EE

United Kingdom

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

Renalytix Announces Results of Annual General Meeting

On December 19, 2022, Renalytix plc (the “Company”) held its 2022 Annual General Meeting (the “Annual General Meeting”). Each of the following ordinary resolutions (requiring a simple majority) were duly proposed and approved on a poll:

1.To receive and adopt the accounts for the year ended 30 June 2022 together with the reports of the Directors and the auditors thereon (the “2022 Annual Report and Accounts”).

2.To approve the Directors’ Remuneration Report set out on pages 32 to 47 (inclusive) of the 2022 Annual Report and Accounts.

3.To re-appoint Christopher Mills as a Director of the Company who retires by rotation in accordance with Article 83.1 of the Company’s articles of association and, being eligible, is offering himself for re- appointment.

4.To re-appoint James McCullough as a Director of the Company who retires by rotation in accordance with Article 83.1 of the Company’s articles of association and, being eligible, is offering himself for re- appointment.

5.To re-appoint Fergus Fleming as a Director of the Company who retires by rotation in accordance with Article 83.1 of the Company’s articles of association and, being eligible, is offering himself for re- appointment.

6.To re-appoint Erik Lium as a Director of the Company who retires by rotation in accordance with Article 83.1 of the Company’s articles of association and, being eligible, is offering himself for re-appointment.

7.To re-appoint Timothy Scannell as a Director of the Company who, having been appointed since the last annual general meeting, is retiring in accordance with Article 83.1 of the Company’s articles of association and, being eligible, is offering himself for re-appointment.

8.To re-appoint Messrs PKF Littlejohn LLP as auditors to act as such until the conclusion of the next annual general meeting of the Company at which the requirements of section 437 of the Companies Act 2006 (the “Act”) are complied with.

9.To authorise the Directors of the Company to determine the auditors’ remuneration.

10.That in substitution for any existing such authorities (but without prejudice to any allotment of Relevant Securities (as defined in (i) below) made or agreed to be made pursuant to such authorities), the Directors be and they are hereby generally and unconditionally authorised pursuant to section 551 of the Act to exercise all the powers of the Company:

(i)to allot shares and grant rights to subscribe for, or convert any security into, shares of the Company (all of which transactions are hereafter referred to as an allotment of “Relevant Securities”) up to an aggregate nominal amount of £61,785.77 (representing approximately 33% of the Company’s issued share capital); and

(ii)to allot further equity securities (within the meaning of Section 560(1) of the Act) up to an aggregate nominal amount of £61,785.77 (representing approximately 33% of the Company’s issued share capital) in connection with a rights issue in favour of shareholders where the equity securities respectively attributable to the interest of the shareholders are proportionate (as nearly as practicable) to the respective numbers of ordinary shares held by them, which satisfies the conditions and may be subject to all or any of the exclusions specified in paragraph (i) of

Resolution 11. The authorities conferred by this resolution shall expire (unless previously revoked or varied by the Company in general meeting) at the conclusion of the next annual general meeting of the Company or the close of business on 19 March 2024, whichever is the earlier, save that the Company may, before such expiry, revocation or variation, make an offer or agreement which would or might require Relevant Securities to be allotted after such expiry and the Directors may allot Relevant Securities in pursuance of such an offer or agreement as if the authority conferred hereby had not expired or been revoked or varied.

Each of the following special resolutions (requiring at least three-quarters of the votes cast) were duly proposed and approved on a poll:

11.That, subject to and conditional upon the passing of Resolution 10 above, the Directors be given power in accordance with sections 570 and 573 of the Act to allot equity securities (as defined in section 560 of the Act) for cash pursuant to the authority conferred by Resolution 10 above and/or sell treasury shares as if section 561(1) of the Act did not apply to any such allotment or sale provided that this power shall be limited to:

(i)the allotment of equity securities in connection with an offer or issue of equity securities (but in the case of the authority granted under paragraph (ii) of Resolution 10 by way of a rights issue only) to or in favour of (a) holders of ordinary shares in proportion (as nearly as may be practicable) to their existing holdings and (b) holders of other equity securities if this is required by the rights of those securities or, if the Directors consider it necessary, as permitted by the rights of those securities, and so that the Directors may make such exclusions or other arrangements as they consider expedient or necessary in relation to fractional entitlements, record dates, shares represented by depositary receipts, the use of more than one currency for making payments in respect of such offer, treasury shares, legal or practical problems under the laws in any territory or the requirements of any relevant regulatory body or stock exchange or any other matter; and

(ii)the allotment of equity securities for cash pursuant to the authority granted under paragraph (i) of Resolution 10 (otherwise than under paragraph (i) of this Resolution 11) up to a maximum aggregate nominal amount of £46,807.40, which represents approximately 25% of the Company’s issued share capital.

The power conferred by this resolution shall expire (unless previously revoked or varied by the Company in general meeting) at the conclusion of the next annual general meeting of the Company or the close of business on 19 March 2024, whichever is the earlier, save that the Company may before such expiry, revocation or variation make an offer or agreement which would or might require equity securities to be allotted or treasury shares to be sold after such expiry, revocation or variation and the Directors may allot equity securities and sell treasury shares pursuant to such offer or agreement as if the power hereby conferred had not expired or been revoked or varied. This power is in substitution for any and all powers previously conferred on the Directors under Section 570 of the Act, but without prejudice to any allotment of equity securities made or agreed to be made pursuant to such powers.

12.That the Company be and is generally and unconditionally authorised for the purposes of section 701(1) of the Act to make one or more market purchases (within the meaning of section 693(4) of the Act) on the London Stock Exchange of ordinary shares of £0.0025 each in the capital of the Company (“Ordinary Shares”) on such terms and in such manner as the Directors may from time to time decide provided that:

(i)the maximum aggregate number of Ordinary Shares authorised to be purchased is 7,489,184 (representing approximately 10% of the Company’s issued ordinary share capital);

(ii)the minimum price (excluding expenses) which may be paid for an Ordinary Share is £0.0025 per share;

(iii)the maximum price (excluding expenses) which may be paid for an Ordinary Share is the higher of (a) 105% of the average of the middle market quotations for an Ordinary Share as derived from the AIM section of the London Stock Exchange Daily Official List for the five business days

immediately preceding the date on which the Ordinary Share is purchased and (b) the higher of the price of the last independent trade and the highest current independent bid on the trading venue where the purchase is carried out;

(iv)unless previously varied or revoked, the authority conferred shall expire at the conclusion of the Company’s next annual general meeting or the close of business on 31 December 2023, if earlier; and

(v)the Company may make a contract or contracts to purchase Ordinary Shares under the authority hereby conferred prior to the expiry of such authority which will or may be executed wholly or partly after the expiry of such authority and may make a purchase of Ordinary Shares in pursuance of any such contract or contracts.

The results are in line with the recommendations made by the Company’s board of directors.

The full text of each resolution passed at the Annual General Meeting was set out in the Notice of Annual General Meeting sent to shareholders on November 10, 2022.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

RENALYTIX PLC |

|

|

By: |

|

/s/ James McCullough |

|

|

James McCullough |

|

|

Chief Executive Officer |

Date: December 20, 2022

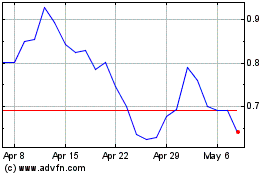

Renalytix (NASDAQ:RNLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Renalytix (NASDAQ:RNLX)

Historical Stock Chart

From Apr 2023 to Apr 2024