Amended Current Report Filing (8-k/a)

May 07 2019 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): May 7, 2019 (May 7, 2019)

REGENERON PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

New York

(State or other jurisdiction of incorporation)

|

|

|

|

|

000-19034

|

|

13-3444607

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

777 Old Saw Mill River Road, Tarrytown, New York

|

|

10591-6707

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number,

including area code: (914) 847-7000

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2. below):

o

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act.

o

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock – par value $0.001 per share

|

REGN

|

NASDAQ Global Select Market

|

Explanatory

Note

As described below, Regeneron Pharmaceuticals,

Inc. (“

Regeneron

” or the “

Company

”) is filing this Amendment to its Current Report on Form

8-K filed with the Securities and Exchange Commission on May 7, 2019 (the “

Original Form 8-K

”) solely to correct

two components of its 2019 financial guidance (GAAP Unreimbursed R&D and GAAP SG&A) and related GAAP-to-non-GAAP reconciliations

included in the Company’s press release, dated May 7, 2019, reporting first quarter 2019 financial and operating results

furnished as Exhibit 99.1 to the Original Form 8-K (the “

Original Earnings Release

”). The information furnished

under Item 7.01 below amends and supersedes the information contained in the Original Earnings Release.

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

The Original Earnings Release is hereby

revised as follows:

2019 Financial Guidance

(3)

The Company’s updated full year 2019 financial guidance

consists of the following components:

|

As reported in the Original Earnings Release:

|

|

GAAP Sanofi collaboration revenue: Sanofi reimbursement of Regeneron commercialization-related expenses

|

$500 million–$535 million

(previously $510 million–$560 million)

|

|

GAAP Unreimbursed R&D

(5)

|

$1.880 billion–$2.000 billion

(previously $1.855 billion–$2.000 billion)

|

|

Non-GAAP Unreimbursed R&D

(2)(4)

|

$1.610 billion

–

$1.710 billion

(previously $1.590 billion–$1.710 billion)

|

|

GAAP SG&A

|

$1.690 billion–$1.795 billion

(previously $1.700 billion–$1.830 billion)

|

|

Non-GAAP SG&A

(2)(4)

|

$1.500 billion–$1.580 billion

(previously $1.500 billion–$1.600 billion)

|

|

GAAP effective tax rate

|

11%–13%

(previously 14%–16%)

|

|

Capital expenditures

|

$410 million–$475 million

(previously $410 million–$490 million)

|

|

As corrected (revised portions bolded and underlined):

|

|

GAAP Sanofi collaboration revenue: Sanofi reimbursement of Regeneron commercialization-related expenses

|

$500 million–$535 million

(previously $510 million–$560 million)

|

|

GAAP Unreimbursed R&D

(5)

|

$2.280 billion

–

$2.400 billion

(previously $1.855 billion–$2.000 billion)

|

|

Non-GAAP Unreimbursed R&D

(2)(4)

|

$1.610 billion

–

$1.710 billion

(previously $1.590 billion–$1.710 billion)

|

|

GAAP SG&A

|

$1.695 billion

–

$1.800 billion

(previously $1.700 billion–$1.830 billion)

|

|

Non-GAAP SG&A

(2)(4)

|

$1.500 billion–$1.580 billion

(previously $1.500 billion–$1.600 billion)

|

|

GAAP effective tax rate

|

11%–13%

(previously 14%–16%)

|

|

Capital expenditures

|

$410 million–$475 million

(previously $410 million–$490 million)

|

|

(1)

|

Regeneron records net product sales of EYLEA in the United States. Outside the United States, EYLEA net product sales comprise sales by Bayer in countries other than Japan and sales by Santen Pharmaceutical Co., Ltd. in Japan under a co-promotion agreement with an affiliate of Bayer. The Company recognizes its share of the profits (including a percentage on sales in Japan) from EYLEA sales outside the United States within “Bayer collaboration revenue” in its Statements of Operations.

|

|

|

|

|

(2)

|

This press release uses non-GAAP net income, non-GAAP net income per share, non-GAAP unreimbursed R&D, and non-GAAP SG&A, which are financial measures that are not calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). These non-GAAP financial measures are computed by excluding certain non-cash and other items from the related GAAP financial measure. Non-GAAP adjustments also include the estimated income tax effect of reconciling items.

The Company makes such adjustments for items the Company does not view as useful in evaluating its operating performance. For example, adjustments may be made for items that fluctuate from period to period based on factors that are not within the Company’s control (such as the Company’s stock price on the dates share-based grants are issued or changes in the fair value of the Company’s equity investments) or items that are not associated with normal, recurring operations (such as changes in applicable laws and regulations). Management uses these non-GAAP measures for planning, budgeting, forecasting, assessing historical performance, and making financial and operational decisions, and also provides forecasts to investors on this basis. Additionally, such non-GAAP measures provide investors with an enhanced understanding of the financial performance of the Company's core business operations. However, there are limitations in the use of these and other non-GAAP financial measures as they exclude certain expenses that are recurring in nature. Furthermore, the Company’s non-GAAP financial measures may not be comparable with non-GAAP information provided by other companies. Any non-GAAP financial measure presented by Regeneron should be considered supplemental to, and not a substitute for, measures of financial performance prepared in accordance with GAAP. A reconciliation of the Company’s historical GAAP to non-GAAP results is included in Table 3 of this press release.

|

|

|

|

|

(3)

|

The Company's 2019 financial guidance does not assume the completion of any significant business development transactions not completed as of the date of this press release (other than the collaboration with Alnylam Pharmaceuticals, Inc. discussed above).

|

|

|

|

|

(4)

|

A reconciliation of full year 2019 non-GAAP to GAAP financial guidance is included below:

|

|

As reported in the Original Earnings Release:

|

|

|

|

Projected Range

|

|

(In millions)

|

|

Low

|

|

High

|

|

GAAP unreimbursed R&D

(5)

|

|

$

|

1,880

|

|

|

$

|

2,000

|

|

|

R&D: Non-cash share-based compensation expense

|

|

(270

|

)

|

|

(290

|

)

|

|

Non-GAAP unreimbursed R&D

|

|

$

|

1,610

|

|

|

$

|

1,710

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP SG&A

|

|

$

|

1,690

|

|

|

$

|

1,795

|

|

|

SG&A: Non-cash share-based compensation expense

|

|

(190

|

)

|

|

(215

|

)

|

|

Non-GAAP SG&A

|

|

$

|

1,500

|

|

|

$

|

1,580

|

|

|

As corrected (revised portions and additions bolded and underlined):

|

|

|

|

Projected Range

|

|

(In millions)

|

|

Low

|

|

High

|

|

GAAP unreimbursed R&D

(5)

|

|

$

|

2,280

|

|

|

$

|

2,400

|

|

|

R&D: Non-cash share-based compensation expense

|

|

(270

|

)

|

|

(290

|

)

|

|

R&D: Up-front payment related to license and collaboration agreements

|

|

(400)

|

|

|

(400)

|

|

|

Non-GAAP unreimbursed R&D

|

|

$

|

1,610

|

|

|

$

|

1,710

|

|

|

|

|

|

|

|

|

GAAP SG&A

|

|

$

|

1,695

|

|

|

$

|

1,800

|

|

|

SG&A: Non-cash share-based compensation expense

|

|

(190

|

)

|

|

(215

|

)

|

|

SG&A: Litigation contingencies

|

|

(5)

|

|

|

(5)

|

|

|

Non-GAAP SG&A

|

|

$

|

1,500

|

|

|

$

|

1,580

|

|

|

(5)

|

Unreimbursed R&D represents R&D expenses reduced by R&D expense reimbursements from the Company’s collaborators and/or customers.

|

|

|

|

|

(6)

|

The Company’s collaborators provide it with estimates of the collaborators’ respective sales and the Company's share of the profits or losses from commercialization of products for the most recent fiscal quarter. The Company’s estimates for such quarter are reconciled to actual results in the subsequent fiscal quarter, and the Company’s share of the profit or loss is adjusted on a prospective basis accordingly, if necessary.

|

*****

The information included in this Item

7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor

shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as

shall be expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

REGENERON PHARMACEUTICALS, INC.

|

|

|

|

/s/ Joseph J. LaRosa

|

|

|

|

Joseph J. LaRosa

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

|

|

|

Date: May 7, 2019

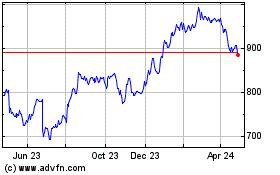

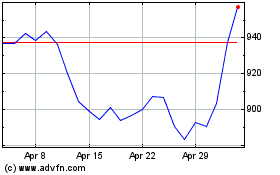

Regeneron Pharmaceuticals (NASDAQ:REGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Regeneron Pharmaceuticals (NASDAQ:REGN)

Historical Stock Chart

From Apr 2023 to Apr 2024