Current Report Filing (8-k)

January 09 2023 - 8:50AM

Edgar (US Regulatory)

0000872589

false

0000872589

2023-01-09

2023-01-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 9, 2023 (January 9, 2023)

REGENERON PHARMACEUTICALS, INC.

(Exact name of registrant as specified

in its charter)

New York

(State or other

jurisdiction of incorporation)

| 000-19034 |

|

13-3444607 |

(Commission

File Number) |

|

(I.R.S.

Employer

Identification

No.)

|

| |

|

| 777 Old Saw Mill River Road, Tarrytown, New York |

|

10591-6707 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number,

including area code: (914) 847-7000

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock – par value $0.001 per share |

REGN |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. |

Results of Operations and Financial Condition. |

On

January 9, 2023, at the 41st Annual J.P. Morgan Healthcare Conference, Leonard S. Schleifer, M.D., Ph.D., President and

Chief Executive Officer of Regeneron Pharmaceuticals, Inc. (“Regeneron” or the “Company”), and George

D. Yancopoulos, M.D., Ph.D., President and Chief Scientific Officer of Regeneron, are providing a corporate update.

The presentation includes information regarding the Company’s

preliminary (unaudited) U.S. net product sales of EYLEA® (aflibercept) Injection of approximately $6.26 billion for

the full year 2022 (based on preliminary (unaudited) fourth quarter 2022 U.S. net product sales of EYLEA of approximately $1.50 billion).

With respect to the preliminary (unaudited) fourth quarter 2022 U.S. net product sales of EYLEA, the presentation further notes the following:

| · | Negatively impacted by a short-term shift to off-label use of

compounded Avastin® (bevacizumab) |

| · | Temporary closing in Q4 2022 of fund that provides patient co-pay

assistance |

| · | Most recent Q4 2022 market data suggests that shift to off-label

Avastin is already beginning to reverse |

The presentation also includes information regarding

the Company’s current expectation that its financial results calculated in accordance with U.S. generally accepted accounting principles

(“GAAP”) and its non-GAAP financial results for the fourth quarter 2022 and full year 2022 will include an acquired

in-process research and development (“IPR&D”) charge of approximately $30 million relating to an up-front payment

in connection with the Company’s previously announced collaboration and licensing agreement with CytomX Therapeutics, Inc. This

acquired IPR&D charge is expected to negatively impact each of GAAP and non-GAAP net income per diluted share for the fourth quarter

2022 by approximately $0.21.

Regeneron’s results for the fourth quarter

and full year 2022 have not been finalized and are subject to Regeneron’s financial statement closing procedures. There can be no

assurance that actual results will not differ from the preliminary (unaudited) estimates described herein.

| Item 7.01. |

Regulation FD Disclosure. |

The

information set forth under Item 2.02 of this Current Report on Form 8-K is incorporated by reference herein. A copy of the

presentation referenced in Item 2.02 is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by

reference in this Item 7.01.

The information included in Item 2.02 and the

information included or incorporated in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall such information and exhibit be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference

in such a filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| 99.1 |

|

Presentation by Leonard S. Schleifer, M.D., Ph.D., President and Chief Executive Officer of Regeneron Pharmaceuticals, Inc., and George D. Yancopoulos, M.D., Ph.D., President and Chief Scientific Officer of Regeneron Pharmaceuticals, Inc., at the 41st Annual J.P. Morgan Healthcare Conference. |

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

Note

Regarding Forward-Looking Statements

This Current Report

on Form 8-K (this “Report”) includes forward-looking statements that involve risks and uncertainties relating to future events

and the future performance of Regeneron Pharmaceuticals, Inc. (“Regeneron” or the “Company”), and actual events

or results may differ materially from these forward-looking statements. Words such as “anticipate,” “expect,”

“intend,” “plan,” “believe,” “seek,” “estimate,” variations of such words,

and similar expressions are intended to identify such forward-looking statements, although not all forward-looking statements contain

these identifying words. These statements concern, and these risks and uncertainties include, among others, Regeneron’s expectations

with respect to commercialization of its marketed products (including EYLEA® (aflibercept)

Injection), competitive and other relevant developments affecting the market share of Regeneron’s marketed products, and other

relevant factors (whether within or without Regeneron’s control) impacting the degree to which commercialization of Regeneron’s

marketed products is successful, as well as the impact of any of the foregoing on Regeneron’s results of operations; Regeneron’s

expected acquired in-process research and development charge in the quarterly period ended December 31, 2022 and its expected impact

on GAAP and non-GAAP net income per diluted share for the quarterly period then ended as discussed in this Report; and the potential

for any license, collaboration, or supply agreement, including Regeneron's agreement with CytomX Therapeutics, Inc. referenced in this

Report, to be cancelled or terminated. A more complete description of these and other material risks can be found in Regeneron’s

filings with the U.S. Securities and Exchange Commission. Any forward-looking statements are made based on management’s current

beliefs and judgment, and the reader is cautioned not to rely on any forward-looking statements made by Regeneron. Regeneron does not

undertake any obligation to update (publicly or otherwise) any forward-looking statement, including without limitation any financial

projection or guidance, whether as a result of new information, future events, or otherwise.

Note Regarding Non-GAAP Financial Measures

This Report includes non-GAAP net income per

diluted share, which is a financial measure that is not calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”).

This non-GAAP financial measure is computed by excluding certain non-cash and/or other items from the related GAAP financial measure.

The Company also includes a non-GAAP adjustment for the estimated income tax effect of reconciling items. The Company makes such adjustments

for items the Company does not view as useful in evaluating its operating performance. Management uses this and other non-GAAP measures

for planning, budgeting, forecasting, assessing historical performance, and making financial and operational decisions, and also provides

forecasts to investors on this basis. Additionally, such non-GAAP measures provide investors with an enhanced understanding of the financial

performance of the Company's core business operations. However, there are limitations in the use of such non-GAAP financial measures as

they exclude certain expenses that are recurring in nature. Furthermore, the Company's non-GAAP financial measures may not be comparable

with non-GAAP information provided by other companies. Any non-GAAP financial measure presented by Regeneron should be considered supplemental

to, and not a substitute for, measures of financial performance prepared in accordance with GAAP.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

REGENERON PHARMACEUTICALS, INC. |

| |

|

| |

|

| |

/s/ Joseph J. LaRosa |

| |

Joseph J. LaRosa |

| |

Executive Vice President, General Counsel and Secretary |

Date: January 9, 2023

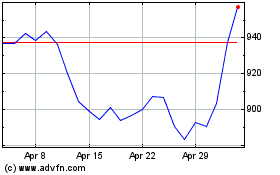

Regeneron Pharmaceuticals (NASDAQ:REGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

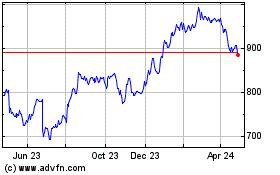

Regeneron Pharmaceuticals (NASDAQ:REGN)

Historical Stock Chart

From Apr 2023 to Apr 2024