It's a Tough Time to Be in the C-Suite, Good Time to Be in a Gas Field

March 13 2020 - 7:29AM

Dow Jones News

By Paul Vigna

The second week of March will be remembered as the one that saw

the longest bull market on record end. The coronavirus epidemic

morphed into a pandemic, businesses were left reeling, and

investors were lost in a sea of red.

On Thursday, the Dow Jones Industrial Average suffered its worst

one-day loss since Black Monday in 1987. It is down 26% this year.

U.S. crude oil is down 48% over the same period. Gold is up, but

copper, a bellwether commodity, is down more than 11%. Treasury

bond yields are actually up for the week, though too little to give

equities investors any comfort.

It was a week of almost nothing but losers, but there were a few

winners as well. Let's take a look.

Winner: Gas Companies

There are only a handful of companies whose shares are up over

the past month, and the reason is obvious. Regeneron

Pharmaceuticals Inc. is working on a possible coronavirus

treatment.

For Campbell Soup Co., people working from home, or sick at

home, will be eating at home. The same theory applies for Take-Two

Interactive Software Inc.: Those at home will have more opportunity

to play games.

Then there are the natural gas companies. You might think in a

week that saw the oil market crater, there wouldn't be any winners

anywhere in the energy industry. But shares of companies like Cabot

Oil & Gas Corp., Southwestern Energy Co. and EQT Corp. are

rising.

Saudi Arabia's oil-price war is going to hurt U.S. oil

companies. This is, somewhat ironically, good for natural gas

companies.

Production of both oil and natural gas is expected to drop. But

demand for natural gas isn't expected to fall. The result is likely

to be a squeeze that would push prices higher. In the current state

of world affairs, there are precious few industries that look to

have pricing power.

EQT is up 18% this month, despite the worst equities selloff in

more than a decade. Cabot is up 15%. Southwestern Energy is up more

than 4%. Another natural gas producer, CNX Resources Corp., is down

only 1%.

While the ultimate outcome of the oil-price fight isn't yet

clear, "gas should be a safe(r) harbor than it is currently being

valued," Bernstein analyst Jean Ann Salisbury wrote in a research

note.

Loser: Managements

Just about everything and everybody in the market was a loser

this week. The bull market is dead. Investors are being hit with

wave after wave of selling. The corporate debt markets are roiling.

The fears of a recession are climbing.

But there is one group that seems to be under acute pressure:

management.

With companies scrambling to protect themselves from the

economic fallout of the coronavirus pandemic, CEOs are under

scrutiny.

Occidental Petroleum Corp. has been one of the hardest hit

stocks in the S&P 500, down 64% this month alone. Damaged by

the new price war in the oil market, the company was forced this

week to cut both spending and dividends.

Now one of the company's most famous, and disgruntled,

shareholders is coming after management. Carl Icahn ratcheted up

his long-running fight with the company this week, disclosing that

he now owns nearly 10% of the company's stock. With that position,

he is demanding big changes: He wants to unseat the entire board

and then get rid of Chief Executive Vicki Hollub.

Occidental isn't the only company fielding angry calls from its

shareholders.

GameStop Corp. is under pressure from an investor group that

owns about 7.5% of the company's shares. The group, which includes

Hestia Capital Partners LP and Permit Capital Enterprise Fund LP,

has been agitating for change for a year. They, too, are ramping up

their campaign.

Even after GameStop appointed three new independent directors

just this week, the group still wants its own representative on the

board. They aren't happy with the company's performance and want

their voices heard.

Elsewhere in C-suite news, United Parcel Service Inc. and

Tupperware Brands Corp. both named new CEOs Thursday. Those are the

latest in what has been a wave of change at corner offices since

Robert Iger stepped down at Walt Disney Co. just over two weeks

ago.

Next Week: Another Rate Cut?

There are very good reasons to question how much impact the

Federal Reserve can have on the current situation. Even Fed

officials have made the point. But they aren't powerless, which

means the biggest event next week is the two-day meeting, March

17-18, of the Fed's rate-setting committee. On Wednesday, there

will be a statement and a press conference with Chairman Jerome

Powell.

The market is betting heavily on another interest-rate cut. Look

out, also, for any surprises, like Thursday's surprise liquidity

announcement, between now and then.

Write to Paul Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

March 13, 2020 07:14 ET (11:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

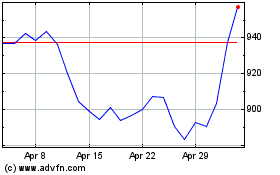

Regeneron Pharmaceuticals (NASDAQ:REGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

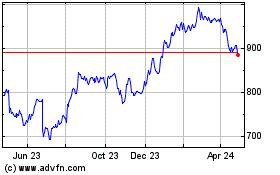

Regeneron Pharmaceuticals (NASDAQ:REGN)

Historical Stock Chart

From Apr 2023 to Apr 2024