Report of Foreign Issuer (6-k)

February 25 2020 - 6:16AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February 2020

Commission File No.: 001-35773

REDHILL BIOPHARMA LTD.

(Translation of registrant's name into English)

21 Ha'arba'a Street, Tel Aviv, 6473921, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

On February 23, 2020, RedHill Biopharma Ltd. (the “Company”), through its wholly-owned subsidiary RedHill Biopharma Inc. (“RedHill US”), entered into a credit agreement (the “Credit Agreement”) with HCR Collateral Management, LLC, as Administrative Agent (“HCR”), and the lenders from time to time party thereto. Pursuant to the terms of the Credit Agreement and subject to the satisfaction of the conditions precedent set forth therein, RedHill US will receive a $30 million loan within approximately 12 business days following the signing of the Credit Agreement. Subject to satisfaction of certain conditions set forth in the Credit Agreement, RedHill US will receive an additional $50 million loan to fund the acquisition of rights to Movantik® from AstraZeneca. Two additional tranches, the second of which is at the mutual agreement of RedHill and HCR, of $20 million and $15 million, respectively, will be available to RedHill US under the Credit Agreement upon the satisfaction of certain conditions, including, in each case, the funding of the previous tranches. HCR will receive a royalty of 2% if only the first $30 million tranche is drawn, 4% if the additional $50 million tranche is drawn and 4.5% if the final tranche of $15 million is drawn, in each case on up to $75 million of the Company’s annual worldwide net revenues, as well as interest on the outstanding term loans to be computed as the 3-month LIBOR rate plus 8.20% (stepping down to 6.70% if trailing four quarter net revenues for the fiscal quarter ending March 31, 2021 equal or exceed $38 million), with a 1.75% LIBOR floor. The term loans mature in six years with no principal amortization payments required in the first three years so long as the Company achieves certain net revenue targets. The facility is secured by the assets of RedHill US, and the Company has also pledged the shares of RedHill US. The facility is also secured by assets of the Company related in any material respect to Talicia®. The term loans can be prepaid at the discretion of RedHill US, subject to certain specified prepayment fees, certain of which decrease over time. RedHill US is the borrower under the facility and the Company is a guarantor.

The Credit Agreement contains certain customary affirmative and negative covenants. The Credit Agreement also contains a financial covenant requiring the Company to maintain a specified level of cash liquidity as well as a covenant requiring it to maintain minimum net sales beginning with the fiscal quarter ending June 30, 2022. In addition, the Credit Agreement contains a covenant restricting the Company’s ability to terminate or to permit certain changes to the respective roles and responsibilities as of February 23, 2020 of the Company’s chief executive officer, Dror Ben-Asher, and the chief commercial officer of RedHill US, Rick Scruggs.

The Credit Agreement contains defined events of default, in certain cases subject to a grace period, following which the lenders may declare any outstanding principal and unpaid interest immediately due and payable.

Attached hereto and incorporated by reference herein is the following:

Exhibit 1: Registrant’s press release entitled “RedHill Biopharma Enters $115 Million Non-Dilutive Financing Agreement with HealthCare Royalty Partners”.

This Form 6-K is incorporated by reference into the Company’s Registration Statements on Form S-8 filed with the Securities and Exchange Commission on May 2, 2013 (Registration No. 333-188286), on October 29, 2015 (Registration No. 333-207654), on July 25, 2017 (Registration No. 333-219441), on May 23, 2018 (Registration No. 333-225122) and on July 24, 2019 (File No. 333-232776) and its Registration Statements on Form F-3 filed with the Securities and Exchange Commission on February 25, 2016 (Registration No. 333-209702), on July 23, 2018 (File No. 333-226278) and on July 24, 2019 (File No. 333-232777).

This Form 6-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Forward-looking statements are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control and cannot be predicted or quantified, and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks related to the timing for the launch of Talicia® as well as risks and uncertainties associated with (i) the initiation, timing, progress and results of the Company’s research, manufacturing, preclinical studies, clinical trials, and other therapeutic candidate development efforts, and the timing of the commercial launch of its therapeutic candidates and its FDA-approved products; (ii) the Company’s ability to advance its therapeutic candidates into clinical trials or to successfully complete its preclinical studies or clinical trials or the development of a commercial companion diagnostic for the detection of MAP; (iii) the extent and number of additional studies that the Company may be required to conduct and the Company’s receipt of regulatory approvals for its therapeutic candidates, and the timing of other regulatory filings, approvals and feedback; (iv) the manufacturing, clinical development, commercialization, and market acceptance of the Company’s therapeutic candidates and Talicia®; (v) the Company’s ability to successfully commercialize and promote Talicia® and Aemcolo® and following closing of the acquisition, Movantik®; (vi) the Company’s ability to establish and maintain corporate collaborations; (vii) the Company's ability to acquire products approved for marketing in the U.S. that achieve commercial success and build its own marketing and commercialization capabilities; (viii) the interpretation of the properties and characteristics of the Company’s therapeutic candidates and the results obtained with its therapeutic candidates in research, preclinical studies or clinical trials; (ix) the implementation of the Company’s business model, strategic plans for its business and therapeutic candidates; (x) the scope of protection the Company is able to establish and maintain for intellectual property rights covering its therapeutic candidates and its ability to operate its business without infringing the intellectual property rights of others; (xi) parties from whom the Company licenses its intellectual property defaulting in their obligations to the Company; (xii) estimates of the Company’s expenses, future revenues, capital requirements and needs for additional financing; (xiii) the effect of patients suffering adverse experiences using investigative drugs under the Company's Expanded Access Program; (xiv) competition from other companies and technologies within the Company’s industry; (xv) the hiring and employment commencement date of executive managers, (xvi) whether the proposed acquisition of Movantik® will be consummated or as to the timing thereof and (xvii) whether the conditions set forth pursuant to the Credit Agreement will be met or as to the timing thereof. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company's filings with the Securities and Exchange Commission (SEC), including the Company's Annual Report on Form 20-F filed with the SEC on February 26, 2019, as amended on May 15, 2019. All forward-looking statements included in this Form 6-K are made only as of the date of this Form 6-K. The Company assumes no obligation to update any written or oral forward-looking statement, whether as a result of new information, future events or otherwise unless required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

REDHILL BIOPHARMA LTD.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

Date: February 25, 2020

|

|

By: /s/ Dror Ben-Asher

|

|

|

|

Dror Ben-Asher

|

|

|

|

Chief Executive Officer

|

|

|

|

|

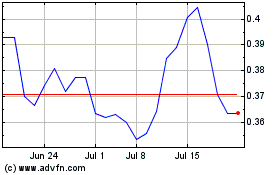

Redhill Biopharma (NASDAQ:RDHL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Redhill Biopharma (NASDAQ:RDHL)

Historical Stock Chart

From Apr 2023 to Apr 2024