Current Report Filing (8-k)

July 29 2022 - 4:10PM

Edgar (US Regulatory)

0001382821false00013828212022-07-292022-07-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 29, 2022

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

Delaware | | 001-38160 | | 74-3064240 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

1099 Stewart Street | Suite 600 | | | | |

Seattle | WA | | | | 98101 |

(Address of principal executive offices) | | | | (Zip Code) |

| | | | | |

| (206) | 576-8333 |

| Registrant's telephone number, including area code |

| | |

|

| (Former name, former address and former fiscal year, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | RDFN | The Nasdaq Global Select Market |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | |

| Emerging growth company | ☐ | |

| | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | |

Item 8.01 Other Events.

We are providing additional financial information for our four reportable segments (real estate services, properties, rentals, and mortgage), as well as our "other" segment, for each of the three months ended March 31, 2022, December 31, 2021, September 30, 2021, June 30, 2021, and March 31, 2021 (collectively, the "Reporting Periods"). We have assigned certain previously reported expenses to each segment to conform to the way we internally manage and monitor our business. We allocated indirect costs to each segment based on a reasonable allocation methodology, when such costs are significant to the performance measures of the segments. Accordingly, the additional information shows operating expenses and net income (loss) for each segment with respect to the Reporting Periods.

The additional information provides greater visibility into the profitability of each of our segments but does not revise our previously reported gross profit (on a consolidated basis or with respect to any segment) for the Reporting Periods. However, due to our new allocation methodology, the amount of operating expenses allocated to each segment with respect to the Reporting Periods was revised from previously reported amounts on a segment basis. Operating expenses on a consolidated basis have not been revised from our previously reported amounts for the Reporting Periods.

Additionally, for each reportable segment and our "other" segment, we are presenting adjusted EBITDA, along with a reconciliation from net income (loss), for each Reporting Period. Adjusted EBITDA is a non-GAAP financial measure. We believe adjusted EBITDA is useful for investors because it enhances period-to-period comparability of our financial statements on a consistent basis and provides investors with useful insight into the underlying trends of the business. The presentation of this financial measure is not intended to be considered in isolation or as a substitute of, or superior to, our financial information prepared and presented in accordance with GAAP. Our calculation of adjusted EBITDA may be different from adjusted EBITDA or similar non-GAAP financial measures used by other companies, limiting its usefulness for comparison purposes.

Exhibit 99.1 contains the additional financial information and our presentation of adjusted EBITDA and the related reconciliation.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover page interactive data file, submitted using inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | Redfin Corporation | |

| | | (Registrant) | |

| | | | |

| Date: July 29, 2022 | | /s/ Chris Nielsen | |

| | | Chris Nielsen

Chief Financial Officer | |

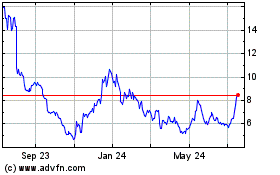

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

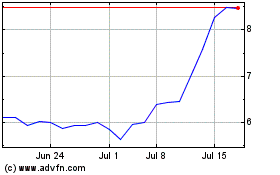

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Apr 2023 to Apr 2024