Current Report Filing (8-k)

November 25 2020 - 4:03PM

Edgar (US Regulatory)

0000709283FALSE00007092832020-11-252020-11-2500007092832020-10-162020-10-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 25, 2020

|

|

|

|

|

Quantum Corporation

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-13449

|

94-2665054

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File No.)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

224 Airport Parkway

|

Suite 550

|

|

|

|

|

San Jose

|

CA

|

|

|

95110

|

|

(Address of Principal Executive Offices)

|

|

|

(Zip Code)

|

|

|

|

|

|

|

|

|

(408)

|

944-4000

|

|

Registrant's telephone number, including area code

|

|

|

|

|

|

|

|

(Former name, former address and former fiscal year, if changed since last report)

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

|

QMCO

|

|

Nasdaq Global Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On November 25, 2020, Quantum Corporation (the “Company”) entered into that certain Sales Agreement (the “Agreement”) with B. Riley Securities, Inc. (the “Sales Agent”), under which the Company may sell shares of its common stock from time to time having an aggregate offering price of up to $50,000,000, depending upon market demand, with the Sales Agent acting as agent and/or principal for sales. Pursuant to the Agreement, the Company may offer and sell the shares in transactions deemed to be an “at-the-market” offering as defined in Rule 415 of the Securities Act of 1933.

The Company will pay the Sales Agent a commission equal to 3% of the gross proceeds from the sale of shares of common stock by it as agent under the Agreement. The Agreement provides that the Company will provide customary indemnification rights to the Sales Agent. The Company has no obligation to sell any shares of common stock pursuant to the Agreement and may at any time suspend sales pursuant to the Agreement. Either party may terminate the Agreement at any time without liability of any party. The Company intends to use the net proceeds from any sales made under the Agreement to repay indebtedness owed under the Term Loan Credit and Security Agreement dated December 27, 2018 with U.S. Bank, National Association and the various lenders party thereto (as amended, the “Loan Agreement”). After paying amounts due under the Loan Agreement, or to the extent permitted under the Loan Agreement, the Company may use any remaining net proceeds for working capital and general corporate purposes.

The shares of common stock will be sold pursuant to a new shelf registration statement on Form S-3 which will be filed by the Company with the Securities and Exchange Commission, including a prospectus and a prospectus supplement, but the registration statement has not yet become effective. Interested investors should read the registration statement, prospectus and prospectus supplement and all documents incorporated therein by reference. This Current Report shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state.

B. Riley Financial, Inc., the parent company of the Sales Agent, is the beneficial owner of approximately 21% of our outstanding shares of Common Stock, including shares owned indirectly through the Sales Agent or other subsidiaries of B. Riley Financial, Inc. In addition, John A. Fichthorn, a member of our board of directors, was Head of Alternative Investments at B. Riley Capital Management, LLC, a wholly-owned subsidiary of B. Riley Financial, Inc., from April 2017 until May 2020. In May 2020, Mr. Fichthorn became a consultant for B. Riley Capital Management, LLC, with such consultancy to conclude on November 30, 2020. In recognition of the foregoing relationships and in accordance with the Company’s related party transaction policy, the Company implemented a series of steps to address potential conflicts, which conflict mitigation steps included presenting to the audit committee of the board of directors of the Company (the “Audit Committee”), which is comprised solely of independent directors, for its review and approval of the related party aspects of Agreement. Upon its review the Agreement and transactions contemplated thereunder were approved by the Audit Committee.

The foregoing description of the Agreement does not purport to be complete and is subject to and qualified in its entirety by reference to the Agreement, a copy of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quantum Corporation

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

November 25, 2020

|

|

/s/ J. Michael Dodson

|

|

|

|

(Date)

|

|

J. Michael Dodson

|

|

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

(Principal Financial Officer)

|

|

|

|

|

|

|

|

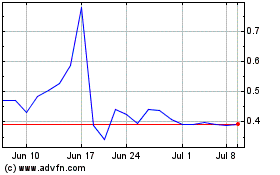

Quantum (NASDAQ:QMCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

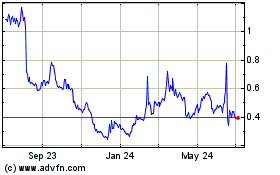

Quantum (NASDAQ:QMCO)

Historical Stock Chart

From Apr 2023 to Apr 2024