Current Report Filing (8-k)

December 18 2020 - 3:55PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 16, 2020

Qualigen

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-37428

|

|

26-3474527

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

2042

Corte Del Nogal, Carlsbad, California 92011

(Address

of principal executive offices) (Zip Code)

(760)

918-9165

(Registrant’s

telephone number, including area code)

n/a

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol

|

|

Name

of each exchange on which registered

|

|

Common

Stock, par value $.001 per share

|

|

QLGN

|

|

The

Nasdaq Capital Market of The Nasdaq Stock Market LLC

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (§230.405

of this chapter) or Rule 12b-2 of the Exchange Act (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [ ]

Item

1.01. Entry into a Material Definitive Agreement.

On

December 18, 2020, Qualigen Therapeutics, Inc. (“Qualigen” or the “Company”), closed its Securities Purchase

Agreement (dated December 16, 2020) with a single institutional investor for the purchase and sale for $12,000,000 of (i) 2,370,786

shares of Qualigen common stock, (ii) 1,000,000 pre-funded warrants (i.e., warrants to purchase shares of Qualigen common stock,

for which the exercise price is almost entirely prepaid) (iii) 1,348,314 two-year warrants to purchase shares of Qualigen common

stock for an exercise price of $4.07 per share, and (iv) 842,696 warrants (first exercisable 6 months after issuance, and with

an expiration date 30 months after issuance) to purchase shares of Qualigen common stock for an exercise price of $4.07 per share.

The warrants included a 9.99% beneficial-ownership blocker provision.

Item

8.01. Other Events.

The

sale described above was made pursuant to an effective shelf registration statement on Form S-3 (File No. 333-232798) previously

filed with the Securities and Exchange Commission (the “SEC”).

On

December 18, 2020, the Company filed a prospectus supplement with the SEC, under such shelf registration statement on Form S-3,

pertaining to such sale.

On

December 18, 2020, the Company issued a press release announcing the closing of such sale. A copy of the press release is attached

as Exhibit 99.1 to this Current Report on Form 8-K.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

5.1

|

|

Opinion of Stradling Yocca Carlson & Rauth, a Professional Corporation.

|

|

|

|

|

|

10.1**

|

|

Securities Purchase Agreement, dated December 16, 2020.

|

|

|

|

|

|

10.2

|

|

Placement Agency Agreement between Qualigen Therapeutics, Inc. and A.G.P./Alliance Global Partners, dated December 15, 2020.

|

|

|

|

|

|

10.3

|

|

“Two-Year” Common Stock Purchase Warrant for 1,348,314 shares, dated December 18, 2020.

|

|

|

|

|

|

10.4

|

|

“Deferred” Common Stock Purchase Warrant for 842,696 shares, dated December 18, 2020.

|

|

|

|

|

|

10.5

|

|

“Prefunded” Common Stock Purchase Warrant for 1,000,000 shares, dated December 18, 2020.

|

|

|

|

|

|

23.1

|

|

Consent of Stradling Yocca Carlson & Rauth, a Professional Corporation (included in Exhibit 5.1).

|

|

|

|

|

|

99.1

|

|

Press Release dated December 18, 2020, issued by Qualigen Therapeutics, Inc.

|

|

**

|

Schedules

have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedules will be furnished to the SEC

upon request.

|

Cautionary

Note Regarding Forward Looking Statements

This

Current Report on Form 8-K contains forward-looking statements by the Company that involve risks and uncertainties and reflect

the Company’s judgment as of the date of this Current Report. Actual events or results may differ from the Company’s

expectations. For example, there can be no assurance that clinical trials will be approved to begin by or will proceed as contemplated

by any projected timeline; that the Company will successfully develop any drugs or therapeutic devices; that preclinical or clinical

development of the Company’s drugs or therapeutic devices will be successful; that future clinical trial data will be favorable

or that such trials will confirm any improvements over other products or lack negative impacts; that any drugs or therapeutic

devices will receive required regulatory approvals or that they will be commercially successful; that patents will issue on the

Company’s owned and in-licensed patent applications; that such patents, if any, and the Company’s current owned and

in-licensed patents would prevent competition; that the Company will be able to procure or earn sufficient working capital to

complete the development, testing and launch of the Company’s prospective therapeutic products; that the Company will be

able to maintain or expand market demand and/or market share for the Company’s FastPack diagnostic products generally, particularly

in view of COVID-19-related deferral of patients’ physician-office visits and FastPack reimbursement pricing challenges;

that adoption and placement of FastPack PRO System instruments (which are the only FastPack instruments on which the Company’s

SARS-CoV-2 IgG test kits can be run) will be widespread; that the Company will be able to manufacture the FastPack PRO System

instruments and SARS-CoV-2 IgG test kits successfully; that any commercialization of the FastPack PRO System instruments and SARS-CoV-2

IgG test kits will be profitable; or that the FDA will ultimately approve an Emergency Use Authorization for the Company’s

SARS-CoV-2 IgG test. The Company’s stock price could be harmed if any of the events or trends contemplated by the forward-looking

statements fails to occur or is delayed or if any actual future event otherwise differs from expectations. Additional information

concerning these and other risk factors affecting the Company’s business (including events beyond the Company’s control,

such as epidemics and resulting changes) can be found in the Company’s prior filings with the Securities and Exchange Commission,

available at www.sec.gov. The Company disclaims any intent or obligation to update these forward-looking statements beyond the

date of this Current Report, except as required by law. This caution is made under the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

QUALIGEN

THERAPEUTICS, INC.

|

|

|

|

|

|

Date:

December 18, 2020

|

By:

|

/s/

Michael S. Poirier

|

|

|

|

Michael

S. Poirier, President and Chief Executive Officer

|

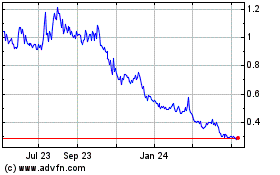

Qualigen Therapeutics (NASDAQ:QLGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Qualigen Therapeutics (NASDAQ:QLGN)

Historical Stock Chart

From Apr 2023 to Apr 2024