Stocks Edge Up as Investor Eye Earnings, Stimulus

February 03 2021 - 1:44PM

Dow Jones News

By Will Horner and Sam Goldfarb

U.S. stocks edged higher Wednesday as investors reacted to a

mixed batch of corporate earnings reports and tracked the progress

in Washington toward another round of coronavirus relief

spending.

The S&P 500 ticked up 0.3%. The Dow Jones Industrial Average

was near flat. The tech-heavy Nasdaq Composite Index climbed 0.5%

after Alphabet reported strong sales growth late Tuesday.

Stock markets have rallied this week, shaking off concerns about

stretched valuations, a sharp run-up in prices for a handful of

stocks and silver, a weak economic backdrop and the threat of new

coronavirus variants. Investors have focused instead on

better-than-expected corporate results, a decline in new

coronavirus cases and bets that President Biden will deliver more

fiscal spending in coming weeks.

"The last two days have seen the return of the feeling that we

still have monetary stimulus in the background and the prospect of

an additional stimulus package to come," said Seema Shah, chief

strategist at Principal Global Advisors. "The path ahead isn't a

smooth one, but we think it is an upward one."

Shares in Alphabet climbed 8.3% after the parent of Google said

late Tuesday that it had booked record revenue in the fourth

quarter.

Spotify Technology, though, slipped around 7.8% after it offered

a cautious view of the year ahead early Wednesday, and Biogen fell

5.1% after it also offered downbeat guidance.

Amazon.com edged down 0.4%. The giant online retailer late

Tuesday posted record quarterly sales, marking the first time its

revenue crossed more than $100 billion in a three-month period. It

also said Jeff Bezos would be stepping down as CEO.

More companies including Qualcomm, PayPal Holdings and Costco

Wholesale are due to report earnings after markets close.

"Earnings have been definitely quite a bit stronger than anyone

expected, and they are led by the areas that we have so far seen

strength in: the tech sector, the stay-at-home sector," said Matt

Forester, chief investment officer of BNY Mellon's Lockwood

Advisors. "We still have a lot to see, though, particularly in the

sectors that have been so heavily impacted by Covid."

Investors are closely following talks between lawmakers over

another round of coronavirus relief measures. President Biden's

administration has called for a package totaling $1.9 trillion,

though a counter offer from Republicans this week was less than

half of that. The Democrats are expected to make a decision in

coming days on whether to start trying to quickly push into law a

larger stimulus bill on their own.

Some stocks that have soared in popularity among traders on

online forums climbed again Wednesday, after suffering sharp

reversals in the previous session. AMC Entertainment Holdings rose

18%, having fallen 41% on Tuesday. GameStop climbed 13%, after

slumping 60% Tuesday.

Treasury Secretary Janet Yellen has called a meeting with top

financial regulators to discuss recent volatility in financial

markets related to GameStop, a Treasury spokeswoman confirmed

Tuesday night.

Last week, major stock indexes fell at the same time as stocks

at the center of the social media frenzy surged, suggesting that

headlines about the phenomenon were making some investors

nervous.

"Any time we see extensive volatility in markets that brings a

level of uncertainty for investors across the board," said Charlie

Ripley, senior investment strategist for Allianz Investment

Management.

Volatility, though, "has come down quite a bit from where it was

last week," he said.

Meanwhile, fresh economic data released Wednesday showed further

improvement in the U.S. services sector. The Institute for Supply

Management's services index for January climbed to 58.7 in January

from a revised 57.7 the previous month. Economists surveyed by The

Wall Street Journal had anticipated a reading of 57.0.

In commodity markets, Brent crude, the international benchmark

for oil, rose around 2% to $58.69 a barrel. The gauge is near its

highest level since the pandemic rattled global financial markets

last spring.

Silver prices gained 2.3% to $27 a troy ounce.

In the bond market, the yield on the 10-year Treasury note held

gains after the Treasury Department said it intends to maintain the

size of its nominal note and bond sales this quarter. It was

recently up to 1.131% from 1.105% Tuesday.

Overseas, the pan-continental Stoxx Europe 600 rose 0.3%.

Italy's FTSE MIB stocks index outperformed other regional

benchmarks after former European Central Bank President Mario

Draghi was asked to form a new government.

In Asia, Japan's Nikkei 225 rose 1%. Hong Kong's Hang Seng added

0.2% while on the Chinese mainland, the Shanghai Composite Index

fell 0.5%.

Write to Will Horner at William.Horner@wsj.com and Sam Goldfarb

at sam.goldfarb@wsj.com

(END) Dow Jones Newswires

February 03, 2021 13:29 ET (18:29 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

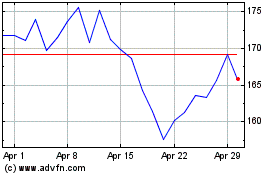

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024