Maroussi, Greece, May 16, 2022 – Pyxis Tankers

Inc. (NASDAQ Cap Mkts: PXS) (the “Company” or “Pyxis Tankers”), an

international pure play product tanker company, today announced

unaudited results for the three months ended March 31, 2022.

Summary

For the three months ended March 31, 2022, our

Revenues, net were $6.9 million, while our time charter equivalent

(“TCE”) revenues were $3.8 million, a decrease of $0.4 million, or

10.1%, compared to the same period in 2021. Net loss attributable

to common shareholders for the three months ended March 31, 2022

was $3.7 million, or a loss per share (basic and diluted) of $0.09,

which was greater than the results from the comparable period of

2021. Our Adjusted EBITDA was negative $0.7 million which

represented a decrease of $1.5 million over the comparable 2021

quarter. For a definition and a reconciliation of Adjusted EBITDA,

please see “Non-GAAP Measures and Definitions” below.

Valentios Valentis, our Chairman and CEO

commented:

“Our results for the three months ended March

31, 2022 reflected the lingering effects from the Covid-19 Omicron

variant on mobility and economic activity which resulted in a

continuation of a soft spot chartering environment. Moreover, our

quarterly results were impacted by non-recurring operational

events, including the sale of two vessels and an accidental

grounding of one of our medium range product tankers (“MR”), which

resulted in reduced operating days for revenue opportunities.

Consequently, the average daily TCE and utilization for our

MR’s were lower than the same period in the prior year.

As previously discussed, we completed various

initiatives over the last couple of years to position the Company

to take advantage of better markets. Just as the recovery of global

economies was gradually picking-up since the outbreak of Omicron,

the war in the Ukraine created new challenges and opportunities

which have been positive for our sector and the Company. Improving

demand for refined petroleum products and low global inventories

have been met by the effects of the war which has resulted in

market dislocation, arbitrage opportunities, ton-mile expansion and

higher charter rates for product tankers starting in March. After a

prolonged, difficult period, we began to see a recovery of the

sector with healthier rates that initially occurred in the Atlantic

basin. Furthermore, over the last month, most of the Pacific basin

has also shown significant improvement. In order to address high

demand for transportation fuels, many refineries, including those

located in the U.S. Gulf Coast, are running at high utilization and

achieving near-record crack spreads. Greater global demand of

diesel/gasoil, especially from Europe and Latin America, is

competing with rising demand of jet fuel and gasoline as summer

travel unfolds in the northern hemisphere, further stressing tight

inventory positions. Increasing cargoes from U.S., Middle East and

certain Asian refineries to end markets reflect expanding ton-mile

voyages. This situation has been further compounded by the closure

of older, less efficient refineries, primarily located in the

Organization for Economic Co-operation and Development countries

(OECD).

The recent dramatic improvement in demand for

product tankers is further supported by long-term fundamentals.

Despite recent headwinds of slowing economic activity, including

the impact of Covid-19 on China, rising inflation and tightening

monetary policies, we believe the chartering environment should

remain favourable for the near-term given demand for refined

products. Reasonable economic activity is supported by data from

the International Monetary Fund (IMF) which still forecasts annual

global GDP growth of 3.6% for this year and 2023. A leading

research firm recently estimated that seaborne trade of refined

products would grow 4% to 1.05 billion tons in 2022. The vessel

supply outlook continues to look very positive with little new

ordering of product tankers. We estimate that annual net supply

growth for MR’s should be approximately 2% over the next two

years.

From a risk/return standpoint, we continue to

employ a mixed chartering strategy of short-term time and spot

charters on a staggered basis to a diverse customer base. Three of

our MR’s are currently trading spot and the remaining two tankers

are under time charters. We have chosen not to pursue any Russian

cargoes. With improving market conditions, we are pleased to report

that as of May 13, 2022, 67% of our available days for the second

quarter were booked at an average estimated daily TCE of $27,900.

While our optimism for the charter market has improved, the

uncertainties surrounding the global economy and the impact of the

war as well as other geo-political events, temper our

enthusiasm.”

Results for the three months ended

March 31, 2021 and 2022

For the three months ended March 31, 2022, we

reported Revenues, net of $6.9 million, an increase of $1.7

million, or 31.7%, from $5.2 million in the comparable period of

2021 primarily due to higher spot employment for our fleet. During

the first quarter of 2022, two of our MR’s were under short time

charters and three under spot voyages resulting in a daily

TCE for our MR fleet of $11,227.

Our net loss attributable to common shareholders

for the period ended March 31, 2022, was $3.7 million, or a loss

per share of $0.09 (basic and diluted), compared to a net loss of

$2.1 million, or a loss per share of $0.07 (basic and diluted) for

the same period in 2021. Lower daily TCE of $11,227 and lower MR

fleet utilization of 74.3% for our MR’s during the quarter ended

March 31, 2022, were compared to $12,738 and 100%, respectively,

during the same period in 2021. Operating expenses and vessel

management fees were comparatively higher in the 2022 period as a

result of the vessel additions in the second half of 2021, the

“Pyxis Karteria” and “Pyxis Lamda”. The first quarter of 2022 was

further negatively impacted by a $0.5 million non-recurring loss,

or $0.01 per share, associated with repositioning costs for the

sale of the two small tankers, the “Northsea Alpha” and

“Northsea Beta”. The vessels were delivered to their buyer on

January 28, and March 1, 2022, respectively. Furthermore, the Q1

2022 results were impacted by the absence of revenues from

unscheduled off-hire days, substantially associated with the

grounding of the Pyxis Epsilon in February and resultant vessel

repairs. The Company’s 2015 built vessel returned to commercial

employment at the end of March.

Our Adjusted EBITDA was negative $0.7 million

for the three months ended March 31, 2022, which represented a

decrease of $1.5 million from $0.8 million for the same period in

2021.

| |

|

Three months ended March 31, |

| (Amounts

in thousands of U.S. dollars, except for daily TCE rates) |

|

2021 |

|

2022 |

| |

|

|

|

|

| MR Revenues, net 2 |

$ |

3,547 |

$ |

6,309 |

| MR Voyage related costs and commissions

2 |

|

(108) |

|

(2,671) |

| MR Time charter equivalent revenues 1,

2 |

$ |

3,439 |

$ |

3,638 |

| |

|

|

|

|

| MR total operating days 2 |

|

270 |

|

324 |

| |

|

|

|

|

| MR daily time charter equivalent rate 1,

2 |

|

12,738 |

|

11,227 |

1 Subject to rounding; please see “Non-GAAP

Measures and Definitions” below.2 “Northsea Alpha” and “Northsea

Beta” which were sold on January 28, 2022 and March 1, 2022

respectively, have been excluded in the above table. Both vessels

have been under spot employment for approximately 7 and 36 days,

respectively, in 2022 as of the delivery date to their buyer.

Management’s Discussion and Analysis of

Financial Results1 for the Three Months ended March 31, 2021 and

2022(Amounts are presented in million U.S. dollars,

rounded to the nearest one hundred thousand, except as otherwise

noted)

Revenues, net: Revenues, net of $6.9 million for

the three months ended March 31, 2022, represented an increase of

$1.7 million, or 31.7%, from $5.2 million in the comparable period

of 2021 as a result of higher spot employment for our MR’s, a

320-day increase in spot operating days, from 4 days in 2021 to 324

days during the same period in 2022. The increase in Revenues, net

was partially counterbalanced by a decrease of 25.7% in fleet

utilization from 100% in the comparable period of 2021 to 74.3% for

the three months ended March 31, 2022. In Q1 2022, our daily TCE

rate for our MR tankers was $11,227, a $1,511 per day decline from

the comparable 2021 period as a result of the lower market rates,

and the $2.1 million increase in the voyage related costs and

commissions discussed below.

Voyage related costs and commissions: Voyage

related costs and commissions of $3.1 million in the first quarter

of 2022, represented an increase of $2.1 million, or 218.1%, from

$1.0 million in the comparable period of 2021. This increase was

substantially due to the 320-day increase in our MR’s spot

employment and a decline in MR’s fleet utilization as well as

significantly higher bunker fuel costs. Under spot charters, all

voyage expenses are typically borne by us rather than the charterer

and a decrease in time chartering results in increased voyage

related costs and commissions

Vessel operating expenses: Vessel operating

expenses of $3.4 million for the three months ended March 31, 2022,

represented an increase of $0.9 million, or 34.4%, compared to the

same period in 2021 which was mainly attributed to the addition of

the “Pyxis Karteria” and “Pyxis Lamda” to our fleet in the second

half of 2021, partially offset by the sales of “Northsea Alpha” and

“Northsea Beta” which occurred during the first quarter, 2022.

Fleet ownership days for the three months ended March 31, 2022 was

536 days compared to 450 days for the same period in 2021.

General and administrative expenses: General and

administrative expenses of $0.6 million for the quarter ended March

31, 2022 were 5.3% lower than the same period in 2021 primarily due

to lower professional fees.

Management fees: For the three months ended

March 31, 2022, management fees were paid to our ship manager,

Pyxis Maritime Corp. (“Maritime”), an entity affiliated with our

Chairman and Chief Executive Officer, Mr.

Valentis, and to International Tanker Management

Ltd. (“ITM”), our fleet’s technical manager, increased by $0.2

million to $0.5 million as a result of the increased average number

of vessels in our fleet, versus the comparable period in 2021, and

the increase in the daily management fee paid to Maritime which

increases annually in line with the inflation in Greece.

Amortization of special survey costs:

Amortization of special survey costs of $0.1 million for the

quarter ended March 31, 2022, remained flat compared to the same

period in 2021.

Depreciation: Depreciation of $1.5 million for

the quarter ended March 31, 2022, increased by $0.4 million or

37.8% compared to $1.1 million in the comparable period of 2021.

The increase was attributed to the acquisition of vessels

“Pyxis Karteria” and “Pyxis Lamda” after the first quarter of

2021 partly offset by the seizure of depreciation for vessels

“Northsea Alpha” and “Northsea Beta” which were classified as held

for sale at the end of 2021.

Loss from the sale of vessels, net: During the

three months ended March 31, 2022, we recorded a non-recurring loss

from the sale of the “Northsea Alpha” and “Northsea Beta” of $0.5

million related to the reposition costs for the delivery of the

vessels to their buyer. No such expense was recorded for the

comparable quarter in 2021.

Loss from debt extinguishment: In the first

quarter of 2022, we recorded a loss from debt extinguishment of

approximately $34,000 reflecting the write-off of the remaining

unamortized balance of deferred financing costs, which were

associated with the repayment of the “Northsea Alpha” and “Northsea

Beta” loans during the most recent period. For the three months

ended March 31, 2021 we recorded a loss from debt extinguishment of

$0.5 million primarily reflecting a prepayment fee and the

write-off of the remaining unamortized balance of deferred

financing costs, both of which were associated with the loan on the

“Pyxis Epsilon” (the “Eighthone Loan”) that was refinanced at the

end of the first quarter in 2021.

Gain from financial derivative instruments:

During the three months ended March 31, 2022, we recorded a gain

from financial derivative instruments amounted to $0.2 million

related to the valuation of the interest rate cap purchased in

July 2021, for the amount of $9.6 million at a cap rate of 2%

with a termination date of July 8, 2025.

Interest and finance costs, net: Interest and

finance costs, net, for the quarter ended March 31, 2022, were

$0.9 million, compared to $1.1 million in the comparable

period in 2021, a decrease of $0.3 million, or 23.4%. This decrease

was primarily attributable to lower interest costs derived from the

refinancing on March 29, 2021, of the Eighthone Loan, which was

partially counterbalanced by higher LIBOR rates paid on all the

floating rate bank debt.

1 Amounts relating to variations in period–on–period comparisons

shown in this section are derived from the unaudited interim

consolidated financials presented below.

Unaudited Interim Consolidated Statements of

Comprehensive LossFor the three months ended March 31,

2021 and 2022(Expressed in thousands of U.S. dollars, except for

share and per share data)

| |

|

|

|

|

Three months ended March 31, |

| |

|

|

|

|

2021 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

Revenues, net |

|

|

|

$ |

5,242 |

$ |

6,906 |

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

| Voyage related

costs and commissions |

|

|

|

|

(961) |

|

(3,057) |

| Vessel operating

expenses |

|

|

|

|

(2,508) |

|

(3,372) |

| General and

administrative expenses |

|

|

|

|

(642) |

|

(608) |

| Management fees,

related parties |

|

|

|

|

(149) |

|

(211) |

| Management fees,

other |

|

|

|

|

(194) |

|

(310) |

| Amortization of

special survey costs |

|

|

|

|

(101) |

|

(85) |

|

Depreciation |

|

|

|

|

(1,091) |

|

(1,503) |

| Bad debt

provisions |

|

|

|

|

— |

|

(50) |

| Loss from the

sale of vessels, net |

|

|

|

|

— |

|

(466) |

|

Operating loss |

|

|

|

|

(404) |

|

(2,756) |

|

|

|

|

|

|

|

|

|

| Other

expenses: |

|

|

|

|

|

|

|

| Loss from debt

extinguishment |

|

|

|

|

(458) |

|

(34) |

| Gain from

financial derivative instruments |

|

|

|

|

— |

|

234 |

| Interest and

finance costs, net |

|

|

|

|

(1,141) |

|

(874) |

| Total

other expenses, net |

|

|

|

|

(1,599) |

|

(674) |

|

|

|

|

|

|

|

|

|

| Net

loss |

|

|

|

$ |

(2,003) |

$ |

(3,430) |

| |

|

|

|

|

|

|

|

| Dividend Series

A Convertible Preferred Stock |

|

|

|

|

(85) |

|

(231) |

| |

|

|

|

|

|

|

|

| Net loss

attributable to common shareholders |

|

|

|

$ |

(2,088) |

$ |

(3,661) |

| |

|

|

|

|

|

|

|

| Loss per

common share, basic and diluted |

|

|

|

$ |

(0.07) |

$ |

(0.09) |

|

|

|

|

|

|

|

|

|

| Weighted

average number of common shares, basic and diluted |

|

|

|

|

29,217,976 |

|

42,455,857 |

Consolidated Balance SheetsAs of December 31,

2021 and March 31, 2022(Expressed in thousands of U.S. dollars,

except for share and per share data)

| |

|

|

|

|

December 31, 2021 |

|

March 31, 2022 |

| |

|

|

|

|

|

|

(unaudited) |

| ASSETS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

|

$ |

6,180 |

$ |

1,901 |

| Restricted cash, current portion |

|

|

|

|

944 |

|

341 |

| Inventories |

|

|

|

|

1,567 |

|

2,317 |

| Trade accounts receivable |

|

|

|

|

1,736 |

|

2,633 |

| Less: Allowance for credit losses |

|

|

|

|

(20) |

|

(20) |

| Trade accounts receivable, net |

|

|

|

|

1,716 |

|

2,613 |

| Vessels held-for-sale |

|

|

|

|

8,509 |

|

— |

| Prepayments and other current assets |

|

|

|

|

186 |

|

299 |

| Insurance claim receivable |

|

|

|

|

— |

|

1,601 |

| Total current

assets |

|

|

|

|

19,102 |

|

9,072 |

| |

|

|

|

|

|

|

|

| FIXED ASSETS, NET: |

|

|

|

|

|

|

|

| Vessels, net |

|

|

|

|

119,724 |

|

118,777 |

| Total fixed assets,

net |

|

|

|

|

119,724 |

|

118,777 |

| |

|

|

|

|

|

|

|

| OTHER NON-CURRENT

ASSETS: |

|

|

|

|

|

|

|

| Restricted cash, net of current

portion |

|

|

|

|

2,750 |

|

2,250 |

| Financial derivative instruments |

|

|

|

|

74 |

|

308 |

| Deferred dry dock and special survey

costs, net |

|

|

|

|

912 |

|

1,019 |

| Total other non-current

assets |

|

|

|

|

3,736 |

|

3,577 |

| Total assets |

|

|

|

$ |

142,562 |

$ |

131,426 |

| |

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

| Current portion of long-term debt, net of

deferred financing costs |

|

|

|

$ |

11,695 |

$ |

5,910 |

| Trade accounts payable |

|

|

|

|

3,084 |

|

5,199 |

| Due to related parties |

|

|

|

|

6,962 |

|

4,822 |

| Accrued and other liabilities |

|

|

|

|

1,089 |

|

867 |

| Total current

liabilities |

|

|

|

|

22,830 |

|

16,798 |

| |

|

|

|

|

|

|

|

| NON-CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

| Long-term debt, net of current portion

and deferred financing costs |

|

|

|

|

64,880 |

|

63,424 |

| Promissory note |

|

|

|

|

6,000 |

|

6,000 |

| Total non-current

liabilities |

|

|

|

|

70,880 |

|

69,424 |

| |

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

— |

|

— |

| |

|

|

|

|

|

|

|

| STOCKHOLDERS'

EQUITY: |

|

|

|

|

|

|

|

| Preferred stock ($0.001 par

value; 50,000,000 shares authorized; of which 1,000,000 authorized

Series A Convertible Preferred Shares; 449,673 Series A Convertible

Preferred Shares issued and outstanding as at December 31, 2021 and

March 31, 2022) |

|

— |

|

— |

| Common stock ($0.001 par

value; 450,000,000 shares authorized; 42,455,857 shares issued and

outstanding as at December 31, 2021 and March 31, 2022,

respectively) |

|

42 |

|

42 |

| Additional paid-in capital |

|

|

|

|

111,840 |

|

111,840 |

| Accumulated deficit |

|

|

|

|

(63,030) |

|

(66,678) |

| Total stockholders'

equity |

|

|

|

|

48,852 |

|

45,204 |

| Total liabilities and

stockholders' equity |

|

|

|

$ |

142,562 |

$ |

131,426 |

Unaudited Interim Consolidated Statements of Cash

FlowsFor the three months ended March 31, 2021 and

2022(Expressed in thousands of U.S. dollars)

| |

|

|

|

|

Three months ended March 31, |

| |

|

|

|

|

2021 |

|

2022 |

|

|

|

|

|

|

|

|

|

| Cash flows

from operating activities: |

|

|

|

|

|

|

|

| Net loss |

|

|

|

$ |

(2,003) |

$ |

(3,430) |

|

Adjustments to reconcile net loss to net cash provided by

operating activities: |

|

|

|

|

|

| Depreciation |

|

|

|

|

1,091 |

|

1,503 |

| Amortization and

write-off of special survey costs |

|

|

|

|

101 |

|

85 |

| Amortization and

write-off of financing costs |

|

|

|

|

62 |

|

81 |

| Loss from debt

extinguishment |

|

|

|

|

458 |

|

34 |

| Gain from

financial derivative instruments |

|

|

|

|

— |

|

(234) |

| Bad debt

provisions |

|

|

|

|

— |

|

50 |

| |

|

|

|

|

|

|

|

| Changes in

assets and liabilities: |

|

|

|

|

|

|

|

| Inventories |

|

|

|

|

195 |

|

(750) |

| Due to related

parties |

|

|

|

|

628 |

|

854 |

| Trade accounts

receivable, net |

|

|

|

|

320 |

|

(947) |

| Prepayments and

other assets |

|

|

|

|

(11) |

|

(113) |

| Insurance claim

receivable |

|

|

|

|

— |

|

(1,601) |

| Special survey

cost |

|

|

|

|

— |

|

(370) |

| Trade accounts

payable |

|

|

|

|

(347) |

|

2,175 |

| Hire collected in

advance |

|

|

|

|

(726) |

|

— |

| Accrued and other

liabilities |

|

|

|

|

81 |

|

(223) |

| Net cash

used in operating activities |

|

|

|

$ |

(151) |

$ |

(2,886) |

| |

|

|

|

|

|

|

|

| Cash flow

from investing activities: |

|

|

|

|

|

|

|

| Proceeds from the

sale of vessel, net |

|

|

|

|

— |

|

8,509 |

| Vessel

acquisition |

|

|

|

|

— |

|

(2,995) |

| Ballast water

treatment system installation |

|

|

|

|

— |

|

(437) |

| Net cash

provided by investing activities |

|

|

|

$ |

— |

$ |

5,077 |

| |

|

|

|

|

|

|

|

| Cash flows

from financing activities: |

|

|

|

|

|

|

|

| Proceeds from

long-term debt |

|

|

|

|

17,000 |

|

— |

| Repayment of

long-term debt |

|

|

|

|

(24,830) |

|

(7,355) |

| Gross proceeds

from issuance of common stock |

|

|

|

|

25,000 |

|

— |

| Common stock

offering costs |

|

|

|

|

(1,737) |

|

— |

| Proceeds from

conversion of warrants into common shares |

|

|

|

|

202 |

|

— |

| Payment of

financing costs |

|

|

|

|

(376) |

|

— |

| Preferred stock

dividends paid |

|

|

|

|

(82) |

|

(218) |

| Net cash

(used in) / provided by financing activities |

|

|

|

$ |

15,177 |

$ |

(7,573) |

| |

|

|

|

|

|

|

|

| Net (decrease) /

increase in cash and cash equivalents and restricted cash |

|

|

|

|

15,026 |

|

(5,382) |

|

Cash and cash equivalents and restricted cash at the beginning of

the period |

|

|

|

4,037 |

|

9,874 |

| Cash and

cash equivalents and restricted cash at the end of the

period |

|

|

|

$ |

19,063 |

$ |

4,492 |

Liquidity, Debt and Capital Structure

Pursuant to our loan agreements, as of March 31,

2022, we were required to maintain a minimum liquidity of $2.25

million. Total cash and cash equivalents, including restricted cash

and the retention account of $0.3 million for one of our loans,

aggregated $4.5 million as of March 31, 2022.

Total debt (in thousands of U.S. dollars), net

of deferred financing costs:

|

|

|

|

|

|

|

December 31, 2021 |

|

March 31, 2022 |

| Funded debt, net of deferred financing

costs |

|

|

|

|

$ |

76,575 |

$ |

69,334 |

| Promissory Note - related party |

|

|

|

|

|

6,000 |

|

6,000 |

| Total funded debt |

|

|

|

|

$ |

82,575 |

$ |

75,334 |

Our weighted average interest rate on our total

funded debt for the three months ended March 31, 2022 was 4.0%.

On January 28, and on March 1, 2022, pursuant to

the sale agreement that we entered into on December 23, 2021, our

small tankers “Northsea Alpha” and “Northsea Beta” respectively,

were delivered to their buyers. The aggregate gross sale price was

$8.9 million from which $5.8 million was used for the prepayment of

the respective loan facilities and the balance for working capital

purposes.

At March 31, 2022, we had a total of 42,455,857

common shares (the “Common Shares”) issued and outstanding of which

Mr. Valentis beneficially owned 54.0%.

Following the Company’s Annual Shareholder

Meeting of May 11, 2022, the board of directors of the Company

approved the implementation of a reverse-split of our Common Shares

at the ratio of one share for four existing Common Shares,

effective May 13, 2022 (the “Reverse Stock Split”). Following the

Reverse Stock Split, our Common Shares continued trading on the

Nasdaq Capital Markets under its existing symbol, “PXS”, with a new

CUSIP number, 71726130. The payment for fractional share interests

in connection with the Reverse Stock Split reduced the outstanding

Common Shares to 10,613,424 post-Reverse Stock Split. The Reverse

Stock Split was undertaken with the objective of meeting the

minimum $1.00 per share requirement for maintaining the listing of

the Common Shares on the Nasdaq Capital Markets. Furthermore,

following the Reverse Stock Split, (a) the Conversion Price, as

defined in the Certification of Designation of the Company’s 7.75%

Series A Cumulative Convertible Preferred Shares (NASDAQ Cap Mkts:

PXSAP), was adjusted from $1.40 to $5.60 and (b) the Exercise

Price, as defined in the Company’s Warrants to purchase Common

Shares (NASDAQ Cap Mkts: PXSAW), was adjusted from $1.40 to

$5.60.

Non-GAAP Measures and Definitions

Earnings before interest, taxes, depreciation

and amortization (“EBITDA”) represents the sum of net income /

(loss), interest and finance costs, depreciation and amortization

and, if any, income taxes during a period. Adjusted EBITDA

represents EBITDA before certain non-operating or non-recurring

charges, such as vessel impairment charges, gain or loss from debt

extinguishment, gain or loss on sale of vessel, gain or loss from

financial derivative instruments and stock compensation. EBITDA and

Adjusted EBITDA are not recognized measurements under U.S.

GAAP.

EBITDA and Adjusted EBITDA are presented in this

press release as we believe that they provide investors with means

of evaluating and understanding how our management evaluates

operating performance. These non-GAAP measures have limitations as

analytical tools, and should not be considered in isolation from,

as a substitute for, or superior to financial measures prepared in

accordance with U.S. GAAP. EBITDA and Adjusted EBITDA do not

reflect:

- our cash expenditures, or future requirements for capital

expenditures or contractual commitments;

- changes in, or cash requirements for, our working capital

needs; and

- cash requirements necessary to service interest and

principal payments on our funded debt.

In addition, these non-GAAP measures do not have

standardized meanings and are therefore unlikely to be comparable

to similar measures presented by other companies. The following

table reconciles net loss, as reflected in the Unaudited Interim

Consolidated Statements of Comprehensive Loss to EBITDA and

Adjusted EBITDA:

| |

|

Three months ended March 31, |

|

(Amounts in thousands of U.S. dollars) |

|

2021 |

|

2022 |

| Reconciliation of Net loss to Adjusted

EBITDA |

|

|

|

|

| |

|

|

|

|

| Net loss |

$ |

(2,003) |

$ |

(3,430) |

|

|

|

|

|

|

| Depreciation |

|

1,091 |

|

1,503 |

|

|

|

|

|

|

| Amortization of special survey costs |

|

101 |

|

85 |

|

|

|

|

|

|

| Interest and finance costs, net |

|

1,141 |

|

874 |

| |

|

|

|

|

| EBITDA |

$ |

330 |

$ |

(968) |

| |

|

|

|

|

| Loss from debt extinguishment |

|

458 |

|

34 |

| |

|

|

|

|

| Gain from financial derivative

instruments |

|

— |

|

(234) |

| |

|

|

|

|

| Loss from the sale of vessels, net |

|

— |

|

466 |

| |

|

|

|

|

| Adjusted EBITDA |

$ |

788 |

$ |

(702) |

Daily TCE is a shipping industry performance

measure of the average daily revenue performance of a vessel on a

per voyage basis. Daily TCE is not calculated in accordance with

U.S. GAAP. We utilize daily TCE because we believe it is a

meaningful measure to compare period-to-period changes in our

performance despite changes in the mix of charter types (i.e. spot

charters, time charters and bareboat charters) under which our

vessels may be employed between the periods. Our management also

utilizes daily TCE to assist them in making decisions regarding the

employment of the vessels. We calculate daily TCE by dividing

Revenues, net after deducting Voyage related costs and commissions,

by operating days for the relevant period. Voyage related costs and

commissions primarily consist of brokerage commissions, port, canal

and fuel costs that are unique to a particular voyage, which would

otherwise be paid by the charterer under a time charter

contract.

Vessel operating expenses (“Opex”) per day are

our vessel operating expenses for a vessel, which primarily consist

of crew wages and related costs, insurance, lube oils,

communications, spares and consumables, tonnage taxes as well as

repairs and maintenance, divided by the ownership days in the

applicable

period.

We calculate fleet utilization by dividing the number of operating

days during a period by the number of available days during the

same period. We use fleet utilization to measure our efficiency in

finding suitable employment for our vessels and minimizing the

amount of days that our vessels are off-hire for reasons other than

scheduled repairs or repairs under guarantee, vessel upgrades,

special surveys and intermediate dry-dockings or vessel

positioning. Ownership days are the total number of days in a

period during which we owned each of the vessels in our fleet.

Available days are the number of ownership days in a period, less

the aggregate number of days that our vessels were off-hire due to

scheduled repairs or repairs under guarantee, vessel upgrades or

special surveys and intermediate dry-dockings and the aggregate

number of days that we spent positioning our vessels during the

respective period for such repairs, upgrades and surveys. Operating

days are the number of available days in a period, less the

aggregate number of days that our vessels were off-hire or out of

service due to any reason, including technical breakdowns and

unforeseen circumstances.

EBITDA, Adjusted EBITDA and daily TCE are not

recognized measures under U.S. GAAP and should not be regarded as

substitutes for Revenues, net and Net income. Our presentation of

EBITDA, Adjusted EBITDA and daily TCE does not imply, and should

not be construed as an inference, that our future results will be

unaffected by unusual or non-recurring items and should not be

considered in isolation or as a substitute for a measure of

performance prepared in accordance with U.S. GAAP.

Recent Daily Fleet Data:

|

(Amounts in U.S. dollars per day) |

|

Three months ended March 31, |

| |

|

2021 |

|

2022 |

| Eco-Efficient

MR2: (2022: 4 vessels) |

|

|

|

|

|

(2021: 2 vessels) |

Daily TCE : |

13,679 |

|

11,356 |

| |

Opex per day : |

6,324 |

|

6,801 |

| |

Utilization % : |

100.0% |

|

74.6% |

| Eco-Modified

MR2: (1 vessel) |

|

|

|

|

| |

Daily TCE : |

10,856 |

|

10,722 |

| |

Opex per day : |

6,660 |

|

7,749 |

| |

Utilization % : |

100.0% |

|

73.3% |

| MR

Fleet:

(2022: 5 vessels) * |

|

|

|

|

|

(2021:

3 vessels) * |

Daily TCE : |

12,738 |

|

11,227 |

| |

Opex per day : |

6,436 |

|

6,991 |

| |

Utilization % : |

100.0% |

|

74.3% |

As of March 31, 2022 our fleet consisted of four

eco-efficient MR2 tankers, “Pyxis Lamda”, “Pyxis Theta”, “Pyxis

Karteria” and “Pyxis Epsilon”, and one eco-modified MR2, “Pyxis

Malou”. During 2021 and 2022, the vessels in our fleet were

employed under time and spot charters.

* a) On December 20, 2021, we took

delivery from a related party the “Pyxis Lamda”, a 50,145 dwt

medium range product tanker built in 2017 at SPP Shipbuilding in

South Korea. After her first special survey,

the “Pyxis Lamda” launched commercial employment in

early January, 2022. For 2021, the vessel contributed nil available

days, and, consequently, voyage and related costs of $10 have been

excluded from the above data. b) “Pyxis Karteria” was acquired on

July 15, 2021 and commenced commercial activities at that time. c)

Our two small tankers “Northsea Alpha” and “Northsea Beta” were

sold on January 28, and March 1, 2022, respectively. Both vessels

had been under Spot employment for approximately 7 and 36 days,

respectively, in 2022 as of the delivery date to their buyer. The

small tankers have been excluded in the table calculations for the

three months ended March 31, 2022 and the comparative period. d) In

February, 2022, the Pyxis Epsilon experienced a grounding at port

which resulted in minor damages to the vessel. The vessel was

off-hire for 43 days including shipyard repairs and returned

to commercial employment at the end of March, 2022.

Conference Call and Webcast

Today, Monday, May 16, 2022, at 8:30 a.m.

Eastern Time, the Company’s management will host a conference call

to discuss the results.

Participants should dial into the call 10

minutes before the scheduled time using the following numbers: [1

(877) 553-9962 (US Toll Free Dial In), 0(808) 238-0669 (UK Toll

Free Dial In) or +44 (0) 2071 928592 (Standard International Dial

In).] Please quote "Pyxis Tankers."

A telephonic replay of the conference and

accompanying slides will be available following the completion of

the call and will remain available until Monday, May 23, 2022. To

listen to the archived audio file, visit our website

http://www.pyxistankers.com and click on Events & Presentations

under our Investor Relations page.

A webcast of the conference call will be

available through our website (http://www.pyxistankers.com) under

our Events & Presentations page.

Webcast participants of the conference call

should register on the website approximately 10 minutes prior to

the start of the webcast and can also access it through the

following link:

https://events.q4inc.com/attendee/321712399An

archived version of the webcast will be available on the website

within approximately two hours of the completion of the call. The

information discussed on the conference call, or that can be

accessed through, Pyxis Tankers Inc.’s website is not incorporated

into, and does not constitute part of this report.

About Pyxis Tankers Inc.We own

a modern fleet of five tankers engaged in seaborne transportation

of refined petroleum products and other bulk liquids. We are

focused on growing our fleet of medium range product tankers, which

provide operational flexibility and enhanced earnings potential due

to their "eco" features and modifications. We are positioned to

opportunistically expand and maximize our fleet due to competitive

cost structure, strong customer relationships and an experienced

management team whose interests are aligned with those of its

shareholders. For more information, visit:

http://www.pyxistankers.com. The information discussed contained

in, or that can be accessed through, Pyxis Tankers Inc.’s website,

is not incorporated into, and does not constitute part of this

report.

Pyxis Tankers Fleet (as of May 13, 2022)

|

Vessel Name |

Shipyard |

Vessel type |

Carrying Capacity (dwt) |

Year Built |

Type of charter |

Charter(1) Rate (per day) |

Anticipated Earliest Redelivery Date |

|

| |

| |

| |

|

|

|

|

|

|

|

|

| Pyxis Lamda (2) |

SPP / S. Korea |

MR |

50,145 |

2017 |

Time |

$15,700 |

Aug

2022 |

|

| Pyxis Epsilon |

SPP / S. Korea |

MR |

50,295 |

2015 |

Spot |

n/a |

n/a |

|

| Pyxis Theta |

SPP / S. Korea |

MR |

51,795 |

2013 |

Spot |

n/a |

n/a |

|

| Pyxis Karteria (3) |

Hyundai / S. Korea |

MR |

46,652 |

2013 |

Time |

23,750 |

July

2022 |

|

| Pyxis Malou |

SPP / S. Korea |

MR |

50,667 |

2009 |

Spot |

n/a |

n/a |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

249,554 |

|

|

|

|

|

- Charter rates are gross and do not reflect any commissions

payable.

- “Pyxis Lamda” is fixed on a time charter for an option period

of min 70, max 180 days +/- 15 days at $15,700 per

day.

- “Pyxis Karteria” is fixed on a time charter for min 75, max 130

days at $23,750 per day.

Forward Looking Statements

This press release contains forward-looking

statements and forward-looking information within the meaning of

the Private Securities Litigation Reform Act of 1995 applicable

securities laws. The words “expected'', “estimated”, “scheduled”,

“could”, “should”, “anticipated”, “long-term”, “opportunities”,

“potential”, “continue”, “likely”, “may”, “will”, “positioned”,

“possible”, “believe”, “expand” and variations of these terms and

similar expressions, or the negative of these terms or similar

expressions, are intended to identify forward-looking information

or statements. But the absence of such words does not mean that a

statement is not forward-looking. All statements that are not

statements of either historical or current facts, including among

other things, our expected financial performance, expectations or

objectives regarding future and market charter rate expectations

and, in particular, the effects of COVID-19 or any variant thereof,

or the war in the Ukraine, on our financial condition and

operations and the product tanker industry in general, are

forward-looking statements. Forward-looking information is based on

the opinions, expectations and estimates of management of Pyxis

Tankers Inc. (“we”, “our” or “Pyxis”) at the date the information

is made, and is based on a number of assumptions and subject to a

variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those

projected in the forward-looking information. Although we believe

that the expectations and assumptions on which such forward-looking

statements and information are based are reasonable, those are not

guarantees of our future performance and you should not place undue

reliance on the forward-looking statements and information because

we cannot give any assurance that they will prove to be correct.

Since forward-looking statements and information address future

events and conditions, by their very nature they involve inherent

risks and uncertainties and actual results and future events could

differ materially from those anticipated or implied in such

information. Factors that might cause or contribute to such

discrepancy include, but are not limited to, the risk factors

described in our Annual Report on Form 20-F for the year ended

December 31, 2021 and our other filings with the Securities and

Exchange Commission. The forward-looking statements and information

contained in this presentation are made as of the date hereof. We

do not undertake any obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, except in accordance

with U.S. federal securities laws and other applicable securities

laws.

Company

Pyxis Tankers Inc.59 K. Karamanli StreetMaroussi 15125

Greeceinfo@pyxistankers.com

Visit our website at www.pyxistankers.com

Company Contact

Henry WilliamsChief Financial OfficerTel: +30 (210) 638 0200 /

+1 (516) 455-0106Email: hwilliams@pyxistankers.com

Source: Pyxis Tankers Inc.

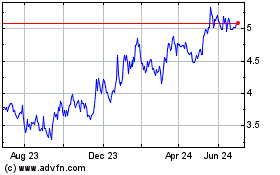

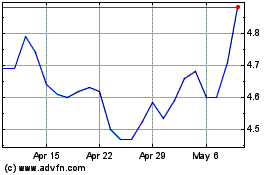

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Apr 2023 to Apr 2024