Current Report Filing (8-k)

November 20 2020 - 8:16AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 20, 2020

Purple

Innovation, Inc.

(Exact

Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-37523

|

|

47-4078206

|

|

(State

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification No.)

|

|

4100

N. Chapel Ridge Rd., Suite 200

|

|

|

|

Lehi,

Utah

|

|

84043

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (801) 756-2600

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

☐

|

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencements

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Class

A Common Stock, par value $0.0001 per share

|

|

PRPL

|

|

The

NASDAQ Stock Market LLC

|

|

|

|

|

|

|

|

Warrants

to purchase one-half of one share of Class A Common Stock

|

|

PRPLW

|

|

The

NASDAQ Stock Market LLC

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§

230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM

7.01 REGULATION FD DISCLOSURE.

As

previously announced, on October 27, 2020 Purple Innovation, Inc. (the “Company”) provided notice to the holders of

(i) warrants that were issued in the initial public offering of Global Partner Acquisition Corp. (“GPAC”) (the predecessor

to the Company) (the “Public Warrants”) and (ii) warrants that were issued in connection with the closing of the Amended

and Restated Credit Agreement dated February 26, 2019 by and among Purple Innovation, LLC, Coliseum Capital Partners, L.P. (“CCP”),

Blackwell Partners LLC – Series A (“Blackwell”), Coliseum Co-Invest Debt Fund, L.P. (“CDF” and together

with CCP and Blackwell, the “Lenders”) and Delaware Trust Company, to the Lenders (the “Incremental Loan Warrants”)

that, pursuant to the terms of such warrants, the Company determined to exercise its right to redeem the Public Warrants and the

Incremental Loan Warrants by paying to the holders of such warrants the redemption price of $0.01 per warrant, with the redemption

to take place on November 30, 2020. Prior to redemption, the Public Warrants and Incremental Loan Warrants may be exercised on

a cashless basis, in accordance with the terms of such warrants.

On

November 20, 2020, the Company issued a press release announcing that, as of November 19, 2020, approximately 9,828,000 Public

Warrants and all of the Incremental Loan Warrants had been exercised since October 27, 2020. If the remaining approximately 1,229,000

Public Warrants are not exercised prior to November 30, 2020, they will be redeemed on that date at the redemption price of $0.01

per warrant. A copy of the press release is attached hereto as Exhibit 99.1.

The

information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any registration

statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise stated

in such filing.

ITEM

9.01 FINANCIAL STATEMENTS AND EXHIBITS

EXHIBIT

INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Dated:

November 20, 2020

|

PURPLE

INNOVATION, INC.

|

|

|

|

|

|

|

By:

|

/s/

Craig L. Phillips

|

|

|

|

Craig

L. Phillips

|

|

|

|

Chief

Financial Officer

|

2

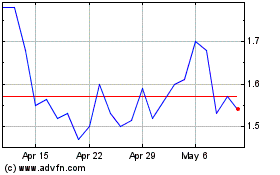

Purple Innovation (NASDAQ:PRPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

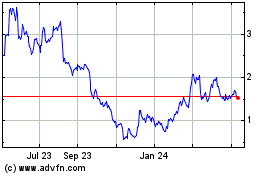

Purple Innovation (NASDAQ:PRPL)

Historical Stock Chart

From Apr 2023 to Apr 2024