Current Report Filing (8-k)

August 10 2021 - 8:01AM

Edgar (US Regulatory)

0001377121

false

0001377121

2021-08-04

2021-08-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): August 4, 2021

PROTAGONIST THERAPEUTICS, INC.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

001-37852

|

|

98-0505495

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

Protagonist Therapeutics, Inc.

7707 Gateway Blvd., Suite 140

Newark, California 94560-1160

(Address of principal executive offices,

including zip code)

(510) 474-0170

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, par value $0.00001

|

|

PTGX

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive

Agreement.

The Company and Zealand

Pharma A/S (“Zealand”) entered into a collaboration agreement in June 2012 (the “Collaboration Agreement”).

In October 2013, Zealand abandoned the collaboration, and the collaboration agreement was terminated in 2014. The abandonment of the collaboration

was memorialized in an Abandonment Agreement dated as of February 28, 2014 (the “Abandonment Agreement”). The

Collaboration Agreement provides for certain post-termination payment obligations to Zealand with respect to compounds related to the

collaboration that meet specified conditions set forth in the Collaboration Agreement and which the Company elects to further develop

following Zealand’s abandonment of the collaboration. Those obligations include development and sales milestone payments, as well

as low-single digit royalties on net sales. The Company initially understood rusfertide to be a compound for which the post-termination

payments described above are required under the Collaboration Agreement and therefore made three development milestone payments

for an aggregate amount of $1.0 million under the Collaboration Agreement. However, upon re-evaluation, the Company concluded in

2019 that rusfertide is not a compound requiring post-termination payments under the agreement, and in 2020 initiated International Chamber

of Commerce arbitration proceedings with Zealand related to the matter (the “Arbitration”).

The Company and Zealand

resolved their dispute pursuant to an Arbitration Resolution Agreement, dated as of August 4, 2021 (the “Agreement”).

Pursuant to the Agreement:

|

|

a)

|

the royalty rate payable by the Company on net sales of rusfertide has been reduced by 50%;

|

|

|

b)

|

all sales milestone payments on net sales of rusfertide have been reduced by 50%;

|

|

|

c)

|

all development milestones in respect of rusfertide have been reduced by 50%, except that the Company has agreed to pay in full within 2 business days after the effective date of the Agreement: (i) a $1.0 million development milestone for commencement of a Phase 2b rusfertide trial; and (ii) a $1.5 million development milestone that would otherwise have been due on initiation of a rusfertide Phase 3 trial (which trial the Company current expects to initiate in the first quarter of 2022).

|

|

|

d)

|

the Company is required to make an additional $1.5 million payment to Zealand in August 2022;

|

|

|

e)

|

each party will retain all payments previously made to it by the other party in connection with the Collaboration Agreement; and

|

|

|

f)

|

the parties have released claims related to the Collaboration Agreement, the Abandonment Agreement and the Arbitration.

|

Royalties, development milestone payments

and sales milestone payments are due in respect of net sales and development made or achieved by either the Company or a Company licensee

or collaborative partner. The Agreement relates only to rusfertide and not to any other compounds.

In addition to the payments

specified in items (c) and (d) above, the Company expects, based on the anticipated number of patients in the rusfertide Phase 3 trial

for polycythemia vera, that it may be required to pay Zealand up to $2.75 million in future rusfertide development milestone payments.

Those payments include up to $1.0 million in the aggregate for registrational approvals (such as a New Drug Application approval by the

United States Food and Drug Administration) and up to $1.75 million in the aggregate for commercial launch in the three geographic territories

specified in the Collaboration Agreement (the United States, the European Union and the rest of the world, or “ROW”).

The reduced one-time sales

milestone payments for rusfertide include up to an aggregate of $50 million based upon achievement of specified fiscal year net sales

thresholds for the various territories.

The Company and Zealand have agreed to dismiss

the Arbitration with prejudice, with each party bearing its own fees and costs.

The description of the terms and conditions of

the Agreement set forth herein is not complete and is qualified in its entirety by reference to the text of the Agreement, which the Company

intends to file as an exhibit to its Quarterly Report on Form 10-Q for the fiscal quarter ending September 30, 2021 and is incorporated

herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Protagonist Therapeutics, Inc.

|

|

|

|

|

Dated:

August 10, 2021

|

|

|

|

By:

|

/s/ Don Kalkofen

|

|

|

|

Don Kalkofen

|

|

|

|

Chief Financial Officer

|

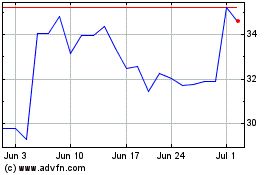

Protagonist Therapeutics (NASDAQ:PTGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

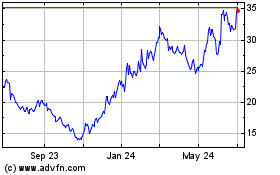

Protagonist Therapeutics (NASDAQ:PTGX)

Historical Stock Chart

From Apr 2023 to Apr 2024