Protagenic Therapeutics Announces Third Quarter 2021 Results and Business Update

November 16 2021 - 9:58AM

Protagenic Therapeutics, Inc. (Nasdaq: PTIX) a biopharmaceutical

company focused on developing therapies to treat stress-related

neurologic disorders, today announced results for the third quarter

ended September 30, 2021.

Recent Highlights

- Hosted a

virtual science review to discuss the scientific rationale and

evidence for PT00114 in the treatment of Depression, Anxiety, PTSD

and Addiction. Replay available at www.protagenic.com.

- Hosted

a key opinion leader (KOL) webinar focused on PT00114 for the

regulation of stress in patients with Depression, PTSD, Anxiety and

Addiction. Replay available at www.protagenic.com.

- Received

FDA comment to provide clinical sites with ready-to-inject clinical

vials of PT00114; to result in IND refiling in the fourth

quarter

“During the third quarter and year to date, we

made significant progress towards moving PT00114 into the clinic,

in order to treat stress-related neuropsychiatric disorders which

afflict a growing patient population,” said Dr. Garo Armen,

Executive Chairman of Protagenic Therapeutics. “We have a

well-defined clinical path targeting psychiatric disorders like

depression, anxiety, PTSD, and drug & alcohol addiction. We

anticipate gathering efficacy and safety data readouts in the

second half of 2022.”

Anticipated Upcoming Milestones

-

Q4 2021: Re-filing of IND application for

PT00114

-

Q1 2022: Initiation of Phase I/IIa study

for PT00114

-

2H

2022: Initial Data Readout of Phase I/IIa

study

Financial Results for the Second Quarter Ended September

30, 2021:

- Net loss

attributable to common stockholders for the quarter ended September

30, 2021 was approximately $0.9 million, compared to approximately

$1.0 million for the quarter ended September 30, 2020.

- Research

and development expense totaled approximately $0.3 million for the

quarter ended September 30, 2021, compared to approximately $0.5

million during the quarter ended September 30, 2020.

- General

and administrative expense was approximately $0.5 million for the

quarter ended September 30, 2021, compared to approximately $0.6

million during the quarter ended September 30, 2020.

- As of

September 30, 2021, the Company had cash and cash equivalents of

approximately $10.8 million.

- As of

November 15, 2021, the Company had approximately 17.0 million

common shares outstanding.

Select Financial Information

Protagenic Therapeutics, Inc., and

SubsidiaryBalance Sheet(In U.S. Dollars)(Unaudited)

| |

|

September 30, 2021 |

|

|

December 31, 2020 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CURRENT

ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

460,115 |

|

|

$ |

671,091 |

|

|

Marketable securities |

|

|

10,394,573 |

|

|

|

- |

|

|

Prepaid expenses |

|

|

802,417 |

|

|

|

208,156 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL CURRENT

ASSETS |

|

|

11,657,105 |

|

|

|

879,247 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

11,657,105 |

|

|

$ |

879,247 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

724,417 |

|

|

$ |

571,517 |

|

|

Derivative liability |

|

|

- |

|

|

|

83,670 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL CURRENT

LIABILITIES |

|

|

724,417 |

|

|

|

655,187 |

|

| |

|

|

|

|

|

|

|

|

| PIK convertible notes payable,

net of debt discount |

|

|

441,435 |

|

|

|

1,081,384 |

|

| PIK convertible notes payable,

net of debt discount - related parties |

|

|

120,654 |

|

|

|

292,412 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL

LIABILITIES |

|

|

1,286,506 |

|

|

|

2,028,983 |

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY

(DEFICIT) |

|

|

|

|

|

|

|

|

| Preferred stock, $0.000001 par

value; 20,000,000 shares authorized; 872,766 shares issued and

outstanding in the following classes: |

|

|

|

|

|

|

|

|

| Preferred stock; par value

$0.000001; 2,000,000 shares authorized; none issued and

outstanding |

|

|

- |

|

|

|

- |

|

| Series B convertible preferred

stock, $0.000001 par value; 18,000,000 shares authorized; 0 and

872,766 shares issued and outstanding at September 30, 2021, and

December 31, 2020 |

|

|

- |

|

|

|

1 |

|

| |

|

|

|

|

|

|

|

|

| Common stock, $.0001 par

value, 100,000,000 shares authorized, 16,955,817 and 10,360,480

shares issued and outstanding at September 30, 2021, and December

31, 2020 |

|

|

1,697 |

|

|

|

1,036 |

|

| Additional

paid-in-capital |

|

|

31,872,763 |

|

|

|

16,719,749 |

|

| Accumulated deficit |

|

|

(21,331,483 |

) |

|

|

(17,698,936 |

) |

| Accumulated other

comprehensive loss |

|

|

(172,378 |

) |

|

|

(171,586 |

) |

| |

|

|

|

|

|

|

|

|

| TOTAL STOCKHOLDERS’

EQUITY (DEFICIT) |

|

|

10,370,599 |

|

|

|

(1,149,736 |

) |

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY (DEFICIT) |

|

$ |

11,657,105 |

|

|

$ |

879,247 |

|

Consolidated Statements of Operations(In U.S.

Dollars) (Unaudited)

| |

|

For the three months endedSeptember

30, |

|

|

For the nine months ended September

30, |

|

| |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| OPERATING AND

ADMINISTRATIVE EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

257,279 |

|

|

|

539,770 |

|

|

|

990,222 |

|

|

|

657,737 |

|

| General and

administrative |

|

|

506,892 |

|

|

|

552,246 |

|

|

|

2,288,972 |

|

|

|

1,356,990 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL OPERATING AND ADMINISTRATIVE EXPENSES |

|

|

764,171 |

|

|

|

1,092,016 |

|

|

|

3,279,194 |

|

|

|

2,014,727 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS FROM

OPERATIONS |

|

|

(764,171 |

) |

|

|

(1,092,016 |

) |

|

|

(3,279,194 |

) |

|

|

(2,014,727 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER (EXPENSE)

INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

336 |

|

|

|

17 |

|

|

|

568 |

|

|

|

494 |

|

|

Interest expense |

|

|

(114,464 |

) |

|

|

(58,827 |

) |

|

|

(437,591 |

) |

|

|

(152,757 |

) |

|

Change in fair value of derivative liability |

|

|

- |

|

|

|

104,718 |

|

|

|

83,670 |

|

|

|

141,907 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL OTHER INCOME (EXPENSES) |

|

|

(114,128 |

) |

|

|

45,908 |

|

|

|

(353,353 |

) |

|

|

(10,356 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS BEFORE

TAX |

|

|

(878,299 |

) |

|

|

(1,046,108 |

) |

|

|

(3,632,547 |

) |

|

|

(2,025,083 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME TAX

EXPENSE |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

|

$ |

(878,299 |

) |

|

$ |

(1,046,108 |

) |

|

$ |

(3,632,547 |

) |

|

$ |

(2,025,083 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE

LOSS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Comprehensive

Loss - net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized loss on marketable securities |

|

|

(974 |

) |

|

|

- |

|

|

|

(974 |

) |

|

|

- |

|

|

Foreign exchange translation income (loss) |

|

|

(791 |

) |

|

|

736 |

|

|

|

182 |

|

|

|

(599 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL COMPREHENSIVE

LOSS |

|

$ |

(880,064 |

) |

|

$ |

(1,045,372 |

) |

|

$ |

(3,633,339 |

) |

|

$ |

(2,025,682 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per common share -

Basic and Diluted |

|

$ |

(0.05 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.20 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares

- Basic and Diluted |

|

|

16,521,882 |

|

|

|

10,275,758 |

|

|

|

13,939,400 |

|

|

|

10,274,005 |

|

See accompanying notes to these unaudited

consolidated financial statements in our Form 10-Q filed with the

SEC November 15, 2021

About Protagenic Therapeutics, Inc.

Protagenic Therapeutics, Inc. (Nasdaq: PTIX) is

a pre-clinical biopharmaceutical company endeavoring to develop

first-in-class neuro-active peptides into human therapeutics to

treat several stress related disorders. For more information, visit

http://www.protagenic.com.

Forward-Looking Statements

This press release contains forward-looking

statements that are made pursuant to the safe harbor provisions of

the federal securities laws, including statements regarding

Protagenic Therapeutics’ product candidates and pre-clinical

development and clinical trial plans and activities.

Forward-looking statements include words such as "expects,"

"anticipates," "intends," "plans," "could," "believes," "estimates"

and similar expressions. These forward-looking statements are

subject to risks and uncertainties that could cause actual results

to differ materially. These risks and uncertainties include, among

others, our ability to obtain additional capital to meet our

liquidity needs on acceptable terms, or at all, including the

additional capital which will be necessary to complete the

pre-clinical testing and eventual clinical trials of our product

candidates; our ability to successfully complete research and

further development and commercialization of our product

candidates; the uncertainties inherent in pre-clinical and clinical

testing; the timing, cost and uncertainty of obtaining regulatory

approvals; our ability to protect the Company's intellectual

property; the loss of any executive officers or key personnel or

consultants; competition; changes in the regulatory landscape or

the imposition of regulations that affect the Company's products;

and the other factors described under the Risk Factors section of

our most recent Annual Report on Form 10-K filed with the

Securities and Exchange Commission.. Protagenic Therapeutics

cautions investors not to place considerable reliance on the

forward-looking statements contained in this release. These

statements speak only as of the date of this press release, and

Protagenic undertakes no obligation to update or revise the

statements, other than to the extent required by law. All

forward-looking statements are expressly qualified in their

entirety by this cautionary statement.

Analyst Contact:Alexander K.

Arrow, MD, CFA Chief Financial

Officer213-260-4342alex.arrow@protagenic.com

Media Contact:James CarbonaraHayden

IR(646)-755-7412james@haydenir.com

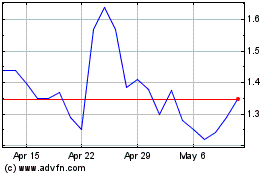

Protagenic Therapeutics (NASDAQ:PTIX)

Historical Stock Chart

From Oct 2024 to Nov 2024

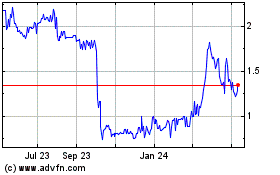

Protagenic Therapeutics (NASDAQ:PTIX)

Historical Stock Chart

From Nov 2023 to Nov 2024