Porch Group, Inc. (“Porch Group,” “Porch” or “the Company”)

(NASDAQ: PRCH), a leading vertical software company reinventing the

home services and insurance industries, today announced the pricing

of a private offering of $333 million aggregate principal amount of

its 6.75% Senior Secured Convertible Notes due 2028 (the “New

Notes”) in a private placement transaction, and a concurrent

privately negotiated repurchase of $200 million aggregate principal

amount of its 0.75% Convertible Senior Notes due 2026 (the

“Existing Notes”). The New Notes offering and Existing Notes

repurchase are expected to close concurrently on April 20, 2023,

subject to customary closing conditions.

The New Notes will be convertible into cash,

shares of common stock of the Company (“common stock”), or a

combination of cash and shares of common stock at Porch’s election

at an initial conversion rate of 39.9956 shares of common stock per

$1,000 principal amount of the New Notes, which is equivalent to an

initial conversion price of approximately $25.00 per share.

Porch intends to use the net proceeds from the

New Notes offering to repurchase $200 million of the Existing Notes

and to fund the repayment of a $10 million senior secured term loan

of a Porch Group subsidiary, in each case plus accrued and unpaid

interest thereon and related fees and expenses, and use the

remainder of the net proceeds for general corporate purposes.

Following the closing of this transaction, Porch

Group will hold:

- $225 million

aggregate principal amount of the unsecured Existing Notes due

2026

- $333 million

aggregate principal amount of secured New Notes due 2028

The transaction is additionally expected to

result in approximately $100 million of additional cash to Porch

Group, net of the debt repayments described above and payment of

related fees and expenses.

“This transaction will allow us to reduce our

medium-term debt maturity from $425 million to $225 million, while

delivering additional liquidity to the business, all while

minimizing dilution by maintaining a $25 per share conversion

price,” said Shawn Tabak, Porch Group CFO.

The New Notes will be senior secured obligations

of the Company, will accrue interest at a rate of 6.75%, payable

semi-annually in arrears on April 1 and October 1 of each year,

beginning on October 1, 2023, and will be initially issued at 95.0%

of par value. The New Notes will mature on October 1, 2028, unless

earlier repurchased, redeemed or converted. Prior to the close of

business on the business day immediately preceding July 1, 2028,

the New Notes will be convertible at the option of the holders only

upon the satisfaction of certain conditions and during certain

periods. Thereafter, until the close of business on the second

scheduled trading day immediately preceding the maturity date, the

New Notes will be convertible at the option of the holders at any

time regardless of these conditions.

The New Notes will be issued in a private

placement under Section 4(a)(2) of the Securities Act of 1933, as

amended (the “Securities Act”), and, along with the shares of

common stock issuable upon conversion of the New Notes, will not be

registered under the Securities Act or applicable state securities

laws. Accordingly, the New Notes and the shares of common stock

issuable upon conversion of the New Notes, if any, may not be

offered, sold, pledged or otherwise transferred except to a

qualified institutional buyer (within the meaning of Rule 144A

under the Securities Act) pursuant to an effective Securities Act

registration statement or an applicable exemption from the

registration requirements of the Securities Act and applicable

state securities laws.

Oppenheimer & Co Inc. served as exclusive

placement agent for the New Notes. Sidley Austin LLP acted as legal

advisor to Porch Group.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy the New Notes, or any

other securities, and will not constitute an offer, solicitation or

sale in any state or jurisdiction in which such an offer,

solicitation or sale would be unlawful.

About Porch Group

Seattle-based Porch Group, the vertical software

platform for the home, provides software and services to

approximately 30,900 home services companies, such as home

inspectors, moving companies, loan officers, title companies, real

estate agencies, utility companies, and warranty companies. Through

these relationships and its multiple brands, Porch Group provides a

moving concierge service to homebuyers, helping them save time and

make better decisions on critical services, including insurance,

warranty, moving, security, TV/internet, home repair and

improvement, and more.

Forward-Looking

Statements

Certain statements in this release may be

considered “forward-looking statements” within the meaning of the

“safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally

relate to future events or Porch Group’s future financial or

operating performance. For example, statements regarding the

closing of the New Notes offering and the timing and use of net

proceeds therefrom (including the concurrent Existing Notes

repurchase), and other statements herein of management's beliefs,

intentions or goals are forward-looking statements. In some cases,

you can identify forward-looking statements by terminology such as

“may,” “should,” “expect,” “intend,” “will,” “estimate,”

“anticipate,” “believe,” “predict,” “potential,” “target,” or

“continue,” or the negatives of these terms or variations of them

or similar terminology. Such forward-looking statements are subject

to risks, uncertainties, and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements.

These forward-looking statements are based upon

estimates and assumptions that, while considered reasonable by

Porch and its management at the time they are made, are inherently

uncertain. Factors that may cause actual results to differ

materially from current expectations include, but are not limited

to: risks related to the New Notes offering and concurrent Existing

Notes repurchase, including the effect of the capital markets on

the New Notes offering and concurrent Existing Notes repurchase and

our ability to satisfy the closing conditions to the New Notes

offering and concurrent Existing Notes repurchase, and other risks

and uncertainties described in the “Risk Factors” section of

Porch’s most recent Annual Report on Form 10-K for the year ended

December 31, 2022 and subsequent reports filed with the Securities

and Exchange Commission (the “SEC”), all of which are available on

the SEC’s website at www.sec.gov.

Nothing in this release should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You

should not place undue reliance on forward-looking statements,

which speak only as of the date of this release. Unless

specifically indicated otherwise, the forward-looking statements in

this release do not reflect the potential impact of any

divestitures, mergers, acquisitions, or other business combinations

that have not been completed as of the date of this release. Porch

Group does not undertake any duty to update these forward-looking

statements, whether as a result of changed circumstances, new

information, future events or otherwise, except as may be required

by law.

Investor Relations Contact:Lois

Perkins, Head of Investor RelationsPorch

Grouploisperkins@porch.com

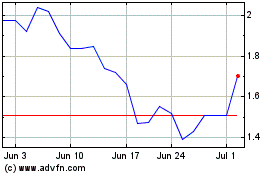

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Porch (NASDAQ:PRCH)

Historical Stock Chart

From Apr 2023 to Apr 2024