Current Report Filing (8-k)

June 03 2021 - 8:44AM

Edgar (US Regulatory)

0001093691

false

0001093691

2021-06-02

2021-06-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 2, 2021

Plug Power Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

1-34392

|

|

22-3672377

|

|

(State or other jurisdiction

|

|

(Commission File

|

|

(IRS Employer

|

|

of incorporation)

|

|

Number)

|

|

Identification No.)

|

968 Albany Shaker Road,

Latham, New York

|

|

12110

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (518) 782-7700

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

PLUG

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934(§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive

Agreement.

On June 2, 2021, Plug

Power Inc., a Delaware corporation (the “Company”), and certain of its subsidiaries entered into a Consent and Tenth Amendment

(the “Tenth Amendment”) to the Loan and Security Agreement, dated as of March 29, 2019, as amended (the “Loan Agreement”),

with Generate PPL SPV I, LLC, as assignee of Generate Lending, LLC, a Delaware limited liability company (“Generate”).

The Tenth Amendment amends the Loan Agreement to remove a restrictive covenant limiting the Company’s ability to make capital expenditures

and certain related definitions. In addition, under the Tenth Amendment, Generate consents to permit the Company to enter into the France

JV (as defined below), to make aggregate investments of up to €80 million relating to the France JV, and to make a secured term

loan of approximately $75 million to an energy project development partner.

The foregoing description

of the Tenth Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Tenth Amendment,

a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2021.

Item 7.01 Regulation FD Disclosure.

On June 3, 2021, the

Company issued a press release in which, among other things, it announced that it had entered into the France JV. A copy of the press

release is attached to this Current Report as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this

Item 7.01.

The information included

in this Item 7.01 and Exhibit 99.1 of this Current Report on Form 8-K are not deemed to be “filed” for purposes of Section

18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall this item and Exhibit 99.1 be incorporated

by reference into the Company’s filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as

amended, except as expressly set forth by specific reference in such future filing.

Item 8.01 Other Events.

On June 3, 2021, the Company, Plug Power France,

a wholly-owned subsidiary of the Company (“Plug Power France”), Renault SAS (“Renault”) and HyVia, a French

société par actions simplifiée (“HyVia”), entered into a definitive Joint Venture Agreement and related

agreements to consummate the parties’ previously announced joint venture based in France (the “France JV”). HyVia, the

joint venture entity, plans to manufacture and sell fuel cell powered electric light commercial vehicles (“FCE-LCVs”) and

to supply hydrogen fuel and fueling stations to support the FCE-LCV market, in each case primarily in Europe. Initially, the Company

will supply HyVia with fuel cell systems and components and refueling infrastructure components and Renault will supply HyVia with commercial

vans. The Company and Renault are subject to customary exclusivity and noncompete restrictions with respect to HyVia’s business.

HyVia will be owned 50% by Plug Power France and

50% by Renault. The Company and Renault will make investments into HyVia to support necessary funding and growth, and the Company

and Renault expect to invest on a pro rata basis not less than €65 million through 2022.

Forward-Looking Statements

This

Current Report on Form 8-K contains forward-looking statements within the meaning of the federal securities laws. These

statements include, but are not limited to, statements regarding the France JV’s plans to manufacture and sell FCE-LCVs and

supply hydrogen fuel and fueling stations primarily in Europe and the amount of investment by the Company and Renault into the

France JV. These forward-looking statements are made as of the date hereof and are based on current expectations,

estimates, forecasts and projections as well as the beliefs and assumptions of management. Forward-looking statements are

subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond the Company’s

control. The Company’s actual results could differ materially from those stated or implied

in forward-looking statements due to a number of factors, including those risks and uncertainties that are detailed in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2020 as well as other filings and reports that

are filed by the Company from time to time with the Securities and Exchange Commission. The Company disclaims any obligation to

update forward-looking statements.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Plug Power Inc.

|

|

|

|

|

|

Date: June 3, 2021

|

By:

|

/s/ Paul Middleton

|

|

|

|

Name: Paul Middleton

|

|

|

|

Title: Chief Financial Officer

|

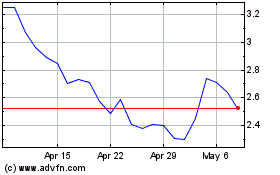

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Mar 2024 to Apr 2024

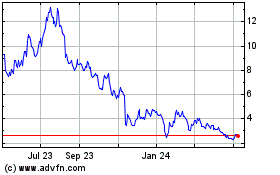

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Apr 2023 to Apr 2024