Current Report Filing (8-k)

June 07 2019 - 4:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 7, 2019

PIXELWORKS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

OREGON

|

|

000-30269

|

|

91-1761992

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

226 Airport Parkway, Suite 595

San Jose, CA 95110

(408) 200-9200

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

PXLW

|

The Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.05

Costs Associated with Exit or Disposal Activity.

On June 7, 2019, the Board of Directors (the “Board”) of the Company completed a previously approved restructuring plan to make the operation of the Company more efficient and which would result in an approximately 2% reduction in workforce, primarily in the areas of sales and operations. The Board believes adoption of this restructuring plan will help streamline the Company’s operations and workforce, and more appropriately align the Company’s operating expenses with current revenue levels. The Company expects the restructuring to be substantially completed by the end of the second quarter ending June 30, 2019 and expects to incur total estimated restructuring charges of approximately $0.4 million related to employee severance and benefits. The Company currently expects that these charges will largely be recorded in the second quarter of 2019.

As a result of the restructuring, the Company expects to realize annualized savings of approximately $0.6 million.

Forward-Looking Statements:

This Current Report on Form 8-K contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may include terms such as “expects”, “will,” “believes,” and similar expressions and include statements regarding the Company’s restructuring plan, its expectations and estimates regarding the workforce reduction, the objectives of the restructuring plan and the timing thereof, amounts and timing of the charges, cash expenditures and savings to be incurred in connection with the restructuring plan, and the potential impact of the restructuring plan. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. Potential risks and uncertainties that could cause actual results to differ from expected results include, among others, whether the Company will be able to implement the restructuring program as planned, whether additional measures outside those set forth herein will need to be taken to fulfill the objectives of the restructuring plan, whether the expected amount of the costs associated with the restructuring program will differ from or exceed the Company's forecasts and whether the Company will be able to realize the full amount of estimated savings from the restructuring program or in the timeframe expected. It is not possible to predict or identify all risks and uncertainties, and additional significant risks and uncertainties are described in the Company’s Form 10-K, Form 10-Q and Form 8-K reports filed with the Securities and Exchange Commission. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are first made. Except to the extent required by law, the Company undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of unanticipated events.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

PIXELWORKS, INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

Dated:

|

June 7, 2019

|

/s/ Steven L. Moore

|

|

|

|

Steven L. Moore

Vice President, Chief Financial

Officer, Secretary and Treasurer

|

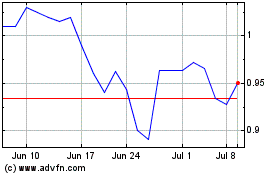

Pixelworks (NASDAQ:PXLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

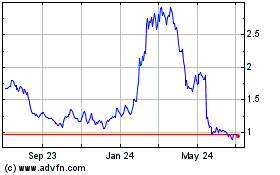

Pixelworks (NASDAQ:PXLW)

Historical Stock Chart

From Apr 2023 to Apr 2024