Current Report Filing (8-k)

October 14 2021 - 4:38PM

Edgar (US Regulatory)

0000077476

false

0000077476

2021-10-14

2021-10-14

0000077476

pep:Commonstockparvalue123centspershareMember

2021-10-14

2021-10-14

0000077476

pep:TwoPointFivePercentNotesDue2022Member

2021-10-14

2021-10-14

0000077476

pep:ZeroPointTwoFivePercentNotesDue2024Member

2021-10-14

2021-10-14

0000077476

pep:TwoPointSixTwoFivePercentNotesDue2026Member

2021-10-14

2021-10-14

0000077476

pep:ZeroPointSevenFivePercentNotesDue2027Member

2021-10-14

2021-10-14

0000077476

pep:ZeroPointEightSevenFivePercentNotesDue2028Member

2021-10-14

2021-10-14

0000077476

pep:ZeroPointFivePercentNotesDue2028Member

2021-10-14

2021-10-14

0000077476

pep:OnePointOneTwoFivePercentNotesDue2031Member

2021-10-14

2021-10-14

0000077476

pep:ZeroPointFourPercentNotesDue2032Member

2021-10-14

2021-10-14

0000077476

pep:ZeroPointEightSevenFiveNotesDue2039Member

2021-10-14

2021-10-14

0000077476

pep:OnePointZeroFivePercentNotesDue2050Member

2021-10-14

2021-10-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): October 14, 2021

PepsiCo, Inc.

(Exact name of registrant as specified in

its charter)

|

North Carolina

|

1-1183

|

13-1584302

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

700 Anderson Hill Road, Purchase, New York

|

10577

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (914) 253-2000

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Securities Exchange Act of 1934:

|

Title

of each class

|

|

Trading

Symbol

|

|

Name

of each exchange on which registered

|

|

Common Stock, par value 1-2/3 cents per share

|

|

PEP

|

|

The Nasdaq Stock Market LLC

|

|

2.500% Senior Notes due 2022

|

|

PEP22a

|

|

The Nasdaq Stock Market LLC

|

|

0.250% Senior Notes due 2024

|

|

PEP24

|

|

The Nasdaq Stock Market LLC

|

|

2.625% Senior Notes due 2026

|

|

PEP26

|

|

The Nasdaq Stock Market LLC

|

|

0.750% Senior Notes due 2027

|

|

PEP27

|

|

The Nasdaq Stock Market LLC

|

|

0.875% Senior Notes due 2028

|

|

PEP28

|

|

The Nasdaq Stock Market LLC

|

|

0.500% Senior Notes due 2028

|

|

PEP28a

|

|

The Nasdaq Stock Market LLC

|

|

1.125% Senior Notes due 2031

|

|

PEP31

|

|

The Nasdaq Stock Market LLC

|

|

0.400% Senior Notes due 2032

|

|

PEP32

|

|

The Nasdaq Stock Market LLC

|

|

0.875% Senior Notes due 2039

|

|

PEP39

|

|

The Nasdaq Stock Market LLC

|

|

1.050% Senior Notes due 2050

|

|

PEP50

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

Emerging growth company

|

¨

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

¨

|

PepsiCo Senior Notes Offering.

On October 7, 2021, PepsiCo, Inc. (“PepsiCo”)

announced an offering of €1,000,000,000 aggregate principal amount of its 0.750% Senior Notes due 2033 (the “Notes”).

BNP Paribas, Goldman Sachs & Co. LLC and Morgan Stanley & Co. International plc were joint book-running managers for the offering

of the Notes.

PepsiCo received net proceeds of approximately

€991 million, after deducting underwriting discounts and estimated offering expenses payable by PepsiCo. The net proceeds will be

used for general corporate purposes, including the repurchase of outstanding indebtedness and the repayment of commercial paper.

The Notes were offered and sold pursuant to a

Terms Agreement (the “Terms Agreement”) dated October 7, 2021 (incorporating the PepsiCo, Inc. Underwriting Agreement Standard

Provisions dated as of November 18, 2019 (the “Standard Provisions”)) among PepsiCo and the several underwriters, under PepsiCo’s

automatic shelf registration statement (the “Registration Statement”) on Form S-3 (File No. 333-234767), filed with the Securities

and Exchange Commission (the “SEC”) on November 18, 2019. PepsiCo has filed with the SEC a prospectus supplement, dated October

7, 2021, together with the accompanying prospectus, dated November 18, 2019, relating to the offer and sale of the Notes. The Notes were

issued on October 14, 2021 pursuant to an Indenture (the “Indenture”) dated as of May 21, 2007 between PepsiCo and The Bank

of New York Mellon, as Trustee. The following table summarizes information about the Notes and the offering thereof.

|

Title of Securities:

|

|

0.750% Senior Notes due 2033

|

|

Aggregate Principal Amount Offered:

|

|

€1,000,000,000

|

|

Maturity Date:

|

|

October 14, 2033

|

|

Interest Payment Dates:

|

|

Annually on October 14, commencing October 14, 2022.

|

|

Coupon:

|

|

0.750%

|

|

Optional Redemption:

|

|

Prior to July 14, 2033, make-whole call at comparable government bond rate plus 15 basis points; par call at any time on or after July 14, 2033.

|

|

Price to Public:

|

|

99.669%

|

The Notes are unsecured obligations of PepsiCo

and rank equally with all of PepsiCo’s other unsecured senior indebtedness. The Indenture also contains customary event of default

provisions.

The above description of the Terms Agreement,

the Indenture and the Notes is qualified in its entirety by reference to the Terms Agreement, the Indenture and the forms of Notes. Each

of the Terms Agreement, the Standard Provisions and the form of Note is incorporated by reference into the Registration Statement and

is filed with this Current Report on Form 8-K as Exhibit 1.1, Exhibit 1.2 and Exhibit 4.1, respectively. The Board of Directors resolutions

authorizing PepsiCo’s officers to establish the terms of the Notes have been filed as Exhibit 4.7 to the Registration Statement.

The Indenture has been filed as Exhibit 4.3 to the Registration Statement. Opinions regarding the legality of the Notes are incorporated

by reference into the Registration Statement and are filed with this Current Report on Form 8-K as Exhibits 5.1 and 5.2; and consents

relating to such incorporation of such opinions are incorporated by reference into the Registration Statement and are filed with this

Current Report on Form 8-K as Exhibits 23.1 and 23.2 by reference to their inclusion within Exhibits 5.1 and 5.2, respectively.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

104

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 14, 2021

|

PepsiCo, Inc.

|

|

|

|

|

|

By:

|

/s/ Cynthia A. Nastanski

|

|

|

|

Name:

|

Cynthia A. Nastanski

|

|

|

|

Title:

|

Senior Vice President, Corporate Law and Deputy Corporate Secretary

|

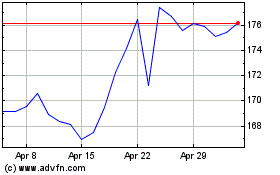

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

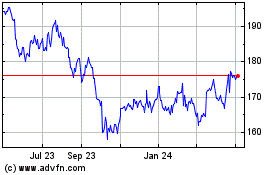

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024