Pepsi, Conagra Still Riding Pandemic Food Wave -- Heard on the Street

October 01 2020 - 12:20PM

Dow Jones News

By Aaron Back

The eat-at-home trend isn't going anywhere, to the lasting

benefit of American food companies.

That was the main takeaway Thursday from two giants of the

industry -- PepsiCo and Conagra Brands. But beneath the surface

there were also signs that continued innovation to keep up with

health and wellness trends remains important.

Both companies reported quarterly earnings that were well ahead

of expectations. Pepsi said organic sales, which strip out

acquisition and currency impacts, rose 6% from a year earlier in

North America for both its Frito-Lay and Quaker Food divisions.

More surprising was that its North America beverage business, which

has been dragged down by weak out-of-home sales, scored a 3%

organic revenue increase on the back of price increases. That

compares with a 7% decline the prior quarter.

Conagra did even better. Its grocery and snacks division, which

includes Hunt's tomato sauce, Vlasic pickles, and Orville

Redenbacher popcorn, saw organic sales soar 21%. In its

refrigerated and frozen segment, which includes Birds Eye

vegetables and Marie Callender's, organic sales rose 19%. The

company also issued stronger-than-expected guidance for the current

quarter and unexpectedly raised its dividend.

On a conference call, Conagra argued that food consumption at

home is likely to stay elevated, even as states open back up, due

to a host of factors: Remote working arrangements are becoming more

normal, recessions tend to increase at-home dining, and families

have invested already in things such as cookware and appliances to

up their kitchen games.

Despite all this, food companies can't rest on their laurels. It

is clear that shifts in health and wellness trends that rocked the

food industry before the pandemic are still present. At Pepsi, for

instance, some of the fastest growth in beverages is coming from

newer, sugar-free products, including bubly sparkling water and

Gatorade Zero. Pepsi Zero Sugar has grown retail sales by over 30%

so far this year, Chief Executive Ramon Laguarta said. Meanwhile,

Conagra cited figures from IRI showing that retail sales of its

frozen, plant-based meat alternatives were up 36% from a year

earlier over the last 13 weeks.

Americans may keep eating more at home, but they still want to

eat healthier. Food companies need to keep adapting.

Write to Aaron Back at aaron.back@wsj.com

(END) Dow Jones Newswires

October 01, 2020 12:05 ET (16:05 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

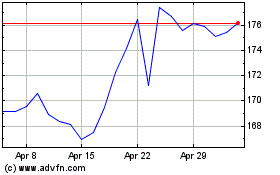

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

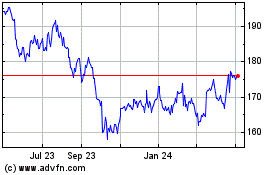

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024