PepsiCo Revenue Climbs but Profit Drops on Higher Expenses -- update

October 03 2019 - 7:31AM

Dow Jones News

By Allison Prang

Profit at snacks and beverage company PepsiCo Inc. fell from a

year ago despite another quarter of strong sales growth.

In the third quarter, organic revenue growth -- a metric that

strips out currency effects and acquisitions -- was up 4.3%. The

company is now guiding to either meet or beat its expectations for

organic revenue growth of 4% for the year.Net income fell to $2.1

billion, a drop from $2.5 billion for the comparable quarter a year

earlier.

Earnings fell to $1.49 a share, from $1.75 a share, hurt by

higher expenses. PepsiCo's selling, general and administrative

costs climbed by more than 8%, canceling out a lot of its top-line

gains. Its income-tax provision also rose significantly.

Adjusted earnings were $1.56 a share, down from $1.59 a share.

Analysts polled by FactSet were expecting $1.50 a share.

Though profit fell, net revenue climbed 4.3% to $17.19 billion,

helped by the Frito-Lay North America unit as well as its markets

abroad. Analysts were expecting revenue of $16.93 billion.

Net revenue at PepsiCo's North American beverage division rose

year over year as well. Pepsi earlier this year rolled out three

different flavors of Pepsi that are made with real juice.

The company is now guiding to either meet or beat its

expectations for organic revenue growth of 4%.

Shares of PepsiCo rose 3.3% on low volume in premarket

trading.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

October 03, 2019 07:16 ET (11:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

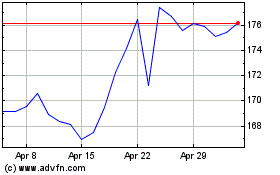

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Aug 2024 to Sep 2024

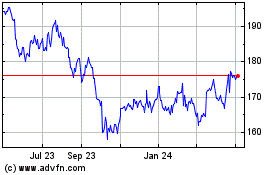

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Sep 2023 to Sep 2024