Current Report Filing (8-k)

May 04 2023 - 6:46AM

Edgar (US Regulatory)

0001639825false441 Ninth Avenue, Sixth FloorNew YorkNew York00016398252023-05-012023-05-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________________

FORM 8-K

_______________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2023

_______________________________________________________

Peloton Interactive, Inc.

(Exact name of Registrant as Specified in Its Charter)

_______________________________________________________

| | | | | | | | |

| Delaware | 001-39058 | 47-3533761 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

|

|

441 Ninth Avenue, Sixth Floor New York, New York |

| 10001 |

| (Address of Principal Executive Offices) |

| (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (929) 567-0006

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_______________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Class A Common Stock, $0.000025 par value per share | PTON | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 1.01. Entry into a Material Definitive Agreement

As previously disclosed by Peloton Interactive, Inc. (“Peloton” or the “Company”), in April 2021, DISH Technologies L.L.C., Sling TV L.L.C., and DISH DBS Corporation (collectively, “Dish”) filed a complaint with the United States International Trade Commission (the “ITC”) under Section 337 of the Tariff Act of 1930 against Peloton Interactive, Inc., along with ICON Health & Fitness, Inc. (now iFIT Inc. f/k/a Icon Health & Fitness, Inc.), FreeMotion Fitness, Inc., NordicTrack, Inc., lululemon athletica, inc., and Curiouser Products Inc. d/b/a MIRROR. The complaint alleged infringement of various patents related to “adaptive bitrate streaming” (“ABR”) by video displays incorporated into the Company’s fitness devices. Dish Technologies L.L.C. and Sling TV L.L.C also filed a complaint asserting the same patents in April 2021 in the United States District Court for the Eastern District of Texas (“Texas Litigation”) seeking an order permanently enjoining Peloton from infringing the asserted patents, an award of damages for the infringement of the asserted patents, an award of damages for lost sales, and recovery of its attorney fees. The Texas Litigation remained stayed pending resolution of the ITC investigation, including any related appeals.

On March 8, 2023, the ITC issued an opinion finding that the Company had imported products that infringe certain claims of some of the ABR patents asserted by Dish. On the basis of that finding, the ITC issued a limited exclusion order and cease and desist order (“Remedial Orders”) to, among other things, preclude (i) the sale, distribution, marketing, transferring or advertising in the United States of products that have the functionality found to infringe installed on them, and (ii) the importation of such products unless and until U.S. Customs and Border Protection deems them non-infringing.

On May 1, 2023, Peloton and Dish entered into a Settlement, Patent License, and Release Agreement (the "Settlement Agreement") to resolve the ITC matter as well as the Texas Litigation. The Settlement Agreement provides for, among other things: (a) Dish to promptly seek termination of the ITC investigation, rescission of the Remedial Orders, and dismissal with prejudice of the Texas Litigation; (b) broad cross-releases between Peloton and Dish; (c) a worldwide, fully paid up royalty-free license for Peloton and its affiliates for Dish patents relating to ABR, including the patents asserted in the ITC investigation and Texas Litigation; (d) covenants not to sue restricting the parties from initiating certain kinds of future litigation; and (f) a one-time settlement payment by Peloton of $75 million to Dish.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| PELOTON INTERACTIVE, INC. |

|

|

|

| Date: May 4, 2023 | By: | /s/ Tammy Albarrán |

|

| Tammy Albarrán |

|

| Chief Legal Officer |

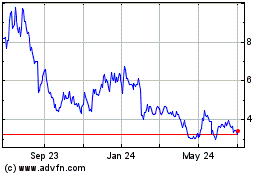

Peloton Interactive (NASDAQ:PTON)

Historical Stock Chart

From Mar 2024 to Apr 2024

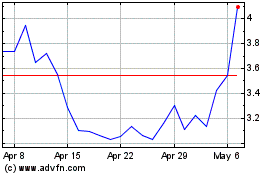

Peloton Interactive (NASDAQ:PTON)

Historical Stock Chart

From Apr 2023 to Apr 2024