- First quarter total revenues of $8.2 million, an increase of

$1.9 million from first quarter 2021

- First quarter net loss of $0.3 million, or diluted net loss

per share of ($0.01)

- First quarter adjusted EBITDA of $0.9 million, or diluted

adjusted EBITDA per share of $0.02

- First quarter gross dollar load volume up 16.2% versus the

year-ago period and 7.6% versus the previous quarter

- First quarter purchase volume up 24.7% versus the year-ago

period

- First quarter unrestricted cash increased by $1.1 million to

$8.5 million

Paysign, Inc. (NASDAQ: PAYS), a leading provider of prepaid card

programs, comprehensive patient affordability offerings, digital

banking services and integrated payment processing, today announced

financial results for the first quarter of 2022.

“We are pleased with our Q1 2022 results with good revenue

growth as our key performance indicators return to a pre-pandemic

normalcy,” said Mark Newcomer, Paysign CEO. “We continue to win new

deals and onboard new plasma centers and pharma clients. We’re

seeing strong interest in our pharma solutions as the industry

navigates the upcoming CMS 2023 rule changes.”

Quarterly Results

The following additional details are provided to aid in

understanding Paysign’s first quarter 2022 results versus the

year-ago period:

- Revenues increased $1.9 million (31%) versus the year-ago

period. The change was driven by the impact of the following

factors:

- Plasma revenue increased $2.0 million (37%) primarily due to an

increase in plasma donations and dollars loaded onto cards. The

average monthly revenue per plasma center increased to $6,672

versus $5,260 during the same period a year ago. We added nine new

plasma centers during the quarter, exiting the quarter with 375

centers. This compares to 366 centers at the end of 2021 and 343

centers at the end of Q1 2021.

- Pharma revenue decreased $76 thousand (-9%) primarily driven by

the ending of four pharma prepaid programs throughout 2021 and the

recognition of settlement income in Q1 2021 from one of those

programs, offset with the addition of seven new pharma copay

programs that have launched since March 31, 2021.

- Cost of revenues decreased by $225 thousand (-7%). Cost of

revenues comprises of transaction processing fees, data

connectivity, data center expenses, network fees, bank fees, card

production, postage costs, customer service, program management,

application integration setup and sales and commission expense. The

decrease was primarily due to the renewal and restructuring of an

agreement in the first quarter of 2022, offset by the increase in

variable transaction costs as a result of increased plasma

transactions which occurred during the period.

- Gross profit increased $2.2 million (77%) primarily due to the

increase in plasma revenue and profitability. Our gross profit

margin improved to 60.8%.

- Selling, general and administrative expenses increased $776

thousand or 20.1% compared to the same period in the prior year and

consisted primarily of (i) an increase in compensation and benefits

of $84 thousand due to continued hiring to support the company’s

growth, a tight labor market and increased personnel insurance

costs; (ii) a decrease in stock-based compensation of $67 thousand;

(iii) a decrease in outside professional services for legal, tax,

accounting and consultants of $95 thousand; (vi) an increase in

legal settlements of $354 thousand; (iv) an increase in

non-personnel insurance of $111 thousand; (v) an increase in

technologies and telecom of $178 thousand; (vi) a decrease in rent,

utilities and maintenance of $30 thousand; (vii) an increase in

travel and entertainment of $75 thousand due to a more normalized

working environment and trade show expenses; and (viii) an increase

in other operating expenses of $166 thousand.

- Depreciation and amortization increased $83 thousand due to the

continued capitalization of new software and equipment and

continued enhancements to our platform.

- Other income increased $7 thousand related to an increase in

interest income resulting from higher restricted cash balances and

rising interest rates.

- Income tax provision increased slightly as a result of the full

valuation on our deferred tax asset in both the current and prior

period and the tax benefit related to our stock-based compensation

and a pretax loss in the prior year period. The effective tax rate

was (0.6%) and (0.1%) for the periods ending March 31, 2022, and

2021, respectively.

- Net loss decreased $1.3 million to a loss of $309 thousand. The

overall change in net loss relates to the factors mentioned

above.

- “EBITDA,” which is defined as earnings before interest, taxes,

depreciation and amortization expense, and which is a non-GAAP

metric, increased $1.4 million to a profit of $357 thousand due to

the factors above.

- “Adjusted EBITDA,” which reflects the adjustment to EBITDA to

exclude stock-based compensation charges, and which is a non-GAAP

metric used by management to gauge the operating performance of the

business, increased $1.3 million to a profit of $927 thousand due

to the factors mentioned above. If not for legal settlements of

$354 thousand during the quarter, Adjusted EBITDA would have been

$1.3 million.

Q1 2022 Milestones

- As of March 31, 2022, we had approximately 4.4 million

cardholders and 438 card programs.

- Year-over-year revenue increased 30.9%.

- We added 9 plasma programs and launched 4 new pharma copay

programs.

Balance Sheet At March 31, 2022

Unrestricted cash increased $1.1 million to $8.5 million due

primarily to the improvement of our plasma business on our

operations. Our operating results continued to improve over the

same period a year ago enabling us to generate positive cash flow

from operations, a trend that started in the second half of 2021.

Restricted cash of $64.7 million are funds used for customer card

funding with a corresponding offset under current liabilities. The

increase in the first quarter of 2022 versus the end of 2021 was

predominately related to increases in funds on cards, increased

plasma deposits and new plasma and pharma copay customers, offset

by declines from pharma prepaid customers whose contracts ended at

the end of the year. Accounts payable and accrued liabilities

increased $1.2 million primarily due to the continued growth of our

copay programs. We believe that our unrestricted cash on hand at

March 31, 2022, of $8.5 million along with forecast revenues and

operating profits anticipated for 2022, as well as our accounts

receivable and accounts payable processes, will be sufficient to

sustain our operations for the next twelve months.

2022 Outlook

“Our plasma business continues to rebound from the negative

impact experienced from COVID-19. On an aggregated basis, we are

back to pre-pandemic operating levels even though we have not yet

obtained those levels on a per plasma donation center basis as the

labor market remains tight and donations from Mexican nationals

along the US border remain halted. Despite these ongoing headwinds,

we continue to post year-over-year improvements in our operating

results and expect that trend to continue as we move throughout

2022. Our balance sheet remains strong and we expect it to continue

to expand as an outcome of the operating result improvements,” said

Jeff Baker, Paysign CFO.

“Our guidance for the full year of 2022 remains unchanged. We

expect total revenue to be in the range of $35.25 million to $38.35

million, reflecting growth of 20% to 30%, with plasma making up

approximately 90% of total revenue. Pharma revenue is expected to

be relatively flat year over year as the loss of programs and

settlement income in 2021 are offset with new pharma copay

programs. Adjusted EBITDA is expected to at least double to $4.0

million over 2021’s adjusted EBITDA of $2.0 million. Full year

gross profit margins are expected to be approximately 50.0% to

52.5% as they are expected to return to a more normalized gross

profit margin experienced in 2021. Operating expenses are expected

to increase to approximately $20.0 million as we continue to make

investments in people and technology, and experience higher costs

in insurance, travel and entertainment and other inflationary

pressures. Depreciation and amortization is expected to be between

$3.0 million and $3.25 million while stock-based compensation is

expected to be approximately $2.0 million,” Baker concluded.

COVID-19 Update

The coronavirus (“COVID-19”) pandemic, which started in late

2019 and reached the United States in early 2020, continues to

significantly impact the economy of the United States and the rest

of the world. While the disruption appears to be mitigating due to

the availability of vaccines and other factors, the ultimate

duration and severity of the pandemic remain uncertain,

particularly given the development of new variants that continue to

spread. The COVID-19 outbreak caused plasma center closures, and

the stimulus packages signed into law during 2020 and 2021 reduced

the incentive for individuals to donate plasma for supplementary

income. Those developments have had and will continue to have an

adverse impact on the company’s results of operations. While we

remain cautiously optimistic and have seen improvements in our

operating results on an aggregated basis, we cannot foresee how

long it may take the company to attain pre-pandemic operating

levels on a per plasma donation center basis as COVID-19 related

labor shortages at plasma donation centers, border closures, and

other effects continue to weigh on the company’s results of

operations. Given the uncertainty around the extent and timing of

the potential future spread or mitigation of COVID-19 and variants

and around the imposition or relaxation of protective measures,

management cannot at this time estimate with reasonable accuracy

COVID-19’s further impact on the company’s results of operations,

cash flows or financial condition.

First Quarter 2022 Financial Results Conference Call

Details

At 5:00 p.m. ET today, the company will host a conference call

to discuss its first quarter 2022 results. The conference call may

include forward-looking statements. The dial-in information for

this call is 877.407.2988 (within the U.S.) and 201.389.0923

(outside the U.S.). A replay of the call will be available until

August 11, 2022, and can be accessed by dialing 877.660.6853

(within the U.S.) and 201.612.7415 (outside the U.S.), using

passcode 13729568.

Forward-Looking Statements

Certain statements contained in this press release may be deemed

to be forward-looking statements under federal securities laws, and

the company intends that such forward-looking statements be subject

to the safe harbor created thereby. All statements, other than

statements of fact included in this release are forward-looking

statements. Such forward-looking statements include, among others,

that our unrestricted cash, anticipated revenues and profits will

be sufficient to sustain operations for the next 12 months; that

the expected total revenue, gross profit margins, operating

expenses, depreciation and amortization, stock-based compensation,

adjusted EBITDA, plasma revenues and pharma revenues for 2022 meet

our expectations; that the company will continue to post

year-over-year improvements; that the company’s growth prospects in

plasma, pharma, and other prepaid business materialize; and that

the company will continue to be affected by COVID-19-related labor

shortages. We caution that these statements are qualified by

important risks, uncertainties and other factors that could cause

actual results to differ materially from those reflected by such

forward-looking statements. Such factors include, among others, the

inability to continue our current growth rate in future periods;

that a downturn in the economy, including as a result of COVID-19

and variants, as well as further government stimulus measures,

could reduce our customer base and demand for our products and

services, which could have an adverse effect on our business,

financial condition, profitability and cash flows; operating in a

highly regulated environment; failure by us or business partners to

comply with applicable laws and regulations; changes in the laws,

regulations, credit card association rules or other industry

standards affecting our business; that a data security breach could

expose us to liability and protracted and costly litigation; and

other risk factors set forth in our Form 10-K for the year ended

December 31, 2021. Except to the extent required by federal

securities laws, the company undertakes no obligation to publicly

update or revise any statements in this release, whether as a

result of new information, future events or otherwise.

About Paysign, Inc.

Paysign, Inc. (NASDAQ: PAYS) is a leading provider of prepaid

card programs, comprehensive patient affordability offerings,

digital banking services and integrated payment processing designed

for businesses, consumers and government institutions. Incorporated

in 1995 and headquartered in southern Nevada, the company creates

customized, innovative payment solutions for clients across all

industries, including pharmaceutical, healthcare, hospitality and

retail. By using Paysign solutions, clients enjoy benefits such as

lower administrative costs, streamlined operations, increased

revenues, accelerated product adoption and improved customer,

employee and partner loyalty.

Built on the foundation of a robust and reliable payments

platform, Paysign’s end-to-end technologies securely enable a wide

range of services, including transaction processing, cardholder

enrollment, value loading, cardholder account management, reporting

and customer care. The modern cross-platform architecture is highly

flexible, scalable and customizable, which delivers cost benefits

and revenue-building opportunities to clients and partners.

As a full-service program manager, Paysign manages all aspects

of the prepaid card lifecycle, from card design and bank approvals,

production, packaging, distribution and personalization, to

inventory and security controls, renewals, lost and stolen cards

and card replacement. The company’s in-house, bilingual customer

care is available 24/7/365 through live agents, interactive voice

response (IVR), and two-way SMS alerts.

For more than 20 years, major pharmaceutical and healthcare

companies and multinational enterprises have relied on Paysign to

provide full-service programs tailored to their unique

requirements. The company has designed and launched prepaid card

programs for corporate rewards, employee incentives, consumer

rebates, donor compensation, clinical trials, healthcare

reimbursement payments and copay assistance.

Paysign’s expanded product offerings include additional

corporate incentive products and demand deposit accounts accessible

with a debit card. The product roadmap includes expanded offerings

into new prepaid card categories, including payroll, travel and

expense reimbursement. For more information, visit paysign.com.

Paysign, Inc.

Condensed Consolidated

Statements of Operation

(Unaudited) Three Months Ended March 31,

2022

2021

Revenues Plasma industry

$

7,394,364

$

5,383,151

Pharma industry

806,568

882,830

Other

19,707

13,447

Total revenues

8,220,639

6,279,428

Cost of revenues

3,222,390

3,447,622

Gross profit

4,998,249

2,831,806

Operating expenses Selling, general and administrative

4,640,912

3,864,986

Depreciation and amortization

679,171

595,848

Total operating expenses

5,320,083

4,460,834

Loss from operations

(321,834

)

(1,629,028

)

Other income Interest income, net

14,336

7,101

Loss before income tax provision

(307,498

)

(1,621,927

)

Income tax provision

1,897

1,600

Net loss

$

(309,395

)

$

(1,623,527

)

Net loss per share Basic

$

(0.01

)

$

(0.03

)

Diluted

$

(0.01

)

$

(0.03

)

Weighted average common shares Basic

51,818,676

50,351,971

Diluted

51,818,676

50,351,971

Paysign, Inc.

Condensed Consolidated Balance

Sheets

March 31,

December 31,

2022

2021

(Unaudited) (Audited) ASSETS Current assets

Cash

$

8,455,671

$

7,387,156

Restricted cash

64,677,683

61,283,914

Accounts receivable

3,405,867

3,393,940

Other receivables

1,019,218

1,019,218

Prepaid expenses and other current assets

1,625,631

1,242,967

Total current assets

79,184,070

74,327,195

Fixed assets, net

1,519,799

1,642,981

Intangible assets, net

4,205,833

4,086,962

Operating lease right-of-use asset

3,900,851

3,993,655

Total assets

$

88,810,553

$

84,050,793

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities Accounts payable and accrued liabilities

$

6,954,565

$

5,765,478

Operating lease liability, current portion

345,544

340,412

Customer card funding

64,677,683

61,283,914

Total current liabilities

71,977,792

67,389,804

Operating lease liability, long term portion

3,584,851

3,673,186

Total liabilities

75,562,643

71,062,990

Stockholders' equity Common stock: $0.001 par value;

150,000,000 shares authorized, 52,218,382 and 52,095,382 issued at

March 31, 2022 and December 31, 2021, respectively

52,218

52,095

Additional paid-in-capital

17,429,498

16,860,119

Treasury stock at cost, 303,450 shares

(150,000

)

(150,000

)

Accumulated deficit

(4,083,806

)

(3,774,411

)

Total stockholders' equity

13,247,910

12,987,803

Total liabilities and stockholders' equity

$

88,810,553

$

84,050,793

Paysign, Inc. Non-GAAP Measures

To supplement Paysign’s financial results presented on a GAAP

basis, we use non-GAAP measures that exclude from net income the

following cash and non-cash items: interest, taxes, depreciation

and amortization, stock-based compensation, impairment of

intangible asset and loss on abandonment of assets. We believe

these non-GAAP measures used by management to gauge the operating

performance of the business help investors better evaluate our past

financial performance and potential future results. Non-GAAP

measures should not be considered in isolation or as a substitute

for comparable GAAP accounting, and investors should read them in

conjunction with the company’s financial statements prepared in

accordance with GAAP. The non-GAAP measures we use may be different

from, and not directly comparable to, similarly titled measures

used by other companies.

“EBITDA” is defined as earnings before interest, taxes,

depreciation and amortization expense. “Adjusted EBITDA” reflects

the adjustment to EBITDA to exclude stock-based compensation

charges, impairment of intangible asset and loss on abandonment of

assets.

Adjusted EBITDA is not intended to represent cash flows from

operations, operating income (loss) or net income (loss) as defined

by U.S. GAAP as indicators of operating performances. Management

cautions that amounts presented in accordance with Paysign’s

definition of Adjusted EBITDA may not be comparable to similar

measures disclosed by other companies because not all companies

calculate Adjusted EBITDA in the same manner.

Paysign, Inc.

Adjusted EBITDA

(Unaudited)

Three Months Ended March

31,

2022

2021

Reconciliation of EBITDA and adjusted EBITDA to net loss: Net loss

$

(309,395

)

$

(1,623,527

)

Income tax provision

1,897

1,600

Interest income, net

(14,336

)

(7,101

)

Depreciation and amortization

679,171

595,848

EBITDA

357,337

(1,033,180

)

Stock-based compensation

569,502

636,214

Adjusted EBITDA

$

926,839

$

(396,966

)

Adjusted EBITDA per share Basic

$

0.02

$

(0.01

)

Diluted

$

0.02

$

(0.01

)

Weighted average common shares Basic

51,818,676

50,351,971

Diluted

52,521,876

50,351,971

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220511006032/en/

Paysign Investor Relations: 888.522.4810 ir@paysign.com

Paysign Media Relations: Alicia Ches Director, Marketing

702.749.7257 pr@paysign.com

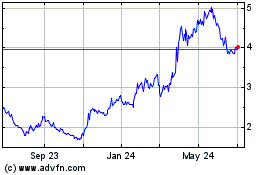

Paysign (NASDAQ:PAYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

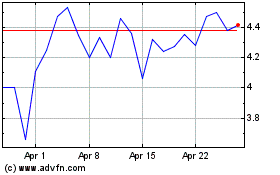

Paysign (NASDAQ:PAYS)

Historical Stock Chart

From Apr 2023 to Apr 2024