Panbela Therapeutics, Inc. (Nasdaq: PBLA), a

clinical stage company developing disruptive therapeutics for the

treatment of patients with urgent unmet medical needs, today

provides a business update and reports financial results for the

quarter ended June 30, 2022. Management is hosting an earnings

conference call today at 4:30 p.m. ET.

The second quarter was marked by meaningful progress.

Q2 and Recent Highlights:

- First Patient

Enrolled in its Aspire Trial.

- Received approval

from the Australian Human Research Ethics Committee (HREC) to

expand the company’s global clinical trial to Australia.

- Closed on the

acquisition of Cancer Prevention Pharmaceuticals, Inc. (CPP).

- Hosted a virtual

R&D Day on the company’s investigational drug, ivospemin

(SBP-101), as a polyamine metabolism modulator in ovarian

cancer.

- Poster

presentation highlighting the results for ivospemin (SBP-101) as a

polyamine metabolism modulator in ovarian cancer at the American

Association for Cancer Research (AACR) in April 2022. The work

reflects the company’s ongoing collaboration with Johns Hopkins

University School of Medicine.

“Through the second quarter we significantly increased our

addressable market at Panbela. First, during the quarter we closed

on our definitive agreement to acquire CPP. The combined entity

targets an estimated $5 billion aggregated market opportunity.

Additionally, we presented ovarian cancer data at AACR, supporting

SBP-101’s potential use beyond our first indication, pancreatic

cancer,” said Jennifer K. Simpson, PhD, MSN, CRNP, President &

Chief Executive Officer of Panbela. “Via our acquisition of CPP and

organic operational advancements, Panbela now has a diversified

pipeline, with an ability to hit multiple targets. The development

programs now consists of the randomized, double-blind, placebo

controlled trial in first line metastatic pancreatic cancer

patients, and a Phase III clinical trial funded by the National

Cancer Institute (the “NCI”) for the study of colon cancer risk

reduction and colon adenoma therapy (“CAT”). Additional programs

are evaluating a single agent tablet eflornithine (CPP-1X) or high

dose powder eflornithine sachet (CPP-1X-S) for several indications

including prevention of gastric cancer and treatment of high risk

refractory neuroblastoma. As we now have programs

ranging from pre-clinical to registration studies, including a lead

asset with a fully funded registration trial scheduled to begin in

early 2023, we expect a steady flow of achievements.”

During the second half of 2022, we expect to announce final data

from our Phase I untreated metastatic pancreatic cancer study, and

the opening of a neoadjuvant pancreatic cancer

investigator-initiated trial with ivospemin (SBP-101). With the

closing of the CPP transaction, we also anticipate achieving

additional milestones during the remainder of 2022 that will

reflect the increased flow of planned development activity and

data. These milestones include initiation of a Phase I/II program

in non-small cell lung cancer and a Phase II study in Type I onset

Diabetes.

Second quarter ended June 30, 2022 Financial

Results

General and administrative expenses were $1.3 million in the

second quarter of 2022, compared to $1.2 million in the second

quarter of 2021. The change is due primarily to legal fees,

associated with the acquisition of CPP.

Research and development expenses were $20.0 million in the

second quarter of 2022, inclusive of a one-time, non-cash expense

of $17.7 million. This expense was the write-off of in process

research and development (or IPR&D). The company has accounted

for the acquisition of CPP as an asset purchase. IPR&D

represents the asset purchased and asset acquisition accounting

requires writing off this asset immediately after the acquisition.

The remaining R&D expense in the quarter of approximately $2.3

million compares to $1.0 million in the second quarter of 2021.

This is related to an increase in spending on our clinical

studies.

Net loss in the second quarter of 2022 was $21.1 million, or

$1.51 per diluted share, compared to a net loss of $2.2 million, or

$0.22 per diluted share, in the second quarter of 2021.

Total cash was $2.5 million as of June 30, 2022. Total current

assets were $3.5 million and current liabilities were $6.2 million

as of the same date. Also at June 30, 2022, total noncurrent

assets, consisting of cash deposits held by our contract research

organization, were $3.1 million. New notes payable on the balance

sheet, the result of the acquisition of CPP, totaled approximately

$6.9 million. Current portion of the notes payable plus accrued

interest totaled approximately $1.7 million.

Conference Call Information

To participate in this event, dial approximately 5 to 10 minutes

before the beginning of the call.

Date: August 15, 2022Time: 4:30 PM Eastern TimeToll Free:

888-506-0062; Access Code: 429849International: 973-528-0011;

Access Code: 429849Webcast Link:

https://www.webcaster4.com/Webcast/Page/2556/45649

Conference Call Replay Information

Toll Free: 877-481-4010International: 919-882-2331Replay

Passcode: 45649

Replay Webcast Link:

https://www.webcaster4.com/Webcast/Page/2556/45649

About our Pipeline

The pipeline consists of assets currently in clinical trials

with an initial focus on familial adenomatous polyposis (FAP),

first-line metastatic pancreatic cancer, neoadjuvant pancreatic

cancer, colorectal cancer prevention and ovarian cancer. The

combined development programs have a steady cadence of news flow

with programs ranging from pre-clinical to registration

studies.

SBP-101

SBP-101 is a proprietary polyamine analogue designed to induce

polyamine metabolic inhibition (PMI) by exploiting an observed high

affinity of the compound for pancreatic ductal adenocarcinoma and

other tumors. The molecule has shown signals of tumor growth

inhibition in clinical studies of US and Australian metastatic

pancreatic cancer patients, demonstrating a median overall survival

(OS) of 14.6 months which is final, and an objective response rate

(ORR) of 48%, both exceeding what is seen typically with the

standard of care of gemcitabine + nab-paclitaxel suggesting

potential complementary activity with the existing FDA-approved

standard chemotherapy regimen. In data evaluated from clinical

studies to date, SBP-101 has not shown exacerbation of bone marrow

suppression and peripheral neuropathy, which can be

chemotherapy-related adverse events. Serious visual adverse events

have been evaluated and patients with a history of retinopathy or

at risk of retinal detachment will be excluded from future SBP-101

studies. The safety data and PMI profile observed in the current

Panbela sponsored clinical trial provides support for continued

evaluation of SBP-101 in a randomized clinical trial. For more

information, please

visit https://clinicaltrials.gov/ct2/show/NCT03412799

Flynpovi™

Flynpovi is a combination of CPP-1X (eflornithine) and sulindac

with a dual mechanism inhibiting polyamine synthesis and increasing

polyamine export and catabolism. In a Phase 3 clinical trial in

patients with sporadic large bowel polyps, the combination

prevented > 90% subsequent pre-cancerous sporadic adenomas

versus placebo. Focusing on FAP patients with lower

gastrointestinal tract anatomy in the recent Phase 3 trial

comparing Flynpovi to single agent eflornithine and single agent

sulindac, FAP patients with lower GI anatomy (patients with an

intact colon, retained rectum or surgical pouch), Flynpovi showed

statistically significant benefit compared to both single agents

(p≤0.02) in delaying surgical events in the lower GI for up to four

years. The safety profile for Flynpovi did not significantly differ

from the single agents and supports the continued evaluation of

Flynpovi for FAP.

CPP-1X

CPP-1X (eflornithine) is being developed as a single agent

tablet or high dose power sachet for several indications including

prevention of gastric cancer, treatment of neuroblastoma and recent

onset Type 1 diabetes. Preclinical studies as well as Phase 1 or

Phase 2 investigator-initiated trials suggest that CPP-1X treatment

is well tolerated and has potential activity.

About Panbela

Panbela Therapeutics, Inc. is a clinical-stage biopharmaceutical

company developing disruptive therapeutics for patients with urgent

unmet medical needs. The company’s lead assets are SBP-101 and

Flynpovi. Further information can be found

at https://panbela.com. Panbela

Therapeutics, Inc. common stock is listed on The Nasdaq Stock

Market LLC under the symbol PBLA.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains “forward-looking

statements,” including within the meaning of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements can be

identified by words such as: “believe,” “design,” “expect,” “feel,”

“intend,” “may,” “plan,” “scheduled,” and “will.” Examples of

forward-looking statements include statements we make regarding

results of collaborations with third parties, future milestones,

and future studies. All statements other than statements of

historical fact are statements that should be deemed

forward-looking statements. Forward-looking statements are

neither historical facts nor assurances of future

performance. Instead, they are based only on our current

beliefs, expectations, and assumptions regarding the future of our

business, future plans and strategies, projections,

anticipated events and trends, the economy and other future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of our control. Our actual results and

financial condition may differ materially and adversely from the

forward-looking statements. Therefore, you should not rely on

any of these forward-looking statements. Important factors

that could cause our actual results and financial condition to

differ materially from those indicated in the forward-looking

statements include, among others, the following: (i) our ability to

obtain additional funding to execute our business and clinical

development plans; (ii) progress and success of our clinical

development program; (iii) the impact of the current COVID-19

pandemic on our ability to conduct our clinical trials; (iv) our

ability to demonstrate the safety and effectiveness of our product

candidates: SBP-101 and eflornithine (v) our reliance on a third

party for the execution of the registration trial for our product

candidate Flynpovi; (vi) our ability to obtain regulatory approvals

for our product candidates, ivospemin (SBP-101) and eflornithine

(CPP-1X) in the United States, the European Union or other

international markets; (vii) the market acceptance and level of

future sales of our product candidates, ivospemin (SBP-101) and

eflornithine (CPP-1X); (viii) the cost and delays in product

development that may result from changes in regulatory oversight

applicable to our product candidates, ivospemin (SBP-101) and

eflornithine (CPP-1X); (ix) the rate of progress in establishing

reimbursement arrangements with third-party payors; (x) the effect

of competing technological and market developments; (xi) the costs

involved in filing and prosecuting patent applications and

enforcing or defending patent claims; and (xii) such other factors

as discussed Item 1A under the caption “Risk Factors” in our most

recent Annual Report on Form 10-K, any additional risks presented

in our Quarterly Reports on Form 10-Q and our Current Reports on

Form 8-K. Any forward-looking statement made by us in this press

release is based on information currently available to us and

speaks only as of the date on which it is made. We undertake

no obligation to publicly update any forward-looking statement or

reasons why actual results would differ from those anticipated in

any such forward-looking statement, whether written or oral,

whether as a result of new information, future

developments or otherwise.

Contact Information:

Investors:James CarbonaraHayden IR(646)

755-7412james@haydenir.com

Media:Tammy GroenePanbela Therapeutics, Inc.(952)

479-1196IR@panbela.com

Panbela Therapeutics, Inc.Consolidated

Statements of Operations and Comprehensive Loss

(unaudited)(In thousands, except share and per share

amounts)

| |

|

Three months ended

March 31, |

|

Six months ended June 30, |

| |

|

2022 |

|

2021 |

|

Percent Change |

|

2022 |

|

2021 |

|

Percent Change |

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

$ |

1,258 |

|

|

$ |

1,241 |

|

|

1.4 |

% |

|

$ |

3,053 |

|

|

$ |

2,391 |

|

|

27.7 |

% |

|

Research and development |

|

|

20,028 |

|

|

|

985 |

|

|

1933.3 |

% |

|

|

22,236 |

|

|

|

2,084 |

|

|

967.0 |

% |

|

Operating loss |

|

|

(21,286 |

) |

|

|

(2,226 |

) |

|

856.2 |

% |

|

|

(25,289 |

) |

|

|

(4,475 |

) |

|

465.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

2 |

|

|

|

0 |

|

|

- |

|

|

|

2 |

|

|

|

- |

|

|

- |

|

|

Interest expense |

|

|

(16 |

) |

|

|

(4 |

) |

|

300.0 |

% |

|

|

(20 |

) |

|

|

(7 |

) |

|

185.7 |

% |

|

Other income (expense) |

|

|

(848 |

) |

|

|

(148 |

) |

|

473.0 |

% |

|

|

(536 |

) |

|

|

(269 |

) |

|

99.3 |

% |

|

Total other income (expense) |

|

|

(862 |

) |

|

|

(152 |

) |

|

467.1 |

% |

|

|

(554 |

) |

|

|

(276 |

) |

|

100.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before

income tax benefit |

|

|

(22,148 |

) |

|

|

(2,378 |

) |

|

831.4 |

% |

|

|

(25,843 |

) |

|

|

(4,751 |

) |

|

443.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax

benefit |

|

|

18 |

|

|

|

192 |

|

|

-90.6 |

% |

|

|

47 |

|

|

|

308 |

|

|

-84.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

|

(22,130 |

) |

|

|

(2,186 |

) |

|

912.4 |

% |

|

|

(25,796 |

) |

|

|

(4,443 |

) |

|

480.6 |

% |

| Foreign

currency translation adjustment |

|

|

813 |

|

|

|

140 |

|

|

480.7 |

% |

|

|

514 |

|

|

|

239 |

|

|

115.1 |

% |

|

Comprehensive Loss |

|

$ |

(21,317 |

) |

|

$ |

(2,046 |

) |

|

941.9 |

% |

|

$ |

(25,282 |

) |

|

$ |

(4,204 |

) |

|

501.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and

diluted net loss per share |

|

$ |

(1.51 |

) |

|

$ |

(0.22 |

) |

|

586.4 |

% |

|

$ |

(1.84 |

) |

|

$ |

(0.44 |

) |

|

318.2 |

% |

| Weighted

average shares outstanding - basic and diluted |

|

|

14,654,102 |

|

|

|

10,092,995 |

|

|

45.2 |

% |

|

|

14,049,910 |

|

|

|

9,989,705 |

|

|

40.6 |

% |

Panbela Therapeutics, Inc.Consolidated

Balance Sheets (unaudited)(In thousands, except share

amounts)

| |

|

June 30, 2022 |

|

December 31, 2021 |

|

ASSETS |

|

(Unaudited) |

|

|

| Current

assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,530 |

|

|

$ |

11,867 |

|

|

Prepaid expenses and other current assets |

|

|

567 |

|

|

|

91 |

|

|

Income tax receivable |

|

|

359 |

|

|

|

321 |

|

| Total

current assets |

|

|

3,456 |

|

|

|

12,279 |

|

| Deposits

held for clinical trial costs |

|

|

3,101 |

|

|

|

593 |

|

| Total

assets |

|

$ |

6,557 |

|

|

$ |

12,872 |

|

| |

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS' (DEFICIT) EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

3,211 |

|

|

$ |

640 |

|

|

Accrued expenses |

|

|

1,274 |

|

|

|

2,020 |

|

|

Accrued interest payable |

|

|

66 |

|

|

|

- |

|

|

Notes payable |

|

|

650 |

|

|

|

- |

|

|

Debt, current portion |

|

|

1,000 |

|

|

|

- |

|

| Total

current liabilities |

|

|

6,201 |

|

|

|

2,660 |

|

| |

|

|

|

|

|

Debt, net of current portion |

|

|

5,194 |

|

|

|

- |

|

| Total non

current liabilities |

|

|

5,194 |

|

|

|

- |

|

| |

|

|

|

|

| Total

liabilities |

|

|

11,395 |

|

|

|

2,660 |

|

| |

|

|

|

|

|

Stockholders' (deficit) equity: |

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 authorized; no shares

issued or outstanding as of June 30, 2022 and December 31,

2021 |

|

|

- |

|

|

|

- |

|

|

Common stock, $0.001 par value; 100,000,000 authorized; 20,774,045

and 13,443,722 shares issued and outstanding as of June 30, 2022

and December 31, 2021, respectively |

|

|

21 |

|

|

|

13 |

|

|

Additional paid-in capital |

|

|

76,451 |

|

|

|

66,227 |

|

|

Accumulated deficit |

|

|

(81,957 |

) |

|

|

(56,161 |

) |

|

Accumulated comprehensive income |

|

|

647 |

|

|

|

133 |

|

| Total

stockholders' (deficit) equity |

|

|

(4,838 |

) |

|

|

10,212 |

|

| Total

liabilities and stockholders' (deficit) equity |

|

$ |

6,557 |

|

|

$ |

12,872 |

|

Panbela Therapeutics, Inc.Consolidated

Statements of Cash Flows (unaudited)(In thousands)

| |

|

Six Months Ended June 30, |

| |

|

2022 |

|

2021 |

| Cash

flows from operating activities: |

|

|

|

|

|

Net loss |

|

$ |

(25,796 |

) |

|

$ |

(4,443 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Write off of in process research and development (IPR&D) |

|

|

17,737 |

|

|

|

- |

|

|

Stock-based compensation |

|

|

627 |

|

|

|

616 |

|

|

Non-cash interest expense |

|

|

13 |

|

|

|

- |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Income tax receivable |

|

|

(33 |

) |

|

|

(251 |

) |

|

Prepaid expenses and other current assets |

|

|

(219 |

) |

|

|

130 |

|

|

Deposits held for clinical trial costs |

|

|

(2,561 |

) |

|

|

- |

|

|

Accounts payable |

|

|

2,483 |

|

|

|

484 |

|

|

Accrued liabilities |

|

|

(931 |

) |

|

|

(194 |

) |

|

Net cash used in operating activities |

|

|

(8,680 |

) |

|

|

(3,658 |

) |

| Cash

flows from investing activities: |

|

|

|

|

|

Investment in IPR&D |

|

|

(659 |

) |

|

|

- |

|

|

Cash acquired in merger |

|

|

4 |

|

|

|

- |

|

|

Net cash used in investing activities |

|

|

(655 |

) |

|

|

- |

|

| Cash

flows from financing activities: |

|

|

|

|

|

Proceeds from exercise of stock purchase warrants |

|

|

- |

|

|

|

1,042 |

|

|

Net cash provided by financing activities |

|

|

- |

|

|

|

1,042 |

|

| |

|

|

|

|

| Effect of

exchange rate changes on cash |

|

|

(2 |

) |

|

|

(1 |

) |

| |

|

|

|

|

| Net change

in cash |

|

|

(9,337 |

) |

|

|

(2,617 |

) |

| Cash and

cash equivalents at beginning of period |

|

|

11,867 |

|

|

|

9,022 |

|

| Cash and

cash equivalents at end of period |

|

$ |

2,530 |

|

|

$ |

6,405 |

|

| |

|

|

|

|

|

Supplemental disclosure of cash flow

information: |

|

|

|

|

|

Cash paid during period for interest |

|

$ |

7 |

|

|

$ |

7 |

|

| |

|

|

|

|

|

Supplemental Disclosure of non-cash

transactions: |

|

|

|

|

|

Fair value of common stock, stock options and stock warrants issued

as consideration for asset acquisition |

|

$ |

9,605 |

|

|

$ |

- |

|

| |

|

|

|

|

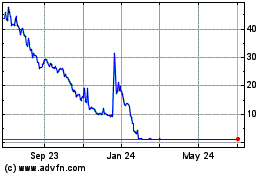

Panbela Therapeutics (NASDAQ:PBLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Panbela Therapeutics (NASDAQ:PBLA)

Historical Stock Chart

From Apr 2023 to Apr 2024