Filed pursuant to Rule 424(b)(5)

Registration No. 333-255751

PROSPECTUS SUPPLEMENT

(To Prospectus dated June 24, 2022)

Up to $8,400,000

Common Stock

We have entered into a sales agreement with Roth Capital Partners, LLC (“Roth”), as our sales agent, relating to the shares of our common stock offered by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the sales agreement, we may, through our sales agent, offer and sell shares of our common stock, $0.001 par value per share, from time to time having an aggregate offering price of up to $8,400,000.

Sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in sales deemed to be “at-the-market offerings” as defined in Rule 415 under the Securities Act of 1933, as amended, or the Securities Act, including by sales made directly on or through The Nasdaq Stock Market, LLC, or another market for our common stock, sales made to or through a market maker other than on an exchange or otherwise, in negotiated transactions at market prices prevailing at the time of sale or at negotiated prices, or as otherwise agreed with the sales agent.

We also may sell shares of our common stock to the sales agent, as principal for its own account, at a price per share agreed upon at the time of sale. If we sell shares to the sales agent, as principal, we will enter into a separate terms agreement with the sales agent, and we will describe the agreement in a separate prospectus supplement or pricing supplement.

We will pay the sales agent a commission of up to 3.0% of the gross sales price per share sold through it as our agent under the sales agreement. In connection with the sale of our common shares on our behalf, the sales agent may be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation paid to the sales agent may be deemed to be an underwriting commission or discount.

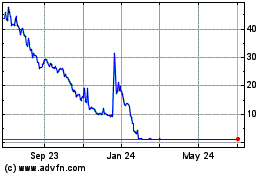

Our common stock is listed on The Nasdaq Stock Market, LLC under the symbol “PBLA.” On July 15, 2022, the last reported sale price of our common stock as reported on the Nasdaq Capital Market was $1.11 per share.

As of June 16, 2022, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $25,319,149, which we calculated based on 20,774,045 shares of outstanding common stock, of which 19,036,954 shares were held by non-affiliates, and a price per share of $1.33 as of June 16, 2022, which is a date within 60 days prior to the date of this prospectus supplement. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell, pursuant to this prospectus supplement, securities in a public primary offering with a value exceeding one-third of the aggregate market value of our outstanding common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our outstanding common stock held by non-affiliates remains below $75 million. During the 12 calendar months prior to and including the date of this prospectus supplement, we have not offered and sold any securities pursuant to General Instruction I.B.6 of Form S-3.

Investing in our common stock involves a high degree of risk. Before making your investment decision, you should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page S-5 of this prospectus supplement, on page 8 of the accompanying prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Roth Capital Partners

The date of this prospectus supplement is July 19, 2022.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

|

ABOUT THIS PROSPECTUS SUPPLEMENT

|

S-i

|

|

PROSPECTUS SUPPLEMENT SUMMARY

|

S-1

|

|

THE OFFERING

|

S-4

|

|

RISK FACTORS

|

S-5

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

S-7

|

|

USE OF PROCEEDS

|

S-8

|

|

DIVIDEND POLICY

|

S-9

|

|

DILUTION

|

S-10

|

|

PLAN OF DISTRIBUTION

|

S-11

|

|

LEGAL MATTERS

|

S-13

|

|

EXPERTS

|

S-13

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

S-13

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

S-14

|

PROSPECTUS

|

ABOUT THIS PROSPECTUS

|

1

|

|

PROSPECTUS SUMMARY

|

2

|

|

RISK FACTORS

|

8

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

9

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

9

|

|

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

|

10

|

|

USE OF PROCEEDS

|

11

|

|

DESCRIPTION OF CAPITAL STOCK

|

11

|

|

DESCRIPTION OF WARRANTS

|

13

|

|

DESCRIPTION OF RIGHTS

|

14

|

|

DESCRIPTION OF UNITS

|

15

|

|

PLAN OF DISTRIBUTION

|

16

|

|

LEGAL MATTERS

|

18

|

|

EXPERTS

|

18

|

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus supplement or the accompanying prospectus. You must not rely on any unauthorized information or representations. This prospectus supplement and the accompanying prospectus are an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus supplement and the accompanying prospectus is current only as of their respective dates.

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, and in any free writing prospectuses we authorize for use in connection with this offering. We have not authorized, and the underwriter has not authorized, anyone to provide you with information that is different. The information contained in this prospectus supplement and the accompanying prospectus, including information incorporated by reference herein and therein, and in any free writing prospectuses we authorize for use in connection with this offering, is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our common stock. It is important for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, and in any free writing prospectuses we authorize for use in connection with this offering, in making your investment decision. You should also read and consider the information in the documents to which we have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus supplement and in the accompanying prospectus.

We are offering to sell, and seeking offers to buy, the securities offered by this prospectus supplement only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the securities offered by this prospectus supplement in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

References in this prospectus to “Panbela,” “we,” “our,” “us” and the “Company” refer to Panbela Therapeutics, Inc., a Delaware corporation, and its wholly owned subsidiaries, Cancer Prevention Pharmaceuticals, Inc., Panbela Research, Inc., and their respective subsidiaries.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus supplement, in the accompanying prospectus and in the documents incorporated by reference herein and therein. This summary is not complete and does not contain all the information you should consider before deciding to invest in our common stock. For a more complete understanding of our Company, we encourage you to read and consider carefully the more detailed information in this prospectus supplement and the accompanying prospectus, including the information incorporated by reference herein and therein, the information under the heading “Risk Factors” in this prospectus supplement and the accompanying prospectus, and the information included in any free writing prospectuses that we authorize for use in connection with this offering.

Our Company

Business Overview

Panbela is a clinical stage biopharmaceutical company developing disruptive therapeutics for the treatment of patients with urgent unmet medical needs. The company’s lead assets are SBP-101 and Flynpovi. SBP-101, is a proprietary polyamine analogue designed to induce polyamine metabolic inhibition (“PMI”), a metabolic pathway of critical importance in multiple tumor types. Many tumors require greatly elevated levels of polyamines to support their growth and survival. SBP-101 has demonstrated encouraging activity against metastatic disease in a clinical trial of patients with pancreatic cancer. The efficacy and safety results demonstrated in our completed phase I clinical trial of SBP-101 in combination with gemcitabine and nab-paclitaxel in the first line treatment of metastatic pancreatic cancer provides support for the current randomized, double-blind, placebo controlled phase II/III study of SBP-101 in combination with gemcitabine and nab-paclitaxel in patients previously untreated for metastatic pancreatic cancer. We believe that SBP-101, if successfully developed, may represent a novel approach that effectively treats patients with pancreatic cancer and could become a dominant product in that market. Only three first-line treatment combinations, a single maintenance treatment for a subset (3-7%) of patients, and one second-line drug have been approved by the FDA for pancreatic cancer in the last 25 years.

On June 15, 2022 Panbela acquired Cancer Prevention Pharmaceuticals, Inc. (“CPP”), which added the company’s second lead asset, an investigational new drug product, Flynpovi, which is a combination of the polyamine synthesis inhibitor eflornithine and the non-steroidal anti-inflammatory drug sulindac. Eflornithine is an enzyme-activated, irreversible inhibitor of the enzyme ornithine decarboxylase, the first and rate-limiting enzyme in the biosynthesis of polyamines. Sulindac facilitates the export and catabolism of polyamines. We believe the investigational drug is unique in that it is designed to treat the risk factors (e.g., polyps) that are hypothesized to lead to Familial Adenomatous Polyposis (FAP) surgeries and colon cancer and therefore may have the ability to prevent various types of colon cancer. Flynpovi has received orphan drug designation status for FAP in the United States and Europe. There are no currently approved pharmaceutical therapies for FAP.

Both of the principal active ingredients in our investigational drug candidate Flynpovi (eflornithine and sulindac) have been previously approved individually but not in combination for other uses by the U.S. Food and Drug Administration (“FDA”) and have shown limited side effects at the dosages utilized in FAP studies. Eflornithine has never been approved in an oral form, is not on the market in any systemic dosage form, and is not available in any generic form. The combination of eflornithine and sulindac is delivered in an oral form, to which we have exclusive license rights to commercialize from the Arizona Board of Regents of the University of Arizona (the “University of Arizona”). This combination showed promising results in a National Cancer Institute (“NCI”) supported randomized, placebo-controlled Phase II/III clinical trial to prevent recurrent colon adenomas, particularly high-risk pre-cancerous polyps. These results led to a Phase III program in FAP, and a Phase III program to study colon cancer risk reduction in partnership with the Southwest Oncology Group (SWOG) and the NCI.

Additional programs are evaluating eflornithine as a single agent tablet (CPP-1X) or high dose powder sachet (CPP-1X-S) for several indications including prevention of gastric cancer, treatment of neuroblastoma and recent onset Type 1 diabetes. Preclinical studies as well as Phase 1 or Phase 2 investigator-initiated trials suggest that eflornithine treatment is well tolerated and has potential activity.

Recent Developments

As previously announced, Panbela and certain of its subsidiaries successfully completed a merger and reorganization of Cancer Prevention Pharmaceuticals, Inc. (“CPP”), a private clinical stage company developing therapeutics to reduce the risk and recurrence of cancer and rare diseases, for a combination of stock and future milestone payments. The combined entity will have an expanded pipeline; areas of initial focus include familial adenomatous polyposis (FAP), first-line metastatic pancreatic cancer, neoadjuvant pancreatic cancer, colorectal cancer prevention and ovarian cancer. The combined development programs will have a steady cadence of catalysts with programs ranging from pre-clinical to registration studies.

Through December 31, 2021, we had:

| |

●

|

secured an orphan drug designation from the FDA;

|

| |

●

|

submitted and received acceptance from the FDA for an IND application;

|

| |

●

|

received acceptance of a Clinical Trial Notification from the Australian Therapeutic Goods Administration;

|

| |

●

|

completed a Phase Ia monotherapy safety study of SBP-101in the treatment of patients with metastatic pancreatic ductal adenocarcinoma;

|

| |

●

|

received “Fast Track” designation from the FDA for SBP-101 for metastatic pancreatic cancer;

|

| |

●

|

completed enrollment and released interim results in our second trial, a Phase Ia /Ib clinical study of SBP-101, a first-line study with SBP-101 given in combination with a current standard of care in patients with pancreatic ductal adenocarcinoma who were previously untreated for metastatic disease; a total of 50 subjects were enrolled in this study, 25 in the Phase Ia and 25 in the Phase Ib or expansion phase;

|

| |

●

|

secured a two year research agreement with Johns Hopkins School of Medicine led by Professor Robert Casero, an internationally recognized researcher in polyamine biology;

|

| |

●

|

completed process improvement measures expected to be scalable for commercial use and received issue notification for a patent covering this new shorter synthesis of SBP-101;

|

| |

●

|

initiated a randomized, double-blind, placebo controlled study with SBP-101 given in combination with gemcitabine and nab-paclitaxel in patients with pancreatic ductal adenocarcinoma who are previously untreated for metastatic disease;

|

| |

●

|

completed preclinical evaluation of SBP-101 for use as neoadjuvant therapy in resectable pancreatic cancer prior to surgery; and

|

| |

●

|

obtained early, preclinical, indication of tumor growth inhibition activity in ovarian cancer.

|

Corporate History

Panbela Therapeutics, Inc., formerly known as Sun BioPharma, Inc., was originally incorporated under the laws of the State of Delaware in September 2011. In 2015, we became a public company by completing a reverse merger transaction with a wholly owned subsidiary of Cimarron Medical, Inc., a public company organized under the laws of the State of Utah. Upon completion of the merger and other separate but contemporaneous transactions by certain of our stockholders, our stockholders collectively owned approximately 99.0% of the post-merger public company, which was renamed “Sun BioPharma, Inc.” In 2016, we reincorporated under the laws of the State of Delaware via a merger with our operating subsidiary. The Company changed its name to Panbela Therapeutics, Inc. on December 2, 2020. On June 15, 2022, Panbela became a successor issuer pursuant to a holding company reorganization via merger by operation of Rule 12g-3(a) promulgated under the Exchange Act.

Corporate Information

Our corporate mailing address is 712 Vista Blvd, #305, Waconia, MN 55387. Our telephone number is (952) 479-1196, and our website is www.panbela.com. The information on our website is not part of this prospectus supplement. We have included our website address as a factual reference and do not intend it to be an active link to our website. The information contained in or connected to our website is not incorporated by reference into, and should not be considered part of, this prospectus supplement. Trade names, trademarks, and service marks of other companies appearing in this prospectus supplement are the property of the respective holders.

THE OFFERING

|

Issuer

|

|

Panbela Therapeutics, Inc.

|

| |

|

|

|

Securities offered by us in this offering

|

|

Shares of our common stock having an aggregate offering price of not more than $8,400,000.

|

| |

|

|

|

Common stock to be outstanding immediately after this offering

|

|

Up to 28,341,612 shares, assuming sales at a price of $1.11 per share, which was the closing price of our common stock on The Nasdaq Stock Market, LLC on July 15, 2022. The actual number of shares issued will vary depending on the price at which the shares may be sold from time to time.

|

| |

|

|

|

Manner of offering

|

|

“At-the-market offering” as defined in Rule 415(a)(4) under the Securities Act, that may be made from time to time thorough or to Roth as sales agent or principal. See “Plan of Distribution” on page S-11 of this prospectus supplement.

|

| |

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering for the continued clinical development of our initial product candidates SBP-101 and eflornithine and for working capital, business development and other general corporate purposes, which may include repayment of debt. See “Use of Proceeds” on page S-8 of this prospectus supplement.

|

| |

|

|

|

Risk factors

|

|

Investing in our common stock involves a high degree of risk. You should carefully read and consider the information beginning on page S-5 of this prospectus supplement and page 6 of the accompanying prospectus set forth under the headings “Risk Factors” and all other information set forth in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein and therein and in any free writing prospectuses we authorize for use in connection with this offering before deciding to invest in our common stock.

|

| |

|

|

|

Nasdaq Capital Market symbol

|

|

“PBLA”

|

The number of shares of our common stock to be outstanding immediately after this offering is based on 20,774,045 shares of our common stock outstanding as of June 15, 2022, and excludes, as of such date:

| |

●

|

4,040,890 shares issuable upon the exercise of outstanding stock options at a weighted-average exercise price of $3.62 per share;

|

| |

●

|

2,019,776 additional shares reserved and available for future issuances under our equity plans; and

|

| |

●

|

5,447,561 shares issuable upon the exercise of stock purchase warrants at a weighted-average exercise price of $4.56 per share.

|

Except as otherwise indicated, all information in this prospectus supplement assumes no exercise of the foregoing stock options or warrants.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks and uncertainties described below, together with the other information in this prospectus supplement, the accompanying prospectus, the information and documents incorporated by reference herein and therein, and the information included in any free writing prospectuses we authorize for use in connection with this offering. You should also consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors” included in our most recent annual report on Form 10-K and the subsequent quarterly reports on Form 10-Q and other reports that we file with the SEC, all of which are on file with the SEC and are incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. Additional risks and uncertainties not presently known to us or that are currently not believed to be significant to our business may also affect our actual results and could harm our business, financial condition and results of operations. The occurrence of any of these risks might cause you to lose all or part of your investment in our common stock.

Risks Related to this Offering

The common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no maximum sales price. Pursuant to the sales agreement, there is a minimum sales price for shares of our common stock sold in this offering, which will limit our ability to make sales if the price goes below that minimum. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the prices they paid.

The actual number of shares we will issue under the sales agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the sales agreement and compliance with applicable law, we have the discretion to deliver placement notices to Roth at any time throughout the term of the sales agreement. The number of shares that are sold by Roth after delivering a placement notice will fluctuate based on the market price of the common stock during the sales period and limits, we set with Roth. Because the price per share of each share sold will fluctuate based on the market price of our common stock during the sales period, it is not possible at this stage to predict the number of shares that will be ultimately issued.

It is not possible to predict the aggregate proceeds resulting from sales made under the Sales Agreement.

Subject to certain limitations in the sales agreement and compliance with applicable law, we have the discretion to deliver a placement notice to Roth at any time throughout the term of the sales agreement. The number of shares that are sold through Roth after delivering a placement notice will fluctuate based on a number of factors, including the market price of our common stock during the sales period, the limits we set with Roth in any applicable placement notice, and the demand for our common stock during the sales period. Because the price per share of each share sold will fluctuate during the sales period, it is not currently possible to predict the aggregate proceeds to be raised in connection with those sales.

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

We currently intend to use the net proceeds from this offering for the continued clinical development of our initial product candidates SBP-101 and eflornithine and for working capital, business development and other general corporate purposes, which may include repayment of debt. We have not allocated specific amounts of the net proceeds from this offering for any specific purposes. Accordingly, our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. You will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the net proceeds are being used appropriately. It is possible that the net proceeds will be invested in a way that does not yield a favorable, or any, return for us. Our failure to apply these funds effectively could have a material adverse effect on our business and cause the price of our common stock to decline.

If you purchase our common stock sold in this offering you will experience immediate dilution in your investment as a result of this offering.

Because the price per share of common stock being offered in this offering may be higher than the net tangible book value per share of our common stock, you will experience dilution to the extent of the difference between the public offering price per share of common stock you pay in this offering and the net tangible book value per share of our common stock immediately after this offering. Our net tangible book value as of March 31, 2022, was $6.6 million, or $0.49 per share of common stock and, after giving effect to our acquisition of Cancer Prevention Pharmaceuticals, our proforma net tangible book value would have been a negative $3.3 million or negative $0.16 per share. Net tangible book value per share is equal to our total tangible assets minus total liabilities, all divided by the number of shares of common stock outstanding. See “Dilution” for a more detailed discussion of the dilution you will incur in this offering.

A substantial number of shares of our common stock may be sold in this offering, which could cause the price of our common stock to decline.

In this offering, we are offering an indeterminate number of shares of common stock. Sales in this offering and any future sales of a substantial number of shares of our common stock in the public market, or the perception that such sales may occur, could adversely affect the price of our common stock on the Nasdaq Capital Market. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of those shares of common stock for sale will have on the market price of our common stock.

Even if this offering is completed, we will need to raise additional capital in the future to finance our operations, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

We have had recurring losses from operations, negative operating cash flow and have an accumulated deficit. We must raise additional funds in order to continue financing our operations. If additional capital is not available to us when needed or on acceptable terms, we may not be able to continue to operate our business pursuant to our business plan or we may have to discontinue our operations entirely. Any additional capital raised through the sale of equity or equity-backed securities may dilute our stockholders’ ownership percentages and could also result in a decrease in the market value of our equity securities. The terms of any securities issued by us in future capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then outstanding.

If we are unable to secure additional funds when needed or on acceptable terms, we may be required to defer, reduce or eliminate significant planned expenditures, restructure, curtail or eliminate some or all of our operations, dispose of technology or assets, pursue an acquisition of our company by a third party at a price that may result in a loss on investment for our stockholders, file for bankruptcy or cease operations altogether. Any of these events could have a material adverse effect on our business, financial condition and results of operations. Moreover, if we are unable to obtain additional funds on a timely basis, there will be substantial doubt about our ability to continue as a going concern and increased risk of insolvency and up to a total loss of investment by our stockholders.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus, including the documents that we incorporate by reference herein and therein, contain forward‑looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

In some cases, you can identify forward-looking statements by the following words: “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this report. These factors include:

| |

●

|

our lack of diversification and the corresponding risk of an investment in our Company;

|

| |

●

|

potential deterioration of our financial condition and results due to failure to diversify;

|

| |

●

|

our ability to successfully complete acquisitions;

|

| |

●

|

our ability to integrate acquired companies and operations for new product candidates;

|

| |

●

|

our ability to obtain additional capital, on acceptable terms or at all, required to implement our business plan;

|

| |

●

|

final results of our Phase I clinical trial;

|

| |

●

|

progress and success of our randomized Phase II/III clinical trial;

|

| |

●

|

our ability to demonstrate safety and effectiveness of our product candidate;

|

| |

●

|

our ability to obtain regulatory approvals for our product candidate in the United States, the European Union, or other international markets;

|

| |

●

|

the market acceptance and future sales of our product candidate;

|

| |

●

|

the cost and delays in product development that may result from changes in regulatory oversight applicable to our product candidate;

|

| |

●

|

the rate of progress in establishing reimbursement arrangements with third-party payors;

|

| |

●

|

the effect of competing technological and market developments;

|

| |

●

|

the costs involved in filing and prosecuting patent applications and enforcing or defending patent claims; and

|

| |

●

|

other risk factors included under the caption “Risk Factors” starting on page S-5 of this prospectus supplement, in the accompanying prospectus and in the other documents incorporated by reference herein and therein, as may be updated from time to time by our future filings under the Exchange Act.

|

You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and any document incorporated by reference herein or therein is accurate as of its date only. Because the risk factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All written or oral forward-looking statements attributable to us or any person acting on our behalf made after the date of this prospectus supplement are expressly qualified in their entirety by the risk factors and cautionary statements contained in and incorporated by reference into this prospectus supplement and the accompanying prospectus. Unless legally required, we do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances after the date of this prospectus supplement or to reflect the occurrence of unanticipated events.

USE OF PROCEEDS

We estimate that the net proceeds from the sale of the shares of common stock that we are offering may be up to approximately $7.9 million, after deducting Roth’s estimated sales agent commissions and estimated offering expenses payable by us. The amount of the proceeds from this offering will depend upon the number of shares of our common stock sold and the market price at which they are sold. There can be no assurance that we will be able to sell any shares under or fully utilize the sales agreement as a source of financing.

We intend to use the net proceeds from this offering for the continued clinical development of our initial product candidates SBP-101 and eflornithine and for working capital, business development and other general corporate purposes, which may include repayment of debt.

We are party to a guaranty (the “Guaranty”) pursuant to which we have agreed to guarantee the payment obligations of our wholly owned subsidiary, Cancer Prevention Pharmaceuticals, Inc., under a promissory note in favor of Sucampo GmbH dated as of September 6, 2017, as amended (the “Note”), which had a principal balance of approximately $6.2 million as of July 15, 2022. Cancer Prevention is required to make five payments of $1 million, plus accrued but unpaid interest, on January 31st of each of 2023, 2024, 2025, 2026, with the remaining balance due on January 31, 2027. Under the terms of the Note, Panbela is required to pay 10% of cash proceeds from the issuance or offering of any debt, equity, preferred or convertible securities that occurs on or before January 31, 2022, including sales in the Offering.

We may also use a portion of the net proceeds to invest in or acquire businesses or technologies that we believe are complementary to our own, although we have no current plans, commitments or agreements with respect to any acquisitions as of the date of this prospectus supplement. Pending these uses, we plan to invest these net proceeds in investment-grade, interest bearing securities.

The expected use of net proceeds of this offering represents our current intentions based upon our present plan and business conditions. Investors are cautioned, however, that expenditures may vary substantially from these uses. Investors will be relying on the judgment of our management, who will have broad discretion regarding the application of the proceeds of this offering. The amounts and timing of our actual expenditures will depend upon numerous factors, including the status of our product development efforts, sales and marketing activities, technological advances, the amount of cash generated or used by our operations and competition. Until we use the net proceeds of this offering, we intend to hold such funds in cash or invest the funds in short-term, investment grade, interest-bearing securities.

DIVIDEND POLICY

We have never declared or paid cash dividends on our common stock. Following the completion of this offering, we intend to retain our future earnings, if any, to finance the further development and expansion of our business and do not expect to pay cash dividends in the foreseeable future. Payment of future cash dividends, if any, will be at the discretion of our Board of Directors after taking into account various factors, including our financial condition, operating results, current and anticipated cash needs, outstanding indebtedness, plans for expansion and restrictions imposed by lenders, if any.

DILUTION

If you purchase shares of our common stock, your interest will be diluted immediately to the extent of the difference between the offering price per share you will pay in this offering and the as adjusted net tangible book value per share of our common stock after this offering. Net tangible book value per share represents our total tangible assets less total liabilities, divided by the number of shares of our common stock outstanding.

As of March 31, 2022, our net tangible book value was $6.6 million, or $0.49 per share of common stock. After giving effect to our acquisition of Cancer Prevention Pharmaceuticals, Inc. on June 16, 2022, which resulted in the issuance of an additional 7,319,533 shares of common stock, our pro forma net tangible book value as of March 31, 2022 would have been approximately $(3.3) million, or approximately $(0.16) per share of common stock.

After giving effect to the foregoing pro forma adjustments and giving further effect to the sales in this offering, and after deducting the estimated sales agent commissions and estimated offering expenses payable by us, our pro forma as adjusted net tangible book value as of March 31, 2022, would have been $4.5 million, or $0.16 per share. This represents an immediate increase in as adjusted net tangible book value to existing stockholders of $0.32 per share and an immediate dilution to new investors purchasing our common stock in this offering of $0.95 per share.

The following table illustrates this per share dilution:

|

Assumed offering price per share

|

|

|

|

|

|

$ |

1.11 |

|

|

Pro forma net tangible book value per share of as March 31, 2022

|

|

$ |

(0.16 |

) |

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$ |

0.32 |

|

|

|

|

|

|

As adjusted net tangible book value per share as of March 31, 2022, after giving effect to this offering

|

|

|

|

|

|

$ |

0.16 |

|

|

Dilution per share to new investors purchasing our common stock in this offering

|

|

|

|

|

|

$ |

(0.95 |

) |

The shares sold in this offering, if any, will be sold from time to time at various prices. Each $0.20 increase or decrease in the assumed offering price of $1.11 per share would increase or decrease, as applicable, our as adjusted net tangible book value per share by approximately $0.01, and would increase or decrease, as applicable, dilution per share to new investors in this offering to $1.14 and $0.76, respectively, if all of our common stock in the aggregate amount of $8,400,000 is sold and after deducting estimated sales agent commissions and estimated offering expenses payable by us. The foregoing as adjusted information is illustrative only and will be adjusted based on the actual offering price, the actual number of shares sold and other terms of the offering determined at the time common stock is sold pursuant to this prospectus supplement and the accompanying prospectus. The above discussion and table are based on 20,774,045 shares of our common stock outstanding as of March 31, 2022 on a pro forma basis, and excludes, as of such date:

| |

●

|

4,040,890 shares issuable upon the exercise of outstanding stock options at a weighted-average exercise price of $3.62 per share;

|

| |

●

|

2,019,776 additional shares reserved and available for future issuances under our equity plans; and

|

| |

●

|

5,447,561 shares issuable upon the exercise of stock purchase warrants at a weighted-average exercise price of $4.56 per share.

|

To the extent that outstanding options or warrants are exercised, the investors purchasing our common stock in this offering may experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of securities, the issuance of these securities could result in further dilution to our stockholders.

PLAN OF DISTRIBUTION

We have entered into the Sales Agreement with Roth Capital Partners, LLC (“Roth”), under which we may issue and sell from time to time up to $8,400,000 of our common stock through or to Roth as agent or principal. The Sales Agreement was filed as an exhibit to a Current Report on Form 8-K filed with the SEC on July 19, 2022. Sales of our common stock, if any, will be made at market prices by methods deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act.

Upon delivery of a placement notice, Roth may offer the common stock subject to the terms and conditions of the Sales Agreement on a daily basis or as otherwise agreed upon by us and Roth. We will designate the maximum amount of common stock to be sold through Roth on a daily basis or otherwise determine such maximum amount together with Roth. Subject to the terms and conditions of the Sales Agreement, Roth will use its commercially reasonable efforts to sell on our behalf all of the shares of common stock requested to be sold by us. We may instruct Roth not to sell common stock if the sales cannot be effected at or above the price designated by us in any such instruction. We or Roth may suspend the offering of the common stock being made through Roth under the Sales Agreement upon proper notice to the other party and subject to other conditions.

We will pay Roth commissions, in cash, for its services in acting as agent in the sale of our common stock. The aggregate compensation payable to Roth shall be equal to 3.0% of the gross sales price per share of all shares sold through Roth under the Sales Agreement. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We estimate that the total expenses of the offering payable by us, excluding commissions payable to Roth under the Sales Agreement, will be approximately $40,000 plus up to $10,000 per quarter during the offering.

Settlement for sales of common stock will occur on the second business day following the date on which any sales are made, or on some other date that is agreed upon by us and Roth in connection with a particular transaction, in return for payment of the net proceeds to us. Sales of our common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and Roth may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

Roth is not required to sell any specific amount of securities, but will act as our sales agent using its commercially reasonable efforts, consistent with its sales and trading practices under the terms and subject to the conditions set forth in the Sales Agreement. In connection with the sales of the common stock on our behalf, Roth will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation to it will be deemed to be underwriting commissions or discounts. We have also agreed in the Sales Agreement to provide indemnification and contribution to Roth with respect to certain liabilities, including liabilities under the Securities Act.

The offering of our common stock pursuant to the Sales Agreement will terminate automatically upon the sale of all shares of our common stock subject to the Sales Agreement or as otherwise permitted therein. We or Roth may terminate the Sales Agreement at any time upon five days’ prior written notice.

Any portion of the $8,400,000 included in this prospectus supplement not previously sold or included in an active placement notice pursuant to the Sales Agreement, may be later made available for sale in other offerings pursuant to the accompanying prospectus, and if no shares have been sold under the Sales Agreement, the full $8,400,000 of securities may be later made available for sale in other offerings pursuant to the accompanying prospectus.

Other Relationships

Roth and its affiliates may in the future provide various investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees. To the extent required by Regulation M, Roth will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus supplement. Roth and/or its affiliates may also make investment recommendations and/or publish or express independent research views in respect of our securities or financial instruments related to our securities and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

This prospectus supplement and the accompanying prospectus for the offering in electronic format may be made available on websites maintained by the sales agent, who may distribute this prospectus supplement and the accompanying prospectus electronically. To the extent required by Regulation M, the sales agent will not engage in any market making activities involving our common stock while the offering is ongoing.

Indemnification

We have agreed to indemnify Roth against specified liabilities, including liabilities under the Securities Act, and to contribute to payments the underwriter may be required to make in respect thereof.

Nasdaq Capital Market Listing

Our common stock is listed on the Nasdaq Capital Market under the symbol “PBLA.”

LEGAL MATTERS

The validity of the shares of common stock offered by this prospectus supplement has been passed upon for us by Faegre Drinker Biddle & Reath LLP. Pryor Cashman LLP, New York, New York, is acting as counsel for the agent in connection with the shares of common stock offered hereby.

EXPERTS

The financial statements of Panbela as of December 31, 2021 and 2020 and for the two years in the period ended December 31, 2021 incorporated in this prospectus supplement by reference from the Company's Annual Report on Form 10-K have been audited by Cherry Bekaert LLP, an independent registered public accounting firm, as stated in their report, which is incorporated herein by reference. Such financial statements have been so incorporated in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

The financial statements of Cancer Prevention as of December 31, 2021 and 2020 and for the two years in the period ended December 31, 2021, incorporated in this prospectus supplement by reference from the Company’s Current Report on Form 8-K have been audited by Mayer Hoffman McCann P.C., an independent public accounting firm, as stated in their report, which is incorporated herein by reference. Such financial statements have been so incorporated in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information reporting requirements of the Exchange Act and, in accordance with these requirements, we are required to file periodic reports and other information with the SEC. The SEC maintains an Internet website at www.sec.gov that contains our filed reports, proxy and information statements, and other information we file electronically with the SEC.

Additionally, we make our SEC filings available, free of charge, on our website at www.panbela.com as soon as reasonably practicable after we electronically file such materials with, or furnish them to, the SEC. The information on our website, other than the filings incorporated by reference in this prospectus supplement, is not, and should not be, considered part of this prospectus supplement, is not incorporated by reference into this document, and should not be relied upon in connection with making any investment decision with respect to the securities.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We “incorporate by reference” into this prospectus supplement and the accompanying prospectus certain information we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus supplement and the accompanying prospectus. Some information contained in this prospectus supplement and the accompanying prospectus updates the information incorporated by reference, and information that we file subsequently with the SEC will automatically update this prospectus supplement and the accompanying prospectus as well as our other filings with the SEC. In other words, in the case of a conflict or inconsistency between information set forth in this prospectus supplement and information incorporated by reference into this prospectus supplement, you should rely on the information contained in the document that was filed later. We incorporate by reference the documents listed below and any filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act following the date of this prospectus supplement (other than any portions of any such documents that are not deemed “filed” under the Exchange Act in accordance with the Exchange Act and applicable SEC rules):

| |

●

|

Description of our common stock contained in Exhibit 4.1 to the Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 24, 2022.

|

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus supplement and the accompanying prospectus and deemed to be part of this prospectus supplement and the accompanying prospectus from the date of the filing of such reports and documents. You may request a copy of these filings, other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing, at no cost, by writing to or telephoning us at the following:

Panbela Therapeutics, Inc.

712 Vista Blvd, Suite 305

Waconia, MN 55387

(952) 479-1196

You should rely only on the information incorporated by reference or presented in this prospectus supplement or the accompanying prospectus or in any free writing prospectuses we authorize for use in connection with this offering. Neither we nor any underwriter or agents have authorized anyone else to provide you with different information. We are not making an offer of our common stock in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the dates of those documents.

PROSPECTUS

Panbela Therapeutics, Inc.

$100,000,000

Preferred Stock

Common Stock

Stock Purchase Contracts

Warrants

Rights

Units

We may offer and sell, from time to time in one or more offerings, up to $100,000,000 in the aggregate of preferred stock, common stock, stock purchase contracts, warrants, rights and units, in any combination. We intend to use the proceeds, if any, for general corporate purposes unless otherwise indicated in the applicable prospectus supplement.

This prospectus provides you with a general description of the securities that may be offered. Each time we offer and sell securities using this prospectus, we will provide a supplement to this prospectus that contains specific information about the offering, as well as the amounts, prices and terms of the securities. The supplement may also add, update or change information contained in this prospectus with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. This prospectus may not be used to offer and sell our securities unless accompanied by a prospectus supplement describing the method and terms of the offering of such securities.

As of June 16, 2022, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $25,319,149, which we calculated based on 20,774,045 shares of outstanding common stock, of which 19,036,954 shares were held by non-affiliates, and a price per share of $1.33 as of June 16, 2022, which is a date within 60 days prior to the date of this prospectus. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell, pursuant to the registration statement of which this prospectus forms a part, securities in a public primary offering with a value exceeding one-third of the aggregate market value of our outstanding common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our outstanding common stock held by non-affiliates remains below $75 million. During the 12 calendar months prior to and including the date of this prospectus, we had offered and sold securities for gross proceeds of $10,000,002 pursuant to General Instruction I.B.6 of Form S-3.

Investing in our securities involves risks. See “Risk Factors” beginning on page 6 of this prospectus and any similar section contained in the applicable prospectus supplement concerning factors you should consider before investing in our securities.

Our common stock is listed on the Nasdaq Capital Market under the symbol “PBLA.” On June 16, 2022 the last reported sale price of our common stock on the Nasdaq Capital Market was $1.33 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.

TABLE OF CONTENTS

|

ABOUT THIS PROSPECTUS

|

1 |

|

PROSPECTUS SUMMARY

|

2 |

|

RISK FACTORS

|

8 |

|

WHERE YOU CAN FIND MORE INFORMATION

|

9 |

|

Incorporation OF CERTAIN INFORMATION by Reference

|

9 |

|

CAUTIONARY STATEMENT REGARDING FORWARD‑LOOKING STATEMENTS

|

10 |

|

USE OF PROCEEDS

|

11 |

|

DESCRIPTION OF CAPITAL STOCK

|

11 |

|

DESCRIPTION OF WARRANTS

|

13 |

|

DESCRIPTION OF RIGHTS

|

14 |

|

DESCRIPTION OF UNITS

|

15 |

|

PLAN OF DISTRIBUTION

|

16 |

|

LEGAL MATTERS

|

18 |

|

EXPERTS

|

18 |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. By using a shelf registration statement, we may sell securities described in this prospectus from time to time and in one or more offerings up to a total dollar amount of $100,000,000.

Each time that we offer and sell securities using this prospectus, we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference in this prospectus or any prospectus supplement — the statement in the later-dated document modifies or supersedes the earlier statement.

The rules of the SEC allow us to incorporate by reference information into this prospectus. This information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC, to the extent incorporated by reference, will automatically update and supersede this information. See “Incorporation of Certain Information by Reference” on page 7 of this prospectus. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information” on page 7 of this prospectus.

W he have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, certain market and industry data obtained from independent market research, industry publications and surveys, governmental agencies and publicly available information. Industry surveys, publications and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe the data from such third-party sources to be reliable. However, we have not independently verified any of such data and cannot guarantee its accuracy or completeness. Similarly, internal market research and industry forecasts, which we believe to be reliable based upon our management’s knowledge of the market and the industry, have not been verified by any independent sources. While we are not aware of any misstatements regarding the market or industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors.

References in this prospectus to “Panbela”, “we”, “our”, “us” and the “Company” refer to Panbela Therapeutics, Inc., a Delaware corporation, and its wholly owned subsidiary, Panbela Therapeutics Pty Ltd. The Company was formerly known as Sun BioPharma, Inc. and our wholly owned subsidiary was formerly known as Sun BioPharma Australia Pty Ltd; the name changes were completed in December 2020. On June 15, 2022, Panbela became a successor issuer pursuant to a holding company reorganization via merger by operation of Rule 12g-3(a) promulgated under the Exchange Act.

PROSPECTUS SUMMARY

This summary highlights certain information about us and selected information contained elsewhere in or incorporated by reference into this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding to invest in our common stock. For a more complete understanding of our company, we encourage you to read and consider carefully the more detailed information in this prospectus, including the information incorporated by reference in this prospectus, and the information under the heading “Risk Factors” in this prospectus, beginning on page 6, before making an investment decision.

Our Company

Business Overview

Panbela is a clinical stage biopharmaceutical company developing disruptive therapeutics for the treatment of patients with urgent unmet medical needs. The company’s lead assets are SBP-101 and Flynpovi. SBP-101, is a proprietary polyamine analogue designed to induce polyamine metabolic inhibition (“PMI”), a metabolic pathway of critical importance in multiple tumor types. Many tumors require greatly elevated levels of polyamines to support their growth and survival. SBP-101 has demonstrated encouraging activity against metastatic disease in a clinical trial of patients with pancreatic cancer. The efficacy and safety results demonstrated in our completed phase I clinical trial of SBP-101 in combination with gemcitabine and nab-paclitaxel in the first line treatment of metastatic pancreatic cancer provides support for the current randomized, double-blind, placebo controlled phase II/III study of SBP-101 in combination with gemcitabine and nab-paclitaxel in patients previously untreated for metastatic pancreatic cancer. We believe that SBP-101, if successfully developed, may represent a novel approach that effectively treats patients with pancreatic cancer and could become a dominant product in that market. Only three first-line treatment combinations, a single maintenance treatment for a subset (3-7%) of patients, and one second-line drug have been approved by the FDA for pancreatic cancer in the last 25 years.

On June 15, 2022 Panbela acquired Cancer Prevention Pharmaceuticals, Inc. (CPP), which added the company’s second lead asset, an investigational new drug product, Flynpovi which is a combination of the polyamine synthesis inhibitor eflornithine and the non-steroidal anti-inflammatory drug sulindac. Eflornithine is an enzyme-activated, irreversible inhibitor of the enzyme ornithine decarboxylase, the first and rate-limiting enzyme in the biosynthesis of polyamines. Sulindac facilitates the export and catabolism of polyamines. We believe the investigational drug is unique in that it is designed to treat the risk factors (e.g., polyps) that are hypothesized to lead to Familial Adenomatous Polyposis (FAP) surgeries and colon cancer and therefore may have the ability to prevent various types of colon cancer. Flynpovi has received orphan drug designation status for FAP in the United States and Europe. There are no currently approved pharmaceutical therapies for FAP.

Both of the principal active ingredients in our investigational drug candidate Flynpovi (eflornithine and sulindac) have been previously approved individually but not in combination for other uses by the U.S. Food and Drug Administration (“FDA”) and have shown limited side effects at the dosages utilized in FAP studies. Eflornithine has never been approved in an oral form, is not on the market in any systemic dosage form, and is not available in any generic form. The combination of eflornithine and sulindac is delivered in an oral form, to which we have exclusive license rights to commercialize from the Arizona Board of Regents of the University of Arizona (the “University of Arizona”). This combination showed promising results in a National Cancer Institute (“NCI”) supported randomized, placebo-controlled Phase II/III clinical trial to prevent recurrent colon adenomas, particularly high-risk pre-cancerous polyps. These results led to a Phase III program in FAP, and a Phase III program to study colon cancer risk reduction in partnership with the Southwest Oncology Group (SWOG) and the NCI.

Additional programs are evaluating eflornithine as a single agent tablet (CPP-1X) or high dose powder sachet (CPP-1X-S) for several indications including prevention of gastric cancer, treatment of neuroblastoma and recent onset Type 1 diabetes. Preclinical studies as well as Phase 1 or Phase 2 investigator-initiated trials suggest that eflornithine treatment is well tolerated and has potential activity.

Holding Company Reorganization

Effective June 15, 2022, Panbela became a successor issuer to Panbela Research, Inc. (formerly known as Panbela Therapeutics, Inc., the “Predecessor”) pursuant to a holding company reorganization pursuant to which the Predecessor became a direct, wholly-owned subsidiary of Panbela. Panbela became a successor issuer to the Predecessor by operation of Rule 12g-3(a) promulgated under the Securities Exchange Act of 1934, as amended the (“Exchange Act”).

Cancer Prevention Acquisition

On June 15, 2022, Panbela acquired Cancer Prevention Pharmaceuticals, Inc. (“Cancer Prevention”), a private clinical stage company developing therapeutics to reduce the risk and recurrence of cancer and rare diseases,, via merger for consideration consisting of (a) 6,587,576 shares of common stock, (b) 731,957 shares of common stock that remained subject to a holdback escrow (as defined in the Merger Agreement), (c) replacement options to purchase up to 1,596,754 shares of common stock at a weighted average purchase price of $0.35 per share, and (d) replacement warrants to purchase up to 338,060 shares of common stock at a weighted average purchase price of $4.145 per share, and post-closing contingent payments up to a maximum of $60 million, subject to satisfaction of milestones.

Clinical Trials

SBP-101

In August 2015, the FDA accepted our Investigational New Drug (“IND”) application for our SBP-101 product candidate. We have completed an initial clinical trial of SBP-101 in patients with previously treated locally advanced or metastatic pancreatic cancer. This was a Phase I, first-in-human, dose-escalation, safety study. Between January 2016 and September 2017, we enrolled twenty-nine patients into six cohorts, or groups, in the dose-escalation phase of our Phase I trial. Twenty-four of the patients received at least two prior chemotherapy regimens. No drug-related serious adverse events occurred during the first four cohorts. In cohort five, serious adverse events (klebsiella sepsis with metabolic acidosis in one patient, renal and hepatic toxicity in one patient, and mesenteric vein thrombosis with metabolic acidosis in one patient) were observed in three of the ten patients, two of whom exhibited progressive disease at the end of their first cycle of treatment and were determined by the Data Safety Monitoring Board (“DSMB”) to be Disease Limiting Toxicities (“DLTs”). Consistent with the study protocol, the DSMB recommended continuation of the study by expansion of cohort 4, one level below that at which DLTs were observed. Four patients were enrolled in this expansion cohort.

In addition to being evaluated for safety, 23 of the 29 patients were evaluable for preliminary signals of efficacy prior to or at the eight-week conclusion of their first cycle of treatment using the RECIST, the current standard for evaluating changes in the size of tumors. Eight of the 23 patients (35%) had Stable Disease (“SD”) and 15 of 24 (65%) had Progressive Disease (“PD”). It should be noted that of the 15 patients with PD, six came from cohorts one and two and are considered to have received less than potentially therapeutic doses of SBP-101.

By cohort, stable disease occurred in two patients in cohort 3, two patients in cohort 4 and four patients in cohort 5. The best response outcomes and best median survival were observed in the group of patients who received total cumulative doses of approximately 6 mg/kg (cohort three). Two of four patients (50%) showed SD at week eight. Median survival in this group was 5.9 months, with two patients surviving 8 and 10 months, respectively. By total cumulative dose received, five of twelve patients (42%) who received total cumulative doses between 2.5 mg/kg and 8.0 mg/kg had reductions in the CA19-9 levels, as measured at least once after the baseline assessment. Nine of these patients (67%) exceeded three months of Overall Survival (“OS”), three patients (25%) exceeded nine months of OS and two patients (17%) exceeded one year of OS and were still alive at the end of the study.

We completed enrollment of patients in our second clinical trial in December 2020. This second clinical trial was a Phase Ia/Ib study of the safety, efficacy and pharmacokinetics of SBP-101 administered in combination with two standard-of-care chemotherapy agents, gemcitabine and nab-paclitaxel. The trial included six study sites; four in Australia and two in the United States. In the Phase Ia portion of this trial, we completed enrollment during the first quarter of 2020 consisting of four cohorts with increased dosage levels of SBP-101 administered in the second and third cohorts; the fourth cohort evaluated an alternate dosing schedule. A total of 25 subjects were enrolled in four cohorts of Phase Ia. The demonstration of adequate safety in Phase Ia allowed us to immediately begin enrollment in February 2020 in the Phase Ib exploration of efficacy. By December 2020 an additional 25 subjects in Phase Ib, using the recommended dosage level and schedule determined in Phase Ia, were enrolled.

After Phase Ib enrollment was completed, some patients in the trial were noted to have complaints of serious visual adverse effects. Visual changes were not seen in the SBP-101 monotherapy study. We consulted with our DSMB and withheld the administration of SBP-101 while all other trial activities continued. In February of 2021, we also conferred with the FDA regarding our plan to withhold dosing of SBP-101. This constituted a “partial clinical hold.” In April of 2021, the FDA lifted the partial clinical hold. The Company agreed with the FDA to include in the design of all future studies the exclusion of patients with a history of retinopathy or risk of retinal detachment and scheduled ophthalmologic monitoring for all patients.

Updated, but still not final results, were presented in a poster at the American Society of Clinical Oncology - GI conference (“ASCO-GI”) in January 2022. Best response in evaluable subjects (cohorts 4 and Ib N=29) was a Complete Response (“CR”) in 1 (3%), Partial Response (“PR”) in 13 (45%), SD in 10 (34%) and PD in 5 (17%). One subject did not have post baseline scans with RECIST tumor assessments. Median Progression Free Survival (“PFS”) , now final at 6.5 months may have been negatively impacted by drug dosing interruptions to evaluate potential toxicity. Median overall survival in Cohort 4 + Phase Ib was 12.0 months when data was presented in January 2022 and is now final at 14.6 months. Two patients from cohort 2 have demonstrated long term survival. One at 30.3 months (final data) and one at 33.0 months and still alive. Seven subjects are still alive at this time, one from cohort 2 and six from cohort 4 plus Ib.

The Company announced that the ASPIRE trial, a randomized, double-blind, placebo-controlled study of SBP-101 with Gemcitabine and Nab-Paclitaxel versus Gemcitabine, Nab-Paclitaxel and placebo, was initiated in January of 2022. The trial is in patients with first-line metastatic pancreatic ductal adenocarcinoma. The trial is designed as a Phase II/III randomized trial, with a primary endpoint of overall survival. The design includes a phase II portion for which a futility analysis after 104 progression free survival events will occur. If the futility analysis is favorable, the trial will be expanded to the phase III portion, and may serve for registration. We are intending to conduct the ASPIRE trial at leading cancer centers in the United States, Europe and the Asia-Pacific Region. It is expected that there will be approximately 60 sites and we anticipate enrollment for the phase II portion to be completed in approximately 12 months after the first subject is enrolled.

If we can successfully complete all FDA recommended clinical studies, we intend to seek marketing authorization from the FDA, the European Medicines Agency (“EMA”) (European Union), Ministry of Health and Welfare (Japan) and TGA (Australia). The submission fees may be waived when SBP-101 has been designated an orphan drug in each geographic region.

Data presented at the American Association for Cancer Research (AACR) in April 2022, demonstrated in an in vitro study evaluating cancer cell lines, SBP-101 was toxic in ovarian cancer cell lines with an average IC50 of ~1.5 μM. Efficacy of SBP-101 was further assessed in the VDID8+murine ovarian cancer model (ID8+C57Bl/6 ovarian cells overexpressing both VEGF and Defensin). Mice were treated with SBP-101 at either 24 mg/kg or 6 mg/kg alternating MWF. Both doses of SBP-101 produced a statistically significant prolongation of survival (24mg/kg p=.0049, 6 mg/kg p=.0042). There was no significant difference in response between the two SBP-101 doses. The prolonged survival was correlated with a delay in the production of ascites, the indication of tumor burden in this model. Given this data, the Company intends to proceed with a clinical development program in ovarian cancer by year-end.

FLYNPOVI