false

0001299130

0001299130

2024-11-05

2024-11-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

November 5, 2024

Pacific Biosciences of California, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-34899 |

|

16-1590339 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1305 O’Brien Drive

Menlo Park, California 94025

(Address of principal executive offices) (Zip

Code)

(650) 521-8000

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Common

Stock, par value $0.001 per share |

|

PACB |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 2.02. RESULTS

OF OPERATIONS AND FINANCIAL CONDITION.

On November 7, 2024, Pacific Biosciences of

California, Inc. (the “Company”) announced its financial results for its third fiscal quarter ended September 30, 2024.

A copy of the press release containing the announcement is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

The information furnished in this Item 2.02

and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended

(the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 5.02. DEPARTURE OF DIRECTORS OR CERTAIN

OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

On November 5, 2024, Susan Kim notified the

Company that she is voluntarily resigning as Chief Financial Officer of the Company effective on December 6, 2024, to accept a position

at another organization. Ms. Kim’s departure is not in connection with any known disagreement with the Company on any matter relating

to its operations, policies, or practices, including its accounting policies and practices. Ms. Kim will not receive any severance in

connection with her resignation. The Company will conduct a search for a new Chief Financial Officer.

ITEM 9.01. FINANCIAL

STATEMENTS AND EXHIBITS.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Pacific Biosciences of California, Inc. |

| |

|

|

| |

By: |

/s/ Brett Atkins |

| |

|

Brett Atkins |

| |

|

General Counsel |

| Date: November 7, 2024 |

|

|

Exhibit 99.1

PacBio Announces Third Quarter 2024 Financial

Results

MENLO PARK, Calif., Nov. 07, 2024 (GLOBE NEWSWIRE) – PacBio

(NASDAQ: PACB) today announced financial results for the quarter ended September 30, 2024.

Third quarter results:

| • | Revenue of $40.0 million compared with $55.7 million in the prior-year period. |

| • | Instrument revenue of $16.8 million compared with $34.7 million in the prior-year period. Instrument revenue in the third quarter

of 2024 included 22 RevioTM sequencing systems. |

| • | Consumables revenue of $18.5 million compared with $16.9 million in the prior-year period. |

| • | Service and other revenue of $4.7 million compared with $4.1 million in the prior-year period. |

Gross profit, operating expenses, net loss, and net loss per share

are reported on a GAAP and non-GAAP basis. The non-GAAP measures are described below and reconciled to the corresponding GAAP measures

at the end of this release.

Gross profit for the third quarter of 2024 was $10.0 million, which

reflected a $3.2 million expense related to the amortization of acquired intangible assets, compared with $17.9 million for the third

quarter of 2023.

Operating expenses totaled $74.1 million for the third quarter of 2024,

compared to $100.4 million for the third quarter of 2023. Operating expenses for the third quarter of 2024 included $6.9 million of restructuring

expenses, $3.6 million related to the amortization of acquired intangible assets, and $1.2 million related to the change in fair value

of contingent consideration. Operating expenses for the third quarter of 2024 and the third quarter of 2023 included non-cash share-based

compensation of $17.0 million and $18.6 million, respectively.

Net loss for the third quarter of 2024 was $60.7 million, compared

to a net loss of $66.9 million for the third quarter of 2023.

Net loss per share for the third quarter of 2024 was $0.22, compared

to net loss per share of $0.26 for the third quarter of 2023.

Cash, cash equivalents, and investments, excluding short- and long-term

restricted cash, at September 30, 2024, totaled $471.1 million, compared to $631.4 million at December 31, 2023.

Non-GAAP third quarter results (see accompanying tables for

reconciliations of GAAP and non-GAAP measures):

Non-GAAP gross profit for the third quarter of 2024 was $13.0 million

compared with $18.1 million for the third quarter of 2023 and a non-GAAP gross margin of 33% in the third quarter of 2024 compared to

32% for the third quarter of 2023.

Non-GAAP operating expenses totaled $62.4 million for the third quarter

of 2024, compared to $90.9 million for the third quarter of 2023.

Non-GAAP net loss for the third quarter of 2024 was $46.0 million,

compared to a non-GAAP net loss of $67.9 million for the third quarter of 2023.

Non-GAAP net loss per share for the third quarter of 2024 was $0.17

compared to a non-GAAP net loss per share of $0.27 for the third quarter of 2023.

Updates since PacBio's last earnings release

| • | Announced SPRQ chemistry for the Revio sequencing system,

increasing throughput by 33% and enabling sub-$500 whole genome sequencing at U.S. list price. This advancement raises Revio’s capacity

to 2,500 human genomes per year while reducing DNA input requirements fourfold to 500ng, allowing more samples to be sequenced on the

platform. The update also enhances and expands methylation detection capabilities. |

| • | Unveiled VegaTM, a new long-read benchtop sequencer

offering customers the extraordinary data accuracy of HiFi technology and a fast turnaround time, with simplified and integrated consumables

delivering up to 60 gigabases per run, all at a U.S. list price of $169,000 per system. |

| • | Introduced the SMRT Link Cloud software, expected to be available in early 2025, allowing customers

to access, store, and analyze their HiFi data without local hardware, making it easier for new and existing customers to ramp up their

PacBio sequencing. |

| • | Collaborated with the Agency for Science, Technology, and Research (A*STAR) and Macrogen to open a state-of-the-art

joint laboratory in Singapore, providing the local research community with access to cutting-edge long-read sequencing technology and

support for the National Precision Medicine (NPM) program's long-read sequencing needs. |

| • | Announced the formation of the HiFi Solves Sub-fertility

Consortium, which unites leading experts and leverages HiFi sequencing technology alongside DNAstack’s federated data platform to

advance the diagnosis and treatment of subfertility and recurrent pregnancy loss. |

| • | Partnered with the University Hospital of Münster to

use long-read whole genome sequencing in advancing research on male infertility and rare diseases. |

| • | Joined the 10x Genomics Compatible Partner Program, expanding the range of applications Onso can address,

particularly in the fast-growing fields of single-cell and spatial biology. |

| • | Signed a Research Collaboration Agreement with the National

Cancer Centre of Singapore to use Onso to profile the genomic landscape of prevalent cancers in Asia. |

| • | Announced a private convertible note exchange transaction

of $459 million principal amount of 1.50% convertible Senior Notes due 2028, meaningfully reducing and extending the duration of our long-term

debt while balancing shareholder dilution and impact to our cash, which is anticipated to close on or about November 21, 2024. |

"While PacBio continued to operate in a difficult macro environment

for capital purchases in the third quarter, we saw several positive signs that lead us to believe that we are on the path to return to

growth in 2025 and beyond," said Christian Henry, President and Chief Executive Officer. "We're seeing sequential growth in

consumables with growing sequencing data output, continued Revio adoption from new customers, and a record quarter for Onso. Meanwhile,

we continue to decrease our cash burn and remain committed to our goal of being cashflow positive exiting 2026. Additionally, we’re

strengthening our balance sheet by reducing our total debt while balancing dilution through our recently announced note exchange with

SoftBank. With the launch of our SPRQ chemistry and the Vega benchtop system, PacBio is delivering on its strategy to bring a suite of

advanced platforms and solutions to the market and expand HiFi's ability to reach more customers than ever before.”

Quarterly Conference Call Information

Management will host a quarterly conference call to discuss its third

quarter ended September 30, 2024, results today at 4:30 p.m. Eastern Time. Investors may listen to the call by dialing 1-888-349-0136,

if outside the U.S., by dialing 1-412-317-0459, requesting to join the “PacBio Q3 Earnings Call". The call will be webcast

live and available for replay at PacBio's website at https://investor.pacificbiosciences.com.

About PacBio

PacBio (NASDAQ: PACB) is a premier life science technology company

that designs, develops, and manufactures advanced sequencing solutions to help scientists and clinical researchers resolve genetically

complex problems. Our products and technologies stem from two highly differentiated core technologies focused on accuracy, quality and

completeness which include our HiFi long-read sequencing and our SBB® short-read sequencing technologies. Our products

address solutions across a broad set of research applications including human germline sequencing, plant and animal sciences, infectious

disease and microbiology, oncology, and other emerging applications. For more information, please visit www.pacb.com and follow @PacBio.

PacBio products are provided for Research Use Only. Not for use in

diagnostic procedures.

Statement regarding use of non-GAAP financial measures

PacBio reports non-GAAP results for basic and diluted net income and

loss per share, net income, net loss, gross margins, gross profit and operating expenses in addition to, and not as a substitute for,

or because it believes that such information is superior to, financial measures calculated in accordance with GAAP. PacBio believes that

non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability

with past financial performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has

limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in

accordance with GAAP. In addition, other companies may calculate similarly titled non-GAAP measures differently or may use other measures

to evaluate their performance, all of which could reduce the usefulness of PacBio’s non-GAAP financial measures as tools for comparison.

PacBio's financial measures under GAAP include substantial charges

that are listed in the itemized reconciliations between GAAP and non-GAAP financial measures included in this press release. PacBio excludes

recurring charges from its non-GAAP financial statements, including amortization of intangible assets, changes in fair value of contingent

consideration and restructuring related expenses, and further excludes infrequent and limited charges including impairment charges and

gains or losses on the extinguishment of debt. The amortization of acquired intangible assets excluded from GAAP financial measures relates

to acquired intangible assets that were recorded as part of the purchase accounting during the year ended December 31, 2021. The amortization

related to these intangible assets will occur in future periods until they are fully amortized.

Management has excluded the effects of these items in non-GAAP measures

to assist investors in analyzing and assessing past and future operating performance. In addition, management uses non-GAAP measures to

compare PacBio’s performance relative to forecasts and strategic plans and to benchmark its performance externally against competitors.

PacBio encourages investors to carefully consider its results under

GAAP, as well as its supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand its

business. A reconciliation of PacBio’s non-GAAP financial measures to their most directly comparable financial measure stated in

accordance with GAAP has been provided in the financial statement tables included in this press release. PacBio is unable to reconcile

future-looking non-GAAP guidance included in this press release without unreasonable effort because certain items that impact this measure

are out of PacBio's control and/or cannot be reasonably predicted at this time.

Forward-Looking Statements

This press release contains “forward-looking statements”

within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the U.S. Private Securities Litigation Reform

Act of 1995. All statements other than statements of historical fact are forward-looking statements, including statements relating to

PacBio’s note exchange transaction and its anticipated financial impact and closing timing; cost-saving plans and initiatives as

well as the expected financial impact and timing of these plans and initiatives; PacBio’s financial guidance and expectations for

future periods; developments affecting our industry and the markets in which we compete, including the impact of new products and technologies;

anticipated future customer use of our products; and the availability, uses, accuracy, coverage, advantages, quality or performance of,

or benefits or expected benefits of using, PacBio products or technologies; and, the impact of new products and technologies. Reported

results and orders for any instrument system should not be considered an indication of future performance. You should not place undue

reliance on forward-looking statements because they are subject to assumptions, risks, and uncertainties and could cause actual outcomes

and results to differ materially from currently anticipated results, including, challenges inherent in developing, manufacturing, launching,

marketing and selling new products, and achieving anticipated new sales; potential cancellation of existing instrument orders; assumptions,

risks and uncertainties related to the ability to attract new customers and retain and grow sales from existing customers; risks related

to PacBio's ability to successfully execute and realize the benefits of acquisitions; the impact of U.S. export restrictions on the shipment

of PacBio products to certain countries; rapidly changing technologies and extensive competition in genomic sequencing; unanticipated

increases in costs or expenses; interruptions or delays in the supply of components or materials for, or manufacturing of, PacBio products

and products under development; potential product performance and quality issues and potential delays in development timelines; the possible

loss of key employees, customers, or suppliers; customers and prospective customers curtailing or suspending activities using PacBio's

products; third-party claims alleging infringement of patents and proprietary rights or seeking to invalidate PacBio's patents or proprietary

rights; risks associated with international operations; and other risks associated with general macroeconomic conditions and geopolitical

instability. Additional factors that could materially affect actual results can be found in PacBio's most recent filings with the Securities

and Exchange Commission, including PacBio's most recent reports on Forms 8-K, 10-K, and 10-Q, and include those listed under the caption

“Risk Factors.” These forward-looking statements are based on current expectations and speak only as of the date hereof; except

as required by law, PacBio disclaims any obligation to revise or update these forward-looking statements to reflect events or circumstances

in the future, even if new information becomes available.

The unaudited condensed consolidated financial statements that follow

should be read in conjunction with the notes set forth in PacBio's Quarterly Report on Form 10-Q when filed with the Securities and Exchange

Commission.

Contacts

Investors:

Todd Friedman

ir@pacb.com

Media:

pr@pacb.com

Pacific Biosciences of California, Inc.

Unaudited Condensed Consolidated Statements

of Operations

| | |

Three Months Ended | |

| (in thousands, except per share amounts) | |

September 30,

2024 | | |

June 30,

2024 | | |

September 30,

2023 | |

| Revenue: | |

| | | |

| | | |

| | |

| Product revenue | |

$ | 35,296 | | |

$ | 31,746 | | |

$ | 51,562 | |

| Service and other revenue | |

| 4,671 | | |

| 4,267 | | |

| 4,129 | |

| Total revenue | |

| 39,967 | | |

| 36,013 | | |

| 55,691 | |

| Cost of Revenue: | |

| | | |

| | | |

| | |

| Cost of product revenue (1) | |

| 23,278 | | |

| 23,083 | | |

| 33,551 | |

| Cost of service and other revenue (2) | |

| 3,484 | | |

| 3,366 | | |

| 4,054 | |

| Amortization of acquired intangible assets | |

| 3,201 | | |

| 2,628 | | |

| 184 | |

| Loss on purchase commitment | |

| — | | |

| 998 | | |

| — | |

| Total cost of revenue | |

| 29,963 | | |

| 30,075 | | |

| 37,789 | |

| Gross profit | |

| 10,004 | | |

| 5,938 | | |

| 17,902 | |

| Operating Expense: | |

| | | |

| | | |

| | |

| Research and development (1) | |

| 25,516 | | |

| 38,485 | | |

| 47,514 | |

| Sales, general and administrative (1) | |

| 43,746 | | |

| 45,877 | | |

| 43,431 | |

| Goodwill impairment (3) | |

| — | | |

| 93,200 | | |

| — | |

| Merger-related expenses (4) | |

| — | | |

| — | | |

| 8,979 | |

| Amortization of acquired intangible assets | |

| 3,649 | | |

| 4,222 | | |

| 741 | |

| Change in fair value of contingent consideration (5) | |

| 1,170 | | |

| — | | |

| (271 | ) |

| Total operating expense | |

| 74,081 | | |

| 181,784 | | |

| 100,394 | |

| Operating loss | |

| (64,077 | ) | |

| (175,846 | ) | |

| (82,492 | ) |

| Interest expense | |

| (3,538 | ) | |

| (3,542 | ) | |

| (3,588 | ) |

| Other income, net | |

| 6,890 | | |

| 6,069 | | |

| 8,505 | |

| Loss before benefit from income taxes | |

| (60,725 | ) | |

| (173,319 | ) | |

| (77,575 | ) |

| Benefit from income taxes (6) | |

| — | | |

| — | | |

| (10,706 | ) |

| Net loss | |

$ | (60,725 | ) | |

$ | (173,319 | ) | |

$ | (66,869 | ) |

| | |

| | | |

| | | |

| | |

| Net loss per share: | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.22 | ) | |

$ | (0.64 | ) | |

$ | (0.26 | ) |

| Diluted | |

$ | (0.22 | ) | |

$ | (0.64 | ) | |

$ | (0.26 | ) |

| | |

| | | |

| | | |

| | |

| Weighted average shares outstanding used in calculating net loss per share: | |

| | | |

| | | |

| | |

| Basic | |

| 272,915 | | |

| 272,385 | | |

| 255,001 | |

| Diluted | |

| 272,915 | | |

| 272,385 | | |

| 255,001 | |

| |

(1) |

Balances for the three months ended September 30, 2024 and June 30, 2024 include restructuring costs. Refer to the Reconciliation of Non-GAAP Financial Measures table below for additional information on such costs and related amounts. |

| |

(2) |

Balance for the three months ended June 30, 2024 includes restructuring costs of $0.6 million. Refer to the Reconciliation of Non-GAAP Financial Measures table below for additional information on such costs. |

| |

(3) |

Goodwill impairment during the three months ended June 30, 2024 was related to a sustained decrease in the Company's share price, among other factors. |

| |

(4) |

Merger-related expenses for the three months ended September 30, 2023 consists of $4.9 million of transaction costs arising from the acquisition of Apton, $2.8 million of compensation expense resulting from the liquidity event bonus plan in connection with the Apton merger, and $1.3 million of compensation expense resulting from the acceleration of certain equity awards in connection with the Apton merger. |

| |

(5) |

Change in fair value of contingent consideration during the three months ended September 30, 2024 and September 30, 2023 was due to fair value adjustments of milestone payments payable upon the achievement of the respective milestone event. |

| |

(6) |

A deferred income tax benefit during the three months ended September 30, 2023 is related to the release of the valuation allowance for deferred tax assets due to the recognition of deferred tax liabilities in connection with the Apton acquisition. |

Pacific Biosciences of California, Inc.

Unaudited Condensed Consolidated Statements

of Operations

| |

Three Months Ended | | |

Nine Months Ended | |

| (in thousands, except per share amounts) | |

September 30,

2024 | | |

September 30,

2023 | | |

September 30,

2024 | | |

September 30,

2023 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Product revenue | |

$ | 35,296 | | |

$ | 51,562 | | |

$ | 102,051 | | |

$ | 129,871 | |

| Service and other revenue | |

| 4,671 | | |

| 4,129 | | |

| 12,739 | | |

| 12,293 | |

| Total revenue | |

| 39,967 | | |

| 55,691 | | |

| 114,790 | | |

| 142,164 | |

| Cost of Revenue: | |

| | | |

| | | |

| | | |

| | |

| Cost of product revenue (1) | |

| 23,278 | | |

| 33,551 | | |

| 68,808 | | |

| 87,147 | |

| Cost of service and other revenue (2) | |

| 3,484 | | |

| 4,054 | | |

| 10,588 | | |

| 11,258 | |

| Amortization of acquired intangible assets | |

| 3,201 | | |

| 184 | | |

| 7,172 | | |

| 550 | |

| Loss on purchase commitment | |

| — | | |

| — | | |

| 998 | | |

| — | |

| Total cost of revenue | |

| 29,963 | | |

| 37,789 | | |

| 87,566 | | |

| 98,955 | |

| Gross profit | |

| 10,004 | | |

| 17,902 | | |

| 27,224 | | |

| 43,209 | |

| Operating Expense: | |

| | | |

| | | |

| | | |

| | |

| Research and development (1) | |

| 25,516 | | |

| 47,514 | | |

| 107,456 | | |

| 142,626 | |

| Sales, general and administrative (1) | |

| 43,746 | | |

| 43,431 | | |

| 133,376 | | |

| 123,822 | |

| Goodwill impairment (3) | |

| — | | |

| — | | |

| 93,200 | | |

| — | |

| Merger-related expenses (4) | |

| — | | |

| 8,979 | | |

| — | | |

| 8,979 | |

| Amortization of acquired intangible assets | |

| 3,649 | | |

| 741 | | |

| 13,377 | | |

| 741 | |

| Change in fair value of contingent consideration (5) | |

| 1,170 | | |

| (271 | ) | |

| 1,100 | | |

| 13,960 | |

| Total operating expense | |

| 74,081 | | |

| 100,394 | | |

| 348,509 | | |

| 290,128 | |

| Operating loss | |

| (64,077 | ) | |

| (82,492 | ) | |

| (321,285 | ) | |

| (246,919 | ) |

| Loss on extinguishment of debt (6) | |

| — | | |

| — | | |

| — | | |

| (2,033 | ) |

| Interest expense | |

| (3,538 | ) | |

| (3,588 | ) | |

| (10,655 | ) | |

| (10,772 | ) |

| Other income, net | |

| 6,890 | | |

| 8,505 | | |

| 19,718 | | |

| 24,301 | |

| Loss before benefit from income taxes | |

| (60,725 | ) | |

| (77,575 | ) | |

| (312,222 | ) | |

| (235,423 | ) |

| Benefit from income taxes (7) | |

| — | | |

| (10,706 | ) | |

| — | | |

| (10,706 | ) |

| Net loss | |

$ | (60,725 | ) | |

$ | (66,869 | ) | |

$ | (312,222 | ) | |

$ | (224,717 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.22 | ) | |

$ | (0.26 | ) | |

$ | (1.15 | ) | |

$ | (0.90 | ) |

| Diluted | |

$ | (0.22 | ) | |

$ | (0.26 | ) | |

$ | (1.15 | ) | |

$ | (0.90 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding used in calculating net loss per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 272,915 | | |

| 255,001 | | |

| 271,631 | | |

| 249,082 | |

| Diluted | |

| 272,915 | | |

| 255,001 | | |

| 271,631 | | |

| 249,082 | |

| |

(1) |

Balances for the three and nine months ended September 30, 2024 include restructuring costs. Refer to the Reconciliation of Non-GAAP Financial Measures table below for additional information on such costs and related amounts. |

| |

(2) |

Balance for the nine months ended September 30, 2024 includes restructuring costs of $0.6 million. Refer to the Reconciliation of Non-GAAP Financial Measures table below for additional information on such costs. |

| |

(3) |

Goodwill impairment during the nine months ended September 30, 2024 was related to a sustained decrease in the Company's share price, among other factors. |

| |

(4) |

Merger-related expenses for the three and nine months ended September 30, 2023 consists of $4.9 million of transaction costs arising from the acquisition of Apton, $2.8 million of compensation expense resulting from the liquidity event bonus plan in connection with the Apton merger, and $1.3 million of compensation expense resulting from the acceleration of certain equity awards in connection with the Apton merger. |

| |

(5) |

Change in fair value of contingent consideration during the three and nine months ended September 30, 2024 and September 30, 2023 was due to fair value adjustments of milestone payments payable upon the achievement of the respective milestone event. |

| |

(6) |

Loss on extinguishment of debt during the nine months ended September 30, 2023 is related to the exchange of a portion of the Company's 1.50% Convertible Senior Notes due 2028 for the Company's 1.375% Convertible Senior Notes due 2030. |

| |

(7) |

A deferred income tax benefit during the three and nine months ended September 30, 2023 is related to the release of the valuation allowance for deferred tax assets due to the recognition of deferred tax liabilities in connection with the Apton acquisition. |

Pacific Biosciences of California, Inc.

Unaudited Condensed Consolidated Balance Sheets

| (in thousands) | |

September 30,

2024 | | |

December 31,

2023 | |

| Assets | |

| | | |

| | |

| Cash and investments | |

$ | 471,147 | | |

$ | 631,416 | |

| Accounts receivable, net | |

| 29,383 | | |

| 36,615 | |

| Inventory, net | |

| 65,737 | | |

| 56,676 | |

| Prepaid and other current assets | |

| 17,277 | | |

| 17,040 | |

| Property and equipment, net | |

| 31,952 | | |

| 36,432 | |

| Operating lease right-of-use assets, net | |

| 17,344 | | |

| 32,593 | |

| Restricted cash | |

| 2,222 | | |

| 2,722 | |

| Intangible assets, net | |

| 436,426 | | |

| 456,984 | |

| Goodwill | |

| 369,061 | | |

| 462,261 | |

| Other long-term assets | |

| 9,503 | | |

| 13,274 | |

| Total Assets | |

$ | 1,450,052 | | |

$ | 1,746,013 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Accounts payable | |

$ | 12,064 | | |

$ | 15,062 | |

| Accrued expenses | |

| 19,183 | | |

| 45,708 | |

| Deferred revenue | |

| 22,747 | | |

| 21,872 | |

| Operating lease liabilities | |

| 27,608 | | |

| 41,197 | |

| Contingent consideration liability | |

| 20,650 | | |

| 19,550 | |

| Convertible senior notes, net | |

| 893,144 | | |

| 892,243 | |

| Other liabilities | |

| 1,534 | | |

| 9,077 | |

| Stockholders' equity | |

| 453,122 | | |

| 701,304 | |

| Total Liabilities and Stockholders' Equity | |

$ | 1,450,052 | | |

$ | 1,746,013 | |

Pacific Biosciences of California, Inc.

Reconciliation of Non-GAAP Financial Measures

| |

Three Months Ended | | |

Nine Months Ended | |

| (in thousands, except per share amounts) | |

September 30,

2024 | | |

June 30,

2024 | | |

September 30,

2023 | | |

September 30,

2024 | | |

September 30,

2023 | |

| GAAP net loss | |

$ | (60,725 | ) | |

$ | (173,319 | ) | |

$ | (66,869 | ) | |

$ | (312,222 | ) | |

$ | (224,717 | ) |

| Change in fair value of contingent consideration (1) | |

| 1,170 | | |

| — | | |

| (271 | ) | |

| 1,100 | | |

| 13,960 | |

| Goodwill impairment (2) | |

| — | | |

| 93,200 | | |

| — | | |

| 93,200 | | |

| — | |

| Amortization of acquired intangible assets | |

| 6,850 | | |

| 6,850 | | |

| 939 | | |

| 20,549 | | |

| 1,395 | |

| Merger-related expenses (3) | |

| — | | |

| — | | |

| 8,979 | | |

| — | | |

| 8,979 | |

| Loss on extinguishment of debt (4) | |

| — | | |

| — | | |

| — | | |

| — | | |

| 2,033 | |

| Income tax benefit (5) | |

| — | | |

| — | | |

| (10,706 | ) | |

| — | | |

| (10,706 | ) |

| Restructuring (6) | |

| 6,701 | | |

| 18,028 | | |

| — | | |

| 24,729 | | |

| — | |

| Non-GAAP net loss | |

$ | (46,004 | ) | |

$ | (55,241 | ) | |

$ | (67,928 | ) | |

$ | (172,644 | ) | |

$ | (209,056 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP net loss per share | |

$ | (0.22 | ) | |

$ | (0.64 | ) | |

$ | (0.26 | ) | |

$ | (1.15 | ) | |

$ | (0.90 | ) |

| Change in fair value of contingent consideration (1) | |

| — | | |

| — | | |

| — | | |

| — | | |

| 0.06 | |

| Goodwill impairment (2) | |

| — | | |

| 0.34 | | |

| — | | |

| 0.34 | | |

| — | |

| Amortization of acquired intangible assets | |

| 0.03 | | |

| 0.03 | | |

| — | | |

| 0.08 | | |

| — | |

| Merger-related expenses (3) | |

| — | | |

| — | | |

| 0.04 | | |

| — | | |

| 0.04 | |

| Loss on extinguishment of debt (4) | |

| — | | |

| — | | |

| — | | |

| — | | |

| 0.01 | |

| Income tax benefit (5) | |

| — | | |

| — | | |

| (0.04 | ) | |

| — | | |

| (0.04 | ) |

| Restructuring (6) | |

| 0.02 | | |

| 0.07 | | |

| — | | |

| 0.09 | | |

| — | |

| Other adjustments and rounding differences | |

| — | | |

| — | | |

| (0.01 | ) | |

| — | | |

| (0.01 | ) |

| Non-GAAP net loss per share | |

$ | (0.17 | ) | |

$ | (0.20 | ) | |

$ | (0.27 | ) | |

$ | (0.64 | ) | |

$ | (0.84 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP gross profit | |

$ | 10,004 | | |

$ | 5,938 | | |

$ | 17,902 | | |

$ | 27,224 | | |

$ | 43,209 | |

| Amortization of acquired intangible assets | |

| 3,201 | | |

| 2,628 | | |

| 184 | | |

| 7,172 | | |

| 550 | |

| Restructuring (6) | |

| (207 | ) | |

| 4,650 | | |

| — | | |

| 4,443 | | |

| — | |

| Non-GAAP gross profit | |

$ | 12,998 | | |

$ | 13,216 | | |

$ | 18,086 | | |

$ | 38,839 | | |

$ | 43,759 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP gross profit % | |

| 25 | % | |

| 16 | % | |

| 32 | % | |

| 24 | % | |

| 30 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP gross profit % | |

| 33 | % | |

| 37 | % | |

| 32 | % | |

| 34 | % | |

| 31 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP total operating expense | |

$ | 74,081 | | |

$ | 181,784 | | |

$ | 100,394 | | |

$ | 348,509 | | |

$ | 290,128 | |

| Change in fair value of contingent consideration (1) | |

| (1,170 | ) | |

| — | | |

| 271 | | |

| (1,100 | ) | |

| (13,960 | ) |

| Goodwill impairment (2) | |

| — | | |

| (93,200 | ) | |

| — | | |

| (93,200 | ) | |

| — | |

| Amortization of acquired intangible assets | |

| (3,649 | ) | |

| (4,222 | ) | |

| (755 | ) | |

| (13,377 | ) | |

| (845 | ) |

| Merger-related expenses (3) | |

| — | | |

| — | | |

| (8,979 | ) | |

| — | | |

| (8,979 | ) |

| Restructuring (6) | |

| (6,908 | ) | |

| (13,378 | ) | |

| — | | |

| (20,286 | ) | |

| — | |

| Non-GAAP total operating expense | |

$ | 62,354 | | |

$ | 70,984 | | |

$ | 90,931 | | |

$ | 220,546 | | |

$ | 266,344 | |

| |

(1) |

Change in fair value of contingent consideration was due to fair value adjustments of milestone payments payable upon the achievement of the respective milestone event. |

| |

(2) |

Goodwill impairment during the three months ended June 30, 2024 and nine months ended September 30, 2024 was related to a sustained decrease in the Company's share price, among other factors. |

| |

(3) |

Merger-related expenses for the three and nine months ended September 30, 2023 consists of $4.9 million of transaction costs arising from the acquisition of Apton, $2.8 million of compensation expense resulting from the liquidity event bonus plan in connection with the Apton merger, and $1.3 million of compensation expense resulting from the acceleration of certain equity awards in connection with the Apton merger. |

| |

(4) |

Loss on extinguishment of debt during the nine months ended September 30, 2023 is related to the exchange of a portion of the Company's 1.50% Convertible Senior Notes due 2028 for the Company's 1.375% Convertible Senior Notes due 2030. |

| |

(5) |

A deferred income tax benefit during the three and nine months ended September 30, 2023 is related to the release of the valuation allowance for deferred tax assets due to the recognition of deferred tax liabilities in connection with the Apton acquisition. |

| |

(6) |

Restructuring costs consist primarily of employee separation costs, accelerated amortization and depreciation for right-of-use assets, leasehold improvements, and furniture and fixtures relating to the abandonment of the San Diego office, including charges for excess inventory due to a decrease in internal demand relating to the expense reduction initiatives. |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

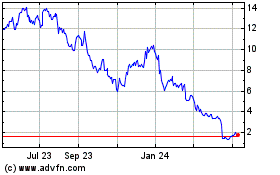

Pacific Biosciences of C... (NASDAQ:PACB)

Historical Stock Chart

From Oct 2024 to Nov 2024

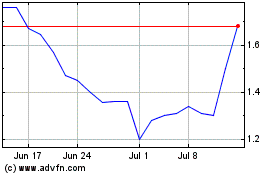

Pacific Biosciences of C... (NASDAQ:PACB)

Historical Stock Chart

From Nov 2023 to Nov 2024