Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(2)

Registration No. 333-239498

CALCULATION OF REGISTRATION FEE(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered

|

|

Maximum

Offering Price Per

Share

|

|

Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee

|

|

|

|

Common Stock, $0.0001 par value per share

|

|

2,415,000(2)

|

|

$84.50

|

|

$204,067,500

|

|

$26,487.97(3)

|

|

|

-

(1)

-

The

information in this Calculation of Registration Fee Table (including the footnotes hereto) updates, with respect to the securities distributed hereby, the

information set forth in the Calculation of Registration Fee Table included in the Registration Statement on Form S-3 (No. 333-239498) filed by the registrant on June 26, 2020.

-

(2)

-

Includes

shares of common stock that may be purchased by the underwriters pursuant to their option to purchase additional shares of common stock.

-

(3)

-

Calculated

in accordance with Rule 457(o) and (r) under the Securities Act of 1933, as amended (the "Securities Act").

Table of Contents

PROSPECTUS SUPPLEMENT

(To Prospectus Dated June 26, 2020)

2,100,000 Shares

Common Stock

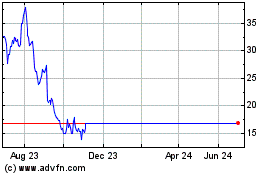

This is an offering by Overstock.com, Inc. of 2,100,000 shares of common stock, par value $0.0001 per share. Our shares of common stock

are listed on the Nasdaq Global Market under the symbol "OSTK". The closing price of our common stock on the Nasdaq Global Market on August 11, 2020 was $92.00 per share.

Investing in our common stock involves a high degree of risk. You should carefully consider the information under the heading

"Risk Factors" beginning on page S-3 of this prospectus supplement and in the documents incorporated by reference into this

prospectus supplement and the accompanying prospectus, before buying our common stock.

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

Total

|

|

|

Public Offering Price

|

|

$

|

84.50000

|

|

$

|

177,450,000

|

|

|

Underwriting Discounts and Commissions

|

|

$

|

4.43625

|

|

$

|

9,316,125

|

|

|

Proceeds to OSTK (before expenses)

|

|

$

|

80.06375

|

|

$

|

168,133,875

|

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or

adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

We

have granted the underwriters an option to purchase from us within 30 days after the date of this prospectus supplement set forth below up to an additional 315,000 shares of

our common stock at the public offering price less the underwriting discount.

The

underwriters expect to deliver the shares of common stock against payment in New York, New York on or about August 14, 2020.

|

|

|

|

|

BofA Securities

|

|

Credit Suisse

|

|

|

|

|

|

|

|

|

|

Piper Sandler

|

|

Needham & Company

|

|

D.A. Davidson & Co.

|

|

Wedbush Securities

|

The date of this prospectus supplement is August 11, 2020

Table of Contents

TABLE OF CONTENTS

PROSPECTUS

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the common stock we are offering and other matters

relating to us and our financial condition. The second part is the accompanying prospectus, which gives more general information about securities we may offer from time to time, some of which does not

apply to the common stock we are offering. If there is any inconsistency between the information contained in this prospectus supplement, on the one hand, and the information contained in the

accompanying prospectus or information incorporated by reference therein, on the other hand, you should rely on the information in this prospectus supplement, which supersedes any such inconsistent

information in the accompanying prospectus and the documents incorporated therein. You should read carefully this prospectus supplement, the accompanying prospectus, and the additional information

described below and in the accompanying prospectus under the headings "Where You Can Find More Information" and "Information Incorporated by Reference."

This

prospectus supplement is part of a registration statement that we have filed with the U.S. Securities and Exchange Commission (the "SEC") using a "shelf" registration process. This

prospectus supplement does not contain all of the information included in the registration statement. For a more complete understanding of the offering of our common stock, you should refer to the

registration statement, including its exhibits.

We

have provided you only the information contained in this prospectus supplement, the accompanying prospectus, and the documents we have incorporated by reference herein and therein.

We have not authorized anyone to provide you with different information. We do not take responsibility for, or provide assurance as to the reliability of, any other information that others may give

you. This prospectus supplement shall not constitute an offer to sell or a solicitation of an offer to buy our common stock in any jurisdiction in which it is unlawful to make such an offering or

solicitation.

You

should read the entire prospectus supplement and the accompanying prospectus, as well as the documents incorporated by reference into this prospectus supplement and the accompanying

prospectus. Neither the delivery of this prospectus supplement nor any sale made hereunder shall under any circumstances imply that the information contained or incorporated by reference herein is

correct as of any date subsequent to the date hereof. You should assume that the information appearing in this prospectus supplement and the accompanying prospectus or any document incorporated by

reference in either of them is accurate only as of the date of the applicable documents, regardless of the time of delivery of this prospectus supplement or the time of any sale or distribution of

securities. Our business, financial condition, results of operations and prospects may have changed since those dates.

As

used in this prospectus supplement, "we," "us," "Overstock," "Overstock.com," "our," "our company" and "the Company" refer to Overstock.com, Inc., a Delaware corporation, and

do not include its consolidated subsidiaries.

S-ii

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus supplement and the information incorporated by reference in this prospectus supplement and in the accompanying prospectus

contain certain statements that constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as

amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The words "anticipate," "expect," "believe," "goal," "plan," "intend,"

"estimate," "may," "will," and similar expressions and variations thereof are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Those

statements appear in this prospectus supplement and the documents incorporated by reference herein and in the accompanying prospectus and include statements regarding the intent, belief or current

expectations of the Company and management that are subject to known and unknown risks, uncertainties and assumptions and other factors that could cause actual results and the timing of certain events

to differ materially from future results expressed in or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those

discussed in the section titled "Risk Factors" beginning on page S-3 of this prospectus supplement.

This

prospectus supplement and the information incorporated by reference in this prospectus supplement and in the accompanying prospectus also contain statements that are based on

management's current expectations and beliefs, including estimates and projections about the Company, industry, financial condition, results of operations and other matters. These statements are not

guarantees of future performance and are subject to numerous risks, uncertainties, and assumptions that may cause actual results to vary materially from those projected in the forward-looking

statements. Actual events or results may differ materially from those contemplated by our forward-looking statements for a variety of reasons, including among

others:

-

•

-

the impact that the novel coronavirus, or COVID-19, pandemic may have on our business and the industries in which we and our subsidiaries and

investee entities operate;

-

•

-

the impact that any litigation or regulatory matters could have on our business, financial condition, results of operations, and cash flows;

-

•

-

the possibility that we will be unable to generate sufficient cash flow from operations, raise any required additional capital or borrow

additional funds, in the case of capital-raising or borrowing on acceptable terms, to successfully conduct our business or pursue our initiatives in a timely manner or at all;

-

•

-

any increases in the price of importing into the U.S. the types of merchandise we sell in our retail business or other supply chain challenges

that limit our access to merchandise we sell in our retail business;

-

•

-

any difficulties we may encounter as a result of our reliance on third-parties that we do not control for the performance of critical functions

material to our business;

-

•

-

any strategic transactions, restructurings or other changes we may make to our business;

-

•

-

any downturn in the U.S. housing industry or other changes in U.S. and global economic conditions or U.S. consumer spending, as a result of the

COVID-19 pandemic or otherwise;

-

•

-

our exposure to cyber security risks, risks of data loss and other security breaches;

-

•

-

any challenges that result in the unavailability of our Website or reduced performance of our transaction systems;

-

•

-

the possibility that we are unable to protect our proprietary technology and to obtain trademark protection for our marks;

S-iii

Table of Contents

-

•

-

current claims of intellectual property infringement to which we are subject and additional infringement claims to which we may become subject

in the future;

-

•

-

the commercial, competitive, technical, operational, financial, regulatory, legal, reputational, marketing and other obstacles we face in

trying to create a profitable business from our blockchain initiatives, including tZERO;

-

•

-

the extensive regulatory regimes applicable to tZERO and the possibility that various tZERO subsidiaries or ventures do not receive the

regulatory approval required to operate their anticipated businesses;

-

•

-

any losses or issues we may encounter as a consequence of accepting or holding bitcoin or other cryptocurrencies;

-

•

-

our inability to attract and retain key personnel;

-

•

-

the possibility that the cost of our current insurance policies may increase significantly or fail to adequately protect us as expected; and

-

•

-

the risks and other factors set forth in the section entitled "Risk Factors" in this prospectus supplement or in our other public filings.

Because

forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon forward-looking

statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur and actual results could differ materially from those

projected in the forward-looking statements. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we do not plan to

publicly update or revise any forward-looking statements contained herein after we distribute this prospectus supplement, whether as a result of any new information, future events or otherwise.

S-iv

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights selected information contained in this prospectus supplement and the accompanying

prospectus, and in the documents incorporated by reference herein and therein, and may not contain all the information you will need in making in making your investment decision. You should read

carefully this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein.

About Overstock.com, Inc.

We are an online eCommerce business and advocate of blockchain technology. Through our online eCommerce business, we offer a broad range of

price-competitive products, including furniture, home decor, bedding and bath, and housewares, among other products. We sell our products and services through our Internet websites located at

www.overstock.com, www.o.co and www.o.biz (referred to collectively as the "Website"). We have included our Website addresses only as inactive textual references and do not intend them to be an active

link to our Website or incorporate information from our Website into this prospectus supplement.

In

late 2014, we began working on initiatives to develop and advance blockchain technology. Those initiatives are housed within Medici Ventures, Inc., a Delaware corporation and

our wholly owned subsidiary. We are also pursuing initiatives to develop and commercialize financial applications of blockchain technologies through tZERO Group, Inc., a Delaware corporation

("tZERO") and our indirectly-held, majority-owned subsidiary.

Our

company, based near Salt Lake City, Utah, was founded as a Utah limited liability company in 1997, reorganized as a C Corporation in the State of Utah in 1998, and reincorporated in

Delaware in 2002. Our principal executive offices are located at, and our mailing address is, 799 W. Coliseum Way, Midvale, UT 84047, and our telephone number is (801) 947-3100.

Our

Common Stock trades on The Nasdaq Global Market under the symbol "OSTK".

O®,

Overstock.com®, O.com®, Club O®, and Worldstock® are registered trademarks and service marks of

Overstock.com, Inc., and tZERO and tZERO.com are trademarks and service marks of tZERO. Any third party trademarks, service marks, brand names, and trade names referred to in this prospectus

and any documents

incorporated by reference into the accompanying prospectus are the property of their respective owners and any use thereof in this prospectus does not imply any affiliation with or endorsement of or

by such third parties. Solely for convenience, trademarks, service marks, brand names, and trade names referred to in this prospectus supplement may appear with or without the ® or TM

symbols, but use (or omission) of such symbols are not intended to limit in any way our rights in and to these trademarks, service marks, brand names, and trade names.

S-1

Table of Contents

THE OFFERING

The summary below describes the principal terms of our common stock. Some of the terms and conditions described below

are subject to important limitations and exceptions. See "Description of Common Stock" for a more detailed description of our common stock.

|

|

|

|

|

Issuer:

|

|

Overstock.com, Inc.

|

|

Shares of common stock offered:

|

|

2,100,000 shares (2,415,000 shares if the underwriters exercise their option to purchase additional shares in

full).

|

|

Shares to be outstanding immediately after this offering:

|

|

42,480,363 shares (42,795,363 shares if the underwriters exercise their option to purchase additional shares in

full.)(1)

|

|

Underwriters' option:

|

|

We have granted the underwriters an option to purchase from us within 30 days after the date of this prospectus

supplement up to an additional 315,000 shares of our common stock at the public offering price less the underwriting discount.

|

|

Use of proceeds:

|

|

We estimate that the net proceeds from this offering will be approximately $167.9 million (or approximately $193.2 million

if the underwriters exercise their option to purchase additional shares in full), after deducting underwriting discounts and commissions and our estimated offering expenses. We intend to use the net proceeds from this offering for general corporate

purposes. We have not determined the amount of net proceeds to be used specifically for such purposes. As a result, management will retain broad discretion over the allocation of net proceeds. See "Use of Proceeds" on page S-9 of this prospectus

supplement.

|

|

Risk factors:

|

|

Investing in our common stock involves significant risks. See "Risk Factors" on page S-3 of this prospectus supplement

and the other information included in, or incorporated by reference into, this prospectus supplement for a discussion of certain factors you should carefully consider before deciding to invest in shares of our common stock.

|

|

Nasdaq Global Market symbol:

|

|

"OSTK"

|

-

(1)

-

The

number of shares of our common stock to be outstanding after this offering, assuming no other changes to the number of shares outstanding, is based on 40,380,363

shares of common stock outstanding as of July 31, 2020. It excludes, as of such date, approximately 743,408 shares of our common stock that may be issued upon the vesting of outstanding RSUs as

well as approximately 1,922,240 shares of our common stock that remain available for future equity grants under our equity incentive plan. It excludes 4,203,576 shares of our Digital Voting

Series A-1 Preferred Stock and 356,713 shares of our Voting Series B Preferred Stock, all of which were outstanding as of the date of this prospectus supplement and vote with our common

stock and are entitled to participate in dividends and other distributions on substantially the same basis as our common stock, and which have certain preferences over our common stock.

S-2

Table of Contents

RISK FACTORS

An investment in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks

and uncertainties described below and under the section captioned "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" contained in our most

recent Annual Report on Form 10-K, all of our subsequent Quarterly Reports on Form 10-Q, and other filings we make with the SEC from time to time, all of which are incorporated by

reference in the accompanying prospectus. If any of these risks actually occur, our business, financial condition, results of operations or cash flow could suffer materially. In such event, the

trading price of our common stock could decline and you might lose all or part of your investment.

In addition to the foregoing risks relating to us, the following are additional risks relating to an investment in the shares of our common

stock.

Risks Related to Our Business

The duration and extent to which the COVID-19 pandemic might impact our results of operations and overall

financial performance remains uncertain.

On March 11, 2020, the World Health Organization ("WHO") characterized COVID-19 as a pandemic. This widespread health crisis has

profoundly and adversely affected the world economy, employment levels, and financial markets. The duration and extent of the impact from the COVID-19 pandemic is currently unknown and difficult to

predict, but could result in a loss of workforce, including key personnel, due to adverse health effects of the disease, a lack of consumer demand for the services and products we and our subsidiaries

offer, and an inability to operate our warehouses or other key locations at full capacity, and could adversely affect our business and financial results.

Our ability to maintain the substantial increase in sales we have experienced since the onset of the COVID-19

pandemic is uncertain.

We have seen a substantial increase in sales from newly acquired customers and existing customers on our online retail website due in large

part to the COVID-19 pandemic, with resulting home confinement mandates from state and local governments and closures of many brick-and-mortar stores. The rapid increase in sales volume resulted in a

reduction of certain inventory, shipment delays, and delays in responding to customer service issues with a corresponding reduction in customer satisfaction. The extent to which our increased sales

volume will continue or newly acquired customers will convert into repeat customers as home confinement mandates are lifted and brick-and-mortar stores re-open is uncertain. Further, this uncertainty

could result in a volatility of our stock price.

New regulations and policies relating to, or arising as a result of, COVID-19 could have a material adverse

effect on our business.

Foreign, state and local governments have enacted certain regulations and policies relating to COVID-19, which include but are not limited to

new immigration policies and regulations on pricing and shipment of goods. Various jurisdictions have imposed restrictions on immigration to contain the spread of COVID-19. Immigration policies vary

from jurisdiction to jurisdiction but could negatively impact our ability to retain our existing foreign employees or our ability to recruit new talent from foreign jurisdictions. In addition, so

called "price gouging" regulations vary from state to state and seek to limit the amount by which a price can be increased for certain items. Similarly, certain regulations have been enacted to

restrict or limit the shipment of non-essential items in the wake of COVID-19. It is difficult to predict the impact these and other regulations, including both current and future regulations,

relating to, or arising as a result of, COVID-19 might have on us and our subsidiaries. If we are unable to both meet consumer demand and comply with such regulations, our reputation could

S-3

Table of Contents

be

damaged and we could be exposed to liabilities, penalties, and fines, which could have a material adverse effect on our business and financial results.

Tariffs, the spread of illness, including COVID-19, or other governmental measures or events that increase

the effective price of products or limit our ability to access or deliver products we or our suppliers or fulfillment partners import into the United States or otherwise source could have a material

adverse effect on our business.

We and many of our suppliers and fulfillment partners source a large percentage of the products we offer on our Website from China and other

countries. The United States imposed tariffs on goods from China in 2019 which adversely impacted our revenues. If the United States imposes additional tariffs, or if a disease or illness such as

COVID-19 spreads and such measures or events directly or indirectly increase the price of imported products sold on our Website, limit the ability for us or our suppliers and fulfillment partners to

source products, limit our ability to access products sold on our Website, or limit or interfere with the timely transportation or delivery of products on our Website, the increased prices and/or

supply chain challenges could have a material adverse effect on our financial results, business and prospects. Further, the broader global effects of potentially reduced consumer confidence and

spending related to COVID-19 could also have a negative effect on our overall business. At this point, the extent to which COVID-19 may impact our business is uncertain.

The spread of COVID-19 could have technology and security consequences and could negatively impact our

operations.

We have facilities located in Washington, New York, Pennsylvania, Kansas, Utah, and Ireland. We also have contractors located in California,

India and the Philippines. Our employees and contractors working in these facilities may be at risk for exposure to and for contracting COVID-19. Known cases of COVID-19 have been reported in these

regions. The spread of COVID-19 in these locations may result in our employees and contractors being forced to work remotely or missing work if they or a member of their family contract COVID-19.

Additional risks are inherent when employees and contractors work remotely, including risks that third-party internet and phone service providers may not provide adequate services for employees and

contractors to perform their responsibilities, risks that hardware, software, or other technological problems or failures could prevent employees or contractors from performing their responsibilities

and could take an excessive amount of time to resolve and risks that employees and contractors may not be trained as effectively or monitored as closely from remote locations, creating greater risks

for the security of confidential information. Any such occurrences could have a material negative impact on the business. The extent to which COVID-19 may impact our business remains uncertain.

We may be required to recognize impairments losses or allowances for bad debt relating to our equity

interests in or creditor relationships with startup businesses.

We hold minority interests and promissory notes in several companies that are in the startup or development stages and we may acquire

additional minority interests in other entities in the future. Minority interests are inherently risky because we may not have the ability to influence business decisions. Further, these interests are

inherently risky because the markets for the technologies or products these companies are developing are typically in the early stages, unproven, and may never materialize. These companies may

abandon, modify, or alter their product and service mix and overall strategy whether due to COVID-19 or otherwise. Additionally, since these interests are in companies that are in the early startup or

development stages, even if their technology or products are viable, they may not be able to obtain the capital or resources necessary to successfully bring their technology or products to market.

Furthermore, the economic impact of the COVID-19 pandemic may limit the ability for these entities to raise capital in the future. Furthermore, we have no assurance that the technology or products of

companies we have funded would be successful, even if they were brought to

S-4

Table of Contents

market.

We have previously recognized impairment losses or made allowances for bad debt related to these equity interests and may in the future recognize additional impairment losses or make

allowances for bad debt related to these interests. Any such impairment losses or allowances for bad debt could be material and could have a material adverse effect on our financial results and

business.

We depend on third-party companies to perform functions critical to our business, and any failure or

increased cost on their part could have a material adverse effect on our business.

We depend on third-party companies, including third-party carriers and a large number of independent fulfillment partners whose products we

offer for sale on our Website, to perform functions critical to our ability to deliver products and services to our customers on time and at a reasonable cost. We depend on our carriers and

fulfillment partners to perform traditional retail operations such as maintaining inventory, preparing merchandise for shipment to our customers and delivering purchased merchandise on a timely and

cost-effective basis. We also depend on the delivery and product assembly services that we and they utilize, on the payment processors that facilitate our customers' payments for their purchases, and

on other third parties over which we have no control, for the operation of our business. Difficulties with any of our significant fulfillment partners or third-party carriers, delivery or product

assembly services, payment processors or other third parties involved in our business, regardless of the reason, could have a material adverse effect on our financial results, business and prospects.

tZERO may be adversely affected as a result of the COVID-19 pandemic.

The potential negative impacts of COVID-19 and its related political and economic responses on tZERO may include increased stress on tZERO's

broker-dealer subsidiaries' and tZERO Crypto's technology due to increased trading volatility and volume which they have and are expected to continue to experience and increases in attempted

cyber-attacks or a decrease in worker productivity as a result of remote work. Further, the global economic impacts of COVID-19 could also negatively affect tZERO's business. Such impacts may include

a reduced willingness by potential securities issuers to pursue capital raising transactions or seek secondary liquidity for existing capital (thereby reducing tZERO's ability to commercialize the

tZERO Technology Stack), shift in attention by regulators and other market participants from regulatory innovation initiatives, decreased interest by third-party broker-dealers in subscribing to the

tZERO ATS or a decline in investor appetite or available capital for trading in securities, including securities that use the tZERO Technology Stack and trade on the tZERO ATS, or bearer digital

assets such as cryptocurrencies.

Additionally,

certain tZERO management and employees have, and in the future others may, contract COVID-19. This may contribute to a disruption in tZERO's ordinary business activities

and slow development of tZERO's products and technology and may be particularly pronounced in the event of the death or extended incapacity of any officer or employee performing a key function.

At

this point, while the COVID-19 pandemic may have an adverse impact on tZERO's operations, the extent, duration and nature of such impacts remain uncertain.

There can be no assurance that BSTX will receive the regulatory approval it requires to operate.

tZERO and BOX Digital have entered into a joint venture intended to develop a national securities exchange facility of BOX Exchange LLC

("BSTX") that would facilitate the trading of a type of digital security called a security token that would utilize the tZERO Technology Stack. The SEC published proposed rule changes related to BSTX

on October 11, 2019, soliciting public comments thereon. The SEC extended the review period on November 29, 2019 to January 16, 2020, BOX Exchange LLC filed an amendment to

the proposal on December 26, 2019, and the SEC again extended the review period on January 16, 2020 to April 15, 2020. A subsequent amendment was filed by BOX Exchange LLC

on February 19, 2020, after which the SEC extended the review period on April 14, 2020 until June 14, 2020. To allow for further review by the SEC, BOX Exchange LLC

S-5

Table of Contents

withdrew

and resubmitted the proposed rule changes on May 12, 2020. The SEC extended the review period for the proposed rule changes on July 16, 2020 to August 30, 2020.

The

application of federal securities law and other bodies of law to assets enhanced by blockchain technology is subject to significant uncertainty and likely to rapidly evolve as

government agencies take greater interest in them. As a result, there may be a delay in the receipt of the regulatory approvals BSTX requires to operate, if they are received at all. In the event BSTX

is not able to receive the regulatory approvals it requires to begin operations or there is significant delay in BSTX's receipt of such approvals, it may be forced to revise its anticipated

operations. Any such revision could have a material adverse effect on tZERO's operations and financial condition and a material adverse effect on us.

Risks related to software developed by our Medici businesses could contain flaws or vulnerabilities and

expose us or Medici Ventures' customers to cyber security risks and risks of data loss, other security breaches, or damages that could negatively impact our business.

Our Medici businesses offer certain products and services, which include the development and sale of certain software products which could

contain flaws or vulnerabilities that could present cyber security-related risks, data loss, other security breaches, or damages to our own business or our customers. Any flaws or vulnerabilities in

the software developed by our Medici businesses and any data breaches, cyber security breaches, malfunctions, or errors could result in a loss of opportunity, damages, or an improper or illegal use of

ours or our customer's data and could expose our business to a risk of loss and could result in claims, fines, penalties, and litigation. Any flaw, vulnerability, or compromise of our Medici business

software or security could result in a violation of applicable privacy and other laws, significant legal and financial exposure, damage to reputation, and a loss of confidence in our business, any of

which could have a material adverse effect on our financial results and business.

Risks Related to This Offering

Our stock price and trading volume may be volatile, which could affect the price at our common stock may be

sold and result in rapid and substantial losses to our shareholders.

The market price for our common stock has been, and may continue to be, volatile. From March 18, 2020 through the date of this

prospectus supplement, the market price of our common stock has fluctuated from a high of $112.62 per share to a low of $2.53 per share. In addition, the trading volume in our common stock has

fluctuated and may continue to fluctuate, resulting in significant price variations.

Our

common stock trading price could be negatively affected our actual or projected operating results, financial condition, cash flows and liquidity or changes in business strategy or

prospects, in particular due to the potential adverse effect of the ongoing public health crisis of the COVID-19 pandemic on our financial condition, results of operations, cash flows and performance,

the online retail market and the global economy and financial markets. Although we have recently seen a substantial increase in sales from newly acquired customers and existing customers on our online

retail website due in large part to the COVID-19 pandemic, which has in turn had a positive effect on our common stock price,

our ability to maintain the substantial increase in sales we have experienced since the onset of the COVID-19 pandemic could cause our stock price to decline from its current levels.

In

addition to the foregoing, some of the other factors that could negatively affect the share price or result in fluctuations in the price or trading volume of our common stock

include:

-

•

-

our failure to meet, or the lowering of, our earnings estimates or those of any securities analysts;

-

•

-

changes in market valuations of similar companies;

S-6

Table of Contents

-

•

-

equity issuances by us, or share resales by our significant stockholders, or the perception that such issuances or resales may occur;

-

•

-

significant fluctuations in our operating results in part because of seasonal fluctuations in traditional retail patterns;

-

•

-

short-selling activities involving our common stock;

-

•

-

changes in governmental policies, regulations or laws, in particular related to our regulated subsidiaries operating within our blockchain

businesses;

-

•

-

lack of significant coverage by securities analysts;

-

•

-

the prices of cryptocurrencies, particularly Bitcoin, despite our disclosures that we generally hold very little Bitcoin, and by perceptions

regarding the business prospects of blockchain technology generally;

-

•

-

speculation in the press or investment community or negative press in general, in particular related to:

-

–

-

disclosures or announcements we have made in the past about our exploration of strategic initiatives, and speculation regarding

our plan in regard to pursuing or not pursuing such actions;

-

–

-

the cryptocurrency industry or our blockchain initiatives;

-

•

-

announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

-

•

-

additions to or departures of our senior management team;

-

•

-

the realization of any of the other risk factors presented in, or incorporated by reference into, this prospectus supplement and accompanying

prospectus;

-

•

-

price and volume fluctuations in the stock market generally; and

-

•

-

market and economic conditions generally, including the current state of the capital markets.

If you purchase shares of common stock in this offering, you will suffer immediate dilution of your

investment.

The offering price per share of our common stock being offered in this offering is substantially higher than the net tangible book value per

share of our common stock. Therefore, if you purchase shares of our common stock in this offering, you will pay a price per share that substantially exceeds our net tangible book value per share after

this offering.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or

exchangeable for our common stock at prices that may be substantially different from the prices at which we may sell shares in this offering. We may sell shares or other securities in any other

offering at prices per share that are less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to

existing stockholders. The price or prices per share at which we may sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may

be higher or lower than the price per share paid by investors in this offering.

We have broad discretion over the use of our cash, cash equivalents and marketable securities, including the

net proceeds we receive in this offering, and may not use them effectively.

Our management has broad discretion to use our cash, cash equivalents and marketable securities, including the net proceeds we receive in this

offering, to fund our operations and could

S-7

Table of Contents

spend

these funds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by our management to apply these funds effectively could result in

financial losses that could have a material adverse effect on our business and cause the price of our common stock to decline. Pending their use to fund operations, we may invest our cash, cash

equivalents and marketable securities in a manner that does not produce income or that loses value.

Future sales of our common may depress our stock price.

Sales of a substantial number of shares of our common stock, or the perception that these sales may occur (including the shares of common stock

in this offering), in the public market or otherwise, by us or by a significant stockholder, could depress the trading price of our common and impair our ability to raise capital through the sale of

additional equity securities.

In

addition, we may issue additional shares of our common stock from time to time in the future in amounts that may be significant. The sale of substantial amounts of our common, or the

perception that these sales may occur, could adversely affect the trading prices of either or both of these securities.

S-8

Table of Contents

USE OF PROCEEDS

We estimate that the net proceeds from the sale of the shares of our common stock will be approximately $167.9 million, after deducting

the underwriting discounts and estimated offering expenses payable by us, or approximately $193.2 million if the underwriters exercise their option to purchase additional shares in full.

We

intend to use the net proceeds from this offering for general corporate purposes.

S-9

Table of Contents

DIVIDEND POLICY

In calendar years 2017, 2018 and 2019, our board of directors has declared and paid a $0.16 annual cash dividend on our shares of our

then-outstanding preferred stock. We may continue to pay dividends on our shares of preferred stock in the future. With the exception of the recently distributed stock dividend of shares of our

Digital Voting Series A-1 Preferred Stock, par value $0.0001 per share (the "Series A-1 Preferred") to holders of our capital stock, we have not declared or paid any cash or stock

dividends on our shares of common stock and do not anticipate paying any dividends on our common stock in the foreseeable future. Any future determination to declare and pay dividends on our common

stock will be at the discretion of our board of directors and will depend on our results of operations, financial conditions, contractual and legal restrictions and other factors the board of

directors deems relevant.

S-10

Table of Contents

DESCRIPTION OF COMMON STOCK

The following information describes our common stock and certain provisions of our amended and restated certificate of incorporation and

amended and restated bylaws. This description is only a summary. You should also refer to our amended and restated certificate of incorporation and amended and restated bylaws, which have been filed

with the SEC as exhibits to our registration statement, of which this prospectus supplement forms a part.

General

Our authorized capital stock consists of 100,000,000 shares of common stock, par value $0.0001 per share, and 5,000,000 shares of preferred

stock, par value $0.0001 per share. Under our amended and restated certificate of incorporation, our board of directors is authorized to issue such preferred stock in one or more series, with such

voting powers, full or limited or none, designations, preferences and relative, participating, optional and other or special rights and such qualifications, limitations and restrictions thereof as

shall be set forth in the resolutions providing therefor. As of the date hereof, all 5,000,000 authorized shares of preferred stock have been so designated, with 4,630,000 shares having been

designated as Digital Voting Series A-1 Preferred Stock (the "Series A-1 Preferred") and 370,000 shares having been designated as Voting Series B Preferred Stock (the

"Series B Preferred" and together with the Series A-1 Preferred, collectively, the "Preferred Stock"). Accordingly, the approval of both our board of directors and our stockholders would

be required in order to amend our amended and restated certificate of incorporation to increase the number of authorized shares of preferred stock and to designate and/or issue one or more additional

series of preferred stock in the future. Our board of directors may cause us to issue additional shares of our authorized but unissued shares of common stock, except as required by the listing

standards of the Nasdaq Global Market.

The

following is a summary of the material provisions of our common stock provided for in our amended and restated certificate of incorporation and amended and restated bylaws, each as

amended to date. For additional detail about our capital stock, please refer to our amended and restated certificate of incorporation and amended and restated bylaws, including our amended and

restated certificates of designations of our Series A-1 Preferred and of our Series B Preferred (the "Series A-1 Certificate of Designation" and the "Series B Certificate

of Designation," respectively) and "Description

of Capital Stock" set forth beginning on page 2 of the accompanying prospectus for additional information.

Common Stock

The holders of our common stock are entitled to one vote per share on all matters to be voted upon by the stockholders. Our amended and

restated certificate of incorporation prohibits cumulative voting. The election of directors shall be decided by a plurality vote of the shares present in person or represented by proxy at the meeting

and entitled to vote on the election of directors. With respect to matters other than the election of directors, if a quorum is present, the affirmative vote of a majority of the shares represented

and voting at a duly held meeting (which shares voting affirmatively also constitute at least a majority of the required quorum) shall be the act of the stockholders, unless the vote of a greater

number or a vote by classes is required by law, by our amended and restated certificate of incorporation or by our amended and restated bylaws. The holders of a majority of the shares issued and

outstanding and entitled to vote thereat, present in person or represented by proxy, shall constitute a quorum for the transaction of business at all meetings of the stockholders. Our amended and

restated certificate of incorporation prohibits stockholders from taking action by written consent in lieu of a meeting.

Subject

to any preferential rights of holders of any outstanding shares of preferred stock, holders of our common stock are entitled to receive ratably any dividends or other

distributions that

S-11

Table of Contents

may

be declared from time to time by the board of directors out of funds legally available therefor. We have never declared or paid any cash dividends on our common stock. We currently intend to

retain any earnings for future growth and do not anticipate paying any cash dividends on our common stock in the foreseeable future. Any future determination to pay dividends will be at the discretion

of our board of directors and will depend on our results of operations, financial conditions, contractual and legal restrictions and other factors the board of directors deems relevant. In the event

of our liquidation, dissolution or winding up, holders of our common stock would be entitled to share ratably in our assets remaining after the payment of liabilities, subject to prior distribution

rights of holders of any shares of preferred stock then outstanding.

Holders

of our common stock have no preemptive or conversion rights or other subscription rights, and there are no redemption provisions applicable to the common stock. The outstanding

shares of common stock are fully paid and non-assessable, and the shares of our common stock offered under

this prospectus supplement will be fully paid and non-assessable when issued. The rights of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders

of shares of our outstanding preferred stock and, subject to the receipt of stockholder approval described below, of any series of preferred stock that we may designate and/or issue in the future.

As

of July 31, 2020, 40,380,363 shares of common stock were outstanding. As of July 31, 2020, we had outstanding restricted stock unit awards covering 743,408 shares of

common stock under our 2005 Equity Incentive Plan, and had reserved an additional 1,922,240 shares of common stock for future option and restricted stock unit grants and we had no options outstanding.

The restricted stock units generally vest over three-year periods at varying rates and are subject to the holder's continuing service.

Anti-Takeover Effects of Certain Provisions of Delaware Law

Provisions of Delaware law and of our amended and restated certificate of incorporation and amended and restated bylaws could make the

acquisition of our company through a tender offer, a proxy contest or other means more difficult and could make the removal of incumbent officers and directors more difficult. We expect these

provisions to discourage inadequate takeover bids and to encourage persons seeking to acquire control of our company to first negotiate with our board of directors. We believe that the benefits

provided by our ability to negotiate with the proponent of an unsolicited proposal would outweigh the disadvantages of discouraging these proposals. We believe the negotiation of an unsolicited

proposal could result in terms more favorable to our stockholders.

We

are subject to Section 203 of the General Corporation Law of the State of Delaware (the "DGCL"), an anti-takeover law. In general, Section 203 prohibits

a publicly-held Delaware corporation from engaging in a "business combination" with an "interested stockholder" for a period of three years following the time the person became an interested

stockholder, unless:

-

•

-

prior to such time, the board of directors of the corporation approved either the business combination or the transaction which resulted in the

stockholder becoming an interested stockholder;

-

•

-

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the stockholder owned at least 85%

of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding (a) shares owned by persons who

are directors and also officers, and (b) shares owned by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the

plan will be tendered in a tender or exchange offer; or

S-12

Table of Contents

-

•

-

on or subsequent to such time, the business combination is approved by the board of directors and authorized at an annual or special meeting of

stockholders, and not by written consent, by the affirmative vote of at least two-thirds of the outstanding voting stock that is not owned by the interested stockholder.

In

general, Section 203 defines a business combination to include:

-

•

-

any merger or consolidation involving the corporation and the interested stockholder;

-

•

-

any sale, transfer, pledge or other disposition involving the interested stockholder of 10% or more of the assets of the corporation;

-

•

-

subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the

interested stockholder;

-

•

-

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the

corporation beneficially owned by the interested stockholder; and

-

•

-

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or

through the corporation.

In

general, an "interested stockholder" is a person who owns or, in certain circumstances, within three years prior to the determination of interested stockholder status, did own 15% or

more of a corporation's outstanding voting securities. We expect the existence of this provision to have an anti-takeover effect with respect to transactions our board of directors does not approve in

advance.

This

summary of the provisions of Section 203 of the DGCL does not purport to be complete and is qualified in its entirety by reference to our amended and restated certificate of

incorporation and the DGCL.

Anti-Takeover Effects of Certain Provisions of Our Charter Documents

Our amended and restated certificate of incorporation and amended and restated bylaws contain provisions that could discourage, delay or

prevent a change in control of our company or changes in our management that the stockholders of our company may deem advantageous. These provisions among other

things:

-

•

-

permit the board of directors to establish the number of directors;

-

•

-

provide that only one-third of our board of directors is elected at each of our annual meetings of stockholders (and our amended and restated

certificate of incorporation prohibits cumulative voting in the election of directors);

-

•

-

provide that directors may be removed by the affirmative vote of the holders of the outstanding shares of common stock only for cause;

-

•

-

if holders of our capital stock approved additional authorized shares of preferred stock, authorize the issuance of "blank check" preferred

stock that our board of directors could use to implement a stockholder rights plan (also known as a "poison pill");

-

•

-

provide that any vacancies on the board of directors shall be filled by the remaining directors;

-

•

-

prohibit stockholder action by written consent, which requires all stockholder actions to be taken at a meeting of our stockholders;

-

•

-

provide that the board of directors is expressly authorized to make, alter or repeal our amended and restated bylaws;

S-13

Table of Contents

-

•

-

establish advance notice requirements, including specific requirements as to the timing, form and content of a stockholder's notice, for

nominations for election to our board of directors or for proposing matters that can be acted upon by stockholders at annual stockholder meetings;

-

•

-

provide that special meetings of our stockholders may be called only by the board of directors, the chairman of the board of directors, the

chief executive officer, or the president; and

-

•

-

provide that stockholders are permitted to amend the amended and restated bylaws only with the approval of the holders of sixty-six and

two-thirds percent (662/3%) of the voting power of outstanding capital stock entitled to vote at an election of directors.

In

addition, our amended and restated certificate of incorporation and our amended and restated bylaws provide that, unless we consent in writing to the selection of an alternative

forum, a state court located within the state of Delaware (or if no such state court shall have jurisdiction, the federal district court for the District of Delaware) will be, to the fullest extent

permitted by law, the exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a breach of fiduciary duty owed by any of our

directors, officers or other employees to us or our stockholders, (iii) any action asserting a claim against us or any of our directors, officers or other employees pursuant to the DGCL, the

amended and restated certificate of incorporation or the bylaws, or (iv) any action asserting a claim against us or any of our directors or officers or other employees that is governed by the

internal affairs doctrine.

Transfer Agent and Registrar

Our transfer agent and registrar for our common stock is Computershare Trust Company, N.A.

Listing

Our common stock is listed on The Nasdaq Global Market under the trading symbol "OSTK".

S-14

Table of Contents

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS TO NON-U.S. HOLDERS

The following is a summary of the material U.S. federal income tax considerations related to the ownership and disposition of our common stock

by a non-U.S. holder (as defined below) that holds our common stock as a "capital asset" (generally property held for investment) and who purchases the common stock pursuant to this offering. This

summary is based on the provisions of the Internal Revenue Code of 1986, as amended (the "Code"), U.S. Treasury regulations, administrative rulings, and judicial decisions, all as in effect on the

date hereof, and all of which are subject to change, possibly with retroactive effect. We have not sought any ruling from the Internal Revenue Service (the "IRS") with respect to the statements made

and the conclusions reached in the following summary, and there can be no assurance that the IRS or a court will agree with such statements and conclusions.

This

summary does not address all aspects of U.S. federal income taxation that may be relevant to non-U.S. holders in light of their personal circumstances. In addition, this summary

does not address the Medicare tax on certain investment income, the alternative minimum tax, U.S. federal estate or gift tax laws, any state, local or non-U.S. tax laws or any tax treaties. This

summary also does not address tax considerations applicable to investors that may be subject to special treatment under the U.S. federal income tax laws, such

as:

-

•

-

banks, insurance companies, or other financial institutions;

-

•

-

tax-exempt or governmental organizations;

-

•

-

qualified foreign pension funds (or any entities all of the interests of which are held by a qualified foreign pension fund);

-

•

-

dealers in securities;

-

•

-

"controlled foreign corporations," "passive foreign investment companies," and corporations that accumulate earnings to avoid U.S. federal

income tax;

-

•

-

traders in securities that use the mark-to-market method of accounting for U.S. federal income tax purposes;

-

•

-

partnerships and other entities treated as pass-through entities for U.S. federal income tax purposes or holders of interests therein;

-

•

-

persons deemed to sell our common stock under the constructive sale provisions of the Code;

-

•

-

certain former citizens or long-term residents of the United States; and

-

•

-

persons that hold our common stock as part of a straddle, conversion transaction or other risk reduction transaction.

PROSPECTIVE INVESTORS ARE ENCOURAGED TO CONSULT THEIR OWN TAX ADVISORS WITH RESPECT TO THE APPLICATION OF THE U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR

SITUATION, AS WELL AS ANY TAX CONSEQUENCES OF THE PURCHASE, OWNERSHIP, AND DISPOSITION OF OUR COMMON STOCK ARISING UNDER THE U.S. FEDERAL ESTATE OR GIFT TAX LAWS OR UNDER THE LAWS OF ANY STATE, LOCAL,

NON-U.S., OR OTHER TAXING JURISDICTION OR UNDER ANY APPLICABLE INCOME TAX TREATY.

S-15

Table of Contents

Non-U.S. Holder Defined

For purposes of this discussion, a "non-U.S. holder" is a beneficial owner of our common stock that is not for U.S. federal income tax purposes

a partnership or any of the following:

-

•

-

an individual who is a citizen or resident of the United States;

-

•

-

a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the

United States, any state thereof or the District of Columbia;

-

•

-

an estate the income of which is subject to U.S. federal income tax regardless of its source; or

-

•

-

a trust (i) the administration of which is subject to the primary supervision of a U.S. court and which has one or more United States

persons who have the authority to control all substantial decisions of the trust or (ii) which has made a valid election under applicable U.S. Treasury regulations to be treated as a United

States person.

If

a partnership (including an entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds our common stock, the tax treatment of a partner in the

partnership generally will depend upon the status of the partner, upon the activities of the partnership, and upon certain determinations made at the partner level. Accordingly, we urge partners in

partnerships (including entities or arrangements treated as partnerships for U.S. federal income tax purposes) considering the purchase of our common stock to consult their own tax advisors regarding

the U.S. federal income tax considerations of the ownership and disposition of our common stock by such partnership.

Distributions

In the event we make distributions of cash or other property on our common stock, such distributions will constitute dividends for U.S. federal

income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. To the extent those distributions exceed our

current and accumulated earnings and profits, the distributions will be treated as a non-taxable return of capital to the extent of the non-U.S. holder's tax basis in our common stock and thereafter

as capital gain from the sale or exchange of such

common stock. See "—Gain on Disposition of Common Stock." Subject to the discussion below of withholding requirements under FATCA (as defined below) and effectively connected dividends,

any distribution made to a non-U.S. holder on our common stock generally will be subject to U.S. withholding tax at a rate of 30% of the gross amount of the distribution unless an applicable income

tax treaty provides for a lower rate. To receive the benefit of a reduced treaty rate of withholding, a non-U.S. holder must provide the applicable withholding agent with an IRS Form W-8BEN or

IRS Form W-8BEN-E (or other applicable or successor form) certifying qualification for the reduced rate. A non-U.S. holder that does not timely furnish the required documentation, but that

qualifies for a reduced treaty rate, may obtain a refund of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS. Non-U.S. holders should consult their tax

advisors regarding their entitlement to benefits under any applicable tax treaties.

Dividends

paid to a non-U.S. holder that are effectively connected with a trade or business conducted by the non-U.S. holder in the United States (and, if required by an applicable

income tax treaty, are treated as attributable to a permanent establishment maintained by the non-U.S. holder in the United States) generally will be taxed on a net-income basis at the rates and in

the manner generally applicable to United States persons (as defined in the Code). Such effectively connected dividends will not be subject to U.S. tax withholding if the non-U.S. holder satisfies

certain certification requirements by providing the applicable withholding agent with a properly executed IRS

S-16

Table of Contents

Form W-8ECI

certifying eligibility for exemption. If the non-U.S. holder is a corporation for U.S. federal income tax purposes, it may also be subject to a branch profits tax (at a 30% rate or

such lower rate as specified by an applicable income tax treaty) on its effectively connected earnings and profits (as adjusted for certain items), which will include effectively connected dividends.

Gain on Disposition of Common Stock

Subject to the discussion below under "—Backup Withholding and Information Reporting," a non-U.S. holder generally will not be

subject to U.S. federal income or withholding tax on any gain realized upon the sale or other disposition of our common stock unless:

-

•

-

the non-U.S. holder is an individual who is present in the United States for a period or periods aggregating 183 days or more during the

taxable year in which the sale or disposition occurs and certain other conditions are met;

-

•

-

the gain is effectively connected with a trade or business conducted by the non-U.S. holder in the United States (and, if required by an

applicable income tax treaty, is attributable to a permanent establishment maintained by the non-U.S. holder in the United States); or

-

•

-

our common stock constitutes a United States real property interest by reason of our status as a United States real property holding

corporation ("USRPHC") for U.S. federal income tax purposes, as a result of which such gain would be treated as effectively connected with a trade or business conducted by the non-U.S. holder in the

United States.

A

non-U.S. holder described in the first bullet point above will be subject to U.S. federal income tax at a rate of 30% (or such lower rate as specified by an applicable income tax

treaty) on the amount of such gain, which generally may be offset by U.S.-source capital losses.

A

non-U.S. holder whose gain is described in the second bullet point above or, subject to the exceptions described in the next paragraph, the third bullet point above, generally will be

taxed on a net income basis at the rates and in the manner generally applicable to United States persons (as defined in the Code) unless an applicable income tax treaty provides otherwise. A non-U.S.

holder that is a corporation for U.S. federal income tax purposes may be subject to a branch profits tax (at a 30% rate or such lower rate as specified by an applicable income tax treaty) on such

effectively connected gain (as adjusted for certain items).

With

respect to the third bullet point above, we believe that we currently are not a USRPHC for U.S. federal income tax purposes, and we do not expect to become a USRPHC. Generally, a

corporation is a USRPHC if the fair market value of its United States real property interests equals or exceeds 50% of the sum of the fair market value of its worldwide real property interests and its

other assets used or held for use in a trade or business. In the event that we are or become a USRPHC, as long as our common stock continues to be "regularly traded on an established securities

market" (within the meaning of the U.S. Treasury regulations), only a non-U.S. holder that actually or constructively owns, or owned at any time during the shorter of the five-year period ending on

the date of the disposition or the non-U.S. holder's holding period for the common stock, more than 5% of our common stock will be treated as disposing of a United States real property interest and

will be taxable on gain realized on the disposition of our common stock as a result of our status as a USRPHC. If we were to become a USRPHC and our common stock were not considered to be regularly

traded on an established securities market, such non-U.S. holder (regardless of the percentage of stock owned) would be treated

as disposing of a United States real property interest and would be subject to U.S. federal income tax on a taxable disposition of our common stock (as described in the preceding paragraph), and a 15%

withholding would apply to the gross proceeds from such disposition.

Non-U.S.

holders should consult their own tax advisors with respect to the application of the foregoing rules to their ownership and disposition of our common stock.

S-17

Table of Contents

Backup Withholding and Information Reporting

Any dividends paid to a non-U.S. holder must be reported annually to the IRS and to the non-U.S. holder. Copies of these information returns

may be made available to the tax authorities in the country in which the non-U.S. holder resides or is established. Payments of dividends to a non-U.S. holder generally will not be subject to backup

withholding if the non-U.S. holder establishes an exemption by properly certifying its non-U.S. status on an IRS Form W-8BEN or IRS Form W-8BEN-E (or other applicable or successor form).

Payments

of the proceeds from a sale or other disposition by a non-U.S. holder of our common stock effected by or through a U.S. office of a broker generally will be subject to

information reporting and backup withholding (at the applicable rate) unless the non-U.S. holder establishes an exemption by properly certifying its non-U.S. status on an IRS Form W-8BEN or IRS

Form W-8BEN-E (or other applicable or successor form) and certain other conditions are met. Subject to certain exceptions, information reporting and backup withholding generally will not apply

to any payment of the proceeds from a sale or other disposition of our common stock effected outside the United States by a non-U.S. office of a broker.

Backup

withholding is not an additional tax. Rather, the U.S. federal income tax liability (if any) of persons subject to backup withholding may be credited by the amount of tax

withheld. If backup withholding results in an overpayment of taxes, a refund may be obtained, provided that the required information is timely furnished to the IRS.

Additional Withholding Requirements under FATCA

Sections 1471 through 1474 of the Code, and the U.S. Treasury regulations and administrative guidance issued thereunder ("FATCA"),

impose a U.S. federal withholding tax of 30% on "withholdable payments," including dividends on our common stock paid to a "foreign financial institution" or a "non-financial foreign entity" (each as

defined in the Code) (including, in some cases, when such foreign financial institution or non-financial foreign entity is acting as an intermediary), unless (i) in the case of a foreign

financial institution, such institution enters into an agreement with the U.S. government to withhold on certain payments, and to collect and provide to the U.S. tax authorities substantial

information regarding U.S. account holders of such institution (which includes certain equity and debt holders of such institution, as well as certain account holders that are non-U.S. entities with

U.S. owners), (ii) in the case of a non-financial foreign entity, such entity certifies that it does not have any "substantial United States owners" (as defined in the Code) or provides the

applicable withholding agent with a certification identifying the direct and indirect substantial United States owners of the entity (in either case, generally on an IRS Form W-8BEN-E), or

(iii) the foreign financial institution or non-financial foreign entity otherwise qualifies for an exemption from these rules and provides appropriate documentation (such as an IRS

Form W-8BEN-E). While withholdable payments would have originally included payments of gross proceeds from the sale or other disposition of our common stock on or after January 1, 2019,

proposed U.S. Treasury regulations provide that such payments of gross proceeds do not constitute withholdable payments. Taxpayers may rely generally on these proposed U.S. Treasury regulations until

they are revoked or final U.S. Treasury regulations are issued.

Foreign

financial institutions located in jurisdictions that have an intergovernmental agreement with the United States governing these rules may be subject to different rules. Under

certain circumstances, a non-U.S. holder might be eligible for refunds or credits of such taxes. In addition, if a dividend payment is both subject to withholding under FATCA and subject to the

withholding tax discussed above under "Distributions," the withholding under FATCA may be credited against, and therefore reduce, such other withholding tax. Non-U.S. holders are encouraged to consult

their own tax advisors regarding the effects of FATCA on an investment in our common stock.

S-18

Table of Contents

INVESTORS CONSIDERING THE PURCHASE OF OUR COMMON STOCK ARE URGED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE APPLICATION OF THE U.S. FEDERAL INCOME TAX LAWS

TO THEIR PARTICULAR SITUATIONS AND THE APPLICABILITY AND EFFECT OF U.S. FEDERAL ESTATE AND GIFT TAX LAWS AND ANY STATE, LOCAL OR NON-U.S. TAX LAWS AND TAX TREATIES.

S-19

Table of Contents

UNDERWRITING (CONFLICTS OF INTEREST)

BofA Securities, Inc. and Credit Suisse Securities (USA) LLC are acting as representatives of each of the underwriters named

below. Subject to the terms and conditions set forth in an underwriting agreement among us and the underwriters, we have agreed to sell to the underwriters, and each of the underwriters has agreed,

severally and not jointly, to purchase from us, the number of shares of common stock set forth opposite its name below.

|

|

|

|

|

|

|

Underwriter

|

|

Number of

Shares

|

|

|

BofA Securities, Inc.

|

|

|

1,029,375

|

|

|

Credit Suisse Securities (USA) LLC

|

|

|

571,875

|

|

|

Piper Sandler & Co.

|

|

|

166,250

|

|

|

Needham & Company, LLC

|

|

|

133,000

|

|

|

D.A. Davidson & Co.

|

|

|

116,375

|

|

|

Wedbush Securities Inc.

|

|

|

83,125

|

|

|

|

|

|

|

|

|

Total

|

|

|

2,100,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subject

to the terms and conditions set forth in the underwriting agreement, the underwriters have agreed, severally and not jointly, to purchase all of the shares sold under the

underwriting agreement if any of these shares are purchased. If an underwriter defaults, the underwriting agreement provides that the purchase commitments of the nondefaulting underwriters may be

increased or the underwriting agreement may be terminated.

We

have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act, or to contribute to payments the underwriters may be required

to make in respect of those liabilities.

The

underwriters are offering the shares, subject to prior sale, when, as and if issued to and accepted by them, subject to approval of legal matters by their counsel, including the

validity of the shares, and other conditions contained in the underwriting agreement, such as the receipt by the underwriters of officer's certificates and legal opinions. The underwriters reserve the

right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part.

Commissions and Discounts

The representatives have advised us that the underwriters propose initially to offer the shares to the public at the public offering price set

forth on the cover page of this prospectus and to dealers at that price less a concession not in excess of 2.40825 per share. After the initial offering, the public offering price, concession or any

other term of the offering may be changed.

The

following table shows the public offering price, underwriting discount and proceeds before expenses to us. The information assumes either no exercise or full exercise by the

underwriters of their option to purchase additional shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

Without Option

|

|

With Option

|

|

|

Public offering price

|

|

$

|

84.50000

|

|

$

|