Continues trend of record quarterly net revenue

and positive Adjusted EBITDA while growing share of adult

recreational market

Q4 FISCAL 2022 FINANCIAL HIGHLIGHTS

- Continued record growth in net revenue, reaching $45.5 million,

the highest in the history of the Company, up 83% from $24.9

million in the same prior-year period and 19% from $38.1 million in

Q3 Fiscal 2022.

- Adjusted EBITDA1 of $3.2 million, the third consecutive quarter

of positive Adjusted EBITDA, compared to negative Adjusted EBITDA

of $4.8 million in the same prior year period.

- Adjusted Gross Margin1 of $10.4 million or 23%, compared to

$3.0 million or 12% in the same prior year period, reflecting

improvements from increased efficiencies and higher sales

volume.

FISCAL 2022 FINANCIAL HIGHLIGHTS

- Net revenue of $145.8 million, an increase of 84% over $79.2

million in Fiscal 2021.

- Adjusted EBITDA1 of $3.5 million, compared to a loss of $27.6

million in Fiscal 2021.

- Adjusted Gross Margin1 of $33.4 million or 23%, an increase of

837% over $3.6 million or 5% in Fiscal 2021.

SALES AND OPERATIONAL HIGHLIGHTS

- In Q4 Fiscal 2022, held #3 position among Canadian licensed

producers with 8.2% market share compared to 7%, in the same

prior-year period. In October, Organigram achieved the #2 market

position.2

- According to OCS shipped sales data, Organigram achieved the #1

market position in Ontario since January, 2022 and maintained it

throughout the balance of the fiscal year3.

- Organigram achieved the #1 market position in the Maritimes,

since January 2022, until the end of the fiscal year3.

- Continues to hold #1 position in dried flower, the largest

category of the Canadian cannabis market, the #3 market position

nationally in gummies2 and the #1 position for hash in the Quebec

market4.

- Introduced 18 SKUs in Q4 Fiscal 2022 for a total of 85 in

market.

- Generated a 11% increase in yield per plant in Q4 Fiscal 2022,

compared to the same prior year period, as a result of environment

improvements which contributed to reduced cultivation costs of 23%

in Fiscal 2022 versus Fiscal 2021 and provided additional flower to

address growing consumer demand.

- In Q4 Fiscal 2022, completed 4C expansion at Moncton growing

facility, increasing annual capacity from 45,000 kilograms at the

end of Fiscal 2021 to 85,000 kilograms of dry flower at the end of

fiscal 2022, which will drive further cost reductions through

operating leverage.

- Shipped $6.0 million of high margin flower to Australia and

Israel in Q4 Fiscal 2022. In Fiscal 2022, Organigram shipped $15.4

million of flower internationally, compared to $0.4 million in

Fiscal 2021.

Organigram Holdings Inc. (NASDAQ: OGI) (TSX: OGI), (the

“Company” or “Organigram”), a leading licensed producer of

cannabis, announced its results for the fourth quarter and year

ended August 31, 2022 (“Q4 Fiscal 2022” or "Fiscal 2022").

"In Fiscal 2022, our innovative product launches, comprehensive

retail distribution, sales execution, and operational excellence

helped Organigram become a leading consumer products company in the

cannabis sector," said Beena Goldenberg, Chief Executive Officer.

"During the year, we increased and optimized production to meet

consumer demand, drove market share gains nationally and solidified

our position as serious competitors in several new categories. In

Fiscal 2023 we expect continued success as we build on the high

recognition of our brands, our track record of innovation and our

proven ability to execute.

Select Key Financial Metrics (in $000s

unless otherwise indicated)

Q4-2022

Q4-20213

% Change

Fiscal 2022

Fiscal 20213

% Change

Gross revenue

65,657

36,182

81

%

209,109

109,859

90

%

Excise taxes

(20,177

)

(11,317

)

78

%

(63,300

)

(30,696

)

106

%

Net revenue

45,480

24,865

83

%

145,809

79,163

84

%

Cost of sales

36,718

25,867

42

%

119,037

103,567

15

%

Gross margin before fair value changes to

biological assets & inventories sold

8,762

(1,002

)

974

%

26,772

(24,404

)

210

%

Realized loss on fair value on inventories

sold and other inventory charges

(10,191

)

(7,286

)

40

%

(35,204

)

(35,721

)

(1

)%

Unrealized gain (loss) on changes in fair

value of biological assets

15,677

11,639

35

%

40,001

31,726

26

%

Gross margin

14,248

3,351

325

%

31,569

(28,399

)

211

%

Adjusted gross margin1

10,362

3,017

243

%

33,390

3,563

837

%

Adjusted gross margin %1

23

%

12

%

92

%

23

%

5

%

360

%

Selling (including marketing), general

& administrative expenses2

15,657

12,415

26

%

59,768

45,727

31

%

Adjusted EBITDA1

3,232

(4,818

)

167

%

3,484

(27,643

)

113

%

Net loss

(6,144

)

(25,971

)

76

%

(14,283

)

(130,704

)

89

%

Net cash used in operating activities

(19,695

)

(7,699

)

156

%

36,211

28,589

27

%

1 Adjusted gross margin, adjusted gross

margin % and Adjusted EBITDA are non-IFRS financial measures not

defined by and do not have any standardized meaning under IFRS;

please refer to “Non-IFRS Financial Measures” in this press release

for more information. 2 Excluding non-cash share-based

compensation. 3 During Fiscal 2022, certain reclassifications have

been made to the prior periods comparative figures to enhance

comparability with the current period amounts, none of the

reclassifications resulted in a change to net loss or shareholders'

equity. See Note 29 of the Financial Statements.

Select Balance Sheet Metrics (in

$000s)

AUGUST 31, 2022

AUGUST 31, 2021

% Change

Cash & short-term investments

(excluding restricted cash)

98,607

183,555

(46

)%

Biological assets & inventories

68,282

48,818

40

%

Other current assets

54,734

28,242

94

%

Accounts payable & accrued

liabilities

40,864

18,952

116

%

Current portion of long-term debt

80

80

—

%

Working capital

166,338

234,349

(29

)%

Property, plant & equipment

259,819

235,939

10

%

Long-term debt

155

230

(33

)%

Total assets

577,107

554,017

4

%

Total liabilities

69,049

74,212

(7

)%

Shareholders’ equity

508,058

479,805

6

%

“We are pleased with record net revenue and the third

consecutive quarter of positive Adjusted EBITDA achieved in Q4

Fiscal 2022. This is a reflection of our disciplined approach, the

execution by our team and our success at integrating acquisitions,”

added Derrick West, Chief Financial Officer. “We enter Fiscal 2023

well-capitalized and with a proven strategy to continue to generate

shareholder value.”

Key Financial Results for the Fourth Quarter and Fiscal

2022

- Net revenue:

- Compared to the prior period, net revenue increased 83% to

$45.5 million, from $24.9 million in Q4 Fiscal 2021. The increase

was primarily due to an increase in adult-use recreational revenue,

partly offset by lower average net selling price (“ASP”) due to

product mix and a decrease in medical revenue.

- For Fiscal 2022, net revenue increased 84% to $145.8 million

from $79.2 million in the previous year primarily due to an

increase in recreational and international revenue, partially

offset by a decrease in medical sales.

- Cost of sales:

- Q4 Fiscal 2022 cost of sales increased to $36.7 million, from

$25.9 million in Q4 Fiscal 2021, primarily as a result of the

increase in sales volume in the adult-use recreational market.

- For Fiscal 2022, cost of sales was $119.0 million, compared to

$103.6 million in the previous year.

- Gross margin before fair value changes to biological assets,

inventories sold, and other charges:

- Q4 Fiscal 2022 margin improved to $8.8 million from negative

$1.0 million in Q4 Fiscal 2021.

- In Fiscal 2022, margin improved to $26.8 million from negative

$24.4 million in Fiscal 2021. Quarterly and annual improvement were

both positively impacted by higher net revenue, lower cost of

production and a reduction in inventory provisions and unabsorbed

overhead costs.

- Adjusted gross margin5:

- Q4 Fiscal 2022 adjusted gross margin was $10.4 million, or 23%

of net revenue, compared to $3.0 million, or 12%, in Q4 Fiscal

2021.

- In Fiscal 2022, adjusted gross margin was $33.4 million, or 23%

of net revenue, compared to $3.6 million, or 5% in Fiscal

2021.

- The improvement in quarterly and annual results was largely due

to higher overall sales volumes and improved efficiency, net of the

impact of a lower average selling price.

- Selling, general & administrative (SG&A) expenses:

- Q4 Fiscal 2022 SG&A expenses increased to $15.7 million

from $12.4 million in Q4 Fiscal 2021.

- In Fiscal 2022, SG&A expenses increased to $59.8 million,

compared to $45.7 million in Fiscal 2021.

- Annual SG&A expenses as a percent of net revenue has

decreased from 57.8% to 40.9%.

- Both quarterly and annual increases were primarily due to

acquisitions and the higher spend to support the growth in the

business.

- Adjusted EBITDA6:

- Q4 Fiscal 2022 Adjusted EBITDA was $3.2 million compared to

negative $4.8 million in Q4 Fiscal 2021.

- Adjusted EBITDA was $3.5 million for Fiscal 2022, compared to

negative $27.6 million in Fiscal 2021.

- The improvement in quarterly and annual results is primarily

attributable to the increase in adjusted gross margins due to the

higher volume of products sold and lower production costs.

- Net loss:

- Q4 Fiscal 2022 net loss was $6.1 million, compared to a net

loss of $26.0 million in Q4 Fiscal 2021.

- In Fiscal 2022, net loss was $14.3 million, compared to $130.7

million in Fiscal 2021.

- The quarterly and annual decrease in net loss is primarily due

to the increased revenues, lower production costs and a decrease in

inventory provisions and unabsorbed overheads.

- Net cash used in operating activities:

- Q4 Fiscal 2022 net cash used in operating activities was $19.7

million, compared to $7.7 million in Q4 Fiscal 2021.

- In Fiscal 2022, net cash used in operating activities was $36.2

million, compared to $28.6 million in Fiscal 2021.

- The year over year increase to cash used in operating

activities is primarily due to the higher working capital needs

resulting from the growth in revenues.

The following table reconciles the Company's Adjusted EBITDA to

net income (loss).

Adjusted EBITDA Reconciliation (in $000s

unless otherwise indicated)

Q4-2022

Q4-2021

Fiscal 2022

Fiscal 2021

Net loss as reported

$

(6,144

)

$

(25,971

)

$

(14,283

)

$

(130,704

)

Add/(Deduct):

Financing costs, net of investment

income

(364

)

(286

)

(1,058

)

2,106

Income tax expense (recovery)

(299

)

—

(88

)

—

Depreciation, amortization, and (gain)

loss on disposal of property, plant and equipment (per statement of

cash flows)

7,570

17,349

31,487

33,459

Impairment of intangible assets

—

1,701

—

1,701

Impairment of property, plant and

equipment

2,245

—

4,245

—

Share of loss and impairment loss from

loan receivable and investments in associates

528

4,162

1,614

6,363

Unrealized loss (gain) on changes in fair

value of contingent consideration

317

3,392

(2,621

)

3,558

Realized loss on fair value on inventories

sold and other inventory charges

10,191

7,286

35,204

35,721

Unrealized (gain) loss on change in fair

value of biological assets

(15,677

)

(11,639

)

(40,001

)

(31,726

)

Share-based compensation (per statement of

cash flows)

2,809

1,150

5,127

3,896

COVID-19 related charges, net of

government subsidies and insurance recoveries

—

(892

)

(335

)

(8,147

)

Legal provisions

—

1,050

(310

)

2,750

Share issuance costs allocated to

derivative warrant liabilities and change in fair value of

derivative liabilities

(3,415

)

(6,001

)

(32,650

)

29,828

Incremental fair value component of

inventories sold from acquisitions

—

—

1,363

—

ERP implementation costs

1,793

—

3,203

—

Transaction costs

(188

)

—

2,384

—

Provisions and impairment of inventories

and biological assets and provisions of inventory to net realizable

value

1,600

2,619

4,546

19,904

Research and development expenditures, net

of depreciation

2,266

1,262

5,657

3,648

Adjusted EBITDA

$

3,232

$

(4,818

)

$

3,484

$

(27,643

)

The following table reconciles the Company's adjusted gross

margin to gross margin before fair value changes to biological

assets and inventories sold:

Adjusted Gross Margin Reconciliation (in

$000s unless otherwise indicated)

Q4-2022

Q4-2021

Fiscal 2022

Fiscal 2021

Net revenue

$

45,480

$

24,865

$

145,809

$

79,163

Cost of sales before adjustments

35,118

21,848

112,419

75,600

Adjusted Gross margin

10,362

3,017

33,390

3,563

Adjusted Gross margin %

23

%

12

%

23

%

5

%

Less:

Provisions (recoveries) and impairment of

inventories and biological assets

1,600

1,997

4,048

15,039

Provisions to net realizable value

—

622

498

4,865

Incremental fair value component on

inventories sold from acquisitions

—

—

1,363

Unabsorbed overhead

—

1,400

709

8,063

Gross margin before fair value

adjustments

8,762

(1,002

)

26,772

(24,404

)

Gross margin % (before fair value

adjustments)

19

%

(4

)%

18

%

(31

)%

Add/(Deduct):

Realized loss on fair value on inventories

sold and other inventory charges

(10,191

)

(7,286

)

35,204

35,721

Unrealized gain on changes in fair value

of biological assets

15,677

11,639

(40,001

)

(31,726

)

Gross margin

14,248

3,351

21,975

(20,409

)

Gross margin %

31

%

13

%

15

%

(26

)%

Canadian Recreational Market Introductions

SHRED Dankmeister XL Bong Blends

- Launched in July 2022, SHRED Dankmeister is a new offering in

the popular SHRED milled flower line up that provides a coarser

grind to suit bong and pipe smokers.

Sour Blue Razzberry

- An addition to the SHRED'ems gummy line in an electrifying sour

raspberry flavour with a 2:1 ratio of CBD to THC. There are now

eight SHRED'ems SKUs in market.

Holy Mountain

- Launched subsequent to quarter-end, HOLY MOUNTAIN, the

Company’s newest value brand, features an initial lineup of dried

flower strains along with value pressed hash. With the introduction

of HOLY MOUNTAIN, Organigram now offers value-priced flower in an

expanded range of sizes, starting with 3.5 gram offerings at

launch.

Research and Product Development

Product Development Collaboration ("PDC") and Centre of

Excellence ("CoE")

- The Organigram and BAT CoE has completed all key spaces

including the R&D Laboratories, enhanced Analytics, Quality

Assurance and Control laboratory, GPP production space, Sensory

Testing Laboratory and state-of-the-art Biolab for advanced plant

science research. The CoE has undertaken initial stage development

and safety studies on first generation edibles and novel beverages

as part of its work. As part of the development, the CoE has

created and assessed numerous delivery systems and created over 60

unique formulations to develop differentiated products in the

future.

Plant Science, Breeding and Genomics R&D in Moncton

- Organigram’s cultivation program; a key strategic advantage for

the Company has continued its expansion with the addition of a

dedicated cultivation R&D space. The new space has accelerated

rapid assessment and screening, delivering 20-30 unique cultivars

every two months while freeing up rooms for commercial grow. The

Plant Science team continues to move the garden towards unique,

high terpene and high THC, in-house grown cultivars, while also

leveraging the newly commissioned Biolab for ongoing plant science

innovation focusing on quality, potency and disease-resistance

marker discovery to enrich the future flower pipeline.

International

- In Fiscal Q4 2022, the Company completed three international

shipments totaling $6.0 million to Israel and Australia. In Fiscal

2022, seven international shipments were made for total shipped

sales of $15.4 million.

- Recent political changes and cannabis election ballot

initiatives for medical and recreational use in the United States

suggest that the potential movements to U.S. federal legalization

of cannabis (THC) remain difficult to predict. The Company

continues to monitor and develop a potential U.S. entry strategy

that could include THC, CBD and other minor cannabinoids. The

Company is also monitoring recreational legalization opportunities

in European jurisdictions based on the size of the addressable

market and recent regulatory changes with a particular focus on

Germany.

Liquidity and Capital Resources

- On August 31, 2022, the Company had unrestricted cash and

short-term investments balance of $99 million compared to $184

million at August 31, 2021. The decrease in cash of $85 million was

the result of the following: $49 million invested in capital

expenditures across three facilities, $8 million in cash

consideration towards the acquisition of Laurentian Organics Inc.

("Laurentian"), $3 million investment into Hyasynth Biologicals

with the balance related to supporting the increase in the working

capital assets.

- For Fiscal 2022 the Company has budgeted $29 million in capital

expenditures for the three facilities. This spend would relate to

the completion of the expansion at the Laurentian operations and

also include automation investments at the Winnipeg edibles and

Moncton flower facilities.

- Organigram believes its capital position is healthy and that

there is sufficient liquidity available for the near to medium

term.

Capital Structure

in $000s

AUGUST 31, 2022

AUGUST 31, 2021

Current and long-term debt

235

310

Shareholders’ equity

508,058

479,805

Total debt and shareholders’ equity

508,293

480,115

in 000s

Outstanding common shares

313,816

298,786

Options

11,051

7,797

Warrants

16,944

16,944

Top-up rights

7,590

6,559

Restricted share units

2,346

1,186

Performance share units

265

472

Total fully-diluted shares

352,012

331,744

Outstanding basic and fully diluted share count as at November

28, 2022 is as follows:

in 000s

NOVEMBER 28, 2022

Outstanding common shares

313,857

Options

11,998

Warrants

16,944

Top-up rights

8,393

Restricted share units

3,797

Performance share units

1,103

Total fully-diluted shares

356,092

Outlook7

Net revenue

- Organigram currently expects Fiscal 2023 revenue to be higher

than that of Fiscal 2022. This expectation is largely due to

ongoing sales momentum, stronger forecasted market growth, the

Company's expanded product line in multiple segments, greater

capacity to meet demand at the Moncton Campus, increased throughput

at the Winnipeg facility and contributions from the Lac-Supérieur

facility.

- In addition, the anticipated continuation of shipments to

Canndoc in Israel and Cannatrek and Medcan in Australia is expected

to generate higher sequential revenue in Fiscal 2023 as compared to

Fiscal 2022. The Company believes it is better equipped to fulfill

demand in Fiscal 2023 with larger harvests expected compared to

Fiscal 2022. In addition, on November 17, 2022, the Company entered

into a new multi-year agreement with Canndoc that contemplates

shipping up to 20,000 kilograms of dried flower.

Adjusted gross margins8

- The Company expects to see an improvement in adjusted gross

margins in Fiscal 2023 and has put measures in place that it

expects will further improve margins over time.

- The overall level of Fiscal 2023 adjusted gross margins versus

Fiscal 2022 will also be dependent on other factors, including

product category and brand sales mix.

- Organigram has identified the following opportunities which it

believes have the potential to further improve adjusted gross

margins over time:

- Economies of scale and efficiencies gained as a result of

moving from an annual capacity of 45,000 to 85,000 kilograms of dry

flower at the Moncton facility, in addition to enhanced growing and

harvesting methodologies, and design and environmental

improvements, which have resulted in higher-quality flower and

improved yields;

- Expansion of the Lac-Supérieur facility which is expected to

increase capacity for annual hash production from 1 million to over

2 million units;

- Continued investment in automation at all three sites, which

will drive cost efficiencies and reduce dependence on manual

labor;

- Revitalization of the Edison brand, including product

innovation, packaging and post harvest processing and increased

investment in building brand equity within the premium segment,

geared toward securing higher margins;

- Additional innovative product launches to support other key

brands: SHRED, Monjour, Holy Mountain and Tremblant to create new

potential avenues for growth; and

- Full-year margin contribution from the Laurentian

acquisition.

Adjusted EBITDA

- The Company expects significant growth in Adjusted EBITDA in

Fiscal 2023 over Fiscal 2022.

Cash flow

- The Company expects to have positive cash flows from operating

activities during Fiscal 2023 and positive free cash flows ("FCF")

during calendar 2023.

Fourth Quarter and Full Year Fiscal 2022 Conference

Call

The Company will host a conference call to discuss its results

with details as follows: Date: November 29, 2022 Time: 8:00 am

Eastern Time To register for the conference call, please use this

link: https://conferencingportals.com/event/RUyBPhzX

To ensure you are connected for the full call, we suggest

registering a day in advance or at minimum 10 minutes before the

start of the call. After registering, a confirmation will be sent

through email, including dial in details and unique conference call

codes for entry. Registration is open through the live call.

To access the webcast:

https://events.q4inc.com/attendee/926817268

A replay of the webcast will be available within 24 hours after

the conclusion of the call at https://www.organigram.ca/investors

and will be archived for a period of 90 days following the

call.

Non-IFRS Financial Measures

This news release refers to certain financial performance

measures (including adjusted gross margin and Adjusted EBITDA) that

are not defined by and do not have a standardized meaning under

International Financial Reporting Standards (“IFRS”) as issued by

the International Accounting Standards Board. Non-IFRS financial

measures are used by management to assess the financial and

operational performance of the Company. The Company believes that

these non-IFRS financial measures, in addition to conventional

measures prepared in accordance with IFRS, enable investors to

evaluate the Company’s operating results, underlying performance

and prospects in a similar manner to the Company’s management. As

there are no standardized methods of calculating these non-IFRS

measures, the Company’s approaches may differ from those used by

others, and accordingly, the use of these measures may not be

directly comparable. Accordingly, these non-IFRS measures are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. Adjusted EBITDA is a

non-IFRS measure that the Company defines as net income (loss)

before: financing costs, net of investment income; income tax

expense (recovery); depreciation, amortization, reversal of/or

impairment, (gain) loss on disposal of property, plant and

equipment (per the statement of cash flows); share-based

compensation (per the statement of cash flows); share of loss from

investments in associates and impairment loss from loan receivable;

change in fair value of contingent consideration; change in fair

value of derivative liabilities; expenditures incurred in

connection with research & development activities (net of

depreciation); unrealized (gain) loss on changes in fair value of

biological assets; realized loss on fair value on inventories sold

and other inventory charges; provisions and impairment of

inventories and biological assets; provisions to net realizable

value of inventories; COVID-19 related charges; government

subsidies; legal provisions; incremental fair value component of

inventories sold from acquisitions; transaction costs; and share

issuance costs. Adjusted EBITDA is intended to provide a proxy for

the Company’s operating cash flow and derive expectations of future

financial performance for the Company, and excludes adjustments

that are not reflective of current operating results.

Adjusted gross margin is a non-IFRS measure that the Company

defines as net revenue less cost of sales, before the effects of

(i) unrealized gain (loss) on changes in fair value of biological

assets; (ii) realized fair value on inventories sold and other

inventory charges; (iii) provisions and impairment of inventories

and biological assets; (iv) provisions to net realizable value; (v)

COVID-19 related charges; and (vi) unabsorbed overhead relating to

underutilization of the production facility and equipment, most of

which is related to non-cash depreciation expense. Management

believes that this measure provide useful information to assess the

profitability of our operations as it represents the normalized

gross margin generated from operations and excludes the effects of

non-cash fair value adjustments on inventories and biological

assets, which are required by IFRS.

The most directly comparable measure to Adjusted EBITDA,

calculated in accordance with IFRS is net income (loss) and

beginning on page 4 of this press release is a reconciliation to

such measure. The most directly comparable measure to adjusted

gross margin calculated in accordance with IFRS is gross margin

before fair value changes to biological assets and inventories sold

and beginning on page 5 of this press release is a reconciliation

to such measure.

About Organigram Holdings Inc.

Organigram Holdings Inc. is a NASDAQ Global Select Market and

TSX listed company whose wholly-owned subsidiaries include

Organigram Inc. and Laurentian Organic Inc. licensed producers of

cannabis and cannabis-derived products in Canada, and The Edibles

and Infusions Corporation, a licensed manufacturer of

cannabis-infused edibles in Canada.

Organigram is focused on producing high-quality, indoor-grown

cannabis for patients and adult recreational consumers in Canada,

as well as developing international business partnerships to extend

the Company’s global footprint. Organigram has also developed a

portfolio of legal adult-use recreational cannabis brands,

including Edison, Big Bag O’ Buds, SHRED, Monjour and Trailblazer.

Organigram operates facilities in Moncton, New Brunswick and

Lac-Supérieur, Québec, with a dedicated manufacturing facility in

Winnipeg, Manitoba. The Company is regulated by the Cannabis Act

and the Cannabis Regulations (Canada).

This news release contains forward-looking information.

Forward-looking information, in general, can be identified by the

use of forward-looking terminology such as “outlook”, “objective”,

“may”, “will”, “could”, “would”, “might”, “expect”, “intend”,

“estimate”, “anticipate”, “believe”, “plan”, “continue”, “budget”,

“schedule” or “forecast” or similar expressions suggesting future

outcomes or events. They include, but are not limited to,

statements with respect to expectations, projections or other

characterizations of future events or circumstances, and the

Company’s objectives, goals, strategies, beliefs, intentions,

plans, estimates, forecasts, projections and outlook, including

statements relating to the Company’s future performance, the

Company’s positioning to capture additional market share and sales

including international sales, expectations for consumer demand,

expected increase in SKUs, expected improvement to gross margins

before fair value changes to biological assets and inventories,

expectations regarding adjusted gross margins, Adjusted EBITDA and

net revenue in Fiscal 2023 and beyond, expectations regarding

cultivation capacity, the Company’s plans and objectives including

around the CoE, availability and sources of any future financing,

expectations regarding the impact of COVID-19, availability of cost

efficiency opportunities, the increase in the number of retail

stores, the ability of the Company to fulfill demand for its

revitalized product portfolio with increased staffing, expectations

relating to greater capacity to meet demand due to increased

capacity at the Company’s facilities, expectations around lower

product cultivation costs, the ability to achieve economies of

scale and ramp up cultivation, expectations pertaining to the

increase of automation and reduction in reliance on manual labour,

expectations around the launch of higher margin dried flower

strains, expectations around market and consumer demand and other

patterns related to existing, new and planned product forms

including by EIC and Laurentian; timing for launch of new product

forms, ability of those new product forms to capture sales and

market share, estimates around incremental sales and more generally

estimates or predictions of actions of customers, suppliers,

partners, distributors, competitors or regulatory authorities;

continuation of shipments to Canndoc Ltd., Cannatrek Ltd. and

Medcan; statements regarding the future of the Canadian and

international cannabis markets and, statements regarding the

Company’s future economic performance. These statements are not

historical facts but instead represent management beliefs regarding

future events, many of which, by their nature are inherently

uncertain and beyond management control. Forward-looking

information has been based on the Company’s current expectations

about future events.

This news release contains information concerning our industry

and the markets in which we operate, including our market position

and market share, which is based on information from independent

third-party sources. Although we believe these sources to be

generally reliable, market and industry data is inherently

imprecise, subject to interpretation and cannot be verified with

complete certainty due to limits on the availability and

reliability of raw data, the voluntary nature of the data gathering

process, and other limitations and uncertainties inherent in any

statistical survey or data collection process. We have not

independently verified any third-party information contained

herein.

Forward-looking information involves known and unknown risks,

uncertainties and other factors that may cause actual events to

differ materially from current expectations. These risks,

uncertainties and factors include: the heightened uncertainty as a

result of COVID-19, including any continued impact on production or

operations, impact on demand for products, effect on third party

suppliers, service providers or lenders; general economic factors;

receipt of regulatory approvals or consents and any conditions

imposed upon same and the timing thereof; the Company's ability to

meet regulatory criteria which may be subject to change; change in

regulation including restrictions on sale of new product forms;

change in stock exchange listing practices; the Company's ability

to manage costs, timing and conditions to receiving any required

testing results and certifications; results of final testing of new

products; timing of new retail store openings being inconsistent

with preliminary expectations; changes in governmental plans

including those related to methods of distribution and timing and

launch of retail stores; timing and nature of sales and product

returns; customer buying patterns and consumer preferences not

being as predicted given this is a new and emerging market;

material weaknesses identified in the Company’s internal controls

over financial reporting; the completion of regulatory processes

and registrations including for new products and forms; market

demand and acceptance of new products and forms; unforeseen

construction or delivery delays including of equipment and

commissioning; increases to expected costs; competitive and

industry conditions; change in customer buying patterns; and

changes in crop yields. These and other risk factors are disclosed

in the Company's documents filed from time to time under the

Company’s issuer profile on the Canadian Securities Administrators’

System for Electronic Document Analysis and Retrieval (“SEDAR”) at

www.sedar.com and reports and other information filed with or

furnished to the United States Securities and Exchange Commission

(“SEC”) from time to time on the SEC’s Electronic Document

Gathering and Retrieval System (“EDGAR”) at www.sec.gov, including

the Company’s most recent MD&A and AIF. Readers are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date of this news release. The Company

disclaims any intention or obligation, except to the extent

required by law, to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Forward looking information is subject to risks and

uncertainties that are addressed in the “Risk Factors” section of

the MD&A dated November 28, 2022 and there can be no assurance

whatsoever that these events will occur.

_______________________________ 1 Adjusted gross margin and

Adjusted EBITDA are non-IFRS financial measures not defined by and

do not have any standardized meaning under IFRS; please refer to

“Non-IFRS Financial Measures” in this press release for more

information. 2 Hifyre data extract from October 18, 2022 3 OCS

wholesale sales and e-commerce orders shipped data: Q4 FY 22 and

Provincial Boards Data: CNB, NSLC, PEILCC, Q4 FY ‘22 4 Weedcrawler,

FY22 5 Adjusted gross margin is a non-IFRS financial measure not

defined by and does not have any standardized meaning under IFRS;

please refer to “Non-IFRS Financial Measures” in this press release

for more information. 6 Adjusted EBITDA is a non-IFRS financial

measure not defined by and does not have any standardized meaning

under IFRS; please refer to “Non-IFRS Financial Measures” in this

press release for more information. 7 The disclosure in this

section is subject to the risk factors referenced in the “Risk

Factors” section of the Company’s Q4 Fiscal 2022 MD&A, which is

available in the Company's profile at www.sedar.com. Without

limiting the generality of the foregoing, the expectations

concerning revenue, adjusted gross margins and SG&A are based

on the following general assumptions: consistency of revenue

experience with indications of fourth quarter performance to date,

consistency of ordering and return patterns or other factors with

prior periods and no material change in legal regulation, market

factors or general economic conditions. The Company disclaims any

obligation to update any of the forward-looking information except

as required by applicable law. See cautionary statement in the

“Introduction” section at the beginning of the Company’s Fiscal

2022 MD&A. 8 Adjusted gross margin is a non-IFRS financial

measure not defined by and does not have any standardized meaning

under IFRS; please refer to “Non-IFRS Financial Measures” in this

press release for more information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221128005806/en/

For Investor Relations enquiries, please contact:

investors@organigram.ca For Media enquiries, please contact:

Paolo De Luca, Chief Strategy Officer

paolo.deluca@organigram.ca

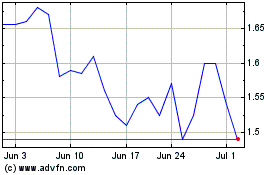

Organigram (NASDAQ:OGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Organigram (NASDAQ:OGI)

Historical Stock Chart

From Apr 2023 to Apr 2024