Current Report Filing (8-k)

February 09 2023 - 4:22PM

Edgar (US Regulatory)

0001538716☐00015387162023-02-092023-02-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

February 9, 2023

Date of Report (date of earliest event reported)

OPORTUN FINANCIAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

Commission File Number 001-39050 | | | | | | | | | | | |

| Delaware | | 45-3361983 |

State or Other Jurisdiction of

Incorporation or Organization | | I.R.S. Employer Identification No. |

| | | |

| 2 Circle Star Way | | |

| San Carlos, | CA | | 94070 |

| Address of Principal Executive Offices | | Zip Code |

(650) 810-8823

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | OPRT | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On February 9, 2023, Oportun Financial Corporation (the “Company”) issued a press release announcing select preliminary financial results and operating metrics for the fourth quarter ended December 31, 2022.

A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

The Company’s audited financial statements for the year ended December 31, 2022 are not yet available. Accordingly, these preliminary financial and operating results are an estimate and subject to the completion of the Company’s financial closing and other procedures and finalization of the Company’s consolidated financial statements for its year ended December 31, 2022, including the completion of the audit of the Company’s financial statements. Accordingly, actual financial and operating results that will be reflected in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, including its audited financial statements, when they are completed and publicly disclosed may differ from these preliminary results.

The information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 2.05 Costs Associated with Exit or Disposal Activities

On February 9, 2023, the Company announced that it is taking a series of measures to streamline its operations, including reducing the size of its corporate staff by 10%, impacting approximately 155 employees, and reducing its expenditures on external contractors. In relation to these and other personnel related activities, management expects to incur non-recurring, pre-tax charges of $5 million to $6 million in the first quarter of 2023. The Company expects to exclude these charges from its calculation of its non-GAAP financial measures. These reductions are anticipated to result in annualized run-rate savings in compensation and benefits of approximately $38 million beginning in 2023.

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements including, but not limited to, statements related to statements related to the effectiveness of the Company’s cost-cutting measures in strengthening its business; the anticipated size and timing of charges taken and annualized run-rate savings in compensation and benefits for the Company in connection with its reduction in its corporate staff and spending on external contractors; the anticipated size, timing and effectiveness of non-personnel related operational efficiencies; the Company’s preliminary unaudited financial and operating results for the fourth quarter of 2022, including fourth quarter aggregate originations, fourth quarter annualized net charge-off rate, the Company’s annualized net charge-off rate range for the second half of 2023 and management’s expectations for fourth quarter revenue and adjusted net income, among other items The charges the Company expects to incur are subject to assumptions, and actual charges may differ from the estimates disclosed above. In addition, the Company may incur other charges or cash expenditures not currently contemplated due to unanticipated events that may occur. These statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements are subject to the safe harbor provisions under the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. The Company has based these forward-looking statements largely on its current expectations and projections about future events and financial trends that it believes may affect its business, financial condition and results of operations. These risks and uncertainties include those risks described in the Company's filings with the Securities and Exchange Commission, including the Company's most recent annual report on Form 10-K and most recent quarterly report on Form 10-Q. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. The forward-looking statements included herein are made only as of the date hereof, and the Company undertakes no obligation to revise or update any forward-looking statements for any reason.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit Number | |

| 99.1 | |

| 104 | Cover Page Interactive Data File embedded within the Inline XBRL document |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| OPORTUN FINANCIAL CORPORATION |

| (Registrant) |

| | | |

| Date: | February 9, 2023 | By: | /s/ Jonathan Coblentz |

| | | Jonathan Coblentz |

| | | Chief Financial Officer and Chief Administrative Officer |

| | | (Principal Financial Officer) |

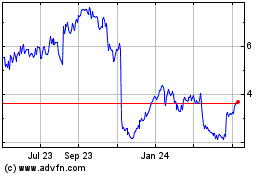

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

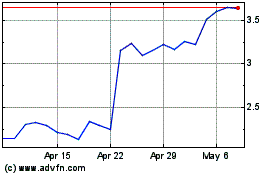

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Apr 2023 to Apr 2024