Current Report Filing (8-k)

April 15 2019 - 8:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 9, 2019

O

DYSSEY

M

ARINE

E

XPLORATION

, I

NC

.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Nevada

|

|

001-31895

|

|

84-1018684

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

5215 West Laurel Street

Tampa, Florida 33607

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (813)

876-1776

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17

CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry Into a Material Definitive Agreement.

|

On April 9, 2019, Odyssey Marine Exploration, Inc. (“Odyssey”) entered into a Share Purchase Agreement (the “Purchase

Agreement”) with Seabed Capital, LLC (“Seabed”) pursuant to which (a) Odyssey has agreed to acquire from Seabed all of Seabed’s 480 shares (the “Acquired Interest”) in a holding company (the “Target

Company”) whose primary asset is an exclusive exploration license for a potentially significant subsea mineral deposit, in consideration for which (b) Odyssey will issue to Seabed up to 250,000 shares (the “Consideration Shares”)

of Odyssey’s common stock, and the Target Company and Seabed will enter into a royalty agreement whereby the Target Company will agree to pay to Seabed up to a 2.5% net smelter royalty (the “Royalty”) from future production (the

“Transaction”). The 480 shares represent 80.0% of the Target Company’s outstanding capital stock. The Purchase Agreement contemplates that the number of Consideration Shares and the percentage of the Royalty will be reduced

proportionately to the extent that the 480 shares represent less than 80.0% of the Target Company’s outstanding capital stock at the closing of the Transaction. Under the Purchase Agreement, Odyssey’s obligation to consummate the

Transaction is subject to the following conditions: (a) specified approvals, consents and waivers shall have been obtained; (b) an extension of the Target Company’s exploration license shall have been obtained; (c) Odyssey shall

have been provided specified audited financial statements of the Target Company; (d) a specified liability of the Target Company shall have been resolved; and (e) other reasonable and customary conditions to closing for transactions such

as the Transaction.

At the closing of the Transaction, Odyssey and Seabed will enter into a Registration Rights Agreement providing

Seabed with “piggyback” registration rights with respect to the Consideration Shares, although Odyssey will agree to file, upon Seabed’s request, a registration statement with respect to the Consideration Shares if Seabed has not had

the opportunity to exercise its piggyback registration rights with respect to the Consideration Shares within six months after the closing of the Transaction.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

O

DYSSEY

M

ARINE

E

XPLORATION

, I

NC

.

|

|

|

|

|

|

|

Dated: April 15, 2019

|

|

|

|

By:

|

|

/s/ Jay A. Nudi

|

|

|

|

|

|

|

|

Jay A. Nudi

|

|

|

|

|

|

|

|

Chief Financial Officer

|

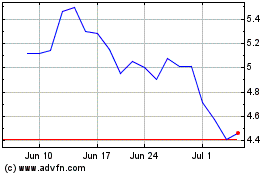

Odyssey Marine Exploration (NASDAQ:OMEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

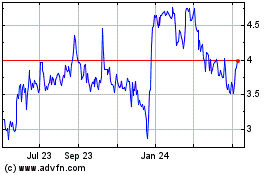

Odyssey Marine Exploration (NASDAQ:OMEX)

Historical Stock Chart

From Apr 2023 to Apr 2024