Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

July 08 2022 - 4:56PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-262129

PROSPECTUS SUPPLEMENT NO. 2

(TO PROSPECTUS DATED APRIL 25, 2022)

OceanPal Inc.

Up to 14,474,000 Shares of Common Stock Underlying Previously Issued Class A Warrants

This prospectus supplement no. 2 (this “Prospectus Supplement”) amends and supplements the prospectus dated April 25, 2022 (as supplemented or amended from time to time, the “Prospectus”) which

forms a part of our Registration Statement on Form F-1 (Registration Statement No. 333-262129), as amended from time to time. This Prospectus Supplement is being filed to update and supplement the information included or incorporated by reference in

the Prospectus with the information contained in our Current Report on Form 6-K, filed with the U.S. Securities and Exchange Commission (the “SEC”) on June 15, 2022 (the “Form 6-K”). Accordingly, we have attached the Form 6-K to this Prospectus

Supplement.

This Prospectus Supplement should be read in conjunction with, and delivered with, the Prospectus and is qualified by reference to the Prospectus except to the extent that the information in this

Prospectus Supplement supersedes the information contained in the Prospectus.

This Prospectus Supplement is not complete without, and may not be delivered or utilized except in connection with, the Prospectus, including any amendments or supplements to it.

Our common stock is listed on the Nasdaq Capital Market ("Nasdaq") under the symbol "OP". On July 7, 2022, the last reported sale price of our common stock was $0.4687 per share, as reported by

Nasdaq. We urge prospective purchasers of our securities to obtain current information about our securities, including the market price of our common stock.

Investing in our securities is speculative and involves a high degree of risk. You should carefully consider the risk factors beginning on page 6 of the Prospectus before

purchasing shares of our common stock.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any

representation to the contrary is a criminal offense.

The date of this prospectus is July 8, 2022

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2022

Commission File Number: 001-40930

OCEANPAL INC.

(Translation of registrant's name into English)

Pendelis 26, 175 64 Palaio Faliro, Athens, Greece

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ].

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ].

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish

and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are

traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K

submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached to this Report on Form 6-K as Exhibit 99.1 is a press release dated June 15, 2022 of OceanPal Inc. (the "Company"), announcing that it has signed, through a

separate wholly-owned subsidiary, a Memorandum of Agreement dated June 13, 2022, to acquire the m/v Baltimore from Diana Shipping Inc., a related party of the Company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

OCEANPAL INC.

|

| |

(registrant)

|

| |

|

| |

|

|

Dated: June 15, 2022

|

|

| |

By:

|

/s/ Eleftherios Papatrifon

|

| |

|

Eleftherios Papatrifon

|

| |

|

Chief Executive Officer

|

Exhibit 99.1

| |

Corporate Contact:

|

| |

Margarita Veniou

|

| |

Chief Corporate Development & Governance Officer

|

| |

Telephone: +30-210-9485-360

|

| |

Email: mveniou@oceanpal.com

|

| |

Website: www.oceanpal.com

|

| |

Twitter: @OceanPal_Inc

|

| |

|

| |

Investor and Media Relations:

|

| |

Edward Nebb

|

| |

Comm-Counsellors, LLC

|

| |

Telephone: + 1-203-972-8350

|

| |

Email: enebb@optonline.net

|

OCEANPAL INC. ANNOUNCES ENTRY INTO AGREEMENT TO

ACQUIRE CAPESIZE DRY BULK VESSEL

ATHENS, GREECE, June 15, 2022 – OceanPal Inc. (NASDAQ: OP) (the “Company”), a global shipping company specializing in the ownership of vessels, today announced that it has signed, through a separate

wholly-owned subsidiary, a Memorandum of Agreement dated June 13, 2022, to acquire the m/v Baltimore from Diana Shipping Inc., a related party of the Company, for an aggregate purchase price of $22.0 million. Of the purchase price, 20% was paid in

cash upon the signing of the Memorandum of Agreement and the remaining 80% is expected to be paid upon delivery of the vessel to OceanPal in the form of shares of a new series of the Company’s preferred stock, the terms of which will be mutually

agreed upon between the Company and Diana Shipping Inc., and are expected to include, among other terms, a preferred dividend and the right to convert the newly issued preferred shares into OceanPal common shares at any time after the issue date. The

aggregate purchase price of the vessel was based on the average of two independent broker valuations, after adjusting for expected drydock expenses and taking into account the share-based component of the consideration.

The m/v Baltimore is a 2005-built Capesize dry bulk vessel having a carrying capacity of 177,243 dwt. The Company expects to take delivery of the vessel in the third quarter of 2022 following the completion of

the vessel’s next scheduled drydocking, the cost of which is reflected in the aggregate purchase price. The purchase of this vessel was made pursuant to the Company’s exercise of a right of first refusal granted to it by Diana Shipping Inc. on six

identified vessels (including the m/v Baltimore) based on an agreement dated November 8, 2021. The acquisition was approved by a committee of independent members of the Company’s Board of Directors.

OceanPal Inc.’s fleet currently consists of 3 dry bulk vessels (1 Capesize and 2 Panamax). A table describing the current OceanPal Inc. fleet can be found on the Company’s website, www.oceanpal.com. Information

contained on the Company’s website does not constitute a part of this press release.

About the Company

OceanPal Inc. is a global provider of shipping transportation services through its ownership of vessels. The Company’s vessels currently transport a range of dry bulk cargoes, including such commodities as iron

ore, coal, grain and other materials along worldwide shipping routes and it is expected that the Company’s vessels will be primarily employed on short term time and voyage charters following the completion of their current employments.

Forward Looking Statements

Matters discussed in this press release may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order

to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other

statements.

The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor

legislation. The words “believe,” “anticipate,” “intends,” “estimate,” “forecast,” “project,” “plan,” “potential,” “may,” “should,” “expect,” “pending” and similar expressions identify forward-looking statements.

The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, Company management’s

examination of historical operating trends, data contained in the Company’s records and other data available from third parties. Although the Company believes that these assumptions were reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies that are difficult or impossible to predict and are beyond the Company’s control, the Company cannot assure you that it will achieve or accomplish these expectations, beliefs or projections.

In addition to these important factors, other important factors that, in the Company’s view, could cause actual results to differ materially from those discussed in the forward-looking statements include the

severity, magnitude and duration of the COVID-19 pandemic, including impacts of the pandemic and of businesses’ and governments’ responses to the pandemic on our operations, personnel, and on the demand for seaborne transportation of bulk products;

the strength of world economies and currencies, general market conditions, including fluctuations in charter rates and vessel values, changes in demand for dry bulk shipping capacity, changes in the Company’s operating expenses, including bunker

prices, drydocking and insurance costs, the market for the Company’s vessels, availability of financing and refinancing, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or

future litigation, general domestic and international political conditions, including risks associated with the continuing conflict between Russia and Ukraine and related sanctions, potential disruption of shipping routes due to accidents or

political events, vessel breakdowns and instances of off-hires and other factors. Please see the Company’s filings with the U.S. Securities and Exchange Commission for a more complete discussion of these and other risks and uncertainties. The Company

undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

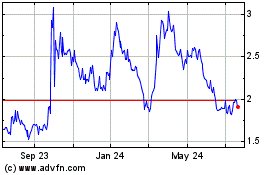

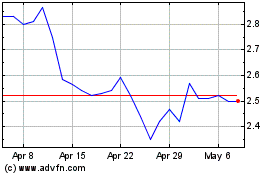

OceanPal (NASDAQ:OP)

Historical Stock Chart

From Mar 2024 to Apr 2024

OceanPal (NASDAQ:OP)

Historical Stock Chart

From Apr 2023 to Apr 2024