Amended Statement of Beneficial Ownership (sc 13d/a)

February 02 2022 - 4:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No.1)*

|

OceanPal Inc.

|

|

(Name of Issuer)

|

|

Common Stock, $0.01 par value per share

|

|

(Title of Class of Securities)

|

|

Y6430L103

|

|

(CUSIP Number)

|

|

Attn: Mr. Ioannis Zafirakis

Pendelis 26, 175 64 Palaio Faliro

Athens, Greece

+ 30-210-9485-360

|

|

(Name, Address and Telephone Number of Person Authorized to Receive

Notices and Communications)

|

|

January 25, 2022

|

|

(Date of Event Which Requires Filing of this Statement)

|

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and

is filing this schedule because of ss.240.13d-1(e), 240.13d‑1(f) or 240.13d-1(g), check the following box [ ].

|

|

|

|

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

|

|

|

|

|

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the

Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

CUSIP No.

|

Y6430L103

|

|

|

|

1.

|

NAME OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

|

|

|

|

Semiramis Paliou

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

|

|

(a)

|

[_]

|

|

|

|

(b)

|

[x]

|

|

3.

|

SEC USE ONLY

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

OO

|

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

[_]

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

Greece

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

|

|

|

|

|

7.

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

8.

|

SHARED VOTING POWER

|

|

|

|

|

|

|

|

0

|

|

|

9.

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

0

|

|

|

10.

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

0

|

|

|

|

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

0

|

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

|

|

|

|

|

[_]

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

0

|

|

|

14.

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

IN

|

|

|

CUSIP No.

|

Y6430L103

|

|

|

|

1.

|

NAME OF REPORTING PERSONS

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

|

|

|

|

|

|

Tuscany Shipping Corp.

|

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

|

|

(a)

|

[_]

|

|

|

|

(b)

|

[x]

|

|

3.

|

SEC USE ONLY

|

|

|

|

|

|

|

4.

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

OO

|

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

[_]

|

|

|

|

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

Marshall Islands

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

|

|

|

|

|

7.

|

SOLE VOTING POWER

|

|

|

|

|

|

|

|

0

|

|

|

8.

|

SHARED VOTING POWER

|

|

|

|

|

|

|

|

0

|

|

|

9.

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

0

|

|

|

10.

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

0

|

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

0

|

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

|

|

|

|

|

[_]

|

|

|

|

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

0

|

|

|

14.

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

CO

|

|

|

Item 1.

|

Security and Issuer.

|

|

|

|

|

|

|

|

This Schedule 13D relates to shares of common stock, par value $0.01 per share (the “Shares”), of OceanPal Inc. (the “Issuer”). The

principal executive office and mailing address of the Issuer is Pendelis 26, 175 64 Palaio Faliro, Athens, Greece.

|

|

|

|

|

|

|

Item 2.

|

Identity and Background.

|

|

|

|

|

|

|

|

This amended Schedule 13D is being filed on behalf of Semiramis Paliou (“Paliou”), a citizen of Greece, and Tuscany Shipping Corp., a

Marshall Islands corporation (“Tuscany”). Paliou and Tuscany are collectively referred to as the “Reporting Persons.” Paliou is the owner of all of the issued and outstanding shares of Tuscany, and may be deemed to have beneficial ownership

of the Shares beneficially owned by Tuscany.

The principal business address for Reporting Persons is Pendelis 26, 175 64 Palaio Faliro, Athens, Greece.

The Reporting Persons have not, during the last five years, been (i) convicted in a criminal proceeding (excluding traffic violations or

similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding were not and are not subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violations with respect to such laws.

|

|

|

|

|

|

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

|

|

|

|

|

|

|

Tuscany acquired an aggregate of 1,301,827 Shares in connection with the spin-off transaction of the Issuer from Diana Shipping Inc. effected on November 29, 2021, in which Tuscany was a beneficial shareholder of

an aggregate of 13,018,276 common shares of Diana Shipping Inc. as of the record date of the spin-off transaction. In addition, Paliou acquired beneficial ownership of an additional 304,401 Shares in connection with the spin-off transaction

through shares of Diana Shipping Inc. held as of the record date of the spin-off transaction by 4 Sweet Dreams S.A. (“4 Sweet Dreams”), an entity wholly-owned by Paliou. In connection with the spin-off transaction, each shareholder of Diana

Shipping Inc. received one common share of the Issuer for each 10 common shares of Diana Shipping Inc. that it held as of the record date. Any fractional shares were rounded up to the nearest whole share.

On January 25, 2022, Tuscany sold all of its 1,301,827 Shares and 4 Sweet Dreams S.A. sold all of the 304,401 Shares that it owned, respectively, in an underwritten offering on Form F-1 (Registration No.

333-262129) pursuant to an Underwriting Agreement dated January 20, 2022 between OceanPal Inc., Tuscany, 4 Sweet Dreams, Abra Marinvest Inc., and Maxim Group LLC., and accordingly, neither Tuscany nor 4 Sweet Dreams remains the beneficial

owner of any Shares.

|

|

|

|

|

|

|

Item 4.

|

Purpose of Transaction.

|

|

|

|

|

|

|

|

Paliou is a director and the Chairperson of the Board of Directors and the Executive Committee of the Issuer and may have influence over

the corporate activities of the Issuer, including activities which may relate to items described in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

The Reporting Persons acquired the Shares in connection with the spin-off transaction as described herein solely for investment purposes.

The Reporting Persons, at any time and from time to time, may acquire additional Shares, including in connection with the provision of any services or other strategic transactions with the Issuer, or dispose of any or all of the Shares they

then own depending upon an ongoing evaluation of their investment in the Shares, prevailing market conditions, other investment opportunities, other investment considerations and/or other factors. The Reporting Persons further reserve the

right to act in concert with any other shareholders of the Issuer, or other persons, for a common purpose should they determine to do so, and/or to recommend courses of action to the Issuer's management, the Issuer's Board of Directors, the

Issuer's shareholders and others. In addition, the Reporting Persons are in contact with members of the Issuer's management, the members of the Issuer's Board of Directors, other significant shareholders and others regarding alternatives that

the Issuer could employ to increase shareholder value.

|

|

|

Item 5.

|

Interest in Securities of the Issuer.

|

|

|

|

(a. & b.) As a result of the sale of the Shares as described in Item 3, above, neither Tuscany nor 4 Sweet Dreams are deemed to be

the beneficial owner of any Shares.

(c.) Except as described in Item 3, above, no transactions in the Shares were effected by the persons enumerated in Item 2 during the past

60 days.

(d.) Not applicable.

(e.) Not applicable.

|

|

|

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

|

|

|

|

|

|

|

In connection with the spin-off transaction effected on November 29, 2021, Tuscany, 4 Sweet Dreams and certain other shareholders of the

Issuer entered into a registration rights agreement, pursuant to which the Issuer agreed to register on a resale registration statement under the Securities Act of 1933, as amended, the common shares of the Issuer held by Tuscany, 4 Sweet

Dreams and the other shareholders.

|

|

|

|

|

|

|

Item 7.

|

Material to be Filed as Exhibits.

|

|

|

|

|

|

|

|

Exhibit A. Joint Filing Agreement dated December 10, 2021 among the Reporting Persons was previously filed as an exhibit to the Reporting Persons’ initial Schedule 13D.

|

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

February 2, 2022

|

|

|

|

(Date)

|

|

|

|

|

|

|

|

Tuscany Shipping Corp.

By

/s/ Semiramis Paliou

|

|

|

|

Semiramis Paliou

Authorized Representative

|

|

|

|

|

|

|

|

/s/ Semiramis Paliou

|

|

|

|

Semiramis Paliou*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* The Reporting Person specifically disclaims beneficial ownership of the securities reported herein except to the extent of their pecuniary interest

therein.

Attention: Intentional misstatements or omissions of fact constitute Federal criminal violations (see 18 U.S.C. 1001).

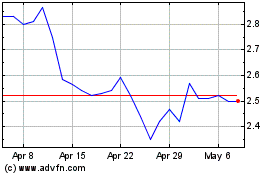

OceanPal (NASDAQ:OP)

Historical Stock Chart

From Mar 2024 to Apr 2024

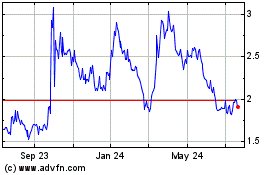

OceanPal (NASDAQ:OP)

Historical Stock Chart

From Apr 2023 to Apr 2024