Report of Foreign Issuer (6-k)

August 13 2020 - 6:01AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the period ended August 11, 2020

Commission File Number: 001-12033

|

Nymox Pharmaceutical Corporation

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(l): o

Indicate by check mark if the registrant is submitting Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-______________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

NYMOX PHARMACEUTICAL CORPORATION

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date: August 12, 2020

|

By:

|

/s/ Paul Averback, MD

|

|

|

|

|

Paul Averback, MD

|

|

|

|

|

President and Chief Executive Officer

|

|

|

Item 1.01 Entry into Material Definitive Agreement.

|

Entry into Equity Distribution Agreement

On July 17, 2020 Nymox Pharmaceutical Corp (the “Company”), entered into an Equity Distribution Agreement (the “Agreement”) with Alliance Global Partners (“AGP”), as agent. Under the Agreement, the Company may offer and sell shares of the Company’s common stock, no par value per share, from time to time during the term of the Agreement through AGP, acting as agent. The Company has filed a prospectus supplement relating to the offer and sale, from time to time, of its shares of common stock having an aggregate offering price of up to $12,000,000 (the “Shares”) pursuant to the Agreement.

The Company is not obligated to sell any Shares pursuant to the Agreement. Subject to the terms and conditions of the Agreement, AGP will use commercially reasonable efforts, consistent with its normal trading and sales practices and applicable state and federal law, rules and regulations and the rules of the Nasdaq Capital Market (“Nasdaq”), to sell Shares from time to time based upon the Company’s instructions, including any price, time or size limits or other customary parameters or conditions the Company may impose. Under the Agreement, AGP may sell Shares by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415 of the Securities Act of 1933, as amended, and the rules and regulations thereunder.

The Agreement will terminate upon the earlier of (i) the issuance and sale of all of the Shares through AGP on the terms and subject to the conditions set forth in the Agreement, or (ii) termination of the Agreement as otherwise permitted by the Agreement. The Agreement may be terminated by AGP or the Company at any time upon notice to the other party, or by AGP at any time in certain circumstances, including the occurrence of a material adverse effect on the Company. The Company will pay AGP compensation in cash equal to 3.0% of the gross proceeds from the sales of Shares pursuant to the Agreement, will reimburse AGP’ expenses in connection with entering into the transactions contemplated by the Agreement in an amount up to $50,000 and an amount not to exceed $2,500 per calendar quarter during the term of the Agreement for legal fees to be incurred by AGP, and has agreed to provide AGP with customary indemnification and contribution rights.

The Shares will be issued pursuant to the Company’s previously filed and effective Registration Statement on Form F-3 (File No. 333-237564), which was initially filed with the Securities and Exchange Commission on April 3, 2020 and declared effective on May 12, 2020.

The foregoing summary of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement, a copy of which is filed as Exhibit 10.1 hereto and incorporated herein by reference. The opinion of the Company’s counsel regarding the validity of the Shares that may be issued pursuant to the Agreement is filed herewith as Exhibit 5.1.

This Current Report on Form 6-K shall not constitute an offer to sell or the solicitation of an offer to buy the Shares, nor shall there be any sale of the Shares in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Nymox Pharmaceutical (NASDAQ:NYMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

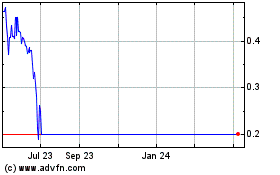

Nymox Pharmaceutical (NASDAQ:NYMX)

Historical Stock Chart

From Apr 2023 to Apr 2024