By Yoko Kubota and Dan Strumpf

Huawei Technologies Co. has spent 15 years and billions of

dollars building an advanced semiconductor company, with the aim of

making the Chinese telecom giant self-sufficient. A U.S.

blacklisting stands to set it back years in that goal.

Huawei's chip subsidiary HiSilicon Technologies Co. has grown

into one of China's biggest and most advanced chip companies. Its

processors power everything from Huawei's data centers and

smartphones to its base stations for forthcoming fifth-generation

wireless networks.

HiSilicon supplies more chips than anyone else for Huawei,

reducing its parent company's reliance on American chip stalwarts

like Qualcomm Inc., Intel Corp. and Nvidia Corp., and helping erode

the dominance of American chip makers. But HiSilicon is among

dozens of Huawei affiliates on a U.S. Department of Commerce export

blacklist that blocks any company from supplying it with American

technology without a license, which won't be easy to obtain.

Because HiSilicon relies on some suppliers for American software

and intellectual property to design and make semiconductors, its

ability to keep producing better chips is at risk. While experts

say the short-term effects of the export ban will be minimal, in

the longer run, as technology evolves, it threatens to curtail

HiSilicon's progress.

"Beyond a year from now, there is a big risk if the ban is not

lifted," said Sebastian Hou, analyst at the Hong Kong-based

investment bank CLSA. "It would be very challenging for HiSilicon

to design next-generation chipsets because a lot of software and

intellectual property is still licensed and bought from American

suppliers."

A Huawei spokesman declined to comment for this article.

Semiconductors have emerged as a choke point in the U.S.-China

tech battle. China needs American semiconductor technologies, while

U.S. chip makers rely on Chinese buyers. The threat to HiSilicon

shows China's tech industry has a way to go to establish a

self-sufficient supply chain.

With the U.S. blacklisting, HiSilicon stands to lose access to

technology from ARM Holdings PLC, the U.K.-based provider of basic

chip designs. It also will prevent HiSilicon from using the latest

software from U.S. suppliers Synopsys Inc. and Cadence Design

Systems Inc., making it harder to produce next-generation

chips.

On Friday, China's Commerce Ministry said it is setting up an

"unreliable entity list," and that foreign companies, organizations

and individuals that disrupt supplies to Chinese companies would be

named.

HiSilicon President Teresa He told Huawei employees in a May 17

memo that all new products must have plans for technological

self-sufficiency. "We must not only be open to innovation but also

achieve independence in technologies," Ms. He said.

China's reliance on U.S. chips was highlighted after last year's

U.S. ban on exports to Huawei's chief Chinese rival, ZTE Corp.,

crippled the company. ZTE was able to get back to business after

the U.S. and China reached a deal that included the company paying

a $1 billion fine.

Experts say Huawei is less reliant on American technology than

ZTE, in part because of HiSilicon. In 2015, HiSilicon supplied more

than one-fifth of Huawei's chips by value, according to CCID, an

official think tank in Beijing. Analysts estimate the figure has

only grown since then.

In Huawei's high-end P20 Pro smartphone launched last year,

about 27% of the semiconductor content came from HiSilicon, while

only 7% came from American companies, according to ABI Research. In

the case of ZTE, more than half of the electronic components in its

top-of-the-line smartphone ran on American components when its ban

hit.

Established in 2004, Shenzhen-based HiSilicon has more than

7,000 employees globally. Its revenue rose 38% in 2018 to $7.9

billion, according to market research firm TrendForce. About 90% of

HiSilicon's revenue comes from Huawei, research firm Gartner said.

Huawei reported more than $100 billion in revenue last year.

HiSilicon is among an elite group of global chip makers that

have succeeded in engineering transistors down to seven nanometers

in size, the industry's current gold standard.

In smartphones, HiSilicon's Kirin-branded chips power

image-recognition and other artificial intelligence functions. In

the future, its Balong chips will connect those phones and other

devices to forthcoming 5G networks, while its Tiangang chips will

power Huawei's 5G base stations.

The looming trouble for HiSilicon is in obtaining new licenses

to access design tools offered by Synopsys and Cadence, both based

in California. The companies' products are used to produce the

blueprints for circuits, and U.S. officials have said applications

for licenses to export these products to Huawei and its affiliates

will be reviewed with a presumption of denial.

In a conference call with investors , Synopsys co-CEO Aart de

Geus said the company was following "exactly the rules set by the

government," including no longer providing on-site support to

HiSilicon. Cadence didn't respond to requests for comment.

The loss of ARM's business likely won't be felt immediately.

Huawei's CEO Ren Zhengfei said in May it has obtained a long-term

license and that the ARM halt "doesn't have an impact." An ARM

spokeswoman said the company is speaking with the U.S. government

to ensure compliance, while a spokesman for ARM China, a separate

entity, said the company is seeking solutions that comply with the

law.

While other chip makers and HiSilicon's suppliers shift to

future versions of ARM technology or products from the software

companies, the U.S. blacklisting will leave HiSilicon stuck with

older tools, hindering its ability to compete on the frontiers of

chip design and extending the time it takes to develop its

products.

In terms of developing new advanced chips, "I foresee 36 months

of midterm setback for Huawei," said Shumpei Kawasaki, CEO of

Software Hardware & Consulting and a former chip designer at

Hitachi Ltd. and Renesas Electronics Corp.

Alternative technologies to ARM, Cadence and Synopsys exist,

including open-sourced RISC-V that was originally developed at the

University of California, Berkeley. Some of RISC-V's design data is

accessible in open platforms and doesn't require signing an

agreement to use that, Mr. Kawasaki said.

In the long run, an export ban would push China toward a

separate set of chip-design tools and standards and lead HiSilicon

to step away from internationally dominant chip architecture and

tools, Mr. Kawasaki said.

--Wenxin Fan contributed to this article.

Write to Yoko Kubota at yoko.kubota@wsj.com and Dan Strumpf at

daniel.strumpf@wsj.com

(END) Dow Jones Newswires

June 02, 2019 05:45 ET (09:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

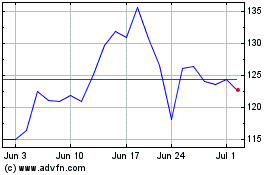

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024