By Gunjan Banerji

Stocks, government bond yields and commodities fell in a wild

session Friday as anxieties over trade relations with China sparked

fresh worries about global growth and the potential for a

recession.

The Dow Jones Industrial Average dropped 623.34 points, or 2.4%,

after China said it would impose retaliatory tariffs on additional

U.S. products and President Trump vowed on Twitter to respond. The

yield on the benchmark 10-year U.S. Treasury note settled at the

lowest level since August 2016, and copper prices tumbled to their

lowest mark since May 2017.

Shares of toy makers, retailers and semiconductor companies that

manufacture products in China were among the hardest hit. Mattel

and Hasbro both dropped more than 6%, while Advanced Micro Devices

and Nvidia fell at least 5%.

The developments marked an escalation of trade tensions between

two of the biggest global economies, stoking waves of selling in

the stock market and continuing a stretch of turbulence in August.

Markets have been punctured by bouts of volatility, driven by the

trade tensions, uncertainty about the pace of the Federal Reserve's

interest-rate cuts and concerns about economic growth around the

world.

"It seems as though it's a freaky Friday," said Michael Arone,

chief investment strategist at State Street Global Advisors. "It

looks as though the markets are bracing for the worst."

The drop marked the Dow industrials' third decline of at least

2% this month and put the blue-chip index 6.3% below last month's

all-time high. The index is still up nearly 10% this year.

Meanwhile, a measure of stock volatility, the Cboe Volatility

Index, jumped about 19% to 19.87 after falling earlier in the

week.

The S&P 500 dropped 75.84 points, or 2.6%, while the Nasdaq

Composite shed 239.62 points, or 3%. All three major indexes have

declined for four consecutive weeks.

This past week's trading activity was marked by mixed signals

about the economy and prospects of stimulus ahead. President Trump

weighed in several times with criticism of the Fed's approach and

seemingly conflicting comments about implementing fresh tax cuts to

boost the economy.

Still, investors said trade remains one of their biggest

concerns, and that was on display Friday. Stock futures overnight

Thursday into Friday pointed to gains but slumped when China rolled

out the new plan for tariffs.

Investors digested that news and even briefly pushed major

indexes higher following Federal Reserve Chairman Jerome Powell's

comments about the future of interest-rate policy. But stocks

reversed course again, diving after President Trump's tweets

ordering U.S. companies to seek alternatives to doing business in

China. The losses accelerated heading into the closing bell.

"The timing of it is remarkable," said John Brady, managing

director at futures brokerage R.J. O'Brien & Associates, of the

trade news early Friday. "It puts tariffs front and center on a

very important day for markets."

After the stock market closed Friday, Mr. Trump tweeted that

China shouldn't have put new tariffs on U.S. products and added

that he was increasing the level of tariffs of Chinese goods.

The trade developments overshadowed a highly anticipated speech

from Mr. Powell in Jackson Hole, Wyo. Ahead of the speech, many

investors suggested his comments would be the biggest event of the

day, with the potential to stoke big moves across stock, bond and

currency markets. Instead, market reaction was muted.

Mr. Powell acknowledged trade in his comments, saying the

uncertainty was "playing a role in the global slowdown" and adding

the Fed would act accordingly to "sustain the expansion."

But the comments again drew the ire of President Trump, who said

in a tweet that "the Fed did NOTHING."

Investors are next looking to the Group of Seven summit in

France, which could also highlight divisions between world leaders.

They will also parse figures on consumer spending and a second

estimate of second-quarter gross domestic product for signals about

the state of the economy.

In one sign of anxiety percolating through markets, a bond

market signal -- the yield curve -- has flashed a warning that a

potential recession is looming. The two-year Treasury yield settled

above the 10-year Treasury yield Friday, according to Dow Jones

Market Data. The curve has inverted ahead of the past seven

economic recessions, making it a widely watched measure.

Investors have also been analyzing news from the Fed as well as

fresh economic data, some of which have sent conflicting signals

about the state of the economy. A series of weak manufacturing data

earlier this past week around the world also raised concerns about

a possible recession, while other figures have elicited

optimism.

Strong earnings reports from retailers like Target and Lowe's

have offered encouraging signs about the strength of the U.S.

consumer.

"There's really been a tug of war in the markets," said Chris

Zaccarelli, chief investment officer at Independent Advisor

Alliance. "I don't think the worst is behind us."

Mr. Zaccarelli said he has recently bought shares of

consumer-staples companies, a sector that tends to fare better when

the economic outlook deteriorates.

Investors scooped up traditionally safer assets like government

bonds and gold Friday, sending the yield on the 10-year Treasury

note down for the fourth consecutive week to 1.523% Friday, from

1.613% Thursday. Yields fall as bond prices rise.

Gold prices notched gains for the fourth consecutive week,

hitting their highest settlement value in more than six years on

Friday. The WSJ Dollar Index fell about 0.4% to 90.90. Lower

Treasury yields can make the U.S. dollar less attractive to income

seeking investors around the world.

Though major U.S. stock indexes are still hovering near their

recent highs, the back-and-forth between U.S. and China led some

analysts to say that they weren't expecting a speedy resolution

between leaders of the two countries, and that they were bracing

for more turbulence.

"This is going to be ping-pong for a while," said Sean O'Hara,

president of the ETF division at Pacer Financial Inc. "That's what

we're going to continue to see until we get a resolution, if we

ever do. It's probably going to drive the short-term ups and downs

of the market."

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com

(END) Dow Jones Newswires

August 23, 2019 18:42 ET (22:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

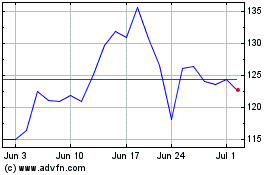

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024