via NewMediaWire –

NextPlay Technologies, Inc. (NASDAQ:

NXTP), a digital native ecosystem for finance, digital

advertisers, and video gamers, reported results for the first

quarter of fiscal 2023 ended May 31, 2022.

On June 28, 2022, NextPlay announced it entered into definitive

agreements to sell its travel business, NextTrip Group, LLC

(NextTrip), and its 51% ownership of Reinhart Digital TV (the owner

of Zappware) to TGS Esports Inc., an esports tournament solutions

provider. Closing of the transaction remains subject to various

conditions, including (without limitation) regulatory approvals and

approval of certain related matters by TGS' shareholders, and is

expected to occur in the second half of this calendar year. The

sale, if and when consummated, is expected to unlock shareholder

value, improve cash flow and allow the company to focus resources

on core businesses.

As a result, as of May 31, 2022, the NextTrip and Reinhart

Digital TV businesses are no longer consolidated with, or presented

as divisions of, NextPlay Technologies, and instead have been

reclassified as assets held for sale by the company. Beginning with

the company’s first quarter of fiscal 2023, the company will report

the financial results of its two continuing business segments:

NextFinTech, comprised of Longroot and NextBank; and

NextMedia, comprised of HotPlay, representing the company’s

in-game advertising (IGA) technology.

Fiscal Q1 2023 Financial Highlights

● Revenue totaled $467,000 vs. none in the corresponding

year-ago quarter.

● Consolidated gross profit totaled $364,000 or 77.9% of total

revenue.

● Assets totaled $106.5 million at May 31, 2022.

Fiscal Q1 2023 Operational Highlights

● Acquired the assets, including

patents and video game development technology, of Fighter Base

Publishing and its Make It Games™ brand. The acquisition

strengthened NextPlay’s IP portfolio and digital business ecosystem

offerings to digital advertisers, consumers and video gamers. The

proprietary Make It Games AI animation tools enable game or film

characters to be more lifelike in appearance and behavior, saving

producers time and money over traditional animation.

● Acquired certain assets of goGame,

including its new-gen game publishing platform that features

tournament, chat and payment systems that support 37 casual games

ranging from arcade to strategy. NextPlay is currently working to

complete the integration of its HotPlay IGA technology into the 37

games, which is expected to be completed by year end. In connection

with the acquisition, goGame also granted the company a perpetual

license for goPay its payment gateway, a payment aggregator that

offers game developers multiple ways to more easily collect and

process user payments through carrier billing, over the counter,

e-voucher, bank transfer and e-wallet transfers.

● Acquired the assets of Token IQ,

Inc., an early innovator in digital asset management and smart

compliant token technology. Token IQ’s foundational IP employs a

distributed ledger, like Ethereum or Stellar, to reconcile legal

and regulatory requirements around digital assets, including Know

Your Customer (KYC) challenges, anti-money laundering (AML) and

shareholder rights enforcement. NextPlay plans to initially deploy

the Token IQ technology through its NextBank International and

Longroot Thailand subsidiaries. The technology is also available to

license partners.

● Signed preliminary agreement with Decentralised

Investment Group (DIG), a leading global blockchain technology

company, to develop and operate an exclusive fiat payment platform

for DIG’s customers. Upon execution of a definitive agreement,

NextBank International would provide DIG customers with access to

its Fintech platform, which would enable these customers to

purchase and monetize DIG assets. This would initially involve

using in-game assets from Realms of Ethernity (RoE), the world’s

first MMORPG (massively multiplayer online role-playing games) NFT

game. NextPlay and DIG are currently in the process of negotiating

definitive agreements to formalize the relationship, which they

hope to finalize in the near term, subject to completion of due

diligence and satisfaction of market, regulatory and other

customary closing conditions.

● Entered memorandum of understanding

with TruCash Group of Companies Inc. to support the launch of

NextBank Payments, which, once implemented, is expected to include

mobile wallets and mobile payments, as well as credit, debit and

prepaid cards. The relationship with TruCash also presents the

opportunity to offer NextBank's international banking services to

TruCash's millions of account holders worldwide. NextBank and

TruCash are in the process of negotiating definitive agreements to

formalize the relationship, which they hope to finalize in the near

term.

Management Commentary

“In fiscal Q1, our topline growth and high gross margin versus

the same year-ago quarter was primarily due to Fintech acquisitions

we completed last year,” commented NextPlay’s co-CEO and principal

executive officer, Nithinan ‘Jess’ Boonyawattanapisut.

“The results were lower sequentially mostly due the

reclassification of Reinhart Digital TV and NextTrip as assets held

for sale in anticipation of their proposed sale to TGS Esports.

“We believe the strategic sale of these assets to a buyer who is

positioned to more quickly leverage them for growth and market

share will accelerate the unlocking of shareholder value,

particularly through the potential distribution of TGS shares to

our investors through a special dividend.

“Further, the valuable acquisitions we have made in the video

game and Fintech areas, and especially the advancements we have

made since their acquisition, calls for us to intensify our focus

and capital resources on what we see as a unique opportunity for

high-margin revenue growth in their fast-growing

markets.

“These advancements include the long-anticipated release of

HotPlay 2.0 during calendar 2022, which will offer new powerful

advertising and real-world rewards delivery technology to our

partners and business customers. HotPlay 2.0 is intended to

strengthen its integration capabilities and deep-linking support

for games via a generational update of its Unity SDK for iOS,

Android, Android TV, and HTML5.

“HotPlay 2.0 also features new online management portals for

advertisers and publishers, and new apps for consumers and players,

including a HotPlay Reward Redemption native mobile app for iOS and

Android. HotPlay 2.0 is being rolled out initially to select

partners in preparation for the global launch through our connected

ecosystem.

“The integration of HotPlay with our newly acquired Make It

Games AI animation platform, once completed, will introduce unique,

highly disruptive capabilities for the development and monetization

of video games, as well as virtual reality, metaverse and other

immersive experiences. We expect that, for these applications, it

will greatly lower the production cost and time for the game

developers in our digital ecosystem, including our own development

teams.

“To showcase our HotPlay IGA technology and generate near-term

revenue, our in-house game development studio is preparing to

launch 15 casual games, including Evergreen Forest, Rolly Loops,

Skyline Stack, Hook’n Hop, and Booster Maths. These games will have

cross-platform capability, and we plan to release them initially

through the Apple iOS and Android app stores before the end of the

year.

“We continued to advance our relationship with Triplecom Media

PVT Ltd., whose iTAP platform is a fast-growing over-the-top (OTT)

entertainment platform based in India. Upon execution of a

definitive agreement formalizing the relationship, we plan to

integrate iTAP’s entertainment and esports content into HotPlay’s

in-game advertising platform, thereby creating a unique opportunity

for us to enter India’s fast-growing entertainment segment of

hyper-casual games.

“Our recent acquisition of the goGame hyper-casual game

portfolio combined with our HotPlay in-game advertising solution

offers synergistic value to entertainment platforms like iTAP. We

believe that it can provide tremendous new revenue opportunities,

especially given iTAP’s rapidly growing user base in one of the

most populous countries in the world, second only to China at

approximately 1.4 billion people. We are planning for a commercial

launch with iTAP by the end of the year, subject to execution of

definitive agreements relating thereto.

“Our NextFinTech division, which comprises insurance,

reinsurance, online banking, and crypto portal operations, has also

been making strong progress. It is bringing forth a

diversified set of Fintech solutions to the market that we

anticipate will offer asset banking, asset management, mobile

payment, and a range of retail banking services for customers

around the world. As a result, it has been our most active division

in terms of new business development and revenue generation.

“A new online banking platform with a more robust core banking

system is scheduled to launch this summer. We expect the new

platform to drive significant acceleration in the number of new

customers, amount of deposits, and related revenue generation, with

this resulting in NextBank turning cash flow positive this

year.

“Due to the extensive investments we’ve made in our core

business over the past year, we believe we are well-positioned for

growth across our digital ecosystem of gaming, Adtech and Fintech.

We now offer highly differentiated digital solutions across several

global high-growth markets. We see our growth in fiscal 2023 being

driven by new HotPlay and NextBank deployments and product

adoption, with the goal of achieving positive cash flow and

profitability.”

Fiscal Q1 2023 Financial Summary

Revenue for the first quarter of fiscal 2023 totaled $467,000,

compared to no revenue in the same year-ago quarter. The increase

was driven by loan portfolio organic growth and increase in

financial services of NextBank. NextMedia, the company’s digital

interactive media division, had no revenue.

Operating expenses totaled $4.9 million, compared to $0.5

million in the same year-ago period. The increase was primarily due

to legal, consulting, and professional fees related to certain

pre-operating activities and employee expenses in the period.

Net loss attributable to the company was $5.7 million or $(0.05)

per basic and diluted share, as compared to a net loss of $0.4

million or $(0.01) per basic and diluted share in the same year-ago

period. The year-ago results only represent HotPlay’s

financials.

Cash and cash equivalents as of May 31, 2022 totaled $2.4

million, compared to $4.3 million on February 28, 2022. The

decrease in cash on hand was mainly from the cash out flow to

operating activities and certain cash classified as asset held for

sale.

The company’s Quarterly Report on Form 10-Q for the quarter

ended May 31, 2022, as well as other reports the company files with

the SEC, including reports on Forms 10-Q, 10-K and 8-K, can be

accessed at sec.gov and on NextPlay’s website in the IR

section.

About NextPlay Technologies

NextPlay Technologies, Inc. (Nasdaq: NXTP) is a technology

solutions company offering games, in-game advertising,

crypto-banking and banking services to consumers and corporations

within a growing worldwide digital ecosystem. NextPlay’s products

and services utilize innovative AdTech, Artificial Intelligence and

Fintech technologies to leverage the strengths and market channels

of its digital ecosystem. For more information about NextPlay

Technologies, visit www.nextplaytechnologies.com and follow us on

Twitter @NextPlayTech and LinkedIn.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of, and within the safe harbor provided by the Safe

Harbor Provisions of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements give our current expectations, opinions,

belief or forecasts of future events and performance. A statement

identified by the use of forward-looking words including “will,”

“may,” “expects,” “projects,” “anticipates,” “plans,” “believes,”

“estimate,” “should,” and certain of the other foregoing statements

may be deemed forward-looking statements. Although the Company

believes that the expectations reflected in such forward-looking

statements are reasonable, these statements involve risks and

uncertainties that may cause actual future activities and results

to be materially different from those suggested or described in

this news release. Factors that may cause such a difference include

risks and uncertainties including, and not limited to, TGS’ ability

to obtain shareholder approval of the NextTrip and

Reinhart/Zappware sale and related matters; the need for regulatory

approval of the sale and related items; the parties’ ability to

satisfy the closing conditions for such sale; our ability to

convert and distribute TGS common shares to our shareholders in the

future in a tax-efficient and cost-effective manner; our ability to

negotiate and enter into definitive agreements with those parties

that we have entered into preliminary non-binding agreements with;

our ability to effectively and efficiently integrate our recently

acquired assets into our business; our need for additional capital

which may not be available on commercially acceptable terms, if at

all, which raises questions about our ability to continue as a

going concern; current regulation governing digital currency

activity is often unclear and is evolving; the future development

and growth of digital currencies are subject to a variety of

factors that are difficult to predict and evaluate, many of which

are out of our control; the value of digital currency is volatile;

amounts owed to us by third parties which may not be paid timely,

if at all; certain amounts we owe under outstanding indebtedness,

which are secured by substantially all of our assets and penalties

we may incur in connection therewith; the fact that we have

significant indebtedness, which could adversely affect our business

and financial condition; uncertainty and illiquidity in credit and

capital markets which may impair our ability to obtain credit and

financing on acceptable terms and may adversely affect the

financial strength of our business partners; the officers and

directors of the Company have the ability to exercise significant

influence over the Company; stockholders may be diluted

significantly through our efforts to obtain financing, satisfy

obligations and complete acquisitions through the issuance of

additional shares of our common or preferred stock; if we are

unable to adapt to changes in technology, our business could be

harmed; if we do not adequately protect our intellectual property,

our ability to compete could be impaired; our business is

susceptible to risks associated with international operations;

unfavorable changes in, or interpretations of, government

regulations or taxation of the evolving Internet and e-commerce

industries, which could harm our operating results; risks

associated with the operations of, the business of, and the

regulation of, Longroot and NextBank International (formerly IFEB);

the market in which we participate being highly competitive, and

because of that we may be unable to compete successfully with our

current or future competitors; our potential inability to adapt to

changes in technology, which could harm our business; the

volatility of our stock price; and that we have incurred

significant losses to date and require additional capital, which

may not be available on commercially acceptable terms, if at all.

More information about the risks and uncertainties faced by

NextPlay are detailed from time to time in NextPlay’s periodic

reports filed with the SEC, including its most recent Annual Report

on Form 10-K and Quarterly Reports on Form 10-Q, under the headings

“Risk Factors”. These reports are available at www.sec.gov. Other

unknown or unpredictable factors also could have material adverse

effects on the Company’s future results and/or could cause our

actual results and financial condition to differ materially from

those indicated in the forward-looking statements. Investors are

cautioned that any forward-looking statements are not guarantees of

future performance and actual results or developments may differ

materially from those projected. The forward-looking statements in

this press release are made only as of the date hereof. The Company

takes no obligation to update or correct its own forward-looking

statements, except as required by law, or those prepared by fourth

parties that are not paid for by the Company. If we update one or

more forward-looking statements, no inference should be drawn that

we will make additional updates with respect to those or other

forward-looking statements.

The terms, structure and timing of the

proposed sale of NextTrip and the NextPlay’s 51% ownership of

Reinhart Digital TV to TGS Esports are outlined in the definitive

agreements entered into on June 28, 2022, and remain subject to a

number of items including (without limitation) TGS shareholder

approval of certain related matters, as well as regulatory

approvals and other customary closing conditions. Further details

regarding the sale can be found in NextPlay’s current report on

Form 8-K filed with the Securities and Exchange Commission on June

29, 2022, available at sec.gov and in the Investors section of the

company’s website.

SOURCE: NextPlay Technologies, Inc.

Company Contacts:Richard MarshallDirector of Corporate

DevelopmentNextPlay Technologies, Inc.Tel (954)

888-9779Email: richard.marshall@nextplaytechnologies.com

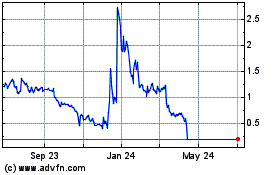

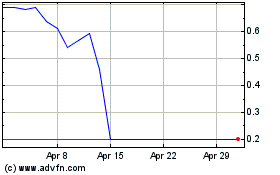

NextPlay Technologies (NASDAQ:NXTP)

Historical Stock Chart

From Mar 2024 to Apr 2024

NextPlay Technologies (NASDAQ:NXTP)

Historical Stock Chart

From Apr 2023 to Apr 2024