UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

NEXTPLAY TECHNOLOGIES, INC.

(Name

of Registrant as Specified In Its Charter)

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a- 6(i)(1) and 0-11

1560 Sawgrass Corporate Parkway, Suite 130

Sunrise, Florida 33323

(954) 888-9779

March 11, 2022

Dear Stockholder:

The board of directors (“Board”)

and officers of NextPlay Technologies, Inc., a Nevada corporation, join me in extending to you a cordial invitation to attend the 2022

Annual Meeting of our stockholders (the “Meeting”) to be held on April 22, 2022 at 9:00 a.m. Eastern Time (subject to postponement(s)

or adjournment(s) thereof). The Meeting will be held virtually via live audio webcast at https://agm.issuerdirect.com/nxtp (please note

this link is case sensitive). For further information about the virtual Meeting, please see the Questions and Answers about the Meeting

beginning on page 1 of our Proxy Statement.

In response to the COVID-19

pandemic and as part of our efforts to conserve environmental resources and prevent unnecessary corporate expense, we are using the “Notice

and Access” method of providing proxy materials to you via the Internet pursuant to the regulations promulgated by the U.S. Securities

and Exchange Commission. We believe that this process will provide you with a safe, convenient and efficient way to access your proxy

materials and vote your shares, while also allowing us to conserve natural resources and reduce the costs of printing and distributing

the proxy materials for the Meeting by postal mail. On or about March 11, 2022, we are mailing to our stockholders a one-page Notice

of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and

vote by mail or fax, or electronically via telephone or the Internet. The Notice will also contain instructions on how to receive a paper

copy of your proxy materials.

Details of the business to

be conducted at the Meeting are described in the Notice and in the accompanying Proxy Statement. We have also made a copy of our Annual

Report on Form 10-K for the year ended February 28, 2021 (the “Annual Report”) available with our Proxy Statement. We encourage

you to read our Annual Report. It includes our audited financial statements and provides information about our business. Please give this

information your careful attention.

Whether or not you attend

the Meeting, it is important that your shares be represented and voted. You may submit your vote on the Internet or by fax, telephone

or mail. Please refer to the Notice for instructions on submitting your vote. If you decide to attend the virtual Meeting, you will also

be able to submit your votes, as well as any questions that you may have, during the Meeting through the designated website, even if you

have previously submitted your proxy. Voting at the Meeting will supersede any votes previously cast.

Our Board has unanimously

approved the proposals set forth in the Proxy Statement and we recommend that you vote in favor of each such proposal.

We look forward to seeing

you (virtually) on April 22, 2022. Your vote and participation in our governance is very important to us.

Sincerely,

| /s/ John Todd Bonner |

|

| John Todd Bonner |

|

| Chairman |

|

1560 Sawgrass Corporate Parkway, Suite 130

Sunrise, Florida 33323

(954) 888-9779

NOTICE OF THE 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 22, 2022

To the Stockholders of NextPlay Technologies,

Inc.:

We are pleased to provide

you notice of, and to invite you to attend, the 2022 Annual Meeting of the stockholders (the “Meeting”) of NextPlay Technologies,

Inc., a Nevada corporation (“NextPlay,” the “Company,” “we,” and “us”), which will be

held on April 22, 2022 at 9:00 a.m. Eastern Time (subject to postponement(s) or adjournment(s) thereof). The Meeting will be held virtually

via live audio webcast at https://agm.issuerdirect.com/nxtp (please note this link is case sensitive). See also “Instructions for

the Virtual Meeting,” beginning on page 1 of our Proxy Statement for additional information regarding attending the virtual Meeting.

The Meeting is being held for the following purposes:

1. To elect ten directors

to hold office until our next annual meeting of stockholders or until their successors are duly elected and qualified, subject to prior

death, resignation, or removal;

2. To ratify the selection

of TPS Thayer, LLC as the Company’s independent registered public accounting firm for the fiscal year ending February 28, 2022;

3. To consider

and vote upon a proposal to approve, in accordance with Nasdaq Listing Rule 5635(d), an amendment to the exercise price provisions of

those warrants issued in connection with a registered direct offering of the Company’s securities pursuant to that Stock Purchase

Agreement entered into by and among the Company and certain investors on November 1, 2021, and specifically to remove the $1.97 floor

price (the “Floor Price”) of the warrants such that the exercise price of the warrants may be reduced below the Floor Price

in the event that the Company issues or enters into any agreement to issue securities for consideration less than the then current exercise

price of the warrants;

4. To consider and vote upon

a proposal to authorize our board of directors (the “Board”), in its discretion, to adjourn the Meeting to another place,

or a later date or dates, if necessary or appropriate, to solicit additional proxies in favor of the proposals listed above at the time

of the Meeting; and

5. To transact such other

business as may properly come before the Meeting or any adjournment or postponement thereof.

The matters are more fully

discussed in the attached Proxy Statement. Any action may be taken on any one of the foregoing proposals at the Meeting on the date specified

above or on any date or dates to which the meeting may be postponed or adjourned. We do not expect to transact any other business at the

Meeting.

Our Board recommends that

you vote your shares “For” each of the director nominees identified in Proposal 1 and “For” each

of the other foregoing proposals.

We have elected to provide

access to our proxy materials primarily electronically via the Internet, pursuant to the “Notice and Access” method regulations

promulgated by the U.S. Securities and Exchange Commission. We believe this method expedites our stockholders’ safe receipt of proxy

materials while the COVID-19 pandemic remains a concern, conserves natural resources and significantly reduces the costs of the Meeting.

On or about March 11, 2022, we are mailing a one-page Notice of Internet Availability of Proxy Materials (the “Notice”)

to each of our stockholders entitled to notice of and to vote at the Meeting, which Notice contains instructions for accessing the attached

Proxy Statement, our Annual Report on Form 10-K for our fiscal year ended February 28, 2021 (the “Annual Report”) via the

Internet, as well as voting instructions. The Notice also includes instructions on how you can receive a paper copy of your proxy materials.

The Proxy Statement and the Annual Report are both available on the Internet at: https://www.nextplaytechnologies.com/investors/sec-filings.

Our Board has fixed the close

of business on February 24, 2022 as the record date for determining those stockholders entitled to notice of, and to vote at, the

Meeting and any adjournment or postponement thereof. Accordingly, only stockholders of record at the close of business on that date are

entitled to notice of, and to vote at, the Meeting. A complete list of our stockholders entitled to vote at the Meeting will be available

for examination at our offices in Sunrise, Florida, during ordinary business hours for a period of 10 days prior to the Meeting.

We cordially invite you to

virtually attend the virtual Meeting. Your vote is important no matter how large or small your holdings in the Company may be. If you

do not expect to be present at the Meeting virtually, you are urged to promptly complete, date, sign, and return the proxy card or submit

your vote using another method included in the Notice you received in the mail. If you hold your shares beneficially in street name through

a nominee, you should follow the instructions you receive from your nominee to vote these shares. Please review the instructions on each

of your voting options described in the enclosed Proxy Statement as well as in the Notice you received in the mail. This will not limit

your right to virtually attend or vote at the Meeting, but will help to secure a quorum and avoid added solicitation costs. You may revoke

your proxy at any time before it has been voted at the Meeting.

Even if you plan to attend

the virtual Meeting, we request that you submit a proxy by following the instructions provided in the Notice you received in the mail

as soon as possible in order to ensure that your shares will be represented at the Meeting if you are unable to attend.

| By Order of the Board of Directors |

|

| |

|

| /s/ John Todd Bonner |

|

| John Todd Bonner |

|

| Chairman |

|

Sunrise, Florida

March 11, 2022

| IMPORTANT: WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, WE ASK YOU TO VOTE BY TELEPHONE, MAIL, FAX OR ON THE INTERNET USING THE INSTRUCTIONS PROVIDED IN THE NOTICE. |

TABLE OF CONTENTS

PROXY STATEMENT

FOR 2022 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

The enclosed proxy is solicited

on behalf of the Board of Directors (the “Board”) of NextPlay Technologies, Inc. (“NextPlay,” “we,”

“us,” “our” or the “Company”) for use in connection with the Company’s solicitation of proxies

for use at our 2022 Annual Meeting of our stockholders (the “Meeting”) to be held on April 22, 2022, at 9:00 a.m. Eastern

Time, and at any postponement(s) or adjournment(s) thereof. The Meeting will be held virtually via live audio webcast at https://agm.issuerdirect.com/nxtp

(please note this link is case sensitive). See also “Instructions for the Virtual Meeting,” beginning on page 1 of this Proxy

Statement for additional information regarding attending the virtual Meeting.

We have elected to provide

access to the proxy materials for the Meeting primarily over the Internet in accordance with the U.S. Securities and Exchange Commission’s

(the “SEC”) “Notice and Access” rules. On or about March 11, 2022, we are mailing a one-page Notice of Internet

Availability of Proxy Materials (the “Notice”) to each of our stockholders entitled to notice of and to vote at the Meeting.

The Notice contains instructions for accessing this Proxy Statement, our Annual Report on Form 10-K for our fiscal year ended February

28, 2021 (our “Annual Report”) and Meeting voting instructions. The Notice also includes instructions on how you can receive

a paper copy of your proxy materials by postal mail.

The Proxy Statement will also

be accessible online on or about March 11, 2022 at: https://www.nextplaytechnologies.com/investors/sec-filings/. You are invited to

attend the Meeting and are requested to vote on the proposals described in this Proxy Statement.

Information Contained In This Proxy Statement

The information contained

in this Proxy Statement relates to the proposals to be voted on at the Meeting, the voting process, ownership of our outstanding securities,

and certain other required information.

Instructions For The Virtual Meeting

The Meeting will be a completely

virtual meeting. There will be no physical meeting location. The Meeting will only be conducted via live audio webcast.

To participate in the virtual

Meeting, visit https://agm.issuerdirect.com/nxtp (please note this link is case sensitive) and enter the control number on your proxy

card, or on the instructions included in the Notice that you received in the mail.

You may vote during the Meeting

by following the instructions available on the Meeting website during the Meeting. To the best of our knowledge, the virtual meeting platform

is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and

cell phones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong Internet

connection wherever they intend to participate in the meeting. Participants should also allow plenty of time to log in and ensure that

they can hear streaming audio prior to the start of the meeting.

Questions pertinent to meeting

matters will be answered during the Meeting, subject to time constraints. Questions which are not pertinent to Meeting matters will not

be answered.

Important Notice Regarding the Availability

of Proxy Materials

Pursuant to rules adopted

by the SEC, we have elected to use the Internet as the primary means of furnishing proxy materials to our stockholders. Accordingly, we

are mailing a Notice to each of our stockholders entitled to notice of and to vote at the Meeting. All stockholders will have the ability

to access the proxy materials (including our Annual Report, which does not constitute a part of, and shall not be deemed incorporated

by reference into, this Proxy Statement or the enclosed form of proxy, except as otherwise stated in this Proxy Statement) via the Internet

at https://www.iproxydirect.com/nxtp or request a printed set of the proxy materials. Instructions on how to access the proxy

materials over the Internet or to request a printed copy may be found in the Notice. The Notice contains a control number that you will

need to vote your shares. Please keep the Notice for your reference through the date of the Meeting. In addition, stockholders may request

to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We encourage our stockholders to take

advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our Meetings.

Record Date and Shares Entitled to Vote

Our Board has fixed the

close of business on February 24, 2022, as the record date for determining the holders of shares of our common stock entitled to

receive notice of and to vote at the Meeting and any adjournments or postponements thereof. Only holders of record of shares of our

common stock at the close of business on that date will be entitled to vote at the Meeting and at any adjournment or postponement

thereof. As of the record date, there were 114,060,020 shares of our common stock issued and outstanding and entitled to vote

at the Meeting, which shares were held by approximately 510 holders of record.

Each share of common stock is

entitled to one vote on each proposal presented at the Meeting and at any adjournment or postponement thereof, for 114,060,020 total

voting shares.

In order for us to satisfy

our quorum requirements, the holders of at least 33 1/3% of our total number of outstanding voting shares entitled to vote at the Meeting

must be present. You will be deemed to be present if you attend the Meeting or if you submit a proxy (including through the mail, by fax

or by telephone or the Internet) that is received at or prior to the Meeting (and not revoked).

If your proxy is properly

executed and received by us in time to be voted at the Meeting, the shares represented by your proxy (including those given through the

mail, by fax or by telephone or the Internet) will be voted in accordance with your instructions. If you execute your proxy but do not

provide us with any instructions, your shares will be voted “For” each of the director nominees identified in Proposal

1 and “For” each of the other proposals set forth in this Proxy Statement, or as otherwise determined by the proxies.

The only matters that we expect

to be presented at our Meeting are set forth in this Proxy Statement. If any other matters properly come before the Meeting, the persons

named in the proxy card will vote the shares represented by all properly executed proxies on such matters in their best judgment.

Voting Process

If you are a stockholder of record, there are

five ways to vote:

| |

● |

At the virtual Meeting. You may vote during the Meeting by following the instructions available on the Meeting website during the Meeting. |

| |

● |

Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the Notice you received. |

| |

● |

By Telephone. You may vote by proxy by calling the toll-free number found on the Notice you received. |

| |

● |

By Fax. If you requested to receive printed proxy materials, you may vote by proxy by faxing your proxy to the number found on the proxy card. |

| |

● |

By Mail. If you requested to receive printed proxy materials, you may vote by proxy by filling out the proxy card and returning it in the postage-paid envelope provided. |

Revocability of Proxies

The presence of a stockholder

at our Meeting will not automatically revoke that stockholder’s proxy. However, a stockholder may revoke their proxy at any time

prior to its exercise by:

| |

● |

submitting a written revocation prior to the Meeting to the Corporate Secretary, NextPlay Technologies, Inc., 1560 Sawgrass Corporate Parkway, Suite 130, Sunrise, Florida 33323; |

| |

|

|

| |

● |

submitting another signed and later dated proxy card and returning it by mail or fax in time to be received before our Meeting or by submitting a later dated proxy by the Internet or telephone prior to the Meeting; or |

| |

|

|

| |

● |

attending the Meeting and voting by following the instructions available on the meeting website during the Meeting. |

Attendance at the Meeting

Attendance at the Meeting

is limited to holders of record of our common stock at the close of business on the record date, February 24, 2022, and our guests. You

will be asked to provide your control number in order to be admitted into the Meeting. If your shares are held in the name of a bank,

broker, or other nominee and you plan to attend the Meeting, you must obtain your control number from such bank, broker, or other nominee,

or contact Issuer Direct Corporation at (919) 447-3740, or 1-866-752-VOTE (8683) to obtain your control number, in order to be admitted.

No recording of the Meeting will be permitted. At the Meeting, our stockholders will be afforded a reasonable opportunity to participate

in the Meeting and to vote on matters submitted to the stockholders, including an opportunity to communicate, and to read or hear the

proceedings of the meetings in a substantially concurrent manner with such proceedings.

Conduct at the Meeting

The Chairman of the Meeting

has broad responsibility and legal authority to conduct the Meeting in an orderly and timely manner. This authority includes establishing

rules for stockholders who wish to address the Meeting. Only stockholders or their valid proxy holders may address the Meeting. The Chairman

may exercise broad discretion in recognizing stockholders who wish to speak and in determining the extent of discussion on each item of

business. In light of the number of stockholders of the Company and the need to conclude the Meeting within a reasonable period of time,

we cannot ensure you that every stockholder who wishes to speak on an item of business will be able to do so.

Quorum

Our Bylaws, as amended, provide

that the presence of 33 1/3% of the outstanding shares of our capital stock entitled to vote at a meeting, represented in person (including

virtually) or by proxy, constitutes a quorum at a meeting of our stockholders. If you vote at the Meeting or by proxy at our Meeting,

your shares will be counted for purposes of determining whether there is a quorum at the Meeting. Shares of our capital stock present

in person (including virtually) or by proxy at our Meeting that are entitled to vote will be counted for the purpose of determining

whether there is a quorum for the transaction of business at the Meeting.

Voting Requirements for Each of the Proposals

| |

Proposal |

|

Vote Required |

|

Broker

Discretionary

Voting

Allowed* |

|

1. |

To elect ten directors to hold office until our

next annual meeting of stockholders or until their successors are duly elected and qualified, subject to prior death, resignation, or

removal.

|

|

The plurality of the votes cast. This means that

the nominees receiving the highest number of affirmative (“FOR”) votes (among votes properly cast virtually or by proxy)

will be elected as directors. |

|

No |

| |

|

|

|

|

|

| 2. |

To ratify the selection of TPS Thayer, LLC as the Company’s independent registered public accounting firm for the fiscal year ending February 28, 2022. |

|

A majority of the votes cast on the proposal. |

|

Yes |

| |

|

|

|

|

|

| 3. |

Approval, in accordance with Nasdaq Listing Rule

5635(d), of an amendment to the exercise price provisions of those warrants issued in connection with a registered direct offering of

the Company’s securities pursuant to that Stock Purchase Agreement entered into by and among the Company and certain investors on

November 1, 2021, and specifically to remove the $1.97 floor (the “Floor Price”) of the warrants such that the exercise price

of the warrants may be reduced below the Floor Price in the event that the Company issues or enters into any agreement to issue securities

for consideration less than the then current exercise price of the warrants (the “Warrant Amendment”).

|

|

A majority of the votes cast on the proposal. |

|

No |

| 4. |

Authorization of our Board, in its discretion, to adjourn the Meeting to another place, or a later date or dates, if necessary or appropriate, to solicit additional proxies in favor of the proposals listed above at the time of the Meeting. |

|

Majority of the shares of stock entitled to vote which are present, in person (including virtually) or by proxy, at the Meeting. |

|

No |

| * |

See also “Quorum; Broker Non-Votes and Abstentions,” below. |

Broker Non-Votes and Abstentions

The presence at the Meeting

of the holders of 33 1/3% of the outstanding shares of voting stock entitled to vote at the Meeting is necessary to constitute a quorum.

Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present.

The election of directors

requires a plurality of the votes cast at the Meeting. Broker Non-Votes will have no effect on the outcome of Proposal 1. Although our

stockholders will not have the option to “Abstain” from voting on Proposal 1, they may elect to “Withhold” their

votes for any or all of the director nominees. Withheld votes will not have any effect on the outcome of Proposal 1.

Only “For”

and “Against” votes are counted for purposes of determining the votes received in connection with Proposals 2 and 3.

Broker non-votes and abstentions will not be counted as votes cast, and will have no effect on determining whether the affirmative vote

constitutes a majority of the votes cast at the Meeting for Proposals 2 and 3. However, approval of these proposals requires the affirmative

vote of a majority of the votes cast on such proposals, and therefore broker non-votes and abstentions could prevent the approval of these

proposals because they do not count as affirmative votes.

Proposal 4 requires the affirmative

(“For”) vote of a majority of the shares of stock entitled to vote which are present, in person (including virtually)

or by proxy, at the Meeting. Broker non-votes will not have any effect on the outcome of Proposal 4. Abstentions will be treated as a

vote “Against” Proposal 4.

In order to minimize the number

of broker non-votes, the Company encourages you to vote or to provide voting instructions to the organization that holds your shares by

carefully following the instructions provided in the proxy materials that you receive.

If a broker indicates on the

proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will not be considered

as present and entitled to vote with respect to that matter. For your vote to be counted, you must submit your voting instruction form

to your broker.

As described above, although

the Company will include abstentions and broker non-votes as present or represented for purposes of establishing a quorum for the transaction

of business, the Company intends to exclude abstentions and broker non-votes from the tabulation of voting results on any issues requiring

approval of a majority of the votes cast (Proposals 2 and 3).

Dissenters’ Rights

Dissenters’ rights are

not available with respect to any of the proposals to be voted on at the Meeting.

Board of Directors Voting Recommendations

Our Board recommends that

you vote your shares:

| |

● |

“FOR” each of the director nominees identified in Proposal 1, each to hold office until our next annual meeting of stockholders or until their successors are duly elected and qualified, subject to prior death, resignation, or removal (Proposal 1); |

| |

|

|

| |

● |

“FOR” the ratification of the appointment of TPS Thayer, LLC as the Company’s independent registered public accounting firm for the fiscal year ending on February 28, 2022 (Proposal 2); |

| |

|

|

| |

● |

“FOR” the approval, in accordance with Nasdaq Listing Rule 5635(d), of the Warrant Amendment (Proposal 3); and |

| |

|

|

| |

● |

“FOR” authorization of our Board, in its discretion, to adjourn the Meeting to another place, or a later date or dates, if necessary or appropriate, to solicit additional proxies in favor of the proposals listed above at the time of the Meeting (Proposal 4). |

Mailing Costs and Solicitation of Proxies

In addition to solicitation

by use of the mail, certain of our officers and employees may solicit the return of proxies personally or by telephone, electronic mail

or facsimile. We have not and do not anticipate retaining a third-party proxy solicitation firm to solicit proxies on behalf of the Board.

The cost of any solicitation of proxies will be borne by us. Arrangements may also be made with brokerage firms and other custodians,

nominees and fiduciaries for the forwarding of material to, and solicitation of proxies from, the beneficial owners of our securities

held of record at the close of business on the record date by such persons. We will reimburse such brokerage firms, custodians, nominees

and fiduciaries for the reasonable out-of-pocket expenses incurred by them in connection with any such activities.

Inspector of Voting

It is anticipated that representatives

of Issuer Direct Corporation or our legal counsel will tabulate the votes and act as inspector of election at the Meeting.

Stockholders Entitled to Vote at the Meeting

A complete list of stockholders

entitled to vote at the Meeting will be available to view during the Meeting. You may also access this list at our principal executive

offices, for any purpose germane to the Meeting, during ordinary business hours, for a period of ten days prior to the Meeting.

Voting Instructions

Your vote is very important.

Whether or not you plan to attend the Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions

as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions included on the Notice you

received in the mail and the enclosed proxy card.

Confidential Voting

Independent inspectors count

the votes. Your individual vote is kept confidential from us unless special circumstances exist. For example, a copy of your proxy card

will be sent to us if you write comments on the card, as necessary to meet applicable legal requirements, or to assert or defend claims

for or against the Company.

Stockholder of Record and Shares Held in

Brokerage Accounts

If on the record date, your

shares were registered in your name with our transfer agent, then you are a stockholder of record and you may vote at the Meeting, by

proxy or by any other means supported by us. If on the record date your shares were held in an account at a brokerage firm, bank, dealer,

or other similar organization, then you are the beneficial owner of shares held in “street name” and the Proxy Statement is

required to be forwarded to you by that organization. The organization holding your account is considered the stockholder of record for

purposes of voting at the Meeting. As a beneficial owner, you have the right to direct your broker or, other agent on how to vote the

shares in your account. You are also invited to attend the Meeting. However, you must obtain your control number from such bank, broker,

or other nominee, or contact Issuer Direct Corporation at (919) 447-3740, or 1-866-752-VOTE (8683) to obtain your control number, in order

to be admitted and since you are not the stockholder of record, you may not vote your shares by following the instructions available on

the Meeting website during the Meeting, unless you request and obtain a valid proxy from your broker or, other agent.

Multiple Stockholders Sharing the Same Address

In some cases, one copy of

this Proxy Statement and the accompanying notice of meeting of stockholders is being delivered to multiple stockholders sharing an address.

We will deliver promptly, upon written or oral request, a separate copy of this Proxy Statement or the accompanying notice of meeting

of stockholders to such a stockholder at a shared address to which a single copy of the document was delivered. Stockholders sharing an

address may also submit requests for delivery of a single copy of this Proxy Statement or the accompanying notice of meeting of stockholders,

but in such event will still receive separate forms of the proxy for each stockholder account. To request separate or single delivery

of these materials now or in the future, a stockholder may submit a written request to our Controller at our principal executive offices

at 1560 Sawgrass Corporate Parkway, Suite 130, Sunrise, Florida 33323, or a stockholder may make a request by calling our Controller at

(954) 888-9779.

If you receive more than one

set of proxy materials, it means that your shares are registered differently and are held in more than one account. To ensure that all

shares are voted, please either vote each account as discussed above under the section of this Proxy Statement entitled “Voting

Process,” or sign and return by mail all proxy cards or voting instruction forms.

Voting Results

The final voting results will

be tallied by the inspector of voting and published in our Current Report on Form 8-K, which we are required to file with the SEC within

four business days following the Meeting.

Company Mailing Address

The mailing address of our

principal executive offices is 1560 Sawgrass Corporate Parkway, Suite 130, Sunrise, Florida 33323.

Other Matters

As of the date of this Proxy

Statement, our Board is not aware of any business to be presented at the Meeting other than as set forth in the proxy materials that have

been mailed to you. If any other matters should properly come before the Meeting, it is intended that the shares represented by proxies

will be voted with respect to such matters in accordance with the judgment of the persons voting the proxies.

FORWARD LOOKING STATEMENTS

Statements in this Proxy Statement

that are “forward-looking statements” are based on current expectations and assumptions that are subject to risks and uncertainties.

In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “should,”

“potential,” “continue,” “expects,” “anticipates,” “intends,” “plans,”

“believes,” “estimates,” and similar expressions. These forward-looking statements are based on our current estimates

and assumptions and, as such, involve uncertainty and risk. Actual results could differ materially from projected results.

We do not assume any obligation

to update information contained in this document, except as required by applicable laws. Although this Proxy Statement may remain available

on our website or elsewhere, its continued availability does not indicate that we are reaffirming or confirming any of the information

contained herein. Neither our website nor its contents are a part of this Proxy Statement.

PROPOSAL 1

ELECTION OF DIRECTORS

Nomination of Directors

The Nominating and Corporate

Governance Committee of the Board (the “Nominating Committee”) is charged with making recommendations to the Board regarding

qualified candidates to serve as members of the Board. The Nominating Committee’s goal is to assemble a board of directors with

the skills and characteristics that, taken as a whole, will assure a strong board of directors with experience and expertise in all aspects

of corporate governance. Accordingly, the Nominating Committee believes that candidates for director should have certain minimum qualifications,

seeks to achieve a balance of knowledge, experience and capability on the Board and Board committees and to identify individuals who can

effectively assist the Company in achieving our short-term and long-term goals, protecting our stockholders’ interests and creating

and enhancing value for our stockholders. In so doing, the Nominating Committee considers a person’s diversity attributes (e.g.,

professional experiences, skills, background, race and gender) as a whole and does not necessarily attribute any greater weight to

one attribute. Moreover, diversity in professional experience, skills and background, and diversity in race and gender, are just a few

of the attributes that the Nominating Committee takes into account. In evaluating prospective candidates, the Nominating Committee also

considers whether the individual has personal and professional integrity, good business judgment and relevant experience and skills, and

whether such individual is willing and able to commit the time necessary for Board and Board committee service.

While there are no specific

minimum requirements that the Nominating Committee believes must be met by a prospective director nominee, the Nominating Committee does

believe that director nominees should possess personal and professional integrity, have good business judgment, have relevant experience

and skills, and be willing and able to commit the necessary time for Board and Board committee service. The Company does not have a formal

diversity policy. However, the Nominating Committee evaluates each individual in the context of the Board as a whole, with the objective

of recommending individuals that can best perpetuate the success of our business and represent stockholder interests through the exercise

of sound business judgment using their diversity of experience in various areas. We believe our current directors possess diverse professional

experiences, skills and backgrounds, in addition to (among other characteristics) high standards of personal and professional ethics,

proven records of success in their respective fields, and valuable knowledge of our business and our industry.

The Nominating Committee uses

a variety of methods for identifying and evaluating director nominees. The Nominating Committee also regularly assesses the appropriate

size of the Board and whether any vacancies on the Board are expected due to retirement or other circumstances. In addition, the Nominating

Committee considers, from time to time, various potential candidates for directorships. Candidates may come to the attention of the Nominating

Committee through current Board members, professional search firms, stockholders or other persons. These candidates may be evaluated at

regular or special meetings of the Nominating Committee and may be considered at any point during the year.

The Nominating Committee evaluates

director nominees at regular or special committee meetings pursuant to the criteria described above and reviews qualified director nominees

with the Board. The Nominating Committee selects nominees that best suit the Board’s current needs and recommends one or more of

such individuals for election to the Board.

The Nominating Committee will

consider candidates recommended by stockholders, provided the names of such persons, accompanied by relevant biographical information,

and other information as required by the Company’s Bylaws, are properly submitted in writing to the Secretary of the Company in

accordance with the Bylaws and applicable law. The Secretary will send properly submitted stockholder recommendations to the Nominating

Committee. Individuals recommended by stockholders in accordance with these procedures will receive the same consideration received by

individuals identified to the Nominating Committee through other means. The Nominating Committee also may, in its discretion, consider

candidates otherwise recommended by stockholders without accompanying biographical information, if submitted in writing to the Secretary.

There currently are no legal

proceedings, and during the past ten years there have been no legal proceedings, that are material to the evaluation of the ability or

integrity of any of our directors or director nominees. There are no material proceedings to which any director, officer, affiliate, or

owner of record or beneficially of more than 5% of any class of voting securities of the Company, or any associates of any such persons,

is a party adverse to the Company or any of our subsidiaries, and none of such persons has a material interest adverse to the Company

or any of its subsidiaries. Other than as disclosed below, during the last five years, none of our directors held any other directorships

in any company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company

under the Investment Company Act of 1940.

The Nominating Committee has

recommended, and the Board has nominated, J. Todd Bonner, Nithinan Boonyawattanapisut, William Kerby, Donald P. Monaco, Athid Nanthawaroon,

Carmen Diges, Komson Kaewkham, Yoshihiro Obata, Farooq Moosa, and Edward Terrance Gardner, Jr. as nominees for election as members of

our Board at the Meeting for a period of one year or until such director’s successor is elected and qualified, subject to such director’s

earlier death, resignation, or removal. Each of the nominees is currently a director of the Company. At the Meeting, ten directors will

be elected to the Board.

We believe that each of our

directors possesses high standards of personal and professional ethics, character, integrity and values; an inquisitive and objective

perspective; practical wisdom; mature judgment; diversity in professional experience, skills and background and a proven record of success

in their respective fields; and valuable knowledge of our business and industry. Moreover, each of our directors is willing to devote

sufficient time to carrying out his or her duties and responsibilities effectively and is committed to serving us and our stockholders.

Information regarding the director nominees, including a brief description of the specific experiences, qualifications and skills attributable

to each of our director nominees that led the Board, as of the date of this Proxy Statement, to its conclusion that such director should

serve as a director of the Company are included below.

Arrangements Related to the Nomination of

Directors

On or around February 22,

2021, Red Anchor Trading Corporation, T&B Media Global (Thailand) Company Limited, Tree Roots Entertainment Group Co., Ltd. and Dees

Supreme Company Limited (collectively, the “HotPlay Stockholders”), representing all of the stockholders of HotPlay Enterprise

Limited (“HotPlay”), and Nithinan Boonyawattanapisut, J. Todd Bonner, Athid Nanthawaroon and Komson Kaewkham, each HotPlay

nominees, entered into a Voting Agreement with William Kerby and Donald P. Monaco (the “Voting Agreement”). Pursuant to the

Voting Agreement, each of the HotPlay Stockholders agreed to vote all voting shares of the Company which they hold and may hold in the

future (during the term of the agreement) to elect Mr. Kerby and Mr. Monaco to the Board, and each of the HotPlay nominees agreed to continue

to nominate each of Mr. Kerby and Mr. Monaco to the Board. The agreement continues in effect until the earlier of February 26, 2026, the

date of both Mr. Kerby’s and Mr. Monaco’s death, or the date that both Mr. Kerby and Mr. Monaco have provided notice of termination

to such HotPlay Stockholders.

Other than pursuant to the

Voting Agreement, there are no arrangements or understandings between any of our current directors, nominees for directors or officers,

and any other person pursuant to which any director, nominee for director, or officer was or is to be selected as a director, nominee

or officer, as applicable.

Information Regarding Directors

| Name |

|

Age |

|

Positions and Offices Held |

|

Director Since |

| J. Todd Bonner |

|

55 |

|

Chairman of the Board |

|

2021 |

| Nithinan Boonyawattanapisut |

|

38 |

|

Co-Chief Executive Officer and Director |

|

2021 |

| William Kerby |

|

64 |

|

Co-Chief Executive Officer and Director |

|

2008 |

| Donald P. Monaco |

|

69 |

|

Director |

|

2011 |

| Athid Nanthawaroon |

|

40 |

|

Director |

|

2021 |

| Carmen Diges |

|

51 |

|

Director |

|

2021 |

| Komson Kaewkham |

|

40 |

|

Director |

|

2021 |

| Yoshihiro Obata |

|

60 |

|

Director |

|

2021 |

| Farooq Moosa |

|

51 |

|

Director |

|

2021 |

| Edward Terrence Gardner, Jr. |

|

56 |

|

Director |

|

2021 |

J. Todd Bonner, age 55, Chairman of the Board

Mr. Bonner has served as Chairman

of the Board since the Company’s acquisition of HotPlay on June 30, 2021 (serving as Co-Chairman of the Board from June 2021 to

December 2021). Mr. Bonner co-founded HotPlay, an in-game advertising platform, and HotPlay Thailand in March 2020, and is currently the

Chairman of HotPlay Thailand. He is also a member of the Board of Directors of Axion Ventures Inc., an online video gaming and technology

company listed on the TSX Venture Exchange, which he co-founded in May 2016. During that time, he started True Axion Interactive, a game

studio formed via a joint venture with True Corporation, a major Thai telecommunication company, in April 2017. In March 2012, he co-founded

Red Anchor Trading Corporation as an incubator for developing applications and predictive algorithms based on crowdsourced data. Mr. Bonner

founded independent AAA games studio Axion games, which was formerly Epic Games China, in 2006. In July 2003, Mr. Bonner founded Northstar

Pacific Partners, an Indonesia Merchant Bank, and served as Partner until September 2005. Northstar Pacific Partners has since grown into

a $2.2 billion private equity fund. Prior to that, Mr. Bonner co-founded Pacific Century CyberWorks in June 2000, where he served as the

company’s Japan based CEO from March 2001 to September 2003. During that time, he raised $2.4 billion to acquire Hong Kong Telecom,

which remains one of the largest acquisitions in Asian history. Mr. Bonner also serves as a member of the Board of Directors of Longroot

Cayman. Mr. Bonner graduated from Stanford University in June 1989 with a degree in Biology and Biomedical Sciences.

We believe that Mr. Bonner’s

knowledge of the industries that the Company operates in, familiarity with the Company’s business and technologies, and experience

founding and growing companies make him a qualified candidate for the Board.

Nithinan “Jess” Boonyawattanapisut,

age 38, Co-Chief Executive Officer and Director

Ms. Boonyawattanapisut has

served as a director on our Board and as Co-Chief Executive Officer of the Company since the Company’s acquisition of HotPlay on

June 30, 2021. Ms. Boonyawattanapisut has was the Co-Founder and Managing Director of HotPlay, an in-game advertising platform, and HotPlay

Thailand, from March 2020 until June 30, 2021. Since April 2017, Ms. Boonyawattanapisut has been serving as the Managing Director of Axion

Games, Inc., an online video gaming and technology company, and leads the content investment arm of Axion Games, Inc. She has

also been serving as the Chief Executive Officer and Chairperson of the Board at True Axion Interactive, a game studio formed via

a joint venture with True Corporation, a major Thai telecommunication company, since she co-founded it in March 2017. In June 2014, Ms.

Boonyawattanapisut founded HotNow (Thailand) Company Limited, a hyper-local promotion discovery platform and has served as the Chief Executive

Officer since its inception. In March 2012, she co-founded Red Anchor Trading Corporation, an incubator for developing applications and

predictive algorithms based on crowdsourced data. In July 2006, Ms. Boonyawattanapisut co-founded the independent AAA games

studio, Epic Games China, which later consolidated as Axion Games Limited in 2014, and where Ms. Boonyawattanapisut currently serves

as Director. Ms. Boonyawattanapisut graduated from Mahidol University with a Bachelor of Business Administration in International Business.

We believe that Ms. Boonyawattanapisut’s

knowledge of the industries that the Company operates in, status as the Company’s Co-Chief Executive Officer, familiarity with the

Company’s business and technologies, and experience founding and growing companies make her a qualified candidate for the Board.

William Kerby, age 64, Co-Chief Executive Officer

and Director

William Kerby is the founder,

Co-Chief Executive Officer, and a director of the Company. From July 2008 to present, he has been the architect of the NextPlay model,

overseeing the development and operations of the Travel, Real Estate and Television Media divisions of the Company. In October 2012, the

Company transferred its real estate assets into a public company - Verus International, Inc., formerly Realbiz Media Group, Inc., where

Mr. Kerby served as Chief Executive Officer until August 2015 and on the board of directors until April of 2016. In July 2015, the decision

was made to separate the Television and Real Estate operations from the Company, thereby allowing management to focus all efforts on the

development of its Travel division. From April 2002 to July 2008, Mr. Kerby served as the Chief Executive Officer of various media and

travel entities that ultimately became part of Extraordinary Vacations Group. Operations included Cruise & Vacation Shoppes, Maupintour

Extraordinary Vacations, Attaché Travel and the Travel Magazine - a TV series of 160 travel shows. From February 1999 to April

2002, Mr. Kerby founded and managed Travelbyus, a publicly- traded company on the TSX and NASD Small Cap. The launch included an intellectually

patented travel model that utilized technology-based marketing to promote its travel services and products. Mr. Kerby negotiated the acquisition

and financing of 21 companies encompassing multiple tour operators, 2,100 travel agencies, media that included print, television, outdoor

billboard and wireless applications and leading-edge technology in order to build and complete the Travelbyus model. The company had over

500 employees, gross revenues exceeding $3 billion and a Market Cap over $900 million. From June 1989 to January 1999, Mr. Kerby founded

and grew Leisure Canada – a company that included the Master Franchise for Thrifty Car Rental British Columbia, TravelPlus (a nationwide

Travel Agency), Bluebird Holidays (an international tour company with operations in the U.S., Canada, Great Brittan, France, South Africa

and the South Pacific) and Canadian Traveler (a travel magazine). Leisure Canada was acquired in May 1998 by Wilton Properties, a

Canadian company developing hotel and resort properties in Cuba. From October 1980 through June 1989, Mr. Kerby worked in the financial

industry as an investment advisor. Mr. Kerby also serves as a member of the Board of Directors of Longroot Cayman. Mr. Kerby graduated

from York University in May 1980 with a Specialized Honors Economics degree.

We believe that Mr. Kerby’s

knowledge of the travel and leisure industry, status as the Company’s Co-Chief Executive Officer, and experience founding and growing

companies make him a qualified candidate for the Board.

Donald P. Monaco, age 69, Director

Mr. Monaco has served as a

member of the Board since August 2011 and served as Chairman of the Board from August 2018 to December 2021 (serving as Co-Chairman of

the Board from June 2021 to December 2021). Mr. Monaco served on the Verus International, Inc., formerly RealBiz Media Group, Inc., board

of directors from October 2012 until April 2016, serving as chairman of the board from August 2015 to April 2016. Mr. Monaco has served

on the board of directors of Enderby Entertainment Inc. since March 2018, serving as its Chief Financial Officer since January 2020. Mr.

Monaco is the founder and owner of Monaco Air Duluth, LLC, a full service, fixed-base operator aviation services business at Duluth International

Airport in Duluth, Minnesota serving airline, military, and general aviation customers since November 2005. Mr. Monaco has been appointed

and reappointed by Minnesota Governors since 2009 to serve as a Commissioner of the Metropolitan Airports Commission in Minneapolis-St.

Paul, Minnesota and currently serves as Chairman of the Operations, Finance and Administration Committee. Mr. Monaco was a Director at

Republic Bank in Duluth, Minnesota between May 2015 until October 2019 and served as Vice Chairman of the Board, and subsequently served

on the Bell Bank Twin-Ports Market Advisory Board. Mr. Monaco is the President and Chairman of the Monaco Air Foundation, Treasurer of

Honor Flight Northland, Treasurer of the Duluth Aviation Institute, and a member of the Duluth Chamber of Commerce Military Affairs Committee.

Mr. Monaco spent over 18 years as a Partner and Senior Executive of the 28 years he served as an international information technology

and business management consultant with Accenture in Chicago, Illinois. Mr. Monaco holds Bachelor’s. and Master’s degrees

in Computer Science Engineering from Northwestern University.

We selected Mr. Monaco to

serve on our Board because he brings a strong business background to the Company, and adds significant strategic, business and financial

experience. We believe that Mr. Monaco’s business background provides him with a broad understanding of the issues facing us, the

financial markets and the financing opportunities available to us.

Athid Nanthawaroon, age 40, Director

Mr. Nanthawaroon has served

as a member of the Board since the Company’s acquisition of HotPlay on June 30, 2021. Mr. Nanthawaroon co-founded and served as

a director of HotPlay and HotPlay Thailand, from the time the companies were founded in March 2020 until June 30, 2021. He also served

as the President of HotPlay Thailand since its founding. Since January 2020, Mr. Nanthawaroon has served as a director and Chief Executive

Officer of Tree Roots Entertainment Group, a joint venture between the Thai property developer, Magnolia Quality Development Corporation

Limited, and the IP management and investment company, T&B Media Global (Thailand) Company Limited, where he is building an ecosystem

bridging real estate and entertainment with technology. Since November 2014, Mr. Nanthawaroon has served as Senior Vice President of Corporate

Finance at DTGO Corporation Limited (“DTGO”), a diversified business group established in 1993 that integrates social contribution

with business success. DTGO’s largest investment portfolio is Magnolia Quality Development Corporation Limited, which holds real

estate assets including condominiums, mixed-use developments and “theme” developments, and maintains a total asset value of

over approximately $5 billion. Mr. Nanthawaroon has over a decade and a half of experience in investment strategy and fund raising across

various industries. Mr. Nanthawaroon holds a Bachelor’s degree in Finance from Kasetsart University and a Master’s degree

in Commerce and Accountancy in Real Estate from Thammasat University.

We believe that Mr. Nanthawaroon’s

knowledge of the industries that the Company operates in, familiarity with the Company’s business and technologies, and significant

finance, investment and fundraising experience make him a qualified candidate for the Board.

Carmen L. Diges, age 51, Director

Ms. Diges has served as a

member of the Board since the Company’s acquisition of HotPlay on June 30, 2021. Ms. Diges is a senior attorney, corporate and government

advisor, and international entrepreneur, with over two decades of experience across various public and private sectors. Since August

2014, Ms. Diges has served as Principal at her own law firm, REVlaw. Ms. Diges has served as the General Counsel/Corporate Secretary of

McEwen Mining Inc. (NYSE:MUX) since August 2015. From November 2011 through July 2014, Ms. Diges served as a Partner at the law firm of

Miller Thomson LLP. Prior thereto, from May 2004 to October 2011, Ms. Diges served as a Partner at the law firm of McMillan LLP. Ms. Diges

currently serves as a Director of several private companies. Ms. Diges holds a CFA Charter, a Master of Laws (Tax) from Osgoode Hall Law

School in Toronto, a Bachelor of Laws from Dalhousie Law School in Halifax, as well as a Bachelor of Arts from the University of Toronto.

We believe that Ms. Diges’

strong background in the legal and corporate industry, as well as her significant corporate governance experience, make her well qualified

to serve on the Board.

Komson Kaewkham, age 40, Director

Mr. Kaewkham has served as

a member of the Board since the Company’s acquisition of HotPlay on June 30, 2021. Mr. Kaewkham is the Legal Counsel and Senior

Vice President of DTGO, a diversified business group that integrates social contribution with business success. He joined the organization’s

property development subsidiary, Magnolia Quality Development Corporation Limited, in March 2011 as Division Manager. He then joined the

Corporate Legal team of DTGO in April 2017 and was promoted to Senior Vice President in March 2019. During his time at the organization,

Mr. Kaewkham has specialized in legal matters related to real estate project development, investment structures, mergers and acquisitions,

and presently is in charge of risk management and compliance of DTP Global REITs Management limited, DTGO’s REIT management company.

From April 2009 to March 2011, Mr. Kaewkham was a litigator at Blumenthal Ritcher & Sumet Limited’s Bangkok office and served

as legal counsel and as a litigator at Siam ILC. Co., Ltd from March 2006 to March 2009. Mr. Kaewkham received his Notarial Service Attorney

License from Lawyers Council under the Royal Patronage in Thailand in June 2010, and graduated from Assumption University in May 2008

with a Master of Law Program in Business Law.

We believe that Mr. Kaewkham’s

strong background in the legal and corporate industry, as well as his significant mergers and acquisitions, risk management and compliance

experience, make him well qualified to serve on the Board.

Yoshihiro Obata, age 60, Director

Mr. Obata has served as a

member of the Board since the Company’s acquisition of HotPlay on June 30, 2021. Mr. Obata is an independent Director of Axion Ventures,

Inc. He has over three decades of experience with technology companies as a founder, software engineer, board member and senior executive.

Most recently, Mr. Obata was a founding member, director and Chief Technology Officer of eAccess, an ADSL wholesale company, which acquired

a 3G license in 2005 and successfully introduced LTE in 2012 (under the EMOBILE brand). In 2013, after the acquisition of eAccess by Softbank,

he moved to Equinix Japan and has served as the President and Chief Executive Officer of BizMobile Inc. since 2015.

We believe that Mr. Obata’s

significant experience in the technologies industry and founding and growing companies make him well qualified to serve on the Board.

Farooq Moosa, age 51, Director

Mr. Moosa has served as a

member of the Board since November 23, 2021. He currently serves as President, Chief Financial Officer and a director of Avenir Senior

Living Inc., a senior healthcare operating company that builds, designs, markets owns and operates luxury private-pay memory care communities

and senior residences, which positions that he has held since February 2021. He also serves as President and Chief Executive Officer of

1285593 Ltd., a company that provides capital markets and financial services consulting services, which positions he has held since January

2021. Prior to that, Mr. Moosa served as managing director at Echelon Wealth Partners and Artemis Investment Management, and as director

of global investment banking at Scotiabank and held various positions, including president, Chief Executive Officer, and director, of

Scotia Managed Companies Administration, a wholly owned subsidiary of Scotiabank. While at Scotia Managed Companies Administration, Mr.

Moosa’s responsibilities included corporate governance, investment oversight, business risk management, corporate due diligence,

and financial analysis. Prior to that, he served as VP of equity capital markets at BMO Capital Markets. Mr. Moosa holds an MBA from Wilfrid

Laurier University and a Bachelor of Arts (Honours Standing) from Western University.

We believe that Mr. Moosa’s

corporate governance, investment oversight, business risk management, corporate due diligence, and financial analysis experience, as well

as his leadership experience and familiarity with capital markets and financial reporting, make him well qualified to serve on the Board.

Edward Terrence Gardner, Jr., age 56, Director

Mr. Gardner has served as

a member of the Board since December 9, 2021. Mr. Gardner has over 25 years of capital markets, equity research, and investment management

experience. From 2015 to present, Mr. Gardner has served as a Partner of C.J. Lawrence, LLC, an investment management boutique and registered

investment advisor based in New York City, where he manages 50+ client accounts and chairs the firm’s Investment Committee. Mr.

Gardner also serves as Chief Compliance Officer of C.J. Lawrence, LLC. Previously, he has held senior analytical and management roles

at Deutsche Bank Securities, ITG, and Soleil Securities Group. Earlier, Mr. Gardner served as an equity research analyst covering the

ground transportation industry and was ranked as the Top Stock Picker in his category in the Wall Street Journal’s All-Star Analyst

survey. He holds a Bachelor of Arts in Economics from St. Lawrence University.

We believe that Mr. Gardner’s

extensive capital market and management experience makes him well qualified to serve on the Board.

Vote Required and Recommendation of the

Board

Directors are elected by plurality

of the votes cast at the Meeting by the holders of shares present virtually or represented by proxy and entitled to vote on the election

of the directors. If a quorum is present and voting at the Meeting, the ten nominees receiving the highest number of “FOR”

votes will be elected. Shares represented by executed proxies will be voted for which no contrary instruction is given, if authority to

do so is not withheld, “FOR” the election of each of the nominees named above.

Votes withheld from any nominee,

abstentions, and broker non-votes will be counted only for purposes of determining a quorum. Broker non-votes will have no effect on this

proposal, as brokers or other nominees are not entitled to vote on such proposals in the absence of voting instructions from the beneficial

owner.

OUR BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR”

THE ELECTION OF EACH NOMINEE UNDER PROPOSAL

ONE

PROPOSAL

2

RATIFICATION OF APPOINTMENT OF AUDITOR

Background

The Audit Committee of the

Board (the “Audit Committee”) has selected TPS Thayer, LLC (“TPS”) as our independent registered public accounting

firm for the fiscal year ending February 28, 2022, and has further directed that we submit the selection of TPS as our independent registered

accounting firm for ratification by our stockholders at the Meeting. TPS was engaged effective September 30, 2020. Thayer O’Neal

Company, LLC (“Thayer”) audited the Company’s financial statements for the fiscal years ended February 29, 2020 and

February 28, 2019, and subsequently applied for de-registration from the Public Company Accounting Oversight Board (“PCAOB”).

We are asking our stockholders

to ratify the appointment of TPS as our independent registered public accounting firm for the fiscal year ending February 28, 2022. In

the event our stockholders do not ratify the appointment of TPS as our independent registered public accounting firm, our Audit Committee

will reconsider its appointment. We do not expect that a representative of TPS will be present at the Meeting; however, if a representative

is present, he or she will be able to make a statement if he or she so desires, and will be available to respond to appropriate questions.

In deciding to appoint TPS

as our independent registered public accounting firm, the Audit Committee reviewed auditor independence issues and existing commercial

relationships with TPS and concluded that TPS has no commercial relationship with the Company that would impair its independence for

the fiscal year ending February 28, 2022.

Independent Registered Public Accounting Firm’s Fees

The following table presents

fees for professional audit and merger and acquisition related services performed by TPS and other professional firms for the audit of

our annual financial statements, review of our quarterly financial statements, and all merger and acquisition related activities from

September 30, 2020 for the years ended February 28, 2021 and February 29, 2020.

Prior to the appointment

of TPS, Thayer served as our independent registered accounting firm from May 16, 2019 to September 30, 2020, and audited our financial

statements for the years ended February 29, 2020 and February 28, 2019. Prior to the appointment of Thayer, M&K had served as our

independent registered accounting firm from October 11, 2018 to May 16, 2019.

| | |

TPS | | |

Others | |

| | |

2021 | | |

2020 | | |

2021 | | |

2020 | |

| Audit Fees(1) | |

$ | 39,500 | | |

$ | — | | |

$ | 48,500 | | |

| 89,000 | |

| Audit-Related Fees(2) | |

| | | |

| — | | |

| — | | |

| — | |

| M&A Fees(3) | |

| 10,000 | | |

| — | | |

| — | | |

| — | |

| All Other Fees(4) | |

| 17,000 | | |

| — | | |

| 20,000 | | |

| — | |

| Total | |

$ | 66,500 | | |

$ | 0 | | |

$ | 68,500 | | |

| 89,000 | |

| (1) | Audit fees include professional

services rendered for (i) the audit of our annual financial statements for the fiscal years ended February 28, 2021 and February

29, 2020 and (ii) the reviews of the financial statements included in our Quarterly Reports on Form 10-Q for such years. |

| (2) | Audit-related fees consist of

fees billed for professional services that are reasonably related to the performance of the audit or review of our consolidated financial

statements, but are not reported under “Audit fees.” |

| (3) |

Fees include professional services relating to preparation of the annual

tax return. |

| (4) |

Other fees include professional services for review of various filings

and issuance of consents. |

Pre-Approval Policies and Procedures

It is the policy of our Board

that all services to be provided by our independent registered public accounting firm, including audit services and permitted audit-related

and non-audit services, must be pre-approved by our Board. Our Board pre-approved all services, audit and non-audit, provided to us by

TPS, Thayer, and M&K for fiscal 2021 and 2020.

In order to assure continuing

auditor independence, the Audit Committee periodically considers the independent auditor’s qualifications, performance and independence

and whether there should be a regular rotation of our independent external audit firm. We believe the continued retention of TPS to serve

as our independent auditor is in the best interests of the Company and its stockholders, and we are asking our stockholders to ratify

the appointment of TPS as our independent auditor for the year ended February 28, 2022. While the Audit Committee is responsible for

the appointment, compensation, retention, termination and oversight of the independent registered public accounting firm, the Audit Committee

and our board of directors are requesting, as a matter of policy, that the stockholders ratify the appointment of TPS as our independent

registered public accounting firm.

Changes in and Disagreements with Accountants

on Accounting and Financial Disclosure

Thayer O’Neal Company, LLC

Prior to its de-registration

with the PCAOB, Thayer served as our independent registered accounting firm from May 16, 2019 to September 30, 2020, and audited our

financial statements for the years ended February 29, 2020 and February 28, 2019. On September 30, 2020, in connection with its de-registration,

the Company dismissed Thayer as the independent registered public accounting firm of the Company. The Company’s Board of Directors

approved the dismissal of Thayer.

The reports of Thayer regarding

the Company’s financial statements for the fiscal years ended February 29, 2020 and February 28, 2019 did not contain any adverse

opinion or disclaimer of opinion and were not modified as to uncertainty, audit scope, or accounting principles, except each report did

contain an explanatory paragraph related to the Company’s ability to continue as a going concern. During the Company’s fiscal

years ended February 29, 2020 and February 28, 2019, and through September 30, 2020, there were (i) no disagreements with Thayer on any

matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if

not resolved to the satisfaction of Thayer would have caused Thayer to make reference to the subject matter of the disagreements in connection

with its report, and (ii) with the exception of material weaknesses related to the reconciliation of various accounts, lack of precision

and accuracy to properly reflect in the financial statements, there were no “reportable events,” as that term is defined

in Item 304(a)(1)(v) of Regulation S-K.

On September 30, 2020, the

Company engaged TPS as the Company’s new independent registered public accounting firm. The appointment of TPS was approved by

the Company’s Board.

The Company disclosed the

change in auditors in a Current Report on Form 8-K filed with the Securities and Exchange Commission on October 5, 2020.

M&K CPAS, PLLC

Prior to the appointment

of Thayer, M&K served as our independent registered accounting firm from October 11, 2018 to May 16, 2019. On May 16, 2019, M&K

resigned as the independent registered public accounting firm of the Company.

M&K reviewed the Company’s

Quarterly Reports on Form 10-Q for the quarters ended August 31, 2018 and November 30, 2018. M&K did not provide any audit reports

to the Company, and as such, there were no adverse opinions or disclaimers of opinion and no qualifications or modifications as to uncertainty,

audit scope or accounting principles.

During the period from October

11, 2018, and through May 16, 2019, there were (i) no disagreements with M&K on any matter of accounting principles or practices,

financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of M&K would

have caused M&K to make reference to the subject matter of the disagreements in connection with its report, and (ii) there were no

events of the type described in Item 304(a)(1)(v) of Regulation S-K, except as disclosed below. The Company had one disagreement with

M&K. M&K believed the complexities related to a series of transactions warranted formal consultation with the Securities and

Exchange Commission’s Office of the Chief Accountant (“SEC-OCA”). The Company believed that the transactions did not

warrant formal consultation with the SEC-OCA and that it did not have sufficient time to request such formal guidance (with the due date

of its Annual Report on Form 10-K approaching). Because the Company did not believe requesting guidance from the SEC-OCA was warranted

and because it did not want to spend the time and resources to request guidance from the SEC-OCA, M&K resigned.

On May 16, 2019, the Company

engaged Thayer as the Company’s new independent registered public accounting firm. The appointment of Thayer was approved by the

Company’s Board.

The Company disclosed the

change in auditors in a Current Report on Form 8-K filed with the Securities and Exchange Commission on May 21, 2019.

Vote Required and Recommendation of the

Board

Ratification of this appointment

requires the affirmative (“For”) vote of a majority of the votes cast on the proposal (more “For”

votes than “Against” votes), provided that a quorum exists at the Meeting. Broker non-votes (if any) and abstentions

will not be counted as votes cast, and will have no effect on determining whether the affirmative votes constitute a majority of the

votes cast at the Meeting. Properly executed proxies will be voted at the Meeting in accordance with the instructions specified on the

proxy; if no such instructions are given, the persons named as agents and proxies in the enclosed form of proxy will vote such proxy

“For” the ratification of the appointment of TPS.

Our Audit Committee is not

required to take any action as a result of the outcome of the vote on this Proposal. In the event stockholders fail to ratify the appointment,

the Audit Committee may reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may

direct the appointment of a different independent accounting firm at any time during the year if the committee determines that such a

change would be in our and the stockholders’ best interests.

OUR BOARD RECOMMENDS A VOTE “FOR”

THE APPOINTMENT OF TPS THAYER, LLC CERTIFIED

PUBLIC ACCOUNTANTS AS OUR INDEPENDENT PUBLIC ACCOUNTING FIRM

FOR THE FISCAL YEAR ENDING FEBRUARY 28, 2022.

PROPOSAL 3

APPROVAL OF THE WARRANT AMENDMENT

Background

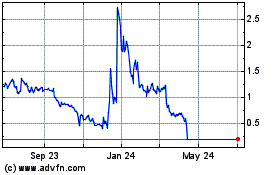

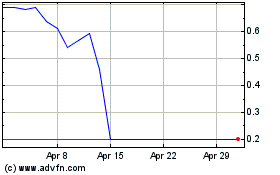

As previously disclosed in

that Current Report on 8-K filed by the Company on November 3, 2021, on November 1, 2021 (the “Offering 8-K”), we entered

into a Securities Purchase Agreement (the “SPA”) with certain institutional investors (the “Purchasers”), pursuant

to which we agreed to issue and sell, in a registered direct offering (the “Offering”), an aggregate of 18,987,342 shares

(the “Shares”) of our common stock, par value $0.00001 per share, together with warrants to purchase an aggregate of 14,240,508

shares of common stock (the “Warrants”), at a combined price of $1.58 per Share and accompanying three quarters of a Warrant.

Each whole Warrant sold

in the Offering is exercisable for one share of our common stock at an initial exercise price of $1.97 per share (the “Initial

Exercise Price”), the closing sales price of our common stock on October 29, 2021 (the last trading day prior to the date that

the SPA was entered into). The Warrants may be exercised commencing six months after the issuance date (the “Initial Exercise Date”)

and terminating on the fifth anniversary of the Initial Exercise Date. The Warrants are exercisable for cash; provided, however that

they may be exercised on a cashless exercise basis if, at the time of exercise, there is no effective registration statement registering,

or no current prospectus available for, the issuance or resale of the shares of common stock issuable upon exercise of the Warrants.

The exercise of the Warrants will be subject to a beneficial ownership limitation, which will prohibit the exercise thereof, if upon

such exercise the holder of the Warrants, its affiliates and any other persons or entities acting as a group together with the holder

or any of the holder’s affiliates would hold 4.99% (or, upon election of a purchaser prior to the issuance of any shares, 9.99%)

of the number of shares of the common stock outstanding immediately after giving effect to the issuance of shares of common stock issuable

upon exercise of the Warrant held by the applicable holder, provided that the holders may increase or decrease the beneficial ownership

limitation (up to a maximum of 9.99%) upon 61 days advance notice to the Company, which 61 day period cannot be waived.

The Warrants also include

certain anti-dilution rights, which provide that if at any time the Warrants are outstanding, we issue or enter into any agreement to

issue, or are deemed to have issued or entered into an agreement to issue (which includes the issuance of securities convertible or exercisable

for shares of common stock), securities for consideration less than the then current exercise price of the Warrants, the exercise price

of such Warrants will be automatically reduced to the lowest price per share of consideration provided or deemed to have been provided

for such securities; provided, however, that unless and until the Company has received stockholder approval to reduce the exercise price

of the Warrants below the Floor Price, $1.97 per share, no such adjustment to the exercise price may be made.

Pursuant to the SPA, we

agreed to use our best efforts to obtain stockholder approval within 90 days from November 1, 2021 (the date of the prospectus supplement)

to remove the Floor Price of the Warrants (the “Warrant Amendment”). In the event that such stockholder approval is not obtained