AT&T's Revenue Rises as Wireless Unit, HBO Add Customers--2nd Update

April 22 2021 - 11:30AM

Dow Jones News

By Drew FitzGerald

AT&T Inc. piled on more cellphone users, fiber-optic

internet customers and HBO viewers during the first quarter,

showing the media-and-telecom conglomerate's focus on growth as the

economy starts to roar back after a year of coronavirus-related

pressure.

The Dallas company reported 44.2 million domestic HBO and HBO

Max subscribers, up from 41.5 million three months earlier, as its

media division sought to gain on rivals like Netflix Inc. and Walt

Disney Co. That figure included viewers who signed up for the

company's new online streaming video service as well as those with

older subscriptions to HBO through a cable-TV provider.

In the U.S. wireless business, AT&T's core profit engine,

the company added 595,000 postpaid phone subscribers, a highly

valued category of customers who are billed for monthly service

after-the-fact. The carrier also posted a net gain of 207,000

prepaid phone subscribers.

Rival Verizon Communications Inc. on Wednesday reported a net

loss of 178,000 postpaid phone connections over the same period.

T-Mobile is slated to report its first-quarter results next

month.

AT&T executives said the telecom business kept expenses in

check by serving more customers online and by giving its sales

force simpler plans to promote, saving them time. The company also

suggested it would continue offering discounts to attract and keep

customers. That strategy could force competitors to respond in kind

if it is sustained.

"I think we still have room to run," Chief Executive John

Stankey said during a conference call with analysts. "We have seen

our competitors continue to try to compete aggressively. They're

mixing and changing their offers pretty frequently. We seem to be

very consistent and very stable, and that's a really good place for

us to be."

AT&T shares jumped about 5% to $31.66 early Thursday. Shares

have gained 10% so far this year after languishing in 2020.

Overall, net income attributable to AT&T reached $7.55

billion, or $1.04 a share, up from $4.61 billion, or 63 cents a

share, a year earlier. The most recent earnings result benefited

from a large on-paper actuarial gain on the value of its

employee-benefit plans. Total revenue rose 2.7% to $43.9

billion.

The company's reported net debt jumped to about $169 billion,

close to its level two years ago following the Time Warner buyout

that turned AT&T into a media heavyweight. The latest debt

increase stemmed from spending on the Federal Communications

Commission's recent auction of C-band spectrum licenses, a key

resource for wireless companies planning to upgrade their services

to support high-speed fifth-generation, or 5G, network

standards.

Verizon spent the most in the FCC auction, committing $45.5

billion to secure the valuable airwaves. AT&T pledged $23.4

billion for its licenses. Clearing existing users from the spectrum

bands and upgrading network gear will cost the companies billions

of dollars more.

AT&T said Thursday that its debt levels will decline in the

coming years as asset sales and revenue growth whittle down its

obligations. The company also affirmed its commitment to sustaining

its dividend at current levels.

Growth in AT&T's mobile-phone business has picked up in

recent months after the carrier offered new and existing customers

sharply discounted smartphones. The workhorse division has helped

stabilize its parent company's results as its media wing plows

billions of dollars into HBO Max programming. Executives have said

it will take time for the new streaming-video service to turn a

profit, though it also helps wireless profitability by offering

mobile-phone customers another enticement to stay with

AT&T.

WarnerMedia, as the entertainment division is now called, has

also begun to benefit from easier comparisons against last year's

coronavirus-addled results. The media unit's first-quarter revenue

rose 9.8% to $8.53 billion, helped by the return of college

basketball on its cable-TV channels and growing revenue from HBO

Max.

AT&T's consumer broadband division posted a net gain of

46,000 customers, powered by new high-speed fiber-optic lines that

outstripped declines among older copper-based internet

connections.

The unit holding AT&T's DirecTV satellite service ended the

quarter with 620,000 fewer customers, excluding those still using

AT&T TV Now. Cord-cutting has bled companies that sell

traditional channel bundles, forcing many to raise rates, which in

turn prompts more customer defections. AT&T has suffered the

brunt of the trend since it acquired DirecTV in 2015 for about $49

billion.

The company in February agreed to carve out the struggling

pay-TV unit into a separate business jointly owned with

private-equity firm TPG. The complex transaction left AT&T with

a 70% stake in the cash-generating enterprise while ceding legal

control of the business to a stand-alone board. That allowed the

telecom giant to exclude future pay-TV results from its

consolidated financial reports.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

April 22, 2021 11:15 ET (15:15 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

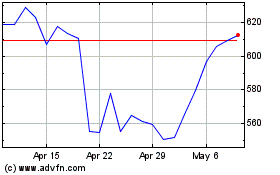

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

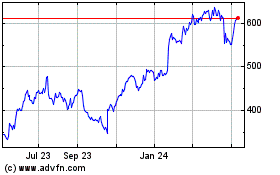

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024