Netflix Faces New Test as Economies Reopen

April 20 2021 - 5:59AM

Dow Jones News

By Micah Maidenberg

Netflix Inc.'s subscriptions soared last year as the Covid-19

pandemic curtailed big parts of economies globally. The company

must now contend with people looking to leave the house more and a

growing number of competitors.

Netflix's subscriber base jumped by roughly 37 million on a net

basis during 2020 to reach 204 million by the end of December, a

performance that further cemented its powerful status in the

content-streaming market. Executives at the Los Gatos, Calif.,

company have said the pandemic pulled forward demand because

alternative entertainment options dried up.

"There's a boost in engagement that you get when people are in a

lockdown situation," Netflix operations chief Gregory Peters said

at an investor event last month.

Many consumers who get vaccinated are venturing out of their

homes more and shifting spending despite the lingering threat posed

by coronavirus. Airlines are looking for a resurgence in summer

travel. Movie theaters and other venues have reopened in New York,

Los Angeles and elsewhere. Restaurants and hotels, both hard hit by

pandemic-related closures and restrictions, have stepped up

hiring.

For the first quarter, Netflix has said it expects to add six

million new subscribers, less than half of the 15.8 million it

gained for the year-earlier period, when the spread of the

coronavirus was first intensifying. The company also forecast $1.36

billion in net income on $7.13 billion in revenue for the

period.

Netflix made a number of changes last year amid the surge in new

subscribers. The company said in July that it promoted Ted Sarandos

to co-chief executive, a position he holds along with Reed

Hastings. In October, Netflix boosted the monthly price of its most

popular streaming plan by $1 to $13.99 a month, and its premium

offering by $2 to $17.99 a month.

Netflix increased the prices as other media companies have

expanded their own streaming platforms, often working to draw in

users with lower monthly rates. Newer services include Walt Disney

Co.'s Disney+, Apple Inc.'s Apple TV+ and AT&T Inc.'s HBO Max.

Discovery Inc. launched Discovery+ in the U.S. in January.

ViacomCBS Inc. debuted the Paramount+ service in the domestic

market last month.

Many competing streaming services "are priced at a discount to

Netflix," analysts at Raymond James said in flagging the company's

increase as a potential risk for subscriber retention.

In January, Netflix said it had been expecting more competition,

and that was why the company had been building up its portfolio of

original shows that appeal to a broad set of consumers world-wide.

The company has been working to secure rights to content from other

studios too, recently signing a deal with Sony Pictures

Entertainment for domestic streaming rights to its theatrical

movies.

Some analysts have said Netflix's command on consumers has

slipped recently and forecast slower growth ahead. The company

controlled half of demand for original content globally in the

first quarter, down from 54% for all of last year, according to

Parrot Analytics, which measures streaming.

EMarketer expects the average amount of time consumers in the

U.S. will spend each day using Netflix will rise 3% this year over

2020. Between last year and 2019, consumer usage jumped 20% to more

than 31 minutes a day, according to the firm.

Some Netflix subscribers may notice other changes to their

service. Last month, the company began experimenting with greater

password enforcement to prevent users from sharing their

accounts.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

April 20, 2021 05:44 ET (09:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

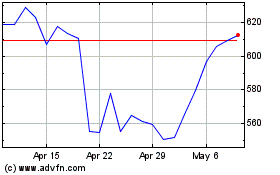

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

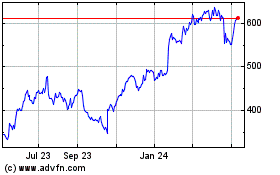

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024