By Joe Flint and Micah Maidenberg

Netflix Inc. ended the first quarter with nearly 16 million new

subscribers as people around the globe stuck at home due to the

coronavirus pandemic are increasingly turning to streaming services

to entertain themselves.

The 15.8 million net customer additions were more than double

what the streaming giant had forecast -- a breakneck pace of growth

the company said was unlikely to continue. Netflix now has 182.9

million subscribers world-wide.

"Like other home entertainment services, we're seeing

temporarily higher viewing and increased membership growth,"

Netflix said in its letter to shareholders, noting that much of

that growth came in March when shelter-at-home orders began. "We

expect viewing to decline and membership growth to decelerate as

home confinement ends, which we hope is soon."

In a video to discuss the results, Chief Executive Reed Hastings

said, "We, too, are really unsure of what the future brings." He

said it would be a couple of months before the company can "grapple

with the long-term implications."

With the pandemic leading to the shutdown of movie theaters,

professional sports leagues, concerts and other events, streaming

services such as Netflix have emerged as one of the rare

video-entertainment options still available.

"People want entertainment. They want to be able to escape and

connect whether times are difficult or joyous," Mr. Hastings

said.

Netflix said it was able to operate remotely "with minimal

disruption in the short to medium term," but it, too, faces

tremendous challenges due to the coronavirus. Production on

practically all movie and television content has been shut down for

weeks, and there is no set date for the content factories to start

churning again.

Netflix said the production shutdown will only have a modest

impact on new content for the next three months. But if producers

and actors remain on the sidelines, it could become problematic.

Netflix is rushing to finish shows that are in final edits and is

aggressively acquiring content from third-party suppliers.

"Our 2020 slate of series and films are largely shot and we're

pretty deep into our 2021 slate," said Ted Sarandos, chief content

officer.

Despite the production shutdown, Netflix said the bulk of its

animation production team is working from home. It also has more

than 200 projects in postproduction, which can also be done during

the quarantine. Writers on existing series are continuing to work

on new scripts.

Mr. Sarandos said several things have to happen before

production can resume, including the lifting of shelter-at-home

orders and protocols for testing on sets and elsewhere.

"We have to be able to look our employees and cast and crew in

the eye and say this is a safe place to work," Mr. Sarandos

said.

Most of the company's subscriber growth occurred outside of

North America. Netflix said it added almost 7 million subscribers

in the region including Europe and the Middle East, 2.9 million in

Latin America and 3.6 million in Asia.

In the U.S. and Canada, where it faces more competition as other

media companies launch their own streaming services, Netflix

reported 2.3 million new paid subscribers, compared with a gain of

548,000 in the fourth quarter and 1.9 million in the first quarter

a year ago.

Shares rose 1% in after-hours trading. The stock is up 34% year

to date, making the streaming service one of the few companies to

see its shares appreciate since the coronavirus crisis started.

Usage was boosted in the quarter by several popular original

efforts, including the third season of the drama "Ozark" and the

documentary series "Tiger King: Murder, Mayhem and Madness."

Netflix said "Tiger King" was sampled by 64 million member

households. Its unscripted dating show, "Love is Blind," also broke

through with 30 million member households tuning into some or all

of the series.

The increase in subscribers and viewing hours put pressure on

internet capabilities in some parts of the world during the

quarter. Netflix reduced bandwidth in Australia, Mexico, India and

elsewhere after requests from local governments. Netflix said the

quality of its service was maintained and it is working with

internet service providers to increase capacity.

The company said its service has seen "significant disruption

when it comes to customer support and content production." Netflix

said it has added 2,000 remote agents to handle the surge in

customer calls which are an offshoot of the increased demand for

content.

Netflix said it generated revenue of $5.77 billion for the first

quarter, up from $4.52 billion a year earlier. Analysts had

forecast $5.75 billion in revenue for the latest period. The

company said strong subscriber growth was offset by a sharply

stronger U.S. dollar, which depressed its international

revenue.

Profit rose to $709.1 million, or $1.57 a share, from $344.1

million, or 76 cents a share, the year earlier. The company was

expected to earn $1.64 a share, according to estimates compiled by

FactSet.

Netflix, which raised its prices in the U.S. in the first

quarter of last year, isn't planning any increases in the near

future.

"We're not even thinking about price increases," said Chief

Product Officer Greg Peters.

Netflix is facing heightened competition from traditional media.

Walt Disney Co.'s Disney+, which launched last November and costs

$6.99 a month, said earlier this month it has passed 50 million

paid subscribers world-wide.

"I've never seen such a good execution of the incumbent learning

the new way and mastering it," Mr. Hastings said of Disney's early

success.

WarnerMedia, a unit of AT&T Inc., said Tuesday its new

streaming service HBO Max, will launch May 27 at a monthly fee of

$14.99. Comcast Corp.'s Peacock platform made its debut in the

cable giant's homes last week and will be available nationally in

July.

Apple Inc. also launched a streaming option last fall called

Apple TV+.

Americans spent an average of $37 a month on streaming services

in March, up $30 in November, according to a recent survey by The

Wall Street Journal and the Harris Poll. The survey found Netflix

was the biggest streaming beneficiary in the crisis, with some 30%

of respondents saying they added a Netflix subscription in

March.

Netflix said its deep reserve of acquired and original content

likely puts it in better position to weather the pandemic than its

rivals, which are also affected by production shutdowns. Comcast

last week said most of the original shows that were to headline the

launch of Peacock likely won't be ready until 2021, while

WarnerMedia on Tuesday said a much-anticipated reunion of the cast

of "Friends" won't be released until the summer or fall.

"Since we have a large library with thousands of titles for

viewing and very strong recommendations, our member satisfaction

may be less impacted than our peers' by a shortage of new content,

but it will take time to tell," Netflix said.

Write to Joe Flint at joe.flint@wsj.com and Micah Maidenberg at

micah.maidenberg@wsj.com

(END) Dow Jones Newswires

April 21, 2020 19:19 ET (23:19 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

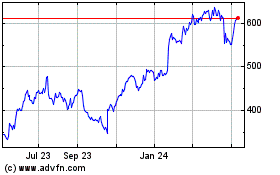

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

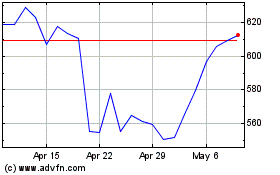

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024