What Is Alternative Data? -- Journal Report

December 08 2019 - 10:29PM

Dow Jones News

By Simon Constable

The term "alternative facts" has been roundly ridiculed since

its introduction into political discourse in 2017. There is,

however, a similar phrase used in finance that investors should

take seriously and understand: "alternative data."

Alternative data in finance refers to proxy metrics or

information originating from unofficial or noncompany sources that

individuals can use to gain insight into an investment. Such

information can be the difference between making a profitable and

unprofitable bet.

When measuring something as nebulous as investor anxiety, for

example you need a proxy because if you survey individuals directly

about anxiety "you may get a fuzzy answer," says David Ranson,

research director at financial analytics company HCWE & Co.

Mr. Ranson instead looks at credit spreads, such as the ICE

BofAML US Corporate BBB Option-Adjusted Spread, which measures how

much more creditworthy companies must pay compared with the

government to borrow money. That is, it measures the extra interest

that investors require before they will lend money to

companies.

When investors are anxious, the credit spread is wider. When

they are less worried, it is narrower. Recently, the BBB spread was

1.54 percentage points, according to data from the St. Louis Fed,

down from 2.06 percentage points on Jan. 3. That indicates that

investors are far less worried now than they were at the beginning

of the year. We know this because collectively, investors are

willing to accept lower interest payments when they lend money.

"You aren't measuring the exact thing, but a symptom of it," Mr.

Ranson says.

Some valuable metrics come from unofficial sources. That could

include consumer activity on the web. For instance, research

company IHS Markit regularly publishes alternative data, including

the various purchasing-managers indexes, or PMIs. A PMI is a

so-called diffusion index, which means that it registers whether a

sector is growing or shrinking.

The advantage for investors is that they typically can get

access to alternative data sooner than official figures.

Similarly, some companies collect information that investors can

use to get a reading on the health of a public company before that

firm reports results.

Eagle Alpha of Dublin collects data on consumer transactions,

social-media activity and online searches that investors could use,

say, to get a read on how much a streaming service's subscription

base has grown or fallen. "Using that gets you inside the boardroom

of the company," says Eagle Alpha founder and chief executive

Emmett Kilduff. "You can't just rely solely on the data sets, but

it is definitely a significant advantage."

Mr. Constable is a writer in Edinburgh, Scotland. He can be

reached at reports@wsj.com.

(END) Dow Jones Newswires

December 08, 2019 22:14 ET (03:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

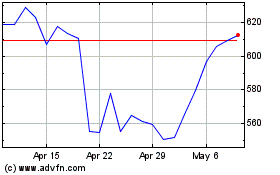

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

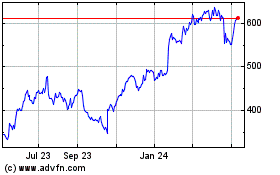

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024