Nauticus Robotics, Inc. (“Nauticus” or the “Company”) (NASDAQ:

KITT), a developer of ocean robots, autonomy software, and services

to the marine industries, today announced results for its third

quarter ended September 30, 2022 and provided a business update.

Recent Operational and Financial

Highlights

- Completed a business combination

with CleanTech Acquisition Corp. (“CLAQ”) on September 9, 2022,

generating net proceeds of $58.7 million to fund the operations and

the initial buildout of Nauticus’ fleet of tandem ocean robots

- Entered into an agreement with

Shell to deploy a Nauticus Aquanaut and its autonomous behaviors

using remote operations and supervised autonomy

- Announced a multi-million-dollar

contract with the U.S. Defense Innovation Unit (“DIU”) for the

development of an unmanned amphibious system

- Disclosed a Department of

Defense-related development partnership with Leidos

- Grew revenues by 51% vs. the third

quarter of 2021

- As of September 30, 2022, Nauticus

held cash and equivalents of $35.9 million and maintained a net

working capital surplus of $43.6 million

“The third quarter of 2022 was filled with many

important milestones for the Company, including an agreement with

Shell for a field trial, a multi-million-dollar project with DIU

and the completion of our business combination with CLAQ to take

Nauticus public,” said Nic Radford, founder and CEO. “With a strong

shareholder base that includes world-class investors like

Schlumberger and Transocean, combined with an extensive list of

blue-chip customers evaluating and qualifying our technology, we

remain confident in our ability to make a real impact on the ocean

economy through the deployment of autonomous systems.”

“Our commercial pipeline continues to expand,

and we are now in active discussions with potential customers on

five different continents. While supply chain issues have impacted

the pace of Aquanaut and Hydronaut deployments, the demand for our

service remains robust. Our team is working diligently to mitigate

these impacts, and we expect to have our initial second-generation

commercial Aquanaut delivered in January 2023, with two additional

units following by mid-year. We are eager to deploy more Aquanauts

into the water for commissioning to fully demonstrate what we

believe is the most advanced and capable ocean robotics system in

the world. Our mission and market opportunity are clear, and we

look forward to providing future updates as we continue converting

our commercial pipeline into firm orders.”

Market OpportunityNauticus

operates in the $2.5 trillion marine economy, targeting the

emerging ocean robotics, services, and data markets that are an

estimated $30 billion total addressable market. The Company’s

autonomous platforms, acoustic communications networks, electric

manipulators, and perception and control software collectively

provide Nauticus a differentiated ability to substantially improve

the efficiency, safety, carbon footprint, and cost profile of the

offshore services market. Nauticus’ near-term focus is on the oil

& gas, offshore wind, and government & defense markets,

with tangible traction being gained in each market.

The market opportunity is attractive and growing

with significant offshore wind deployments and thousands of

offshore oil and gas trees with tens of thousands of flowlines and

pipes around the world, all needing recurring inspection, repairs,

and maintenance (“IRM”). For example, each gigawatt (“GW”) of

offshore wind capacity requires an estimated $22 million of annual

IRM. The United Kingdom alone has 12.7 GW of installed offshore

wind capacity that is growing by approximately 2.5 GW per year.

This translates to an annual $280 million market for Nauticus in

just the U.K.’s offshore wind market, equating to potential demand

for approximately 35 Aquanauts. By the end of the decade, demand

for Aquanauts from just U.K.’s offshore wind market could be double

that.

Financial Results Nauticus

reported third quarter revenue of $3.0 million, an increase of 51%

compared to the prior-year period. The increase in revenue is

primarily attributable to the addition of new defense contracts,

including the continued lease of an Aquanaut vehicle.

Total operating expenses during the third

quarter were $9.0 million, a $6.0 increase from the prior-year

period. Third quarter of 2022 operating expenses includes $3.5

million of expenses related to the Company’s business combination

with CLAQ. Other drivers of the year-over-year increase are

primarily related to higher costs of revenue and increased general

and administrative (“G&A”) costs. Included in the increased

G&A costs are employee salaries, sales and marketing, and

professional fees in order to scale the business further and manage

the additional responsibilities of a public company.

For the quarter, Nauticus recorded a net loss

attributable to common stockholders of $11.0 million, or a loss of

$0.67 per basic and diluted share. This compares to a net loss

attributable to common stockholders of $1.3 million, or a loss of

$0.13 per basic and diluted share in the prior year comparable

period.

Net loss attributable to common stockholders for

the third quarter of 2022 and 2021 includes certain items typically

excluded from published estimates by the investment community.

Adjusted net loss attributable to common stockholders, which

excludes the impact of these items as described in the non-GAAP

reconciliation table below, was $3.7 million, or $0.22 in the third

quarter of 2022, compared to a net loss of $1.3 million, or $0.13

per diluted share, in the third quarter of 2021.

Nauticus ended the third quarter of 2022 with

$35.9 million in cash and equivalents and a working capital surplus

of $43.6 million.

Conference Call and Webcast

InformationNauticus will host a conference call today,

November 14, 2022 at 12:00 p.m. Eastern time (9:00 a.m. Pacific

time). A question-and-answer session will follow management’s

presentation.

U.S. dial-in number: 1-877-407-9039International

number: 1-201-689-8470Conference ID: 13733447

The conference call will broadcast live and be

available for replay here.

A replay of the call will be available after

3:00 p.m. Eastern time today through November 28, 2022.

Toll-free replay number:

1-844-512-2921International replay number: 1-412-317-6671Conference

ID: 13733447

About NauticusNauticus

Robotics, Inc. is a developer of ocean robots, autonomy software,

and services delivered to the marine industries. Nauticus’ robotic

systems and services are delivered to commercial and

government-facing customers through a Robotics-as-a-Service (RaaS)

business model and direct product sales for both hardware platforms

and software licenses. Besides a standalone service offering and

products, Nauticus’ approach to ocean robotics has also resulted in

the development of a range of technology products for

retrofitting/upgrading legacy systems and other third-party vehicle

platforms. Nauticus provides customers with the necessary data

collection, analytics, and subsea manipulation capabilities to

support and maintain assets while reducing their operational

footprint, operating cost, and greenhouse gas emissions to improve

offshore health, safety, and environmental exposure.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of Section 21E of the Securities Exchange Act of 1934, as

amended (the “Act”) and are intended to enjoy the protection of the

safe harbor for forward-looking statements provided by the Act as

well as protections afforded by other federal securities laws. Such

forward-looking statements include the expected timing of product

commercialization or new product releases; customer interest in

Nauticus’ products; estimated 2022 operating results and use of

cash; and Nauticus’ use of and needs for capital. Generally,

statements that are not historical facts, including statements

concerning possible or assumed future actions, business strategies,

events, or results of operations, are forward-looking statements.

These statements may be preceded by, followed by or include the

words “believes,” “estimates,” “expects,” “projects,” “forecasts,”

“may,” “will,” “should,” “seeks,” “plans,” “scheduled,”

“anticipates,” “intends” or “continue” or similar expressions.

Forward-looking statements inherently involve risks and

uncertainties that may cause actual events, results or performance

to differ materially from those indicated by such statements. These

forward-looking statements are based on Nauticus’ management’s

current expectations and beliefs, as well as a number of

assumptions concerning future events. There can be no assurance

that the events, results, or trends identified in these

forward-looking statements will occur or be achieved.

Forward-looking statements speak only as of the date they are made,

and Nauticus is not under any obligation and expressly disclaims

any obligation, to update, alter or otherwise revise any

forward-looking statement, whether as a result of new information,

future events, or otherwise, except as required by law. Readers

should carefully review the statements set forth in the reports

which Nauticus has filed or will file from time to time with the

Securities and Exchange Commission (the “SEC”) for a more complete

discussion of the risks and uncertainties facing the Company and

that could cause the forward-looking statements no to occur, in

particular the sections entitled “Risk Factors” and “Cautionary

Note Regarding Forward-Looking Statements” in documents filed from

time to time with the SEC, including Nauticus’ Quarterly Report on

Form 10-Q filed with the SEC on November 14, 2022. The documents

filed by Nauticus with the SEC may be obtained free of charge at

the SEC’s website at www.sec.gov.

Nauticus Robotics,

Inc.Condensed Consolidated Balance Sheets

(Unaudited)

| |

September 30, 2022 |

|

December 31, 2021 |

|

|

Assets |

|

|

|

|

| Current

Assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

35,928,218 |

|

|

$ |

20,952,867 |

|

|

|

Restricted certificate of deposit |

|

251,236 |

|

|

|

251,236 |

|

|

|

Accounts receivable, net |

|

637,350 |

|

|

|

794,136 |

|

|

|

Inventories |

|

5,558,996 |

|

|

|

- |

|

|

|

Contract assets |

|

483,944 |

|

|

|

893,375 |

|

|

|

Prepaid insurance |

|

2,598,380 |

|

|

|

67,219 |

|

|

|

Other Current assets |

|

2,495,759 |

|

|

|

210,225 |

|

|

|

Total Current assets |

|

47,953,883 |

|

|

|

23,169,058 |

|

|

| |

|

|

|

|

| Property and

equipment, net |

|

9,645,735 |

|

|

|

1,437,311 |

|

|

| Operating

lease right-of-use asset |

|

368,116 |

|

|

|

513,763 |

|

|

| Other

assets |

|

77,889 |

|

|

|

47,240 |

|

|

| |

|

|

|

|

| Total

assets |

$ |

58,045,623 |

|

|

$ |

25,167,372 |

|

|

| |

|

|

|

|

|

Liabilities and Stockholders' Equity (Deficit) |

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

Accounts payable |

$ |

2,786,544 |

|

|

$ |

1,402,424 |

|

|

|

Accrued liabilities |

|

1,171,597 |

|

|

|

1,576,433 |

|

|

|

Operating lease liabilities - current |

|

399,892 |

|

|

|

353,598 |

|

|

|

Notes payable - current |

|

- |

|

|

|

10,250,000 |

|

|

|

Notes payable, related parties - current |

|

- |

|

|

|

3,000,000 |

|

|

|

Total Current Liabilities |

|

4,358,033 |

|

|

|

16,582,455 |

|

|

| Warrant

liabilities |

|

4,148,556 |

|

|

|

- |

|

|

| Operating

lease liabilities - long-term |

|

179,095 |

|

|

|

467,208 |

|

|

| Notes

payable - long-term, net of discount |

|

20,427,812 |

|

|

|

14,708,333 |

|

|

| Other

liabilities |

|

- |

|

|

|

20,833 |

|

|

|

Total Liabilities |

|

29,113,496 |

|

|

|

31,778,829 |

|

|

| |

|

|

|

|

| Commitments

and Contingencies |

|

|

|

|

| |

|

|

|

|

|

Stockholders' Equity (Deficit): |

|

|

|

|

|

Preferred stock, $0.0001 par value; 10,000,000 shares,

authorized |

|

- |

|

|

|

- |

|

|

|

Series A preferred stock, $0.01 par value; 0 and 334,800 shares,

respectively, issued, and outstanding |

|

- |

|

|

|

3,348 |

|

|

|

Series B preferred stock, $0.01 par value; 0 and 725,426 shares,

respectively, issued, and outstanding |

|

- |

|

|

|

7,254 |

|

|

|

Common stock, $0.0001 par value; 625,000,000 shares authorized,

47,250,771 and 13,527,810 shares issued, respectively, and

47,250,771 and 9,669,217 shares outstanding, respectively |

|

4,725 |

|

|

|

967 |

|

|

|

Additional paid-in capital |

|

81,716,561 |

|

|

|

33,221,505 |

|

|

|

Accumulated deficit |

|

(52,789,159 |

) |

|

|

(39,844,531 |

) |

|

|

Total Stockholders' Equity (Deficit) |

|

28,932,127 |

|

|

|

(6,611,457 |

) |

|

| |

|

|

|

|

| Total

Liabilities and Stockholders' Equity (Deficit) |

$ |

58,045,623 |

|

|

$ |

25,167,372 |

|

|

| |

|

|

|

|

Nauticus Robotics,

Inc.Condensed Consolidated Statement of Operations

(Unaudited)

| |

Three months

ended |

|

Nine months

ended |

|

| |

September 30, |

|

September 30, |

|

| |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

| |

|

|

|

|

|

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

Service |

$ |

2,964,610 |

|

|

$ |

1,844,422 |

|

|

$ |

7,996,734 |

|

|

$ |

2,799,113 |

|

|

|

Service - related party |

|

17,000 |

|

|

|

129,222 |

|

|

|

210,400 |

|

|

|

446,600 |

|

|

| Total

revenue |

|

2,981,610 |

|

|

|

1,973,644 |

|

|

|

8,207,134 |

|

|

|

3,245,713 |

|

|

| |

|

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

Cost of revenue (exclusive of items shown separately below) |

|

3,781,224 |

|

|

|

1,446,979 |

|

|

|

8,220,447 |

|

|

|

3,609,236 |

|

|

|

Depreciation and amortization |

|

141,901 |

|

|

|

88,531 |

|

|

|

370,306 |

|

|

|

263,032 |

|

|

|

Research and development |

|

242,996 |

|

|

|

741,558 |

|

|

|

2,094,278 |

|

|

|

2,411,100 |

|

|

|

General and administrative |

|

4,861,319 |

|

|

|

770,066 |

|

|

|

8,778,498 |

|

|

|

2,066,941 |

|

|

| Total costs

and expenses |

|

9,027,440 |

|

|

|

3,047,134 |

|

|

|

19,463,529 |

|

|

|

8,350,309 |

|

|

| |

|

|

|

|

|

|

|

|

| Operating

loss |

|

(6,045,830 |

) |

|

|

(1,073,490 |

) |

|

|

(11,256,395 |

) |

|

|

(5,104,596 |

) |

|

| |

|

|

|

|

|

|

|

|

| Other

(income) expense: |

|

|

|

|

|

|

|

|

|

Other income, net |

|

(234,597 |

) |

|

|

1,140 |

|

|

|

(239,838 |

) |

|

|

(1,573,748 |

) |

|

|

Change in fair value of warrant liabilities |

|

(1,129,589 |

) |

|

|

- |

|

|

|

(1,129,589 |

) |

|

|

- |

|

|

|

Interest expense, net |

|

1,402,026 |

|

|

|

223,492 |

|

|

|

3,057,660 |

|

|

|

361,867 |

|

|

| Total other

(income) expense, net |

|

37,840 |

|

|

|

224,632 |

|

|

|

1,688,233 |

|

|

|

(1,211,881 |

) |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Net

loss |

$ |

(6,083,670 |

) |

|

$ |

(1,298,122 |

) |

|

$ |

(12,944,628 |

) |

|

$ |

(3,892,715 |

) |

|

| Deemed

dividend for earnout shares |

|

(4,957,366 |

) |

|

|

- |

|

|

|

(4,957,366 |

) |

|

|

- |

|

|

| Net loss

attributable to common stockholders |

$ |

(11,041,036 |

) |

|

$ |

(1,298,122 |

) |

|

$ |

(17,901,994 |

) |

|

$ |

(3,892,715 |

) |

|

| |

|

|

|

|

|

|

|

|

| Basic and

diluted earnings (loss) per share |

$ |

(0.67 |

) |

|

$ |

(0.13 |

) |

|

$ |

(1.49 |

) |

|

$ |

(0.40 |

) |

|

| |

|

|

|

|

|

|

|

|

| Basic and

diluted weighted average shares outstanding |

|

16,535,661 |

|

|

|

9,637,962 |

|

|

|

11,983,183 |

|

|

|

9,637,962 |

|

|

| |

|

|

|

|

|

|

|

|

Nauticus Robotics,

Inc.Consolidated Statement of Cash Flows

(Unaudited)

| |

Nine months ended September 30, |

|

|

|

2022 |

|

|

|

2021 |

|

| Cash flows

from operating activities: |

|

|

|

|

Net loss |

$ |

(12,944,628 |

) |

|

$ |

(3,892,715 |

) |

|

Adjustments to reconcile net loss to net cash from operating

activities: |

|

|

|

|

Depreciation and amortization |

|

370,306 |

|

|

|

263,032 |

|

|

Accretion of debt discount |

|

464,780 |

|

|

|

- |

|

|

Stock-based compensation |

|

624,407 |

|

|

|

325,935 |

|

|

Change in fair value of warrant liabilities |

|

(1,129,589 |

) |

|

|

- |

|

|

Noncash impact of lease accounting |

|

145,647 |

|

|

|

177,051 |

|

|

Other income - Paycheck Protection Program Loan forgiveness |

|

- |

|

|

|

(1,578,500 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

156,786 |

|

|

|

(991,666 |

) |

|

Inventories |

|

(5,558,996 |

) |

|

|

- |

|

|

Contract assets |

|

409,431 |

|

|

|

(296,715 |

) |

|

Other assets |

|

(4,817,187 |

) |

|

|

(271,597 |

) |

|

Accounts payable and accrued liabilities |

|

(9,013,681 |

) |

|

|

738,285 |

|

|

Contract liabilities |

|

- |

|

|

|

1,482,096 |

|

|

Operating lease liabilities |

|

(241,819 |

) |

|

|

(269,697 |

) |

| Net cash

from operating activities |

|

(31,534,543 |

) |

|

|

(4,314,491 |

) |

| |

|

|

|

| Cash flows

from investing activities: |

|

|

|

|

Capital expenditures |

|

(6,805,648 |

) |

|

|

(597,325 |

) |

|

Proceeds from restricted certificate of deposit |

|

- |

|

|

|

251,421 |

|

| Net cash

from investing activities |

|

(6,805,648 |

) |

|

|

(345,904 |

) |

| |

|

|

|

| Cash flows

from financing activities: |

|

|

|

|

Proceeds from notes payable |

|

2,000,000 |

|

|

|

10,000,000 |

|

|

Payments of note payable |

|

(17,850,333 |

) |

|

|

(361,236 |

) |

|

Proceeds from Paycheck Protection Program Loan |

|

- |

|

|

|

1,578,500 |

|

|

Proceeds from reverse recapitalization with CleanTech Acquisition

Corp., net |

|

14,947,875 |

|

|

|

- |

|

|

Proceeds from issuance of common stock for Pipe Investment |

|

31,000,000 |

|

|

|

- |

|

|

Proceeds from issuance of Debentures, net of discount |

|

35,800,000 |

|

|

|

- |

|

|

Payment of transaction costs on equity funding |

|

(12,582,000 |

) |

|

|

- |

|

| Net cash

from financing activities |

|

53,315,542 |

|

|

|

11,217,264 |

|

| |

|

|

|

| Net change

in cash and cash equivalents |

|

14,975,351 |

|

|

|

6,556,869 |

|

| |

|

|

|

| Cash and

cash equivalents, beginning of period |

|

20,952,867 |

|

|

|

3,298,180 |

|

| Cash and

cash equivalents, end of period |

$ |

35,928,218 |

|

|

$ |

9,855,049 |

|

| |

|

|

|

Nauticus Robotics,

Inc.Non-GAAP Financial Measures

(Unaudited)

Reconciliation of Net Income

Attributable to Common Stockholders (GAAP) to Adjusted Net Income

Attributable to Common Stockholders (Non-GAAP)

Adjusted net income attributable to common

stockholders is a non-GAAP financial measure which excludes certain

items that are included in net income attributable to common

stockholders, the most directly comparable GAAP financial measure.

Items excluded are those which the Company believes affect the

comparability of operating results and are typically excluded from

published estimates by the investment community, including items

whose timing and/or amount cannot be reasonably estimated or are

non-recurring.

Adjusted net income attributable to common

stockholders is presented because management believes it provides

useful additional information to investors for analysis of the

Company’s fundamental business on a recurring basis. In addition,

management believes that adjusted net income attributable to common

stockholders is widely used by professional research analysts and

others in the valuation, comparison, and investment recommendations

of companies such as Nauticus.

Adjusted net income attributable to common

stockholders should not be considered in isolation or as a

substitute for net income attributable to common stockholders or

any other measure of a company’s financial performance or

profitability presented in accordance with GAAP. A reconciliation

of the differences between net income attributable to common

stockholders and adjusted net income attributable to common

stockholders is presented below. Because adjusted net income

attributable to common stockholders excludes some, but not all,

items that affect net income attributable to common stockholders

and may vary among companies, our calculation of adjusted net

income attributable to common stockholders may not be comparable to

similarly titled measures of other companies.

| |

Three months

ended |

|

Nine months

ended |

|

| |

September 30, |

|

September 30, |

|

| |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

| |

|

|

|

|

|

|

|

|

| Net loss

attributable to common stockholders (GAAP) |

$ |

(11,041,036 |

) |

|

$ |

(1,298,122 |

) |

|

$ |

(17,901,994 |

) |

|

$ |

(3,892,715 |

) |

|

|

Gain on forgiveness of note payable |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,578,500 |

) |

|

|

Change in fair value of warrant liability |

|

(1,129,589 |

) |

|

|

- |

|

|

|

(1,129,589 |

) |

|

|

- |

|

|

|

Expenses related to business combinations(1) |

|

3,519,662 |

|

|

|

- |

|

|

|

3,519,662 |

|

|

|

- |

|

|

|

Deemed dividend for earnout shares |

|

4,957,366 |

|

|

|

- |

|

|

|

4,957,366 |

|

|

|

- |

|

|

| Adjusted Net

loss attributable to common stockholders (non-GAAP) |

$ |

(3,693,597 |

) |

|

$ |

(1,298,122 |

) |

|

$ |

(10,554,555 |

) |

|

$ |

(5,471,215 |

) |

|

| |

|

|

|

|

|

|

|

|

| Basic and

diluted earnings (loss) per share |

$ |

(0.22 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.88 |

) |

|

$ |

(0.57 |

) |

|

| |

|

|

|

|

|

|

|

|

| Basic and

diluted weighted average shares outstanding |

|

16,535,661 |

|

|

|

9,637,962 |

|

|

|

11,983,183 |

|

|

|

9,637,962 |

|

|

| |

|

|

|

|

|

|

|

|

(1) Expenses related to business combinations are comprised of

$2.3 million included within general and administrative expenses

and $1.2 million included within the cost of revenue for the three-

and nine-month periods of 2022.

Investor Relations Contact:Cody Slach or Jeff

Grampp, CFAGateway Group, Inc. (949) 574-3860KITT@GatewayIR.com

Media ContactZach KadletzGateway Group, Inc.

(949) 574-3860KITT@GatewayIR.com

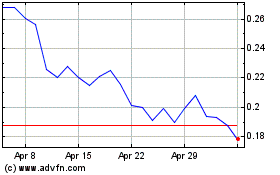

Nauticus Robotics (NASDAQ:KITT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nauticus Robotics (NASDAQ:KITT)

Historical Stock Chart

From Apr 2023 to Apr 2024