UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 3)1

Nano Dimension Ltd.

(Name

of Issuer)

Ordinary Shares par value NIS 5.00 per share

(Title of Class of Securities)

63008G203

(CUSIP Number)

MURCHINSON LTD.

145 Adelaide Street West, Fourth Floor

Toronto, Ontario Canada A6 M5H 4E5

(416) 845-0666

ANDREW FREEDMAN, ESQ.

MEAGAN REDA, ESQ.

OLSHAN FROME WOLOSKY LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

May 1, 2023

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Murchinson Ltd. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Canada |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

7,337,864* |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,337,864* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,337,864* |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,337,864* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

14,675,728* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.8% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

*Represents American Depositary Shares (“Shares”) (each Share

represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Nomis Bay Ltd |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Bermuda |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

4,402,718* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

4,402,718* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

4,402,718* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

1.7% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

*Represents American Depositary Shares (“Shares”) (each Share

represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

BPY Limited |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Bermuda |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

2,935,146* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,935,146* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,935,146* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

1.2% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

*Represents American Depositary Shares (“Shares”) (each Share

represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

EOM Management Ltd. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Bermuda |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,337,864* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,337,864* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

7,337,864* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

2.9% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

*Represents American Depositary Shares (“Shares”) (each Share

represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

James Keyes |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

United Kingdom |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,337,864* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,337,864* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

7,337,864* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

2.9% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

*Represents American Depositary Shares (“Shares”) (each Share

represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Jason Jagessar |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Republic of Trinidad and Tobago |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,337,864* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,337,864* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

7,337,864* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

2.9% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

*Represents American Depositary Shares (“Shares”) (each Share

represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Chaja Carlebach |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Switzerland |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,337,864* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,337,864* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

7,337,864* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

2.9% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

*Represents American Depositary Shares (“Shares”) (each Share

represents one Ordinary Share).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Marc J. Bistricer |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

Canada |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

7,337,864* |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

7,337,864* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,337,864* |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

7,337,864* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

14,675,728* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.8% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

*Represents American Depositary Shares (“Shares”) (each Share

represents one Ordinary Share).

The following constitutes Amendment

No. 3 to the Schedule 13D filed by the undersigned (the “Amendment No. 3”). This Amendment No. 3 amends the Schedule 13D as

specifically set forth herein.

| Item 3 | Source and Amount of Funds or Other Consideration. |

Item 3 is hereby amended

and restated to read as follows:

The Shares purchased by Nomis

Bay were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course

of business). The aggregate purchase price of the 4,402,718 Shares beneficially owned by Nomis Bay is approximately $12,976,980, including

brokerage commissions.

The Shares purchased by BPY

were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course

of business). The aggregate purchase price of the 2,935,146 Shares beneficially owned by BPY is approximately $8,650,646, including brokerage

commissions.

The Shares held in the Managed

Positions were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary

course of business). The aggregate purchase price of the 7,337,864 Shares held in the Managed Positions is approximately $21,627,482,

including brokerage commissions.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

As previously disclosed,

certain of the Reporting Persons (the “Proposing Shareholders”) convened a special general meeting of shareholders of the

Issuer, which was held on March 20, 2023 (the “Special Meeting”). At the Special Meeting, a majority of the Issuer’s

shareholders in attendance voted in favor of the Proposing Shareholders’ proposals to (i) amend certain provisions of the Issuer’s

Articles of Association, (ii) remove four incumbent members of the Issuer’s Board of Directors (the “Board”), including

Chairman and Chief Executive Officer Yoav Stern, and (iii) appoint two director nominees, Kenneth H. Traub and Dr. Joshua Rosensweig,

as directors of the Issuer. Although the Proposing Shareholders believe that the Special Meeting was valid, including that Messrs. Traub

and Rosensweig were duly elected to the Board at the Special Meeting, the Issuer is challenging the validity of the Special Meeting in

Israeli court, which the Proposing Shareholders are vigorously defending. Most recently, the Israeli court issued an order stating that

Messrs. Traub and Rosensweig shall serve as non-voting observers on the Board during the pendency of the litigation.

In addition to the Israeli

litigation, on March 27, 2023, the Issuer filed a lawsuit in the United States District Court for the Southern District of New York (the

“Issuer Complaint”) against certain of the Reporting Persons and certain other third parties (collectively, the “Defendants”).

The following description of the Issuer Complaint is qualified in its entirety by reference to the Issuer Complaint, which is attached

as Exhibit 99.1 hereto and is incorporated herein by reference. The Issuer Complaint alleges, among other things, (i) violations of the

reporting requirements of Section 13(d) of the Securities and Exchange Act of 1934, as amended (the “Act”), (ii) breach of

contract with respect to the Issuer’s Amended and Restated Deposit Agreement dated April 15, 2019, (iii) tortious interference with

certain of the Issuer’s business relations, and (iv) unjust enrichment. The gravamen of the Issuer Complaint is that Defendants

failed to disclose that they formed a “group” as defined under Section 13(d) of the Act and seeks permanent injunctive relief

and damages. The Reporting Persons believe the allegations set forth in the Issuer Complaint are without merit and intend to defend themselves

vigorously.

On April 24, 2023, the Issuer

filed a motion for a preliminary injunction seeking an order enjoining Defendants from (i) purchasing or selling ADSs until at least 6

weeks after “they file an accurate Schedule 13D disclosing their group ownership and coordination”; and (ii) exercising shareholder

rights, including by casting votes in connection with a shareholder meeting until at least 6 weeks after they file an accurate Schedule

13D disclosing their alleged group ownership and coordination, and voiding the votes Defendants cast at the Special Meeting in March 2023.

In addition, the Issuer sought expedited discovery. On April 28, 2023, Defendants opposed the request for expedited discovery on multiple

grounds, including that the Issuer had not brought its motion promptly; the Issuer had not shown a likelihood of success on the merits;

and the discovery sought was over broad. On May 2, 2023, the Court held a status conference at which the Court (i) denied the motion for

expedited discovery, and (ii) set the date for hearing oral argument on the motion, as well as on motions to dismiss, as June 12, 2023.

On May 1, 2023, certain of

the Reporting Persons (the “Reporting Person Plaintiffs”) filed a lawsuit in the United States District Court for the Southern

District of New York (the “Reporting Person Complaint”) against the Issuer and certain other third parties, including Mr.

Stern (the “Issuer Defendants”). The following description of the Reporting Person Complaint is qualified in its entirety

by reference to the Reporting Person Complaint, which is attached as Exhibit 99.2 hereto and is incorporated herein by reference.

The Reporting Person Complaint

seeks to recover the Reporting Person Plaintiffs’ costs and attorneys fees and punitive damages arising from the Issuer Complaint

pursuant to New York Civil Rights Law §§ 70-a and 76-a. As set forth in the Reporting Person Complaint, the Reporting Person

Plaintiffs believe the Issuer Defendants filed the Issuer Complaint in an effort to silence the Reporting Person Plaintiffs’ criticism

of their efforts to effectuate change on the Board. Specifically, the Reporting Person Plaintiffs communications with the Issuer’s

shareholders and public disclosures relating to those communications and the Special Meeting constitute “action involving public

petition and participation” under N.Y. Civil Rights Law 76-a, as they involve a communication in a place open to the public or a

public forum in connection with an issue of public interest as well as lawful conduct in furtherance of the exercise of the constitutional

right of free speech in connection with an issue of public interest.

| Item 5. | Interest in the Securities of the Issuer. |

Items 5 (a)-(c) are hereby

amended and restated to read as follows:

The aggregate percentage

of Shares reported owned by each person named herein is based upon 253,205,493 Shares outstanding, as of March 28, 2023, which is the

total number of Shares outstanding as reported in the Issuer’s Annual Report on Form 20-F filed with the Securities and Exchange

Commission on March 30, 2023.

| (a) | As of the close of business on May 2, 2023, Nomis Bay beneficially owned 4,402,718 Shares. |

Percentage: Approximately

1.7%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 4,402,718

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 4,402,718 |

| (c) | The transactions in the Shares by Nomis Bay since the filing of Amendment No. 2 are set forth in Schedule

A and are incorporated herein by reference. |

| (a) | As of the close of business on May 2, 2023, BPY beneficially owned 2,935,146 Shares. |

Percentage: Approximately

1.2%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 2,935,146

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 2,935,146 |

| (c) | The transactions in the Shares by BPY since the filing of Amendment No. 2 are set forth in Schedule A

and are incorporated herein by reference. |

| (a) | EOM, as the investment advisor to each of Nomis Bay and BPY, may be deemed the beneficial owner of the

(i) 4,402,718 Shares owned by Nomis Bay and (ii) 2,935,146 Shares owned by BPY. |

Percentage: Approximately

2.9%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 7,337,864

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 7,337,864 |

| (c) | EOM has not entered into any transactions in the Shares since the filing of Amendment No. 2. The transactions

in the Shares on behalf of each of Nomis Bay and BPY since the filing of Amendment No. 2 are set forth in Schedule A and are incorporated

herein by reference. |

| (a) | Murchinson, as the sub-investment advisor to each of Nomis Bay and BPY and the investment advisor to the

Managed Positions, may be deemed the beneficial owner of the (i) 4,402,718 Shares owned by Nomis Bay, (ii) 2,935,146 Shares owned by BPY

and (iii) 7,337,864 Shares held through the Managed Positions. |

Percentage: Approximately

5.8%

| (b) | 1. Sole power to vote or direct vote: 7,337,864

2. Shared power to vote or direct vote: 7,337,864

3. Sole power to dispose or direct the disposition: 7,337,864

4. Shared power to dispose or direct the disposition: 7,337,864 |

| (c) | Murchinson has not entered into any transactions in the Shares since the filing of Amendment No. 2. The

transactions in the Shares on behalf of each of Nomis Bay and BPY and through the Managed Positions since the filing of Amendment No.

2 are set forth in Schedule A and are incorporated herein by reference. |

| (a) | Mr. Keyes, as a director of each of Nomis Bay and BPY, may be deemed the beneficial owner of the (i) 4,402,718

Shares owned by Nomis Bay and (ii) 2,935,146 Shares owned by BPY. |

Percentage: Approximately

2.9%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 7,337,864

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 7,337,864 |

| (c) | Mr. Keyes has not entered into any transactions in the Shares since the filing of Amendment No. 2. The

transactions in the Shares on behalf of each of Nomis Bay and BPY since the filing of Amendment No. 2 are set forth in Schedule A and

are incorporated herein by reference. |

| (a) | Mr. Jagessar, as a director of each of Nomis Bay and BPY, may be deemed the beneficial owner of the (i)

4,402,718 Shares owned by Nomis Bay and (ii) 2,935,146 Shares owned by BPY. |

Percentage: Approximately

2.9%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 7,337,864

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 7,337,864 |

| (c) | Mr. Jagessar has not entered into any transactions in the Shares since the filing of Amendment No. 2.

The transactions in the Shares on behalf of each of Nomis Bay and BPY since the filing of Amendment No. 2 are set forth in Schedule A

and are incorporated herein by reference. |

| (a) | Ms. Carlebach, as the director of EOM, may be deemed the beneficial owner of the (i) 4,402,718 Shares

owned by Nomis Bay and (ii) 2,935,146 Shares owned by BPY. |

Percentage: Approximately

2.9%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 7,337,864

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 7,337,864 |

| (c) | Ms. Carlebach has not entered into any transactions in the Shares since the filing of Amendment No. 2.

The transactions in the Shares on behalf of each of Nomis Bay and BPY since the filing of Amendment No. 2 are set forth in Schedule A

and are incorporated herein by reference. |

| (a) | Mr. Bistricer, as the Chief Executive Officer and Chief Investment Officer of Murchinson, may be deemed

the beneficial owner of the (i) 4,402,718 Shares owned by Nomis Bay, (ii) 2,935,146 Shares owned by BPY and (iii) 7,337,864 Shares held

through the Managed Positions. |

Percentage: Approximately

5.8%

| (b) | 1. Sole power to vote or direct vote: 7,337,864

2. Shared power to vote or direct vote: 7,337,864

3. Sole power to dispose or direct the disposition: 7,337,864

4. Shared power to dispose or direct the disposition: 7,337,864 |

| (c) | Mr. Bistricer has not entered into any transactions in the Shares since the filing of Amendment No. 2.

The transactions in the Shares on behalf of each of Nomis Bay and BPY and through the Managed Positions since the filing of Amendment

No. 2 are set forth in Schedule A and are incorporated herein by reference. |

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended

to add the following:

Reference is made to the

Issuer Complaint and the Reporting Person Complaint, each as defined and described in Item 4 above and attached as Exhibit 99.1 and 99.2,

respectively.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby

amended to add the following exhibits:

| 99.1 | Complaint filed by the Issuer on March 27, 2023. |

| 99.2 | Complaint filed by certain Reporting Persons on May 1, 2023. |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: May 2, 2023

| |

Nomis Bay Ltd |

| |

|

| |

By: |

/s/ James Keyes |

| |

|

Name: |

James Keyes |

| |

|

Title: |

Director |

| |

BPY Limited |

| |

|

| |

By: |

/s/ James Keyes |

| |

|

Name: |

James Keyes |

| |

|

Title: |

Director |

| |

EOM Management Ltd. |

| |

|

| |

By: |

/s/ Chaja Carlebach |

| |

|

Name: |

Chaja Carlebach |

| |

|

Title: |

Director |

| |

Murchinson Ltd. |

| |

|

| |

By: |

/s/ Marc J. Bistricer |

| |

|

Name: |

Marc J. Bistricer |

| |

|

Title: |

Chief Executive Officer |

| |

/s/ James Keyes |

| |

James Keyes |

| |

|

| |

|

| |

/s/ Jason Jagessar |

| |

Jason Jagessar |

| |

|

| |

|

| |

/s/ Chaja Carlebach |

| |

Chaja Carlebach |

| |

|

| |

|

| |

/s/ Marc J. Bistricer |

| |

Marc J. Bistricer |

SCHEDULE A

Transactions in the Securities of the

Issuer Since the Filing of Amendment No. 2 to the Schedule 13D

| Nature of the Transaction |

Amount of Securities

Purchased/(Sold) |

Price ($) |

Date of

Purchase/Sale |

NOMIS BAY LTD

| Purchase of Common Stock |

150,000 |

2.5900 |

03/14/2023 |

| Purchase of Common Stock |

75,000 |

2.5452 |

03/21/2023 |

| Purchase of Common Stock |

16,455 |

2.4174 |

04/21/2023 |

| Purchase of Common Stock |

7,500 |

2.4000 |

04/26/2023 |

| Purchase of Common Stock |

30,000 |

2.4401 |

04/27/2023 |

| Purchase of Common Stock |

75,000 |

2.5034 |

05/01/2023 |

BPY LIMITED

| Purchase of Common Stock |

100,000 |

2.5900 |

03/14/2023 |

| Purchase of Common Stock |

50,000 |

2.5452 |

03/21/2023 |

| Purchase of Common Stock |

10,970 |

2.4174 |

04/21/2023 |

| Purchase of Common Stock |

5,000 |

2.4000 |

04/26/2023 |

| Purchase of Common Stock |

20,000 |

2.4401 |

04/27/2023 |

| Purchase of Common Stock |

50,000 |

2.5034 |

05/01/2023 |

MURCHINSON LTD.

(Through the Managed Positions)

| Purchase of Common Stock |

100,000 |

2.5900 |

03/14/2023 |

| Purchase of Common Stock |

150,000 |

2.5900 |

03/14/2023 |

| Purchase of Common Stock |

50,000 |

2.5452 |

03/21/2023 |

| Purchase of Common Stock |

75,000 |

2.5452 |

03/21/2023 |

| Purchase of Common Stock |

10,970 |

2.4174 |

04/21/2023 |

| Purchase of Common Stock |

16,456 |

2.4174 |

04/21/2023 |

| Purchase of Common Stock |

5,000 |

2.4000 |

04/26/2023 |

| Purchase of Common Stock |

7,500 |

2.4000 |

04/26/2023 |

| Purchase of Common Stock |

20,000 |

2.4401 |

04/27/2023 |

| Purchase of Common Stock |

30,000 |

2.4401 |

04/27/2023 |

| Purchase of Common Stock |

50,000 |

2.5034 |

05/01/2023 |

| Purchase of Common Stock |

75,000 |

2.5034 |

05/01/2023 |

Exhibit 99.2

UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK

|

MURCHINSON LTD., EOM MANAGEMENT LTD., NOMIS BAY LTD., and BPY LIMITED,

Plaintiffs,

-against-

NANO DIMENSION LTD., YOAV STERN, AMIT DROR, SIMON ANTHONY-FRIED, CHANNA

CASPI, ODED GERA, RONI KLEINFELD, J. CHRISTOPHER MORAN, YOAV NISSAN-COHEN, and IGAL ROTEM

Defendants, |

Case No: _______________

COMPLAINT |

Plaintiffs Murchinson

Ltd., EOM Management Ltd., Nomis Bay Ltd., and BPY Limited, (“Plaintiffs”) for their claim against defendant Nano Dimension

Ltd. (“Nano”) and each of the individual defendants, by their attorneys, Olshan Frome Wolosky LLP, state:

Preliminary Statement

1. Plaintiffs

bring this claim pursuant to New York Civil Rights Law §§ 70-a and 76-a to recover their fees and damages arising from Nano’s

litigation in this Court, Nano Dimension Ltd. v. Murchinson Ltd. et al., 1:23 Civ. 02566-JLR (the “Federal Litigation”).

As set forth below, Defendants brought the Federal Litigation in an effort to silence Plaintiffs’ criticism of Nano’s Board

and to deter Plaintiffs from their efforts to effectuate change at the Board level.

The Parties

2. Plaintiffs

are long term shareholders of Nano who have criticized its Chairman and CEO, Yoav Stern, and his fellow directors for mismanaging its

business and causing financial loss to shareholders. Plaintiffs are the largest beneficial owners of Nano common stock, collectively holding

approximately 5.7% of its outstanding shares.

3. Defendant

Nano is a corporation organized under the laws of Israel and its common stock trades in the U.S. markets as American Depository Shares

(“ADS”). Defendants Yoav Stern, Amit Dror, Simon Anthony-Fried, Channa Caspi, Oded Gera, Roni Kleinfeld, J. Christopher Moran,

Yoav Nissan-Cohen and Igal Rotem (collectively, “Individual Defendants”) act as members of Nano’s Board of Directors,

even though four of them were voted off the Board at a special meeting of shareholders held in March 2023. These four are Messrs. Stern,

Gera, Rotem and Nissan-Cohen. Defendant Stern is also Nano’s Chief Executive Officer and Chairman of the Board. Upon information

and belief, all Individual Defendants reside in Israel, except for Defendant Moran, who resides in California, and Defendant Stern who

resides in Florida.

Jurisdiction and Venue

4. This

Court has subject matter jurisdiction pursuant to its ancillary jurisdiction. The claim forms part of the same case or controversy as

Nano Dimension Ltd. v. Murchinson Ltd. et al., 1:23 Civ. 02566-JLR (the “Federal Litigation”). Venue is also proper,

as this Court is the venue for the Federal Litigation. The Individual Defendants have had purposeful contacts with this forum by authorizing

the Federal Litigation to be filed in New York.

Plaintiffs’ Challenge

to Nano’s Incumbent Board

5. On

January 22, 2023, Plaintiffs delivered a letter to Nano demanding that it convene a special general meeting of shareholders to (i) amend

Nano’s corporate charter; (ii) remove four incumbent directors, including Nano’s Chairman, Defendant Stern, and (iii) elect

two highly qualified independent directors. Defendant Nano, directed by the Individual Defendants, refused to call the shareholders meeting.

6. On

February 13, 2023, Plaintiffs delivered notice to Nano’s shareholders to independently convene the special meeting in accordance

with Israel’s Companies Law. In advance of the special meeting, Plaintiffs presented their position through a series of press releases

and other public disclosures. Among other things, Plaintiffs criticized Defendant Stern, advocating for his removal and for the election

of new directors, advising:

| · | “Since his [Yoav Stern’s] appointment as Chairman in 2021, the Yoav Stern-led Board has overseen share price underperformance

relative to peers, terrible corporate governance and poor capital allocation.” |

| · | “The Board has continually failed to hold management accountable for its ill-advised acquisition strategy, poor integration

of those acquisitions and significant cash burn.” |

| · | “The Board has apparently rallied behind Mr. Stern by supporting drastic entrenchment measures aimed at preventing the voices

of shareholders from being heard.” |

| · | “Murchinson seeks to restore accountability and ensure the Board prioritizes protecting value for ALL shareholders rather than

simply furthering Mr. Stern’s self-serving entrenchment.” |

| · | “Since Mr. Stern was appointed Chairman in March 2021, Nano Dimension’s stock price has lost 77.7% of its value.” |

7. Plaintiffs’

proposals received support from the leading independent proxy advisory service, Institutional Shareholder Services, Inc. (“ISS”).

Among other things, ISS observed:

| · | “The company’s share price and operating performance, coupled with corporate governance deficiencies, indicate that change

is necessary and that shareholders would benefit from enhanced independence on the board.” |

| · | “(T)he stock’s performance ... suggests that the market does not expect the company’s broader strategic plan to

deliver value.” |

| · | “Over the last three years, only five directors have stood for election, with no directors up for election at the 2020 annual

meeting, two directors up for election at the 2021 annual meeting, and three directors up for election at the 2022 annual meeting.” |

| · | “It is also important to consider the timing of the dissident’s request. Shareholders rejected the company’s proposals

at the December 2022 special meeting, which can be seen as a message of no confidence.” |

| · | “That the CEO has the right to approve new directors calls into question the ability of the board to effectively oversee

management, and of the board to refresh itself.” |

| · | “Stern is at the center of the underperformance and corporate governance concerns underpinning the dissident's compelling case

for change.” |

| · | “In light of these considerations, shareholders are recommended to vote for the removal of Incumbent directors Stern, Gera,

Rotem, and Nissan-Cohen, and for the election of dissident nominees Traub and Rosensweig.” |

8. All

other proxy advisory services joined with ISS in recommending a vote in favor of Plaintiff’s proposals at the special meeting of

shareholders.

9. Plaintiffs’

proposals received overwhelming support at the special meeting of shareholders. But Defendants have refused to honor the vote. Instead,

the Director Defendants caused Nano to commence litigation in the Courts of Israel to block the implementation of the shareholder vote.

Defendants’ Attempt

to Silence Plaintiffs through the Federal Litigation

10. Nano

is required by law to have an annual meeting of shareholders in 2023. Remarkably, a majority of its nine-person staggered Board were never

elected by a shareholder vote. Given the results of the special meeting, Defendants recognized that they could never prevail at a free

and fair election. To avoid an inevitable loss, Defendants devised the Federal Litigation for the purpose of inflicting financial loss

on Plaintiffs and others who had voiced public criticism of the Board.

11. The

Federal Litigation was commenced, and has been continued, without a substantial basis in fact and law. The cornerstone of the Federal

Litigation is the bogus claim under Section 13(d) of the Securities Exchange Act of 1934 that Plaintiffs are members of an undisclosed

“group” with Boothbay Absolute Return Strategies L.P. and Boothbay Diversified Alpha Master Fund L.P. (the “Boothbay

Funds”).

12. Nano

alleges in its Complaint that shares held by the Boothbay Funds should be added to those disclosed on the Schedule 13D filings by Plaintiffs.

But Plaintiffs have repeatedly made clear to Nano that Plaintiff Murchison is the investment manager for the Boothbay Funds with a power

of attorney for their shares. In fact, Plaintiff’s letter dated January 22, 2023 calling for the Special General Meeting identified

each of the Boothbay Funds and their shareholdings, advising that Boothbay Absolute Return Strategies, L.P. held 3,975,000 shares and

Boothbay Diversified Alpha Master Fund L.P., 2,650,000 shares. The January 22, 2023 letter also made clear that those shares were

beneficially owned by Plaintiff Murchinson and included in the Schedule 13D totals reported by Murchinson as “Managed Positions.”

Nano claims to rely on a Schedule 13F filed by Boothbay Fund Management L.P. which also reports share ownership in Nano. The shares reported

on the Schedule 13F, however, are the same as those reported on Plaintiffs’ Schedule 13D. This fact is readily apparent since the

numbers match to the share on the two reports. By its own admission, Nano performed a thorough analysis of publicly reported share ownership

and transactions by Plaintiffs and the Boothbay Funds. Plaintiffs also advised Defendants that their theory was mistaken by letter dated

March 17, 2023. Nano’s claim of undisclosed share ownership and “group” activities is a fiction, as Defendants well

know.

13. Nano

also claims that Plaintiffs are members of an undisclosed “group” with Anson Advisors LP and the fund that it manages (the

“Anson Fund”). The Anson Fund is another shareholder who has publicly criticized Nano’s Board of Directors. Nano hopes

to deter both Plaintiffs and the Anson Fund through meritless litigation. Nano’s allegations rest on groundless speculation that

because both Plaintiffs and the Anson Fund are opposed to the Nano Board of Directors they must be in a “group.” But many

shareholders disagree with Nano’s Board of Directors, as vote of the special meeting confirms. Indeed, at a December 2022 shareholder

meeting called by Nano to vote on proposals that the Individual Defendants recommended, the shareholders voted overwhelmingly against

the proposals.

14. While

Nano alleges a “group” exists between the Anson Fund and Plaintiffs, it does not identify any alleged voting agreement or

any agreement to buy, sell or dispose of Nano shares. Nor does Nano provide any reason for such an agreement. The Anson Fund has over

$600 million under management, according to public reports. Nano offers no reason why the Anson Fund would forego a discretion over its

assets in favor of Plaintiffs – or why Plaintiffs would do likewise. The alleged “group” is yet another desperate fiction

contrived by Nano in a bid to block or silence participation in corporate governance.

15. In

the Federal Litigation, Nano has repackaged its Section 13(d) claim into other meritless claims, including a bogus breach of contract

claim under New York law based on the Depository Agreement for the ADS.

16. Plaintiffs’

communications with Nano shareholders and public disclosures relating to those communications and the special general meeting constitute

“action involving public petition and participation” under N.Y. Civil Rights Law 76-a, as they involve a communication in

a place open to the public or a public forum in connection with an issue of public interest as well as lawful conduct in furtherance of

the exercise of the constitutional right of free speech in connection with an issue of public interest.

17. Each

Plaintiff is a defendant in an action involving public petition and participation, namely the Federal Litigation.

18. The

Federal Litigation was commenced or continued by the Individual Defendants, who authorized and caused Defendant Nano to file the Federal

Litigation. Defendants commenced or continued the Federal Litigation without a substantial basis in fact and law and which could not be

supported by a substantial argument for the extension, modification or reversal of existing law, and the Federal Litigation was commenced

or continued for the purpose of harassing, intimidating, punishing or otherwise maliciously inhibiting the free exercise of speech, petition

or association right.

19. By

virtue of the foregoing, Plaintiffs are entitled to recover their costs and attorneys fees in the Federal Litigation as well as compensatory

damages in an amount to be determined at trial and punitive damages in excess of $5 million.

20. All

damages should be assessed against the Individual Defendants, consistent with policy underlying N.Y. Civil Rights Law § 70-a.

WHEREFORE, Plaintiffs pray for judgment against

Defendants pursuant to N.Y. Civil Rights Law § 70-a awarding the relief requested in this Complaint.

| Dated: New York, New York |

|

| May 1, 2023 |

|

| |

OLSHAN FROME WOLOSKY LLP |

| |

|

| |

|

| |

By: |

/s/ Thomas J. Fleming |

| |

|

Thomas J. Fleming

Adrienne M. Ward

Attorneys for Plaintiffs

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300 |

This regulatory filing also includes additional resources:

ex991to13da313459002_050223.pdf

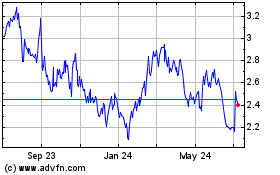

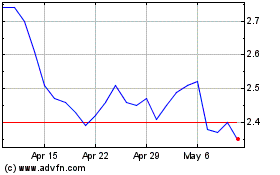

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Apr 2023 to Apr 2024