Current Report Filing (8-k)

September 16 2021 - 6:07AM

Edgar (US Regulatory)

false000093313600009331362021-09-152021-09-15

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 15, 2021

Mr. Cooper Group Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-14667

|

|

91-1653725

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

8950 Cypress Waters Blvd.

Coppell, TX 75019

(Address of Principal Executive Offices, and Zip Code)

469-549-2000

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

COOP

|

The Nasdaq Stock Market

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or

Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01 Regulation FD Disclosure.

In connection with investor meetings held on September 15, 2021, Mr. Cooper Group Inc. (the “Company”) clarified the impact of recent stock repurchase

activity, consisting of 11.1 million shares of common stock that were repurchased from Kohlberg Kravis Roberts & Co. L.P. (“KKR”) on August 2, 2021 and disclosed that no further share repurchases have taken place subsequently. As a result of

this repurchase activity, the Company expects to report approximately 75 million common shares outstanding as of September 30, 2021. Based on the timing of the repurchase, and assuming no change in the stock price prior to quarter end, the Company

expects to report approximately 82 million weighted-average diluted shares for the third quarter.

RECONCILIATION OF COMMON STOCK OUTSTANDING

|

Shares in millions

|

|

3Q'21

|

|

|

|

|

(Estimate)

|

|

|

Ending Common Stock

|

|

|

|

|

Common stock at beginning of period

|

|

|

86

|

|

|

KKR common stock repurchase

|

|

|

(11

|

)

|

|

Common shares at end of period

|

|

|

75

|

|

|

Weighted Average Diluted Common Stock

|

|

|

|

|

|

Common stock at beginning of period

|

|

|

86

|

|

|

Effect of KKR common stock repurchase

|

|

|

(7

|

)

|

|

Dilutive effect of stock awards

|

|

|

3

|

|

|

Weighted average diluted common stock

|

|

|

82

|

|

The information in this Item 7.01 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as

amended, or otherwise subject to the liabilities of that Section, and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, unless

expressly incorporated by specific reference in such filing. Any statements in this current report that are not historical or current facts are forward looking statements. Forward looking statements involve known and unknown risks, uncertainties and

other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Results for any specified quarter

are not necessarily indicative of the results that may be expected for the full year or any future period. Certain of these risks and uncertainties are described in the “Risk Factors” section of Mr. Cooper Group’s most recent annual reports and other

required documents as filed with the SEC which are available at the SEC’s website at http://www.sec.gov. Mr. Cooper undertakes no obligation to publicly update or revise any forward-looking statement or any other financial information contained

herein, and the statements made herein are current as of the date of this current report only.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

Mr. Cooper Group Inc.

|

|

|

Date: September 15, 2021

|

|

|

|

|

By:

|

/s/ Christopher G. Marshall

|

|

|

|

|

Christopher G. Marshall

|

|

|

|

|

Vice Chairman, President & Chief Financial

|

|

|

|

|

Officer

|

|

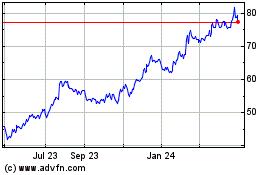

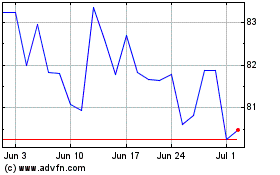

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Apr 2023 to Apr 2024