- Reported $83 million net income or $0.90 per share, and pretax

operating income of $171 million

- Generated record Originations pretax income of $178 million on

record funded volume of $11.9 billion

- Servicing UPB remained stable, ending the quarter at $641

billion

- Xome reported pretax income of $14 million and pretax operating

income of $13 million, with Assurant Mortgage Solutions (AMS)

contributing positive results

- Announced retirement of $100 million of unsecured senior notes

due 2021, which settled in October

- Achieved Great Place to Work certification

Mr. Cooper Group Inc. (NASDAQ: COOP) (the "Company"), which

principally operates under the Mr. Cooper® and Xome® brands,

reported a third quarter net income of $83 million or $0.90 per

diluted share, partially offset by a net fair value mark-to-market

on the MSR portfolio of $(83) million. Excluding the mark-to-market

and other items, the Company reported pretax operating income of

$171 million. Items excluded from pretax operating income was $(83)

million in mark-to-market, net of the add back of $32 million in

fair value amortization included in the full mark-to-market, $4

million gain from remeasuring contingent consideration associated

with the AMS acquisition, $5 million in charges related to

corporate actions, and $12 million of intangible amortization.

Chairman and CEO Jay Bray commented, “The Originations segment

produced another quarter of record fundings, with strong margins,

demonstrating our capability to scale up in response to refinance

market conditions. At the same time, we were very pleased with

continued strong performance in the Servicing segment and delighted

to receive the Great Place to Work certification.”

Chris Marshall, vice chairman and CFO added, “Net income,

operating profits, and cash flow were all very strong in the

quarter, allowing us to move forward with our deleveraging plan and

begin retiring some of our senior notes. Deleveraging will

strengthen the balance sheet, improve profitability, and afford us

greater financial flexibility.”

Servicing

The Servicing segment is focused on providing a best-in-class

home loan experience for our 3.8 million customers while

simultaneously strengthening asset performance for investors. In

the third quarter, Servicing recorded pretax income of $9 million

offset by a net fair value mark-to-market on the MSR portfolio of

$(83) million. During the quarter the total servicing portfolio

remained stable, ending the quarter at $641 billion UPB. Servicing

earned pretax operating income excluding the full mark of $92

million, equivalent to a servicing margin of 5.8 bps. At quarter

end, the carrying value of the MSR was $3,346 million, equivalent

to 109 bps of MSR UPB, and the original cost basis was 86 bps.

Quarter Ended

($ in millions)

Q2'19

Q3'19

$

BPS

$

BPS

Operational revenue

$

314

19.6

$

319

20.0

Amortization, net of accretion

(56

)

(3.5

)

(73

)

(4.6

)

Mark-to-market

(231

)

(14.4

)

(83

)

(5.2

)

Total revenues

27

1.7

163

10.2

Expenses

(189

)

(11.8

)

(171

)

(10.7

)

Total other income (expenses), net

27

1.7

17

1.1

(Loss) income before taxes

(135

)

(8.4

)

9

0.6

Mark-to-market

231

14.4

83

5.2

Pretax operating income excluding

mark-to-market

$

96

6.0

$

92

5.8

Quarter Ended

Q2'19

Q3'19

Ending UPB ($B)

$

644

$

641

Average UPB ($B)

$

639

$

637

60+ day delinquency rate

2.3

%

2.2

%

Annualized CPR

13.0

%

17.5

%

Modifications and workouts

12,108

8,792

Originations

The Originations segment focuses on creating servicing assets at

attractive margins through existing customer relationships,

correspondent, and wholesale originations. Originations earned

record pretax income of $178 million, up from $118 million in the

prior quarter.

Mr. Cooper funded 48,904 loans in the third quarter, totaling

approximately $12 billion UPB comprised of $4.9 billion in

direct-to-consumer, $6.4 billion in correspondent, and $0.6 billion

in wholesale. Funded volume increased 19% quarter-over-quarter.

Quarter Ended

($ in millions)

Q2'19

Q3'19

Income before taxes

$

118

$

178

Quarter Ended

($ in millions)

Q2'19

Q3'19

Total pull through adjusted volume

$

11,197

$

12,699

Funded volume

$

9,996

$

11,911

Refinance recapture percentage

44

%

38

%

Recapture percentage

23

%

25

%

Purchase volume as a percentage of funded

volume

53

%

39

%

Xome

Xome provides real estate solutions including property

disposition, asset management, title, close, valuation, and field

services for Mr. Cooper and third-party clients. The Xome segment

recorded pretax income of $14 million, or pretax operating income

of $13 million in the third quarter, which excluded accounting

items related to remeasuring the contingent consideration

associated with the AMS acquisition and intangible

amortization.

Quarter Ended

($ in millions)

Q2'19

Q3'19

Income before taxes

$

7

$

14

Accounting items

—

(4

)

Intangible amortization

3

3

Pretax operating income excluding

accounting items and intangible amortization

$

10

$

13

Quarter Ended

Q2'19

Q3'19

Exchange property listings sold

2,645

2,453

Average Exchange property listings

6,693

6,688

Services orders completed

417,510

429,128

Percentage of revenue earned from

third-party customers

53

%

53

%

Conference Call Webcast and Investor

Presentation

The Company will host a conference call on October 31, 2019 at

9:00 A.M. Eastern Time. The conference call may be accessed by

dialing 855-874-2685, or 720-634-2923 internationally. Please use

the participant passcode 9583900 to access the conference call. A

simultaneous audio webcast of the conference call will be available

in the Investor section of www.mrcoopergroup.com. A replay will

also be available approximately two hours after the conclusion of

the conference call by dialing 855-859-2056, or 404-537-3406

internationally. Please use the passcode 9583900 to access the

replay. The replay will be accessible through November 14, 2019 at

11:00 A.M. Eastern Time.

Non-GAAP Financial

Measures

The Company utilizes non-GAAP financial measures as the measures

provide additional information to assist investors in understanding

and assessing the Company’s and our business segments’ ongoing

performance and financial results, as well as assessing our

prospects for future performance. The adjusted operating financial

measures facilitate a meaningful analysis and allow more accurate

comparisons of our ongoing business operations because they exclude

items that may not be indicative of or are unrelated to the

Company’s and our business segments’ core operating performance,

and are better measures for assessing trends in our underlying

businesses. These notable items are consistent with how management

views our businesses. Management uses these non-GAAP financial

measures in making financial, operational and planning decisions

and evaluating the Company’s and our business segment’s ongoing

performance. Pretax operating income (loss) in the servicing

segment eliminates the effects of mark-to-market adjustments which

primarily reflects unrealized gains or losses based on the changes

in fair value measurements of MSRs and their related financing

liabilities for which a fair value accounting election was made.

These adjustments, which can be highly volatile and material due to

changes in credit markets, are not necessarily reflective of the

gains and losses that will ultimately be realized by the Company.

Pretax operating income (loss) in each segment also eliminates, as

applicable, transition and integration costs, gains (losses) on

sales of fixed assets, certain settlement costs that are not

considered normal operational matters, intangible amortization, and

other adjustments based on the facts and circumstances that would

provide investors a supplemental means for evaluating the Company’s

core operating performance.

Forward Looking

Statements

Any statements in this release that are not historical or

current facts are forward looking statements, including statements

regarding the results of deleveraging. Forward looking statements

involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance, or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Results for any specified quarter are not necessarily

indicative of the results that may be expected for the full year or

any future period. Certain of these risks and uncertainties are

described in the "Risk Factors" section of Mr. Cooper Group's most

recent annual reports and other required documents as filed with

the SEC which are available at the SEC’s website at

http://www.sec.gov. Mr. Cooper undertakes no obligation to publicly

update or revise any forward-looking statement or any other

financial information contained herein, and the statements made in

this press release are current as of the date of this release

only.

Financial Tables

MR. COOPER GROUP INC. AND

SUBSIDIARIES

UNAUDITED CONSOLIDATED

STATEMENTS OF OPERATIONS

(millions of dollars, except for

earnings per share data)

Three Months Ended June 30,

2019

Three Months Ended September 30,

2019

Revenues:

Service related, net – excluding

mark-to-market

$

368

$

341

Mark-to-market

(231

)

(83

)

Net gain on mortgage loans held for

sale

262

360

Total revenues

399

618

Total expenses

492

478

Other income (expense):

Interest income

162

163

Interest expense

(187

)

(196

)

Other income (expenses)

1

—

Total other income (expenses), net

(24

)

(33

)

(Loss) income before income tax (benefit)

expense

(117

)

107

Income tax (benefit) expense

(29

)

24

Net (loss) income

(88

)

83

Net loss attributable to non-controlling

interest

(1

)

(1

)

Net (loss) income attributable to Mr.

Cooper Group

(87

)

84

Undistributed earnings attributable to

participating stockholders

—

1

Net (loss) income attributable to Mr.

Cooper Group

$

(87

)

$

83

(Loss) income per share attributable to

common stockholders:

Basic

$

(0.96

)

$

0.91

Diluted

$

(0.96

)

$

0.90

Weighted average shares of common stock

outstanding (in thousands):

Basic

91,054

91,080

Diluted

91,054

92,036

MR. COOPER GROUP INC. AND

SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE

SHEETS

(millions of dollars)

June 30, 2019

September 30, 2019

Assets

Cash and cash equivalents

$

245

$

371

Restricted cash

304

271

Mortgage servicing rights

3,511

3,346

Advances and other receivables, net

1,000

967

Reverse mortgage interests, net

7,110

6,662

Mortgage loans held for sale at fair

value

3,422

4,267

Mortgage loans held for investment at fair

value

114

—

Property and equipment, net

115

113

Deferred tax asset

1,055

1,032

Other assets

1,529

1,449

Total assets

$

18,405

$

18,478

Liabilities and Stockholders'

Equity

Unsecured senior notes, net

$

2,462

$

2,464

Advance facilities, net

567

513

Warehouse facilities, net

4,045

4,802

Payables and accrued liabilities

2,116

2,002

MSR related liabilities - nonrecourse at

fair value

1,472

1,328

Mortgage servicing liabilities

80

69

Other nonrecourse debt, net

5,985

5,533

Total liabilities

16,727

16,711

Total stockholders' equity

1,678

1,767

Total liabilities and stockholders'

equity

$

18,405

$

18,478

UNAUDITED SEGMENT STATEMENT

OF

OPERATIONS & EARNINGS

RECONCILIATION

(millions of dollars, except for

earnings per share data)

Three Months Ended for June 30,

2019

Servicing

Originations

Xome

Corporate and Other

Elimination/Reclassification⁽¹⁾

Consolidated

Service related, net

$

27

$

20

$

108

$

—

$

(18

)

$

137

Net gain on mortgage loans held for

sale

—

244

—

—

18

262

Total revenues

27

264

108

—

—

399

Total expenses

189

145

101

57

—

492

Other income (expense):

Interest income

136

23

—

3

—

162

Interest expense

(109

)

(25

)

—

(53

)

—

(187

)

Other expense

—

1

—

—

—

1

Total other income (expense)

27

(1

)

—

(50

)

—

(24

)

Pretax (loss) income

$

(135

)

$

118

$

7

$

(107

)

$

—

$

(117

)

Income tax benefit

(29

)

Net loss

$

(88

)

Net loss attributable to noncontrolling

interests

(1

)

Net loss attributable to common

stockholders of Mr. Cooper Group

$

(87

)

Loss per share

Basic

$

(0.96

)

Diluted

$

(0.96

)

Non-GAAP Reconciliation:

Pretax income (loss)

$

(135

)

$

118

$

7

$

(107

)

$

—

$

(117

)

Mark-to-market

231

—

—

—

—

231

Merger related costs

—

—

—

17

—

17

Intangible amortization

—

—

3

10

—

13

Pretax income (loss), net of notable

items

$

96

$

118

$

10

$

(80

)

$

—

$

144

Fair value amortization⁽²⁾

(26

)

—

—

—

—

(26

)

Pretax operating income (loss)

$

70

$

118

$

10

$

(80

)

$

—

$

118

Income tax expense

(29

)

Operating income

$

89

ROTCE

23.8

%

⁽¹⁾ For Servicing segment results

purposes, all revenue is attributable to servicing the portfolio.

Therefore, $18 of net gain on mortgage loans is moved to service

related, net for the three months ended June 30, 2019. For

consolidated results purposes, these amounts were reclassed to net

gain on mortgage loans held for sale.

⁽²⁾ Amount represents additional

amortization required under the fair value amortization method over

the cost amortization method.

UNAUDITED SEGMENT STATEMENT

OF

OPERATIONS & EARNINGS

RECONCILIATION

(millions of dollars, except for

earnings per share data)

Three Months Ended for September

30, 2019

Servicing

Originations

Xome

Corporate and Other

Elimination/Reclassification⁽¹⁾

Consolidated

Service related, net

$

163

$

22

$

112

$

—

$

(39

)

$

258

Net gain on mortgage loans held for

sale

—

312

—

11

37

360

Total revenues

163

334

112

11

(2

)

618

Total expenses

171

155

101

53

(2

)

478

Other income (expense):

Interest income

137

24

—

2

—

163

Interest expense

(120

)

(24

)

—

(52

)

—

(196

)

Other expense

—

(1

)

3

(2

)

—

—

Total other income (expense)

17

(1

)

3

(52

)

—

(33

)

Pretax income (loss)

$

9

$

178

$

14

$

(94

)

$

—

$

107

Income tax expense

24

Net income

$

83

Net loss attributable to noncontrolling

interests

(1

)

Net income attributable to common

stockholders of Mr. Cooper Group

$

84

Undistributed earnings attributable to

participating stockholders

1

Net income attributable to Mr. Cooper

Group

$

83

Income per share

Basic

$

0.91

Diluted

$

0.90

Non-GAAP Reconciliation:

Pretax income (loss)

$

9

$

178

$

14

$

(94

)

$

—

$

107

Mark-to-market

83

—

—

—

—

83

Accounting items / other

—

—

(4

)

5

—

1

Intangible amortization

—

—

3

9

—

12

Pretax income (loss), net of notable

items

$

92

$

178

$

13

$

(80

)

$

—

$

203

Fair value amortization⁽²⁾

(32

)

—

—

—

—

(32

)

Pretax operating income (loss)

$

60

$

178

$

13

$

(80

)

$

—

$

171

Income tax expense

(41

)

Operating income

$

130

ROTCE

34.5

%

⁽¹⁾ For Servicing segment results

purposes, all revenue is attributable to servicing the portfolio.

Therefore, $37 of net gain on mortgage loans is moved to service

related, net for the three months ended September 30, 2019. For

consolidated results purposes, these amounts were reclassed to net

gain on mortgage loans held for sale.

⁽²⁾ Amount represents additional

amortization required under the fair value amortization method over

the cost amortization method.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191031005308/en/

Investor Contact: Kenneth Posner, SVP Strategic Planning and

Investor Relations (469) 426-3633 Shareholders@mrcooper.com

Media Contact: Christen Reyenga, VP Corporate Communications

MediaRelations@mrcooper.com

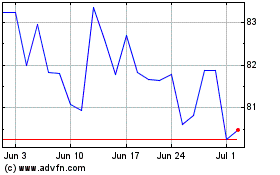

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

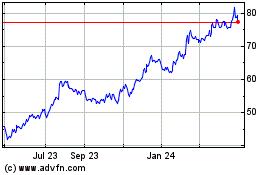

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Apr 2023 to Apr 2024