Current Report Filing (8-k)

June 23 2022 - 4:32PM

Edgar (US Regulatory)

false 0000876427 0000876427 2022-06-17 2022-06-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 17, 2022

MONRO, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| New York |

|

0-19357 |

|

16-0838627 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 200 Holleder Parkway, Rochester, New York |

|

14615 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (585) 647-6400

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $.01 per share |

|

MNRO |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On June 17, 2022 (the “Closing Date”), Monro, Inc. (the “Company” or “Monro”), completed its previously announced sale of assets relating to its wholesale tire operations and internal tire distribution operations to American Tire Distributors, Inc. (the “Buyer”) pursuant to an asset purchase agreement (the “Purchase Agreement”). Also on the Closing Date, the Company entered into a distribution and fulfillment agreement (the “Agreement”) with the Buyer.

Under the Agreement, the Buyer agreed to supply and sell tires to retail locations owned by the Company and its affiliates. After the Buyer has satisfied the earnout payments to the Company under the Purchase Agreement (the “Earnout Period”), Monro’s company-owned retail stores will be required to purchase at least 90% of their forecasted requirements for certain passenger car tires, light truck replacement tires, and medium truck tires from or through Buyer. Any tires that the Buyer is unable to supply or fulfill from those categories will be excluded from the calculation of Monro’s requirements for tires. Under the Agreement, the Company has agreed to designate the Buyer as the distribution and fulfillment partner for orders for tires, wheels, and related products that are supplied by manufacturers or suppliers other than the Buyer and has agreed to use its best efforts to encourage its franchisees to purchase tires from the Buyer.

The initial term of the Agreement is five years after the completion of the Earnout Period. The Agreement will automatically renew for subsequent 12-month periods unless either the Company or the Buyer provides 60 days’ notice prior to the end of the initial or renewal term.

The Agreement contains customary warranties, agreements and indemnification obligations of the Company and the Buyer. The foregoing summary of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement, a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 25, 2022.

The Company issued a press release announcing the completion of the asset sale on June 17, 2022. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MONRO, INC. |

|

|

|

|

(Registrant) |

|

|

|

|

| June 23, 2022 |

|

|

|

By: |

|

/s/ Maureen E. Mulholland |

|

|

|

|

|

|

Maureen E. Mulholland |

|

|

|

|

|

|

Executive Vice President – Chief Legal Officer and Secretary |

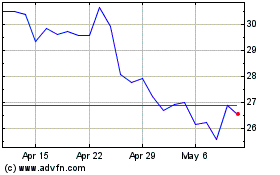

Monro (NASDAQ:MNRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

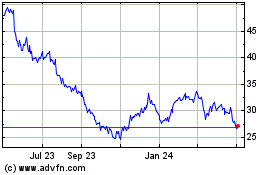

Monro (NASDAQ:MNRO)

Historical Stock Chart

From Apr 2023 to Apr 2024